Crypto Predictions 2019: Alt-Coin Contenders WAVES

In 2019 the cryptocurrency sector will continue its evolution. While its early years have been dominated by almost entirely speculative trading, as the market matures, a digital asset’s ‘fundamentals’ will become increasingly important as value indicators. BNC’s 'Alt-Coin Contenders' series introduces assets with fundamental characteristics that set them apart from their competitors and justify their inclusion in any investor’s ‘ones to watch’ list.

From an investment perspective, valuing businesses is typically done using time honored formulas like price to earnings and price to book ratios, PEG calculations and dividend yields. In the crypto space, none of these methods apply directly — and investors continue to wrestle with how best to assign a value to digital assets in a nascent industry that is sentiment driven and characterized by wild volatility

To that end, the purpose of this ‘Alt-Coin Contenders’ series is to identify specific assets that BNC analysts have identified as having fundamental characteristics that at the very least, justify investors including them in a ‘ones to watch’ list.

The selections are made based on a range of criteria – things like hashrate or an increase in on-chain transactions. Or staking metrics for Proof-of-Stake blockchains and the size and enthusiasm of an asset’s ‘community’. Or apparent liquidity — significant exchange listings and fiat on-ramps. Exposure to potential legislative action is also important, as are the people behind the scenes — inspiring leaders with ‘rock star’ social media status, or alternatively, big-time financial backers with deep pockets and a track record of success.

No single asset will tick every box, and some will tick more than others, but what this series aims to do is move readers beyond simplistic FUD, FOMO and speculation — and introduce the range of fundamental token attributes that should become recognized value indicators as the industry matures.

WAVES: Opening the doors to token creation

Waves is a public blockchain characterised by its simple, clean and streamlined user experience. The main value and appeal of the platform is derived from the Custom Application Token (CAT) process, which lets any user create a custom token directly using the easy-to-navigate WAVES Lite client which can run as a Desktop App or on Mobile with Android or iOS.

Creating a token does not requires a user to download the entire WAVES blockchain, have any prior coding knowledge and costs 1 WAVES (~$3.28). The Lite client also comes packaged with the WAVES Decentralized exchange (DEX) service allowing a user to instantly launch their created token for trading.

Given the streamlined, simple nature of the CAT protocol, custom Waves tokens lack some of the functionality of ERC-20 tokens built on Ethereum. But the simplicity of CAT makes Waves a genuine alternative for basic ICOs or fundraising projects.

From a legal perspective, the Waves platform has partnered with international audit giant Deloitte to help provide compliant legal framework for ICO projects choosing to launch on WAVES. Both parties will hope that with new precedent generated as part of the strategic initiative, Waves will become a robust platform for crypto-focused ventures in the near future. There have been 21,816 tokens launched on Waves.

The Waves blockchain also has number of additional features to compliment its core mechanism as a token creation platform. The Waves DEX is a legitimate infrastructure project in its own right and handles over half a million USD worth of trading volume daily and the WAVES clients wallet allows onboarding of fiat users.

The WAVES token currently has utility as the within ecosystem Waves blockchain. It lets users build and raise funds for new tokens, can be used as a base pair on the Waves DEX, or as peer-to-peer payment medium. The entire supply of the token, 100,000,000 WAVES is already circulating. The token currently trades at ~$3.09. Down ~82% from an all time high of ~$18, but is up over 200% in the last month and was trading around ~$1 in late November.

A new form of hybrid algorithm

Transactions on Waves are settled using the unique WAVES-NG protocol that combines elements of traditional Proof-of-work & Proof-of-stake creating a system designed to drive higher bandwidth(throughput) and lower latency.

The core of the protocol is a liquid block solution. Initially a key-block is determined by proof-of-stake. The node that generates the key block is then a leader that issues ‘micro-blocks’. The micro blocks contain ledger entries with no requirement for proof-of-stake and our generated by the leader every election cycle.

The key-block is small because it only contains the coinbase transaction that defines the public key that will be used by miners to sign subsequent blockchain transactions.

The leader can thereby issue microblocks relatively quickly by simply signing them with the private key corresponding with public key named in the key-block’s coinbase. For a microblock to be valid it must meet the requirements of Waves state machine and have a valid signature. Once all microblocks are validated, they join up with their corresponding key-block, are merged and added to the blockchain.

Unlike traditional proof-of-work which can appear static as miners await progress on consensus results, liquid blocks in Waves-NG package multiple operations together meaning fluidity between mining operations & consensus. More information on Waves-NG can be found here

Waves also implements a leased Proof-of-stake protocol that lets users lease out their entire WAVES balance to a full node who validates blocks on their behalf. This also gives WAVES holders a bank account style value proposition as tokens can sit and earns rewards passively on any Waves Lite client.

Because of the Jack-of-all trades nature of the Waves blockchains, offering token creation operations, DEX transactions, numerous monthly airdrops, it is a network characterised by numerous micro-transactions. The Waves-NG protocol was designed to be scalable with this specific aspect of the Waves blockchain in mind.

For reference the Average daily median transaction value on the Waves blockchain is ~USD 8.78, while the same value sits at ~USD 283 for XRP and ~USD 394 for Bitcoin. Additionally WAVES blockchain has always retained transaction fees of 0.001 despite periods of increased transaction demand triggered by market conditions.

The Waves blockchain settlement layer appears to be functioning with relative stability and security. It has energy conservation advantages over traditional Proof-of-work via the partial implementation of PoS, and uses protocols conceived as part of Bitcoin ‘Next-Generation’ to ensure fluid transaction settlement over a micro-transaction focused network.

Short term fundamentals: surges in on-chain volume

NVT Signal

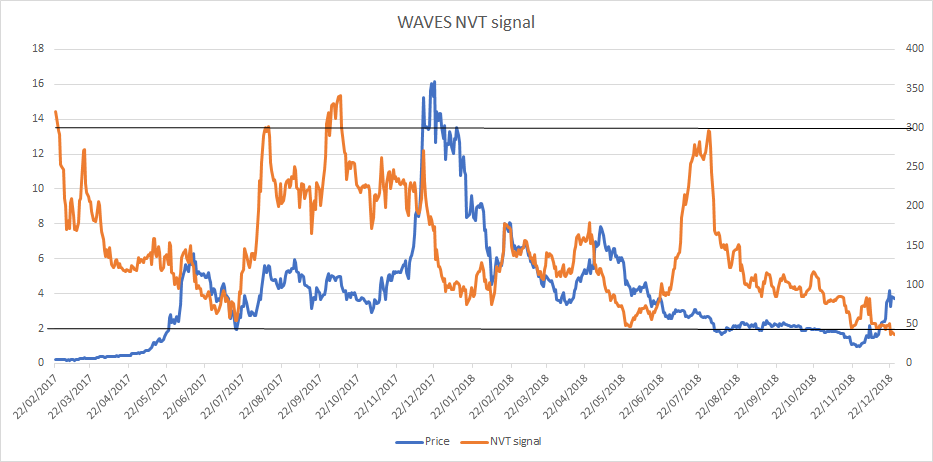

WAVES NVT signal and price. NVT signal calculated with data from Coinmetrics.io.

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin. Crypto markets are prone to bubbles of speculative purchasing, not backed up by underlying network performance and activity. The NVT signal provides some insight into what stage of this price cycle a token may be in.

A high NVT signal is indicative of a network that is going through one of these bubble periods, and may move towards a position of becoming overbought/overvalued, because of the market’s speculative assessments running out of steam.

Despite strong price gains over the last month the NVT signal for WAVES has steadily dropped.The crossing of NVT signal and price in recent months can be considered bullish signal.

A number of factors can be considered for the recent price run of WAVES have been key fundamental updates such as the release of a stable mobile wallet for the platform and the recent raise of $120 million for the Vostok private blockchain for corporations and governments.

The crossing lines of NVT signal and price indicates that along with hype and speculative upward price pressure, there has been a sharp accompanying short term increase in the volume of onchain transactions.

As discussed earlier, the Waves blockchain is often distinguished by its accessible nature. This would suggest that the platform may be more capable of converting initial holders into onchain participants than other competitor networks. This accessibility and coverage has been extended with the recent mobile wallet launch and other fundamental updates.

The new mobile wallet has full DEX capabilities. All traffic on the App is fully encrypted, ensuring protection of private keys. Additionally users can also add extra security layers with mobile specific features like fingerprint recognition.

The downward trend in NVT signal has been ongoing since July and has not yet hit an inflection or begun reversing upwards. It has recently dropped below a historically indicated ‘oversold’ region. If NVT signal does hit eventually hit a threshold and start reversing upwards, it is likely to bring some forward price momentum with it.

Heading into 2019, given Waves closes out the year as blockchain defined by ongoing practical software updates coinciding with rises in network activity, the blockchain also retains a strong long term investment propostion.

The network has recently launched capabilities to host Turing-complete smart contracts, this means new tokens launched on Waves will have added functionality and utility within launched projects. Alongside the other features of Waves, more complex ICOs hosted on the blockchain may be a driver of network activity in the coming year.

Network Momentum

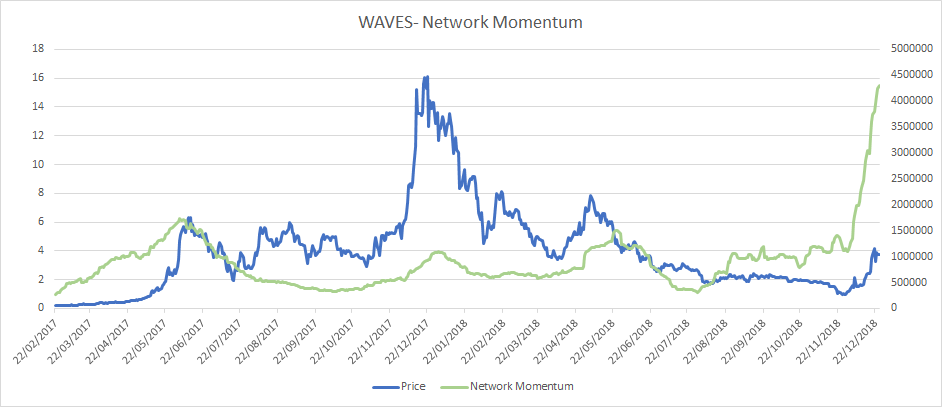

WAVES Network Momentum and price. Network Momentum calculated with data from Coinmetrics.io.

Network momentum is a Blockchain indicator metric conceived by analyst Positivecrypto. Indicated by the red line on figure 3, It assesses onchain volume as an indicator for future price movements. Where it differentiates from NVT signal is that the daily volume of token transactions, rather USD value of onchain transaction volume, is used for assessments.

The simple intuitive idea is that rising rate of onchain volume (in token terms not USD terms) is signal for growing ‘momentum’ within the network, vice versa for falling on chain volume in token terms.

The WAVES network momentum chart backs up the results of the NVT signal analysis. There has been a large surge in the movement of WAVES tokens in recent months. Initially the rising velocity appears to have been triggered by a rising, but WAVES token momentum has continued on a sharp upward trajectory indicating that it may be semi-detached with price and potentially driven by non-market factors and is organic.

On-chain Transaction utility of the WAVES token comes from its use as payment medium when creating custom tokens, as a base pair on the WAVES DEX or as a peer-to-peer payment tool. These are all potential avenues to drive network momentum forward.

Price-to-Metcalfe ratio signal

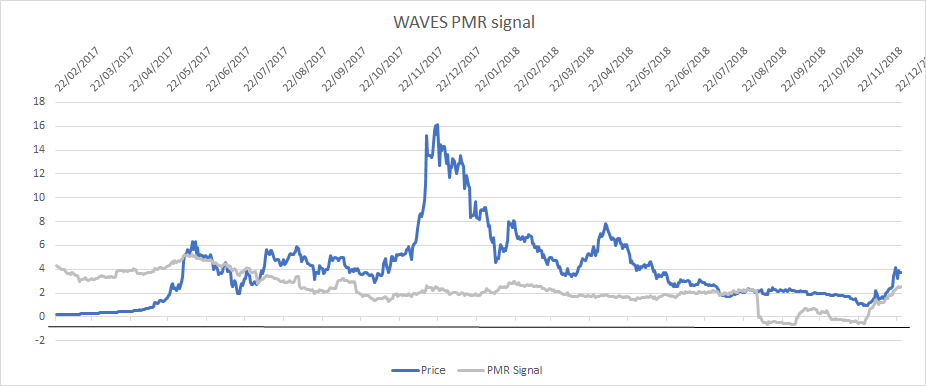

WAVES Kaichkin’s Price-Metcalfe ratio and price. PMR calculated with data from Coinmetrics.io.

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin, and by comparing it to price, can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to implement versus onchain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily. However, there may be a question of the granularity of the data, and who controls these addresses.

Unlike Onchain transaction volume metrics, that have shown no sign of PMR pushing downwards against rising price. Price-to Metcalfe ratio appears to have recently hit an inflection point and is now reversing upwards, moving along with the quickly rising token price over the last month.

The pattern of stabilizing active address growth alongside sharply rising onchain transaction volume indicates that the recent growth in network activity and WAVES token movement is likely coming from existing users. This fits into the narrative that recent fundamental growth has been propelled by the active and eager Waves community.

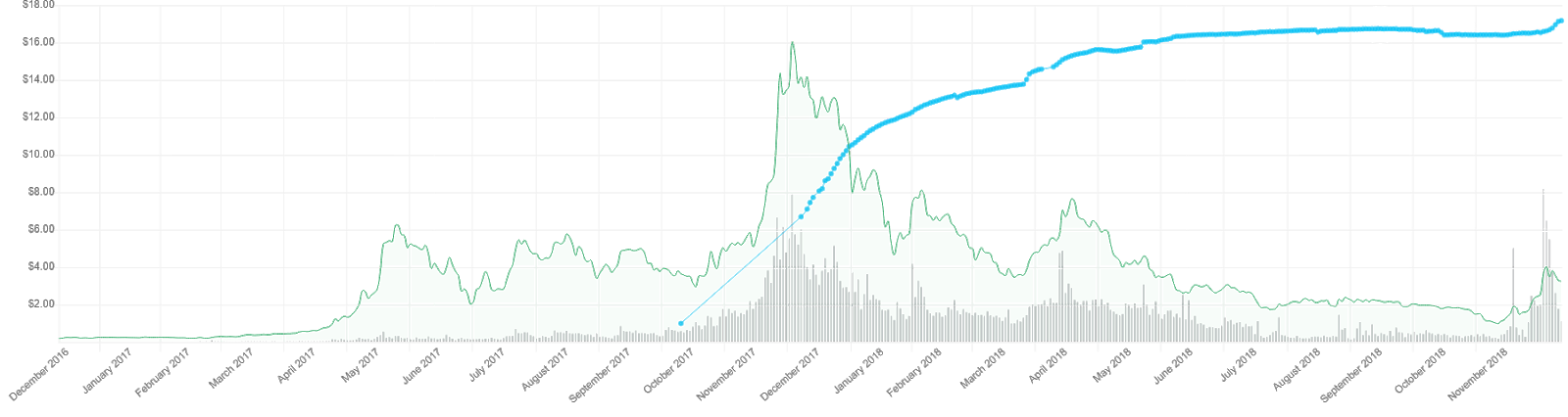

WAVES Github and Twittter activity growth. Github commits represented by black barcharts and Twitter activity blue line.

Conclusions

The WAVES token has gained mainstream coverage over the last months showing a distinct ability to buck the trend of the ongoing crypto bear market and enjoy monnthly price strides reminiscent of 2017’s bull market.

Accompanying this price run has been a subsequent increase in on-chain network activity that shows no signs of waning. Both NVT signal and network momentum point appear likely to soon be reaching a point where they will create a new of forward price pressure driven by fundamentals.

Long term indicators also appear positive and stable. The blockchain and token are backed by an enthusiastic and vocal community and the networks idiosyncratic consensus method has shown an ability to maintain stable throughput while theoretically it has the capability to navigate through any potential transaction bottlenecks smoothly.

Finally, the WAVES tokens multiple utilities, which are likely to be widened with the recent implementation of Turing complete smart contracts, makes the token a diversified investment oppurtunity. It appears likely to have a life beyond the ongoing crypto winter, and seems set to be an alt-coin leader heading into the next crypto bull run.

Don’t miss out – Find out more today