Crypto Market Forecast: Week of September 6th 2021

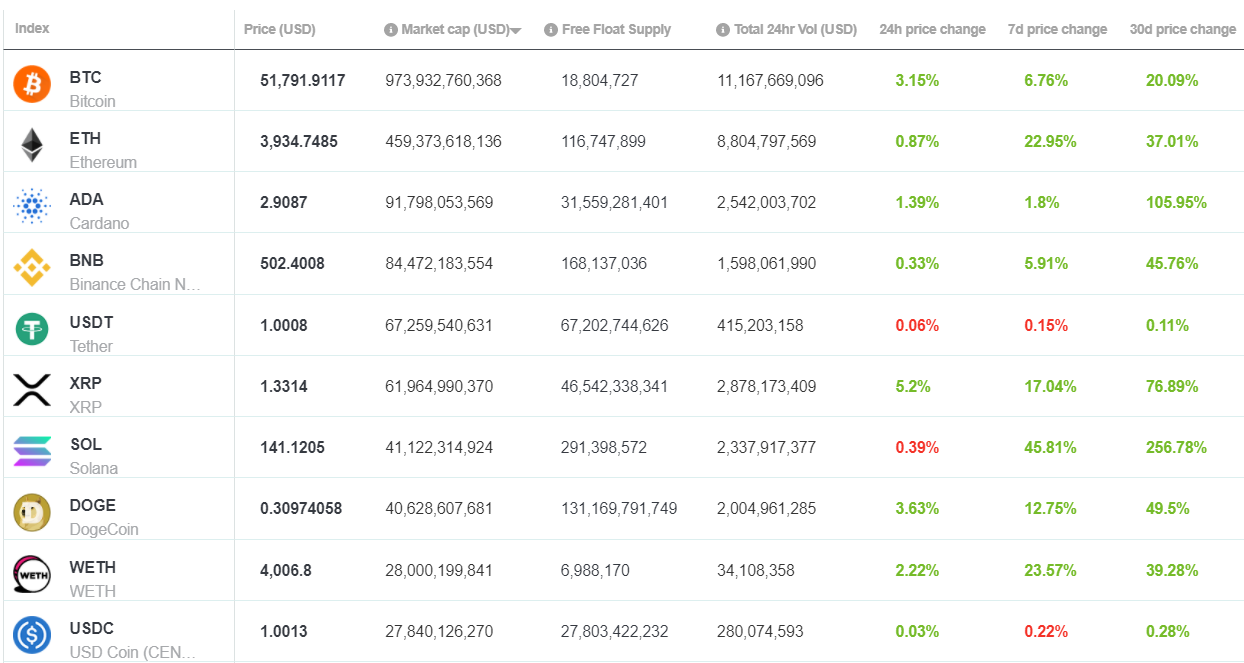

A curated weekly summary of forward-focused crypto news that matters. This week, Ethereum hovers around US$4000 after its first deflationary day, Bitcoin's appeal as a macro asset grows, and Solana continues its epic surge, climbing up the top 10 digital asset chart.

It was a bullish week of trading in the digital asset markets with a surging Ethereum leading to strong gains throughout the week. Ethereum (ETH) ended the week up an impressive 22% and is poised to challenge the key US$4000 price level. Bitcoin (BTC) ended the week up ~6% having broken the key US$50,000 price level. Alpha performers amongst large cap assets included Solana (SOL), and Filecoin (FIL), which rose ~46% and ~60% respectively.

Ethereum had its first ever deflationary day on September 3rd. This means that more Ethereum was burnt from transaction fees than was earned by miners. On September 3rd over 13,814 ETH worth ~US$55 million was burnt, a new record, compared to the 12932 ETH that was minted.

The burning or removal of ETH out of circulation is a new feature of the network. It was introduced on August 5th, as part of EIP1559, which was implemented during the non-backward compatible London hard fork. ETH has been on a sustained rally ever since, rising by ~58%. EIP1559 also introduced a base transaction fee burn mechanism. The base fee required for all Ethereum network transactions is now burnt, a design choice to prevent miner collusion.

The burn feature means that ETH now has a Bitcoin halving-esque supply constriction mechanism. The yearly inflation (money supply) growth rate is set to reduce significantly and gives ETH more appeal as a buy and hold asset.

The design of the burn mechanism means that as the transaction demand of Ethereum increases, more ETH is taken out of circulation. So if demand increases, the new supply decreases, and these two tailwinds should push the price of ETH higher. The biggest driver of demand to use Ethereum in the last week has been the booming Non-Fungible-Token (NFT) market. OpenSea, the biggest marketplace for Ethereum-based NFTs, is the largest user of gas on the network. Other NFT projects driving gas usage include Trash Pandas and the Lucky Buddha Club.

Bitcoin had a strong Sunday on the back of global stagflation concerns. The market is bullish on macro hedge investments and with large outflows of US government debt now occurring, money is flowing into risk assets. Tech stocks and Bitcoin have both surged as a result.

Stagflation occurs when growth is slow but inflation is high. In this environment, even aggressive monetary policy can be ineffective in stimulating economic activity. Last month saw the U.S. create the fewest new jobs in seven months. Job creation in the United States is drying up due to a new rise in COVID19 infections. Sectors that have been especially hard hit include leisure and hospitality.

This macro-environment appears ideal for Bitcoin, and the wider crypto-asset space, to achieve further gains as more investors search for yield and hedging opportunities.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

Crypto news for the week ahead

September 7th – Basic Attention Token Community call

A community call will be held this week for the ever-popular BAT token and Brave browser communities. The number of Brave users has just crossed the 36 million mark and the platform now has over 1.2 million users. The price of BAT is up ~18% in the last 7 days.

September 12th – Alonzo hard fork

The third-largest asset in crypto is set to implement smart contracts to its mainnet as part of the upcoming Alonzo hard fork. After a four-year wait, developers will finally be able to build dapps and programs on the chain. There are, however, concerns around the efficacy of Cardano’s UTXO model. A testnet AMM designed for high throughput dapps struggled to handle transaction demand. Cardano (ADA) is up ~2% and is up ~107% in the last 30 days.

Top 10 Crypto Summary

It was a bumper week for large-cap assets on the Brave New Coin market cap table with many assets enjoying double-digit gains. Solana rose another spot on the table, from 7th to 8th, and is up ~46% in the last seven days. Pyth went live on Solana a week ago. Pyth Network is a decentralized, cross-chain data oracle that is set to make dapp building easier by creating a funnel for real-time market data to DeFi applications.

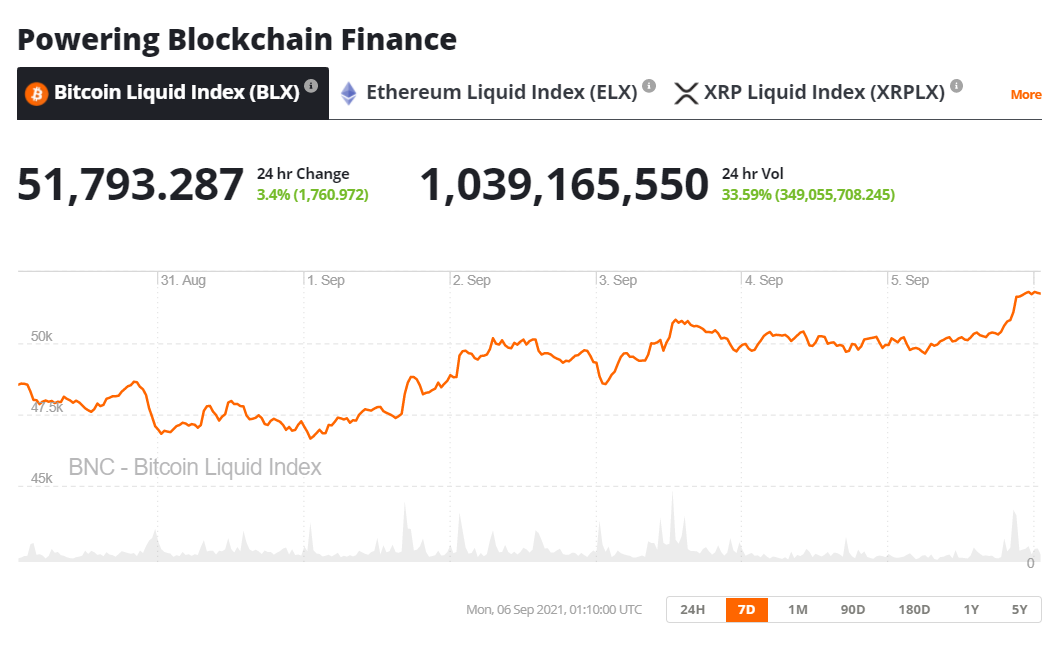

Bitcoin Price Chart

Bitcoin surged past the US$51,000 price level this week and looks primed to rise higher. Glassnode reports that long term holders continue to accumulate BTC. At present, the majority of on-chain volume represents coins that have moved in the last month. That means older coins are staying put with the hands of long-term investors. Glassnode suggests that this is a bullish indicator.

Don’t miss out – Find out more today