DeFi versus CeFi: New Data Reveals Major Market Share Changes After FTX

New data from Brave New Coin and others highlights winners and losers as the loss of trust after FTX triggers a significant shift in trading habits across the crypto sector.

In 2022, the sudden collapse of FTX, one of the largest and most influential centralized cryptocurrency exchanges in the world, left a gaping hole in the crypto trading ecosystem. Data shows that since the fall of FTX, exchange volumes have dropped considerably, and more than 8 months after the incident, they are yet to recover to pre-FTX levels.

Trust in centralized systems has been severely shaken, and volumes on exchanges that operate similarly to FTX have since fallen. Spot volumes are down across major centralized exchanges. Some of this lost volume has likely been swept up by other crypto-swapping options such as decentralized exchanges, OTC brokers, and Peer-to-Peer swap facilities. It is, however, likely that some traders and investors have been burnt so badly by FTX that they are sitting on the sidelines.

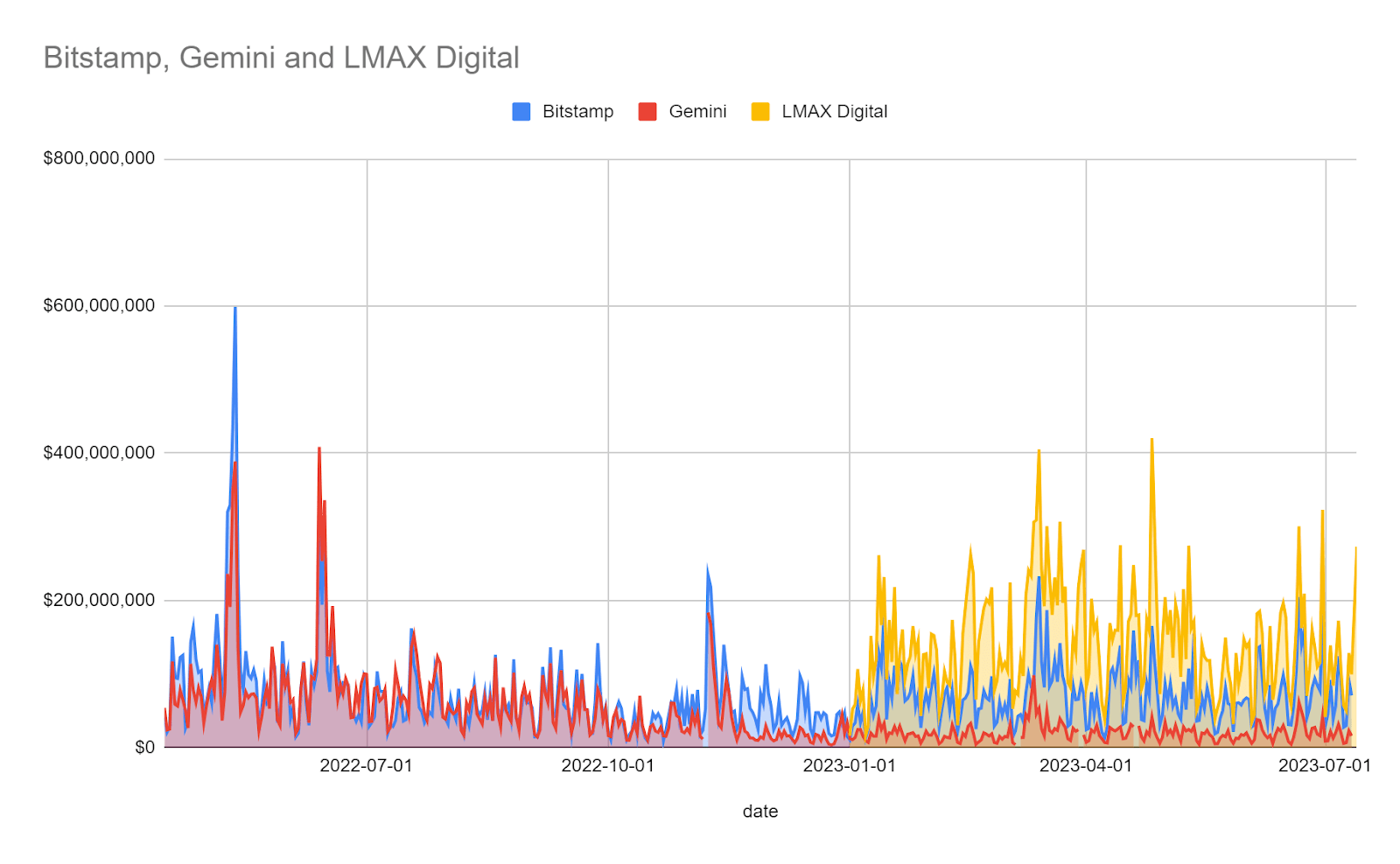

Notable in the data recorded is the volume on institutional exchange LMAX, which has exceeded volumes on more retail-centric exchanges such as Kraken and Gemini.

Another factor is the new set of regulations and requirements for exchanges and digital asset infrastructure companies. Many of these new restrictions against crypto companies have emerged as a result of the revelation of shoddy practices at FTX. The new rules make it harder for exchanges to operate.

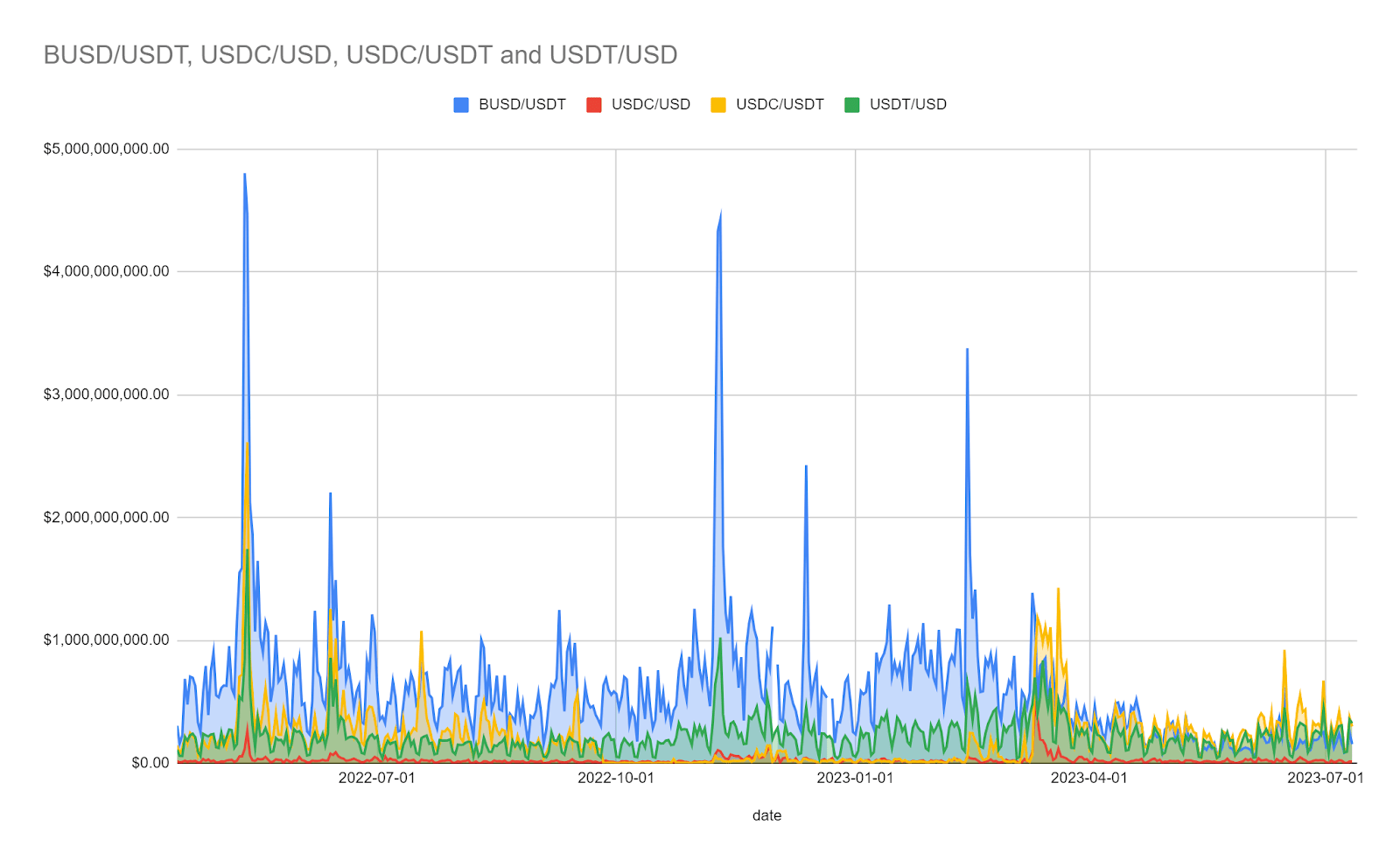

Data from Brave New Coin, for example, indicates how regulation against Binance, the issuer of Binance-USD (BUSD), has affected the overall state of volumes across the stablecoin market.

It is not all doom and gloom. There is evidence within the data to suggest that volumes across crypto and centralized exchanges are recovering alongside strong price momentum of 2023 and that the ecosystem is beginning to move on from the collapse of FTX.

Background: The collapse of FTX

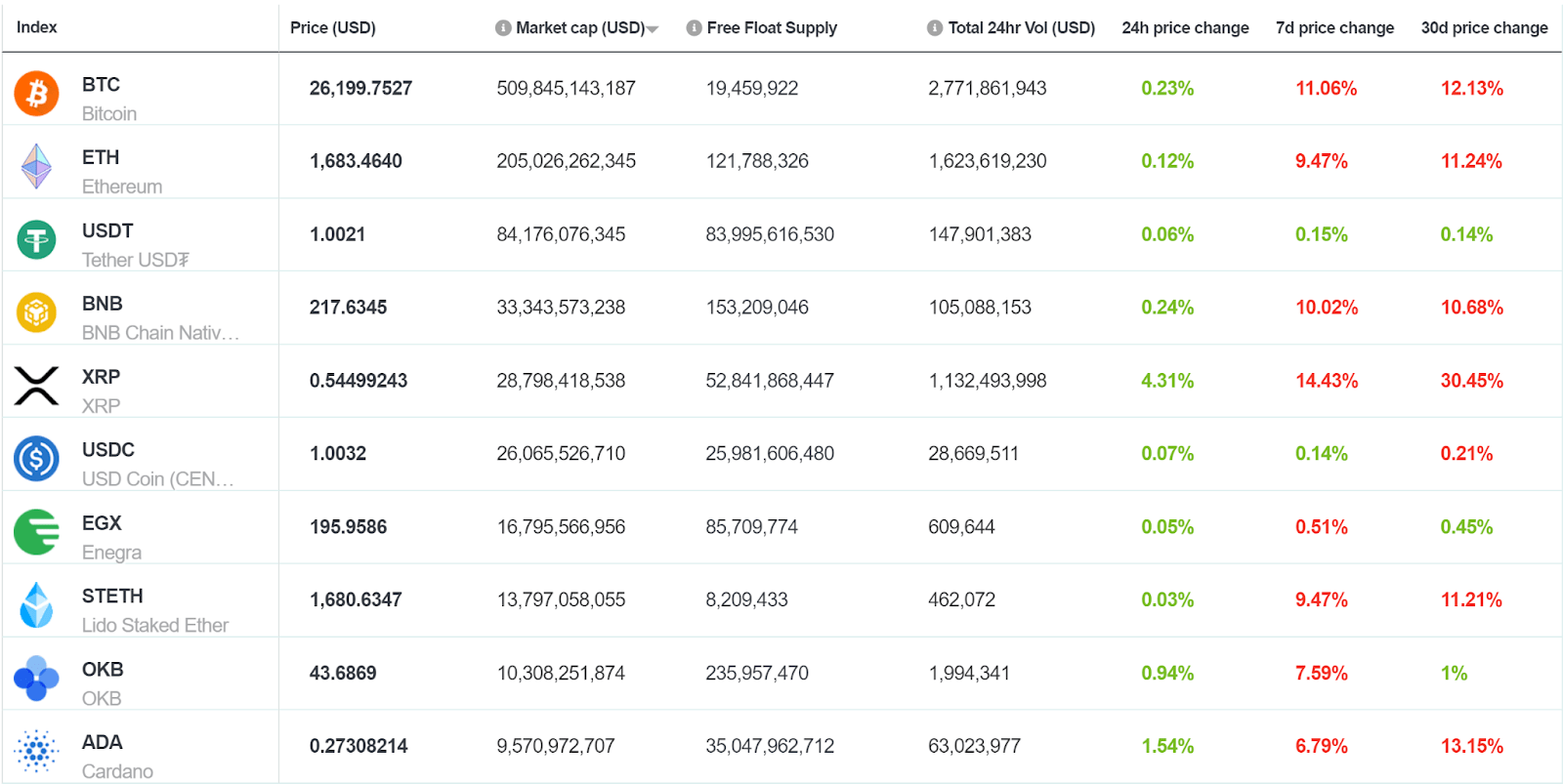

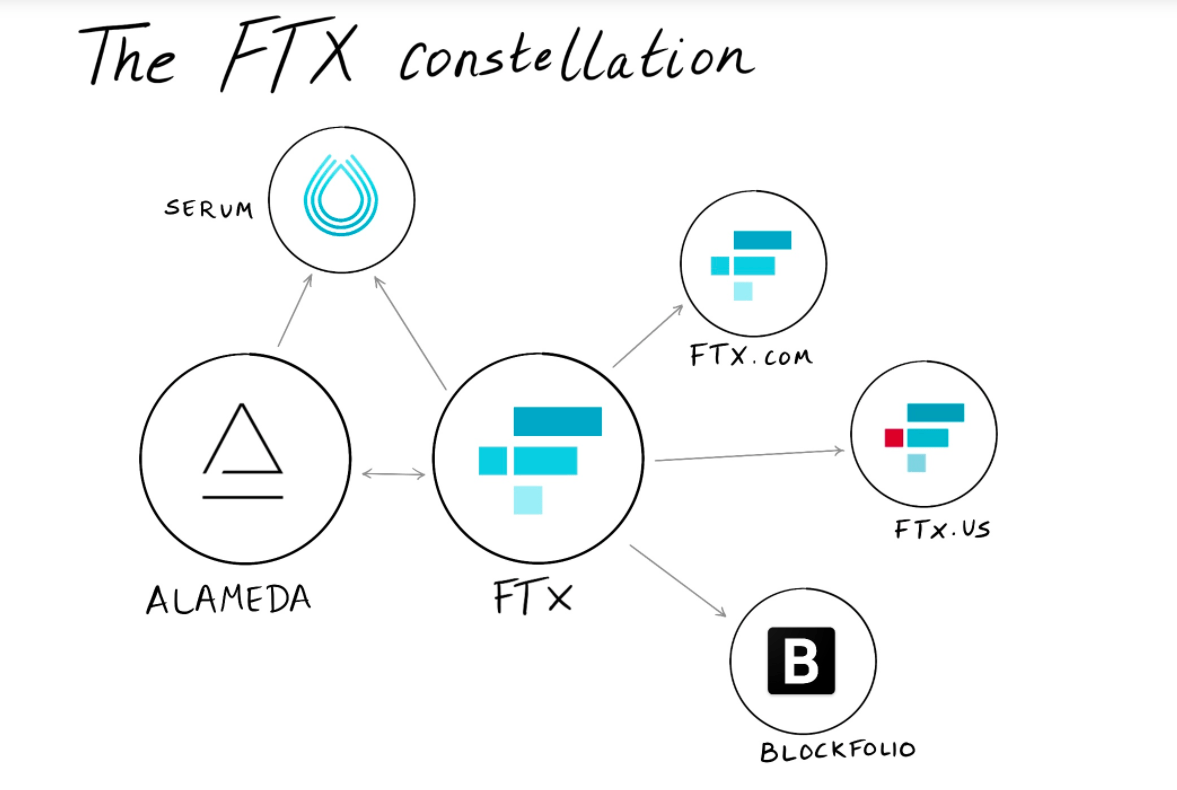

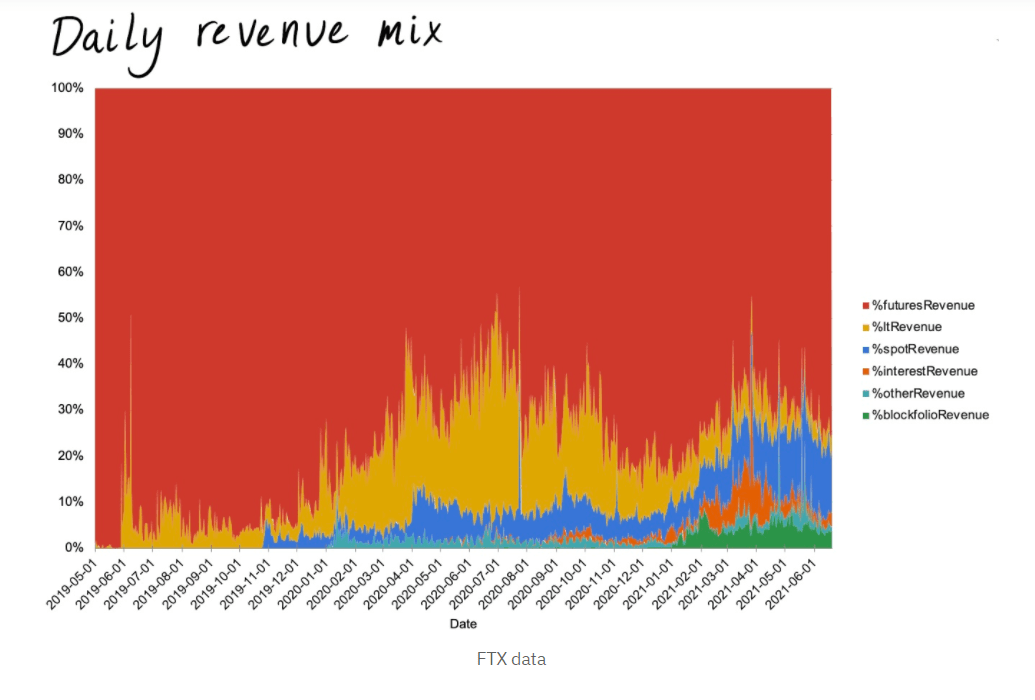

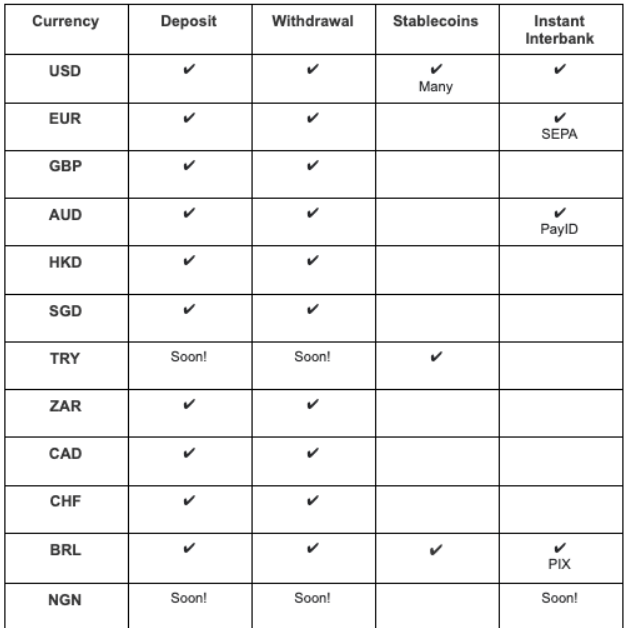

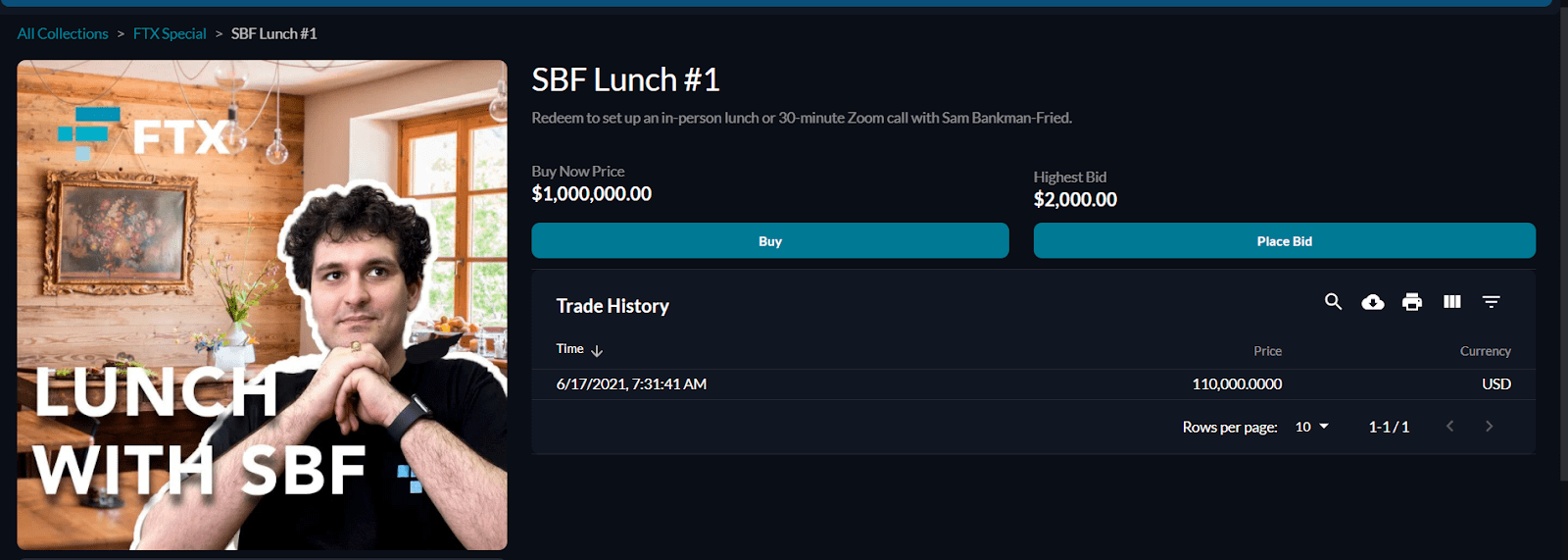

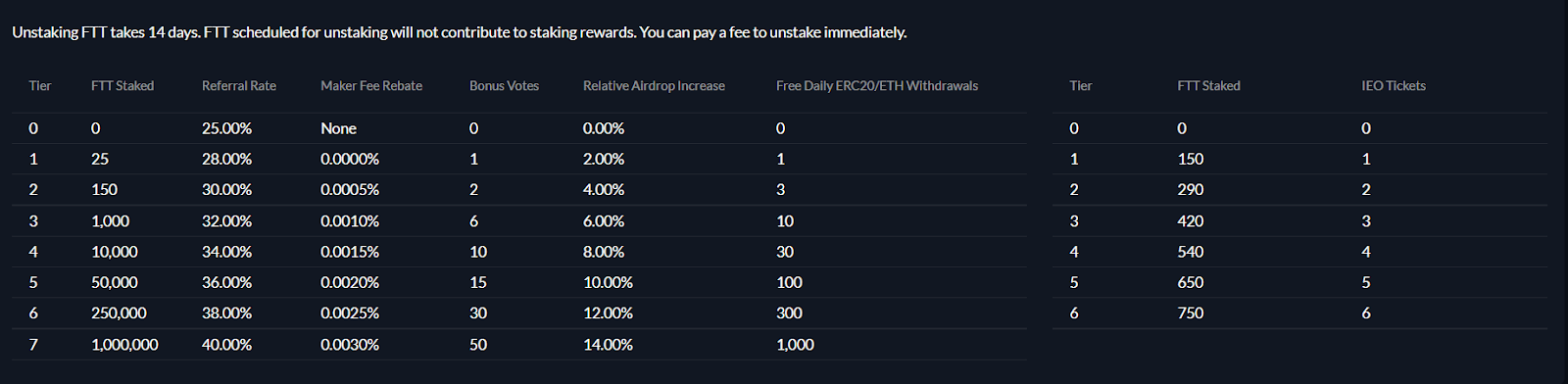

FTX was a Hong-Kong based one-stop-shop cryptocurrency exchange that offered derivatives, fiat-to-crypto, crypto-to-crypto, and OTC solutions for investors and traders. Despite only being founded in 2019, FTX had risen to a position of prominence within the crypto exchange space. It was one of the most used fiat-to-crypto, crypto-to-crypto, and crypto derivatives platforms in the world, owning a significant market share in each of these categories.

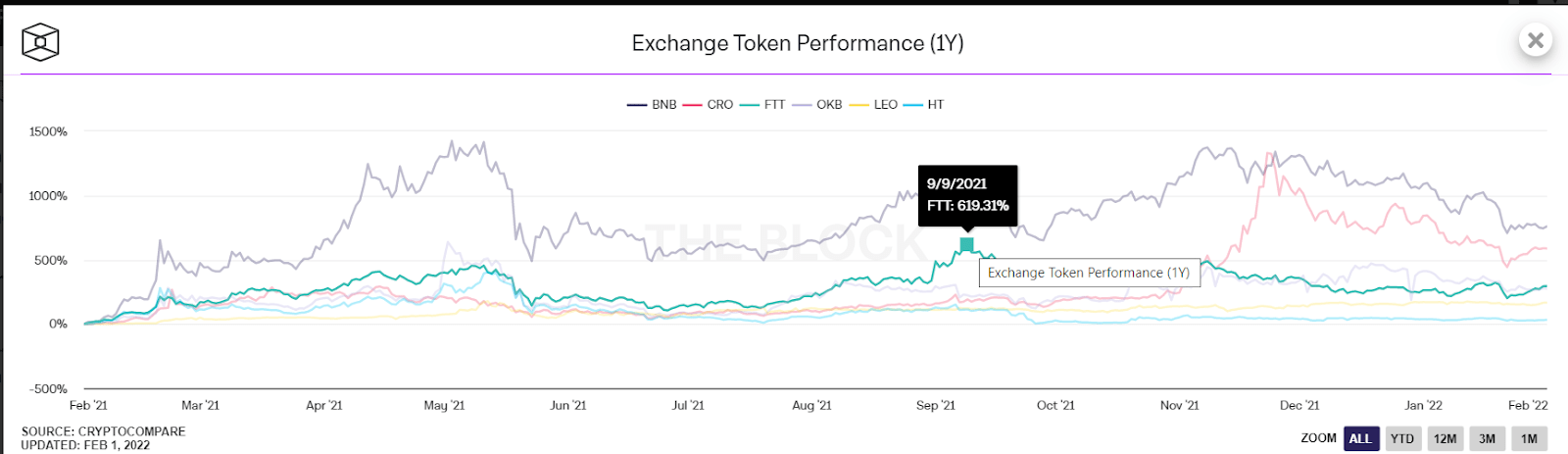

The mega exchange, however, unraveled in November 2021 after the price of its native token FTT collapsed. As time passed and more information arrived about the depths of FTX’s troubles, it became clear that the emperor had no clothes. The exchange is now insolvent, and its founder and several key staff have been charged with multiple counts of fraud by key US financial regulators.

According to FTX statistics from 2021, the exchange had 1.2 million users on its books. The collapse of FTX left millions of crypto users without an exchange. Where would they go now, and would they even be willing to trade crypto again?

What does the data say? Before and during the FTX era

Source: Brave New Coin Data, BTC/USD, BTC/USDT, ETH/USD, and ETH/USDT pairs across selected exchanges, excluding FTX

Data from the last year shows that crypto trading volumes remain well below the levels they were at pre-FTX collapse and for most of 2022. It is likely that many who exited the crypto markets following the FTX collapse have either exited the digital asset space completely or are simply not yet ready to return.

2023 has been a strong year for the price of digital assets but this has not always been reflected by volume growth on centralized exchanges. While there have been some volume spikes, these have generally been artificially driven by promotional events.

Source: Brave New Coin Data. BTC/USD and BTC/USDT pairs across selected exchanges

Source: Brave New Coin Data, ETH/USD and ETH/USDT pairs across selected exchanges, including FTX

For our data observations the daily volumes of Ethereum (ETH) and Bitcoin (BTC) over the last year are used. All data has been sourced from Brave New Coin’s market data engine. The volumes displayed are specific pairs from trusted exchanges. The observed pairs are BTC/USD, BTC/USDT, ETH/USD, and ETH/USDT from Bitfinex, Bitstamp, Coinbase, Gemini, Kraken, and Binance. There is also data from FTX before and just after its closure.

Ether Trends

We can observe clearly with the daily data, that FTX was a major contributor to the ETH trading ecosystem and often jostled with Coinbase to be the second most popular platform to trade Ether outside of Binance.

**Source: Brave New Coin Data, ETH/USD and ETH/USDT pairs across selected exchanges, excluding FTX **

Year-to-date the price of Ether has risen by ~61%. Since January 1st, daily volumes of the ETH/USD and ETH/USDT pairs have risen but remain muted, compared to the rise in price levels.

This suggests that at least some of Ether’s price momentum has been driven by purchases on centralized exchanges. It has not just been a result of other factors like more Ether being staked onchain, or a general increase in on-chain activity.

BTC Trends

The data from BTC markets is a somewhat different story. As of April 2023, volumes across BTC markets are much lower than they were pre-FTX, however, for a 3-month patch BTC volumes soared, primarily driven by volumes on Binance.

Source: Brave New Coin Data, BTC/USD across selected exchanges including FTX

Source: Brave New Coin Data, BTC/USD and BTC/USDT pairs across selected exchanges, excluding FTX

If we just look at exchanges that offer BTC/USD and remove Binance’s dominant BTC/USDT pairs, Bitcoin volumes follow a similar pattern to Ether. A potential factor in why volumes were so high was the zero-fee trading program launched by Binance. To celebrate its fifth anniversary, Binance launched zero-fee trading for 13 Bitcoin spot trading pairs in July 2022.

This included the BTC/USDT pair and immediately after the program began, there was a surge in the popularity of the pair. The popularity of BTC/USDT on Binance only wavered in the immediate aftermath of the FTX collapse and after Binance ended its zero-fee trading program.

Source: Brave New Coin Data, BTC/USDT pair on Binance

The zero-fee trading program ended in March 2023. Following this, the BTC/USDT volumes on Binance immediately dropped off. The zero-fee trading program was unsustainable and inflated volume measurements, but clearly helped Binance temporarily gain market share following the collapse of FTX.

Brave New Coin data indicates that daily volumes from the Binance BTC/USDT pair are down ~45% from the start of the year. From the peak of the zero trading fee program on March 14th, volumes are down ~95%.

Source: Brave New Coin Data, BTC/USD pairs

The chart above displays BTC/USD pair volumes across major exchanges (Coinbase, LMAX, Bitstamp, Kraken, Gemini). The potentially non-organic volumes from the Binance BTC/USDT pair are removed. We now have a trend more reflective of the impact of the FTX collapse.

Volumes for the BTC/USD pair have not returned to pre-FTX levels, however, compared to ETH volumes the drop-off in volumes is less pronounced and erratic.

Since January 1st, daily volumes of the BTC/USD pair have risen but remain muted, compared to the rise in price levels. Year-to-date the price of BTC has risen by ~82%.

More Digital Assets are being held in personal custody

Ether balance held across major exchanges, Source: Glassnode

BTC balance held across major exchanges, Source: Glassnode

Another clear indicator is that the drop in activity in centralized exchanges has also pulled down exchange balances. This is the total amount of ETH and BTC held across various centralized exchanges’ blockchain addresses.

As the charts above show, there is a clear and immediate drop following the collapse, this is then followed by ETH and BTC steadily being moved off exchanges in the following months. The trend of these assets moving off exchanges implies that they are moving into personal custody.

DEXs enjoy newfound relevance

One of the clear winners of the FTX collapse is the decentralized exchange space. Decentralized exchanges (DEXs) are broadly defined as cryptocurrency trading platforms that operate as direct peer-to-peer transactions without a centralized clearing house. DEX’s unique operations are facilitated by Smart Contract blockchains like Ethereum, Avalanche, and Polygon. Unlike volumes on centralized exchanges, the volumes on DEXs (across major smart contract blockchains) remained stable before and after the collapse of FTX.

Source: Defillama

Above, we observe the total decentralized exchange trading volumes across the decentralized finance space over the last year. There is an immediate spike in volumes after the fall of FTX, however, following this volumes dropped off before starting to rise again from the beginning of 2023. Since then, Dex volumes have continued to remain higher than pre-FTX collapse levels.

Decentralized exchanges are an appealing alternative to centralized exchanges for a number of reasons:

- Security – Their inherent lack of counterparty risk. Centralized exchanges take over control of user funds to facilitate trading. Users have to trust them as counterparties. FTX has shown us that exchanges can intermingle customer funds and use them illegally to support separate ventures. It is also a concern that if they do not store funds securely then there is a hacking or rug-pull risk.

- Control – Users of decentralized exchanges can withdraw their assets at any time without third-party discretion. Decentralized exchanges are non-custodial.

- Privacy – There is generally no requirement to provide KYC/AML. Decentralized exchanges are not governed by a central authority, making them more resistant to regulatory interference, censorship, or potential shutdowns. They can be made available to users in far more jurisdictions than centralized exchanges.

Source: GMX.io

Source: GMX.io

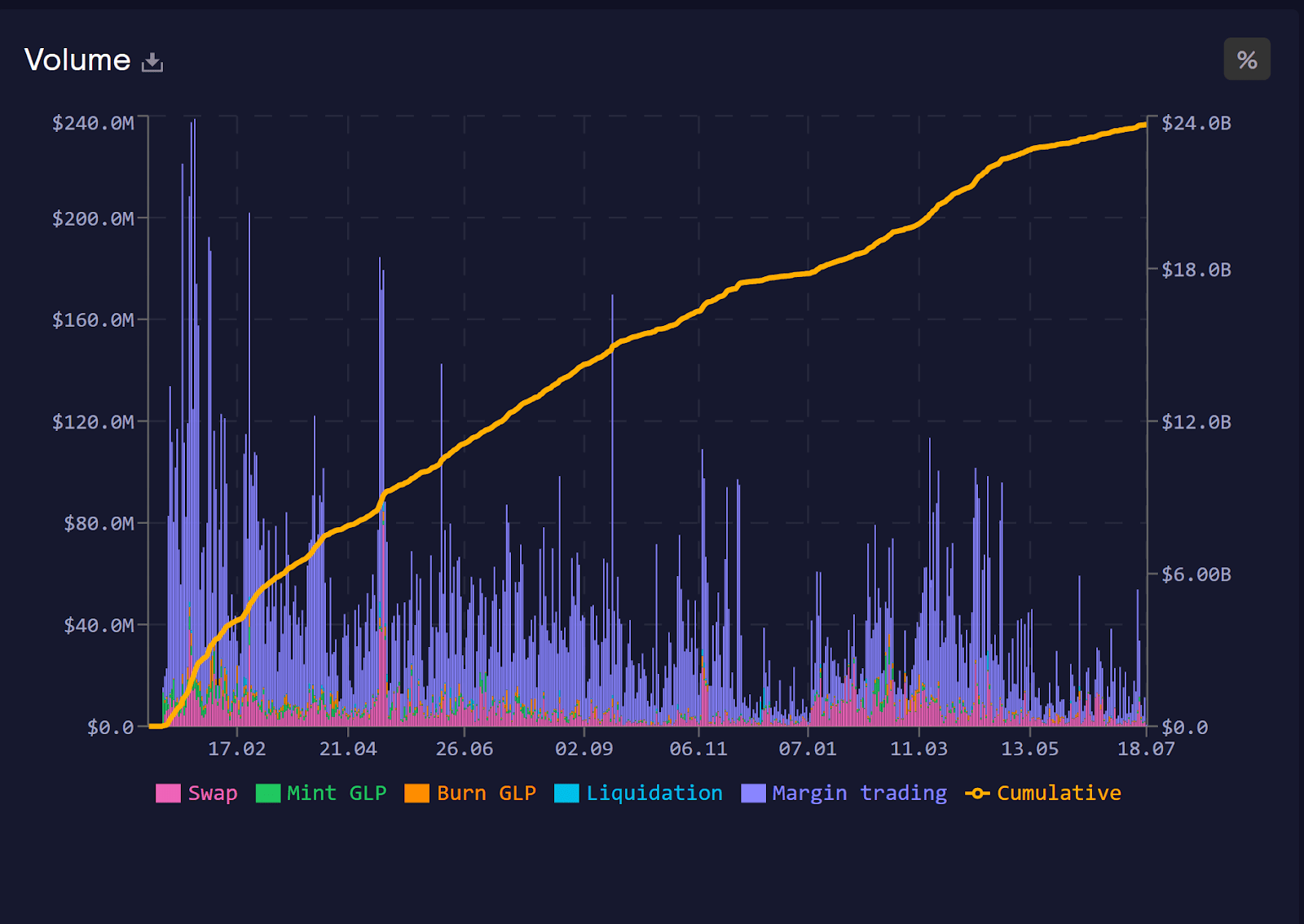

One of the beneficiaries of the collapse of FTX has been the decentralized exchange GMX. GMX is a notable spot and derivative decentralized cryptocurrency exchange, initially built on Artibtrum One and later deployed on Avalanche.

GMX is a KYC and AML-less platform that offers seamless cryptocurrency and derivative contract swapping from personal crypto wallets. Aside from offering high speeds and low fees because of Arbitrum and Avalanche’s flexible consensus model, GMX also distributes protocol revenues back to holders of the GMX token, offering passive income back to investors in the protocol with GMX functioning as a DAO.

Notable, particularly on the Arbitrum version of GMX, is a sharp spike in the volumes on the platform in November 2022. This timing coincides with the collapse of FTX, suggesting a possible migration of users away from the platform or users of other centralized platforms losing faith in the infrastructure system and experimenting with a decentralized alternative. This initial boost in activity eventually leveled out and has subsided.

Over-The-Counter

Over-The-Counter (OTC) crypto trading desks refer to a method of trading cryptocurrencies outside of public exchanges, where transactions take place directly between the buyer and seller or through a trusted intermediary.

OTC trading primarily caters to high-net-worth individuals, institutional investors, and other large-scale traders who want to execute sizable transactions without causing significant price fluctuations in the market. They target a different market to exchanges but are starting to become appealing to some larger exchange users because they offer better customer service, price protection against slippage, and more flexible settlement options.

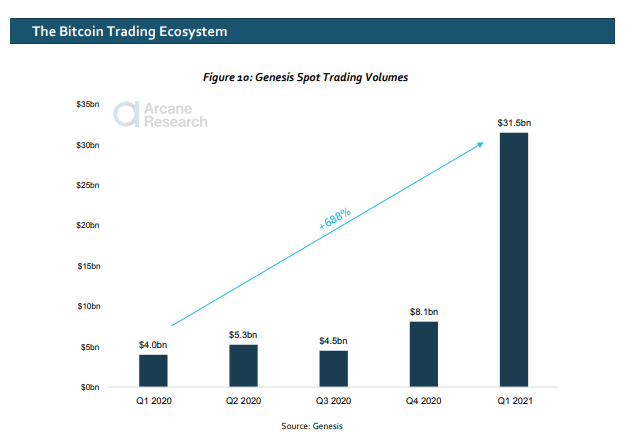

Genesis is a company that launched a U.S. OTC Bitcoin trading desk in 2013. It revealed in a report published by LMAX and Arcane research, that growth in their OTC desk shifted in Q1 2021 when the entrance of companies like Tesla, MicroStrategy, and Square as major Bitcoin buyers led to a wave of interest from corporates which accounted for 25% of the OTC volume in Q1 for Genesis. This is an increase from only 0.5% in Q4 2020.

Nauman Sheikh, the Head of Treasury Management for Blockchain Protocols and Crypto Derivatives Trading at Wave Digital Assets told Brave New Coin that the OTC trading space was caught in the crossfire of the FTX incident. He said, "OTC liquidity is heavily influenced by centralized exchange (CEX) liquidity, particularly in terms of price discovery and risk mitigation.”

“The OTC market has become more fragmented and inefficient as market participants scramble to find alternative "safer" counterparties and trading platforms. Many OTC participants have hunkered down, become more risk-averse, and have retrenched their product and service offerings,” he says.

According to Sheikh the net effect of FTX going down for the OTC space has been “reduced liquidity, wider bid and offer spreads, and greater market impact and slippage on trades."

LMAX Digital is a leading institutional spot cryptocurrency exchange, run by the LMAX Group,

which also operates several leading FCA-regulated trading venues for FX, metals, and indices.

LMAX differentiates itself by only serving institutional customers. Institutional market participants are generally not individual traders and may include banks, funds, asset managers, proprietary trading arms, HFTs, brokers, and corporates. They tend to have characteristics like higher trade amounts and a greater willingness to accept KYC/AML procedures.

Source: Brave New Coin Data, ETH/USD and BTC/USD volumes pairs across selected exchanges, Bitstamp, Gemini, and LMAX digital

Brave New Coin data shows that daily volumes for specific pairs on LMAX digital, exceed the volumes for the same pairs on popular retail exchanges Gemini and Bitstamp. Daily volumes for just these two pairs have exceeded US$400 million twice in 2023.

An enduring question in crypto is whether retail or institutional traders are a bigger driver of the price of digital assets. Opinions differ. Bitcoin and the digital asset space began as a grassroots movement and has been around for less than 15 years.

Additionally, the space is designed to be permissionless with fewer barriers than traditional finance. These factors favoring retail investors in crypto considered, it is clear that institutions have far deeper pockets than retail. Additionally, they have access to resources such as research, data, and computing power that allows for confident, active investment decision-making.

The growing presence of institutional-only exchanges like LMAX digital in the space is evidence that crypto is no longer the realm of internet enthusiasts.

The effects of regulation: The loss of BUSD leaves a hole in stablecoin volumes

A lingering factor in the post-FTX volume slump has been an increase in the regulation of the digital asset space. Former SEC chief of internet enforcement, John Reed Stark said he believed that the FTX incident will spawn more “criminal prosecutions than any other financial fraud in history.”

Writing for Global Legal Insights, authors from the Paul, Weiss, Rifkind, Wharton & Garrison law firm explain that particularly in the last two years, the US Treasury Department’s Office of Foreign Assets Control (OFAC), and the US government more generally, have become more active in applying US sanctions laws to cryptocurrency companies.

They write that the US government’s application of sanctions to the crypto sector is ‘nascent and still evolving’ and it is likely that it will continue to set new precedents in the short term. These efforts were shaped by President Biden’s crypto executive order, which asked government agencies to prepare reports and recommendations about different aspects and risks posed by crypto.

In a recent example of this increased enforcement, on February 21st, Paxos, the issuer of Binance-USD (BUSD), announced that because of instructions from the New York State Department of Financial Services (NYDFS) they would stop issuing the stablecoin.

BUSD remains in circulation but because new BUSD is not being issued it has lost most of its popularity and the asset’s days seem numbered.

The BUSD/USDT trade was one of the most popular stablecoin arbitrage trades in crypto before this enforcement. Arbitrage is the process of simultaneously purchasing and selling a supposedly price-identical asset in two separate markets. Small price discrepancies because of operational factors often mean that if traders move quickly they can make near-risk-free profits.

In the case of BUSD and USDT, they are both assets that should track the US Dollar 1-for-1. Small variations in price between the two meant that trading between the assets was popular.

BUSD was also the primary stablecoin of the popular exchange Binance, meaning it was tradeable with a large number of digital assets. USDT is the de-facto stablecoin for the exchange Bitfinex and is universally popular across the crypto exchange space. There may have been some three-way arbitrage trading between USDT, BUSD, and other crypto assets. additionally, because of the liquidity and distribution of the two stablecoins. Again, however, the regulation of BUSD took down this trade opportunity as well.

Source: Brave New Coin Data, ETH/USD and BTC/USD volumes pairs across selected exchanges, Bitstamp, Gemini, and LMAX digital

Conclusion

The collapse of FTX has left an indelible mark on the crypto trading ecosystem, prompting traders and investors to reassess their options and embrace alternatives to centralized exchanges. The aftermath has impacted major centralized exchanges. They have had to rebuild trust and assure the market that they are different from FTX. Data indicates that some of this trust is beginning to return.

Decentralized exchanges, such as GMX, have emerged as an appealing choice for many users seeking security, control, and privacy in their trading experience. While the dust is still settling after the FTX collapse, it is evident that the crypto community has adapted by diversifying its trading options and placing greater emphasis on decentralized platforms. This has helped to create a more resilient ecosystem that is better equipped to withstand potential future disruption.

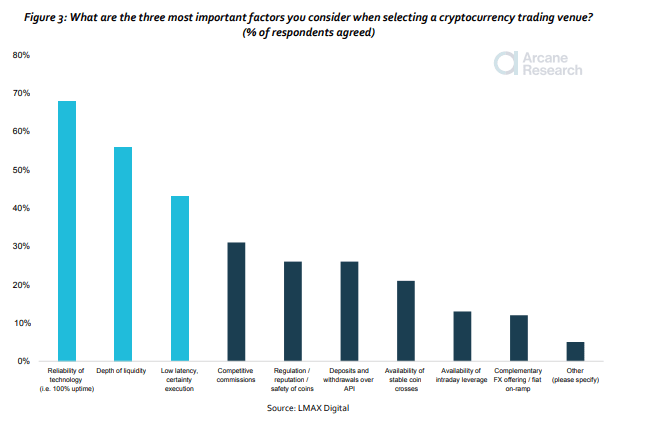

"The Bitcoin Trading Ecosystem and the Emerging Institutional Infrastructure" report from LMAX Digital and Arcane Research found that the biggest factors that institutional participants consider when selecting a cryptocurrency trading venue are the reliability of technology (uptime), depth of liquidity, and certainty of execution.

In all three of these areas, centralized exchanges are superior to other crypto trading solutions. Centralized exchanges are highly scalable and can grow faster than decentralized or smaller-scale counterparts like OTC desks. For this reason, the big centralized exchanges like Coinbase, Binance, and LMAX will continue to attract users because of their deep liquidity and organizational capabilities to deploy new technology. It is therefore unsurprising that volumes remain steady across popular BTC and ETH pairs on the top centralized exchanges.

FTX has been a wake-up call for other big players in the centralized exchange space. It has also meant stronger regulations against exchanges and individuals running exchanges, particularly in the USA. Going forward, centralized exchanges will need to ensure they have strong financial controls, experienced executive teams, and robust due diligence. "Market participants are increasingly wary of counterparty risk involving OTC desks, exchanges, and custodians,” says Wave’s Nauman Sheikh. “They are demanding additional assurances or collateral to mitigate potential risks.”

Don’t miss out – Find out more today