Crypto Market Forecast: Week of September 4th 2023

A curated weekly summary of forward-focused crypto news that matters. This week, Whales load up on BTC pre-halving & spot-ETF approval, California considers a crypto company license regime, and most major crypto exchanges show signs of stability.

The price of Bitcoin (BTC) has dropped by 0.8% to ~US$26.0K in the last week. Over the same period, Ether (ETH) fell by 1.4% to ~US$1.6K. Binance-coin (BNB) did similarly, falling by 2.3% to US$215.

Analytical service IntoTheBlock shared a discovery over the X platform (formerly Twitter) on Saturday, which indicated that whales had accumulated over $1.5 billion of BTC over the past two weeks. They stated that the accumulated bitcoins entered the custody of wallets “holding 0.1% of the Bitcoin supply or more”.

While IntoTheBlock did not indicate any identity of the “whale(s)”, timing is particularly interesting given the prospect of a highly anticipated Securities and Exchange Commission (SEC) approval (albeit with some uncertainty) of a Bitcoin spot ETF as well as the upcoming Bitcoin halving event expected in April 2024. Both events are widely expected to push prices upwards. Buying BTC now may be an opportunity to “front run” this potential swing.

If approved, a Bitcoin spot ETF in the United States would allow investors to potentially benefit from Bitcoin’s price performance via public exchanges such as the NYSE Arca.

California is having another go at passing its so-called “Digital Financial Asset Law”, which is presently coded AB39. The bill was amended in the California Senate on Friday, September 1st, and passed with five votes in favor and five votes against.

The bill establishes various criteria that would require a license, beginning on January 1st, 2025.

The AB39 implementation appears to be a “fork” of sorts from a 2022 bill with the same “Digital Financial Assets Law” name (formerly AB2269). California Assembly member Timothy Grayson (Democrat) is listed as the “Primary Sponsor” for both. The 2022 bill was the object of some criticism. The Blockchain Association, for example, tweeted in August 2022, “[urging] all Assembly Members to reject this bill & engage with the Executive Order process as laid out by Governor Newsom”.

They also compared AB2269 from 2022 to New York’s “BitLicense”. Which they say “would create, have proved deeply onerous and unworkable for many crypto companies, particularly for smaller startups that lack the resources to compete with incumbent financial institutions on compliance costs. The BitLicense has created an environment where only the biggest and most wealthy can manage to comply”.

The present bill (AB39) was also criticized elsewhere for a June amendment that inserted the wording —“is about to engage”. This effectively enables the state’s Department of Financial Protection and Innovation to take action against an entity that has not yet taken any action towards a license (and might only be “about to”).

Crypto news for the weeks ahead

September 13

The Consumer Price Index data for August will be released – one of the indicators the Federal Open Market Committee (FOMC) watches when considering interest rate hikes.

September 20

The FOMC will be meeting. Futures markets are strongly leaning towards a prediction of no further rate hikes for the September meeting, thus leaving the federal funds rate target at 5.25 – 5.5% – for now. Fed Governor Christopher Waller, however, hinted in mid-July of the possibility for additional rate hikes in coming months, and Fed Chair Jerome Powell did likewise in late-August.

September 29

The US Bureau of Economic Analysis’ (BEA’s) release of August’s Personal Consumption Expenditures (PCE) numbers will be released. This is the primary indicator used by the FOMC to measure inflation and is considered carefully when considering interest rate levels.

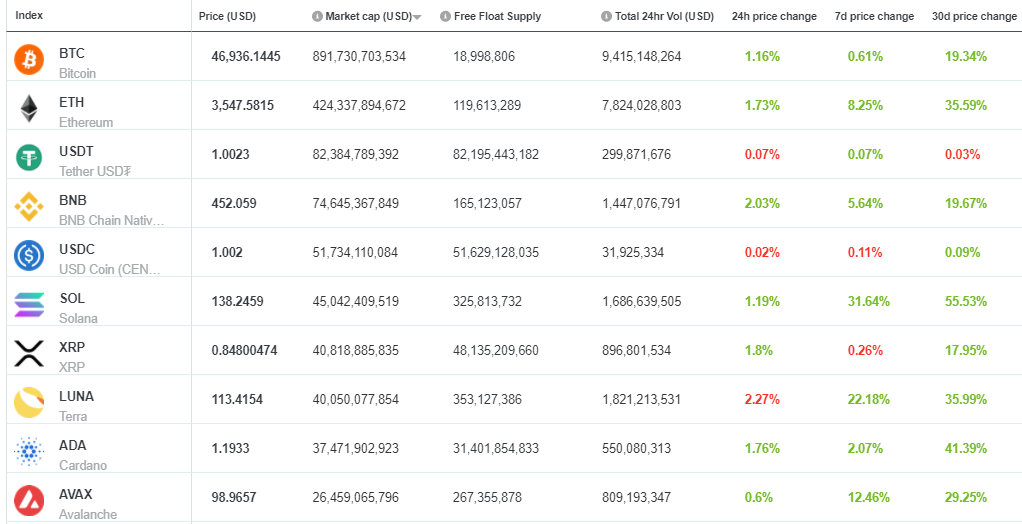

Top 10 Crypto Summary

BNC’s top 10 assets by market finished the week off largely sideways again this week – with BTC trading at its highest and lowest points at $28K and $25.4K during the week. ETH traded its highest and lowest points at $1.7K and $1.6K respectively.

Bitcoin Price Chart

GLASSNODE’s latest deep dive looks at exchange risk using three different indicators: Reshuffling Ratio (looking at internal exchange transactions), Reliance Ratio (“inter-exchange transfers”), and Whale Withdrawal Ratio (large entity withdrawals). These indicators are applied to BTC, ETH, USDT, and USDC across 4 exchanges— Binance, Coinbase, Huobi and FTX. GLASSNODE concludes that FTX stood out as a “prime example of risk indicators to watch out for”, while Binance and Coinbase are best characterized as having an “unalarming overall on-chain footprint”.

Don’t miss out – Find out more today