Data Snippet – Bitcoin ‘Hash Price’ in a fluctuating market

Taking a look at on-chain metrics gives us a glimpse into the health and growth of the Bitcoin network. How is the network doing amidst COVID-19 and the greatest stock market crash since the roaring ’20s?

Taking a look at on-chain metrics gives us a glimpse into the health and growth of the Bitcoin network. How is the network doing amidst COVID-19 and the greatest stock market crash since the roaring ’20s?

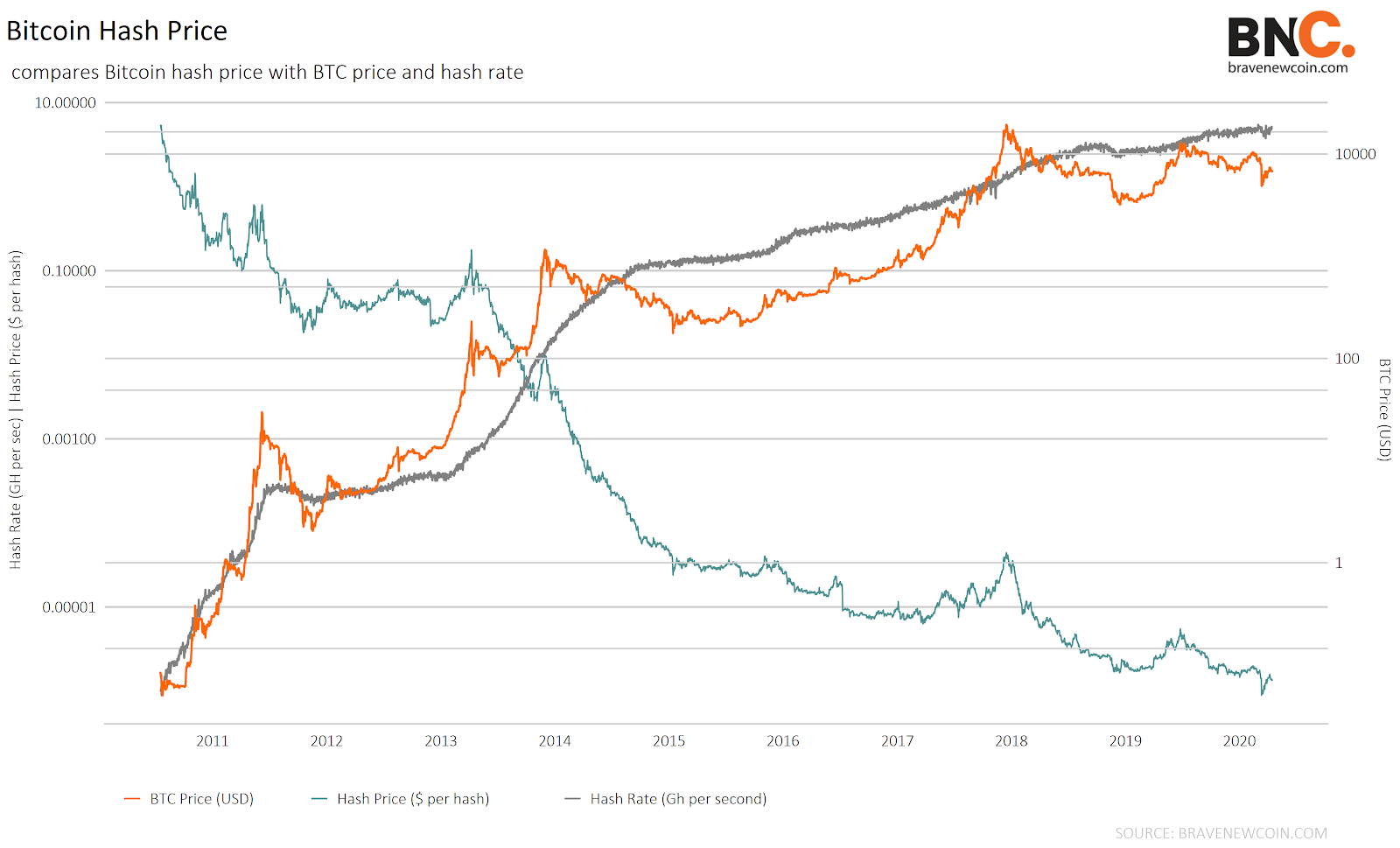

TODAY WE’RE DIVING INTO THE BITCOIN HASH PRICE:

CHART FEATURES

- Hash Rate: The computational power of the bitcoin network, per second.

- Price: The End Of Day closing value of BNC’s Bitcoin Liquid Index (BLX).

- Hash Price: The miners’ revenue generated per hash. This metric can be used to track mining capabilities over time.

- Hash price = (miners revenue * price)/(hash rate(GH/sec) * 86.4)

INSIGHTS BREAKDOWN

Taking a look at price peaks over the last 10 years, with lots of ups and downs alongside hash rate growth, we can identify that the hash price drops gradually following a peak.

- The number of hashes per day is increasing, as miners deploy more and more efficient hardware.

- With the increase in computational power that miners have to invest, the hash price per hash has been declining.

- Revenue per hash has therefore been decreasing.

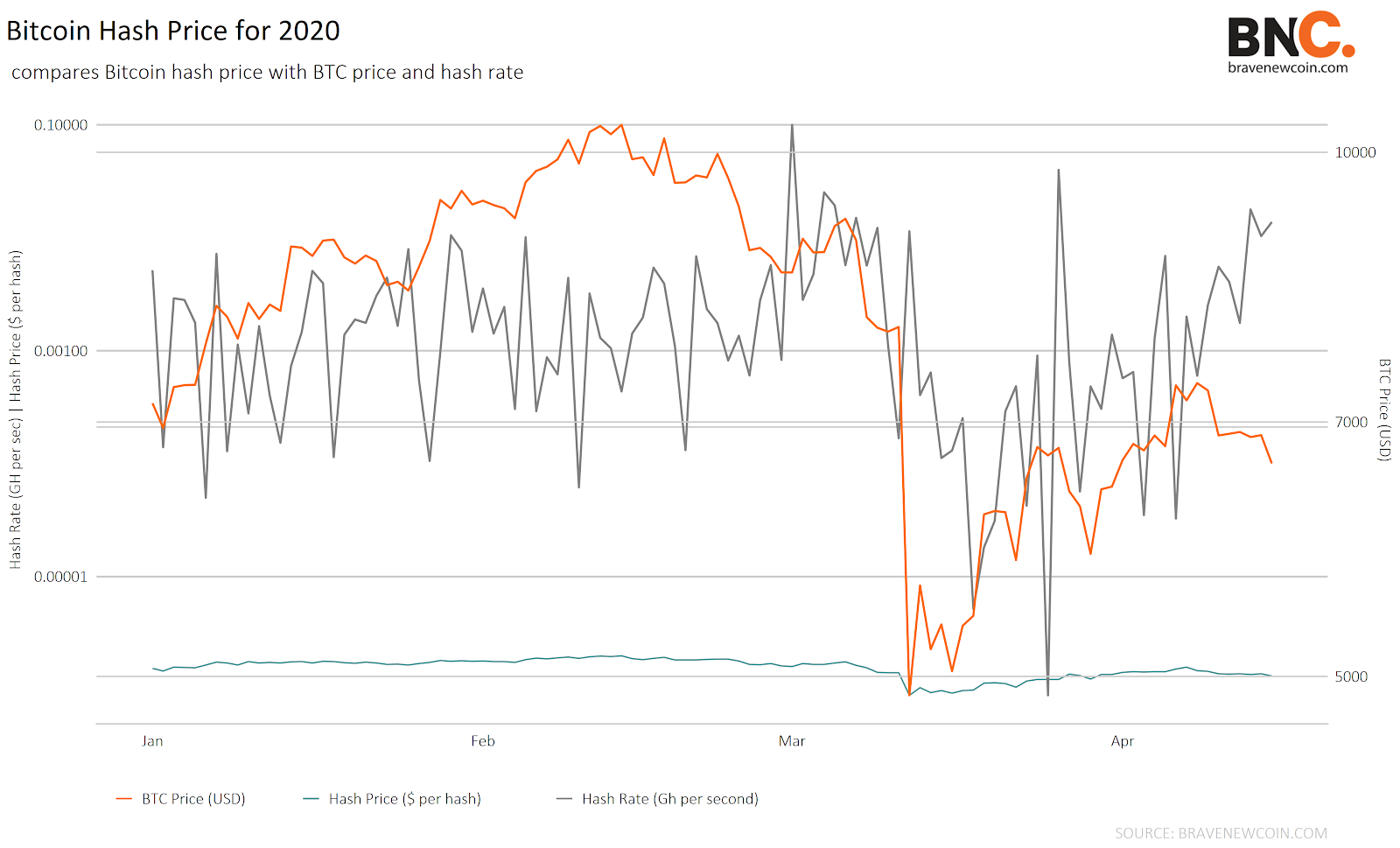

DIVING DEEPER INTO THE 2020 DATA:

TAKE-AWAYS:

Looking at the above graph, which details the bitcoin networks performance and the BTC/USD market spot price in 2020, we can see that:

- At the beginning of the year, the BTC/USD price increased to ~US$10370 on the 14th of February, up from ~7k on the 31st of December, 2019. Because of this, the hash price per hash increased from US$1.16 to US$1.99 in the same period.

- In March, there was a huge drop in BTC/USD markets, bringing spot prices to ~US$5k, amid global turmoil during the COVID-19 pandemic. The drop led the hash price to drop to US$0.89 per hash.

- Hash rate and BTC/USD are not relative to each other in the short term, and the hash price has therefore been gradually changing.

- Due to the high volatility in all global markets, Bitcoin also saw drastic changes in the network. This became evident toward the end of March 2020, as the hash rate fluctuated due to a drop in mining activity. A difficulty target drop of ~19% quickly followed.

- Currently, with a lack of hash power and increasing prices, the miners’ revenue per hash is growing moderately.

With the upcoming Bitcoin halving and current COVID-19 crisis, we can expect more fluctuations in the bitcoin network. The hash price per hash will also see some decrease as the block reward halves, to 6.25 BTC. Miners may then rely more on an increase in transaction fees, or turn to more profitable blockchains.

Don’t miss out – Find out more today