Decoding the Bitcoin Halving: A Guide to the Fourth Halving

At the heart of the Bitcoin ecosystem is a unique event known as the halving, which plays a pivotal role in shaping its supply dynamics and price trajectory. Here’s everything you need to know about today’s Bitcoin Halving.

In the fast-evolving landscape of digital currencies, Bitcoin stands as the pioneer, capturing the imagination of investors, technologists, and economists alike. At the heart of Bitcoin’s ecosystem lies a unique event known as the halving, which plays a pivotal role in shaping its supply dynamics and, consequently, its price trajectory.

As the fourth Bitcoin halving event unfolds today, let’s delve into the fundamentals of Bitcoin, the significance of halving, and the historical patterns surrounding its price movements post-halving.

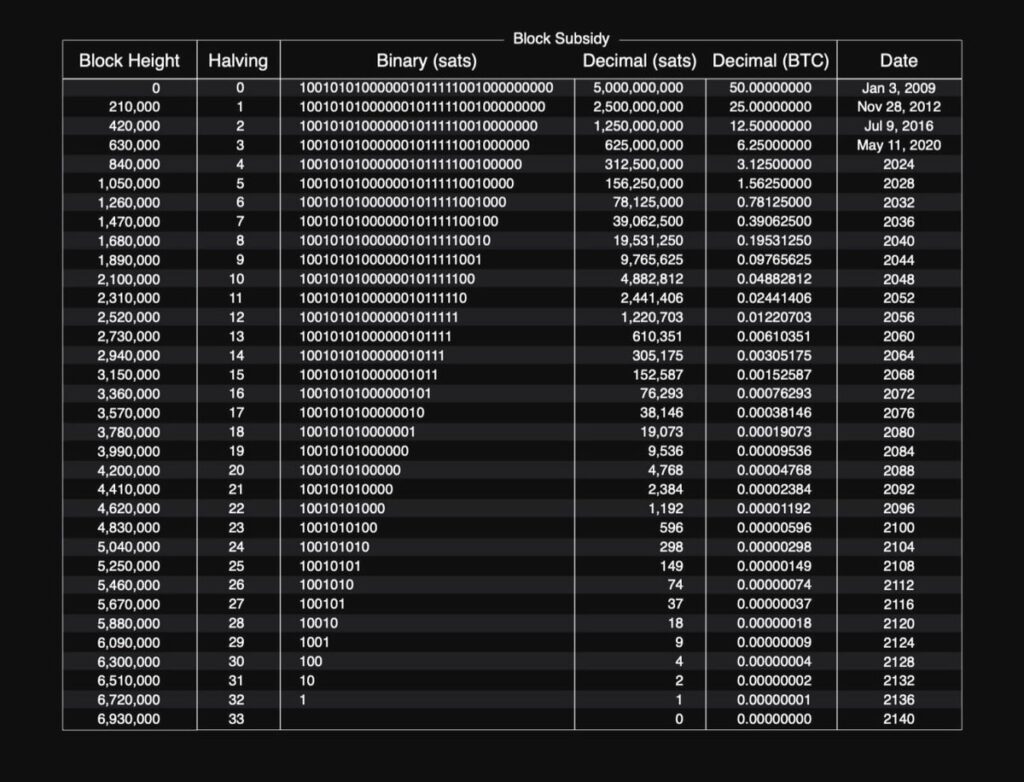

Today’s Bitcoin halving is scheduled to happen around 8 p.m. ET on April 19th, at block height 840,000. This halving will reduce the block subsidy from 6.25 BTC to 3.125 BTC.

Bitcoin halvings are pre-programmed to happen every 210,000 blocks, approximately every four years. With each halving, miners receive 50% fewer bitcoins as a reward for mining and adding transactions to the blockchain. However, they still earn transaction fees as usual for each block mined.

Bitcoin has experienced three previous halving events, which decreased the block subsidy inflation from 50 BTC to 25 BTC in 2012, then to 12.5 BTC in 2016, and finally to 6.25 BTC on May 11, 2020. The latest halving has now further reduced the subsidy reward for miners to 3.125 BTC per block. Ultimately, there will only ever be 21 million bitcoins in existence.

These halving events will continue until the expected year 2140 when the last bitcoin is projected to be mined. After that, miners will solely rely on transaction fees for their earnings

Understanding Bitcoin

Bitcoin, introduced in 2008 by an anonymous entity known as Satoshi Nakamoto, is a decentralized digital currency that operates on a peer-to-peer network without the need for intermediaries like banks or governments. It utilizes blockchain technology, a distributed ledger system, to record all transactions securely and transparently.

Unlike traditional fiat currencies, which are subject to inflationary pressures due to centralized control and issuance, Bitcoin has a capped supply. The total supply of Bitcoin is limited to 21 million coins, making it a deflationary asset over time. This scarcity is fundamental to Bitcoin’s value proposition, akin to digital gold.

The Halving Event

Central to Bitcoin’s monetary policy is the halving, an event that occurs approximately every four years or after every 210,000 blocks mined. During this event, the reward that miners receive for validating transactions and adding them to the blockchain is halved. Initially set at 50 bitcoins per block, the reward reduces by half, ultimately reaching zero through a geometrically decreasing issuance schedule.

The halving mechanism serves two primary purposes. Firstly, it controls the rate at which new bitcoins are introduced into circulation, ensuring a predictable and diminishing supply over time. Secondly, it amplifies Bitcoin’s scarcity, akin to a digital “gold rush,” as the cost of mining increases while the supply diminishes.

Miners are rewarded for their work with newly-created bitcoins. This is called the block reward. This is how new bitcoins are released into the system. A new block of transactions is added to the Bitcoin blockchain approximately every ten minutes. The miner that verifies each block receives the block reward. The current block reward is now 3.125 bitcoins per block.

Source: X The Bitcoin Halving Schedule

Price Impact of Previous Halvings:

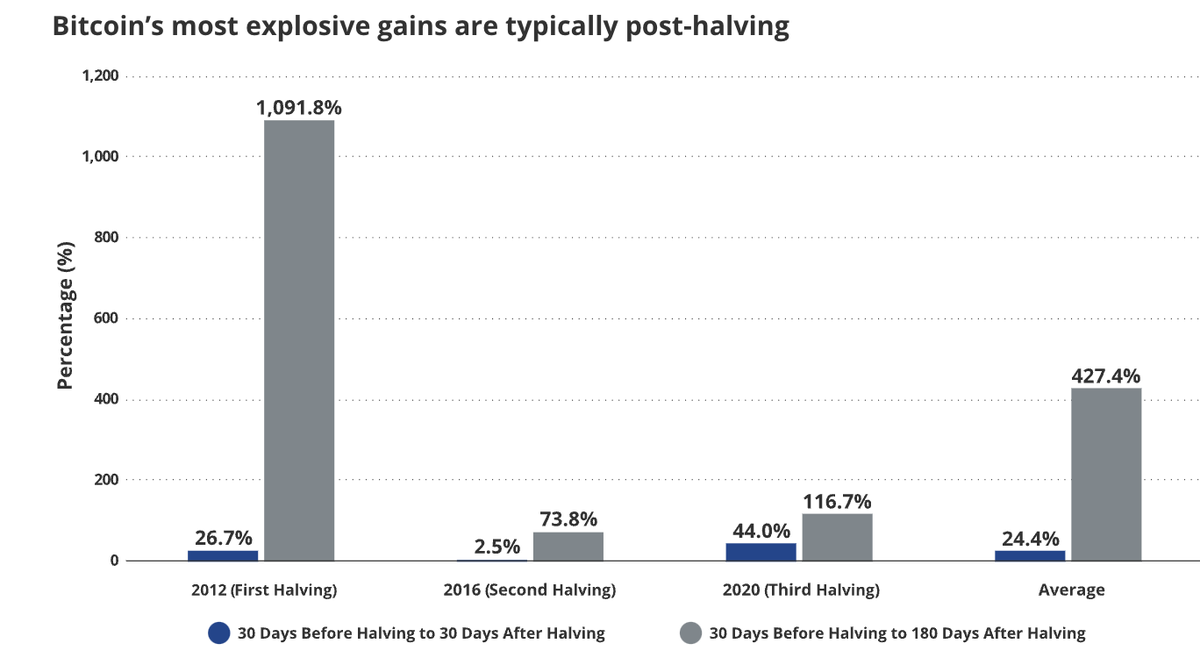

Historically, Bitcoin halving events have been associated with significant price movements, albeit with varying degrees of immediacy and magnitude. The first halving, which occurred in November 2012, marked a watershed moment for Bitcoin, transitioning it from a niche experiment to a viable digital asset. In the year following the first halving, Bitcoin’s price surged from around $12 to over $1,000, representing an increase of over 8,000%.

The second halving took place in July 2016, heralding another phase of price appreciation for Bitcoin. While the immediate reaction was more subdued compared to the first halving, Bitcoin’s price embarked on a steady ascent in the months that followed. By December 2017, Bitcoin reached an all-time high of nearly $20,000, underscoring the enduring impact of the halving on market sentiment and investor behavior.

The most recent halving occurred in May 2020 amidst global economic uncertainty and the COVID-19 pandemic. Despite initial concerns regarding market volatility, Bitcoin demonstrated resilience, with its price rallying in the months following the event. By December 2020, Bitcoin surpassed its previous all-time high, surpassing $20,000 and igniting a renewed frenzy of institutional and retail interest in the cryptocurrency.

While no one knows what will happen to the price of Bitcoin in the months ahead, the key point is that most of Bitcoin’s price appreciation happens in the months following each cycle’s halving event as the chart below shows.

Source: X

If we look at the price chart of Bitcoin with the halvings overlaid, we can see the same dramatic effect.

Source: X

Source: X

Market Dynamics and Speculation:

While the historical patterns surrounding Bitcoin halvings provide valuable insights into market dynamics, it’s essential to approach them with a degree of caution. Market sentiment, macroeconomic factors, regulatory developments, and technological advancements all play a significant role in shaping Bitcoin’s price trajectory.

Moreover, the correlation between halving events and price movements is not always immediate or linear. Price discovery in cryptocurrency markets is inherently speculative, influenced by a myriad of factors beyond the halving schedule. Traders and investors often engage in anticipatory behavior, pricing in the halving event well in advance, leading to both pre-halving rallies and post-halving corrections.

As the fourth Bitcoin halving event unfolds today, the cryptocurrency community eagerly anticipates its impact on market dynamics and investor sentiment. While historical precedents suggest a bullish narrative, always approach these events with a nuanced understanding of the underlying fundamentals and the broader macroeconomic context.

Bitcoin’s journey from a fringe technology to a global digital asset has been characterized by volatility, innovation, and resilience. The halving events represent key milestones in Bitcoin’s evolution, reinforcing its status as a deflationary store of value and a hedge against traditional financial systems.

As we navigate the uncharted waters of digital finance, one thing remains certain: Bitcoin’s halving events will continue to captivate the imagination of enthusiasts and analysts alike, shaping the future of money in the digital age.

Article banner by @worshipbitcoin

Don’t miss out – Find out more today