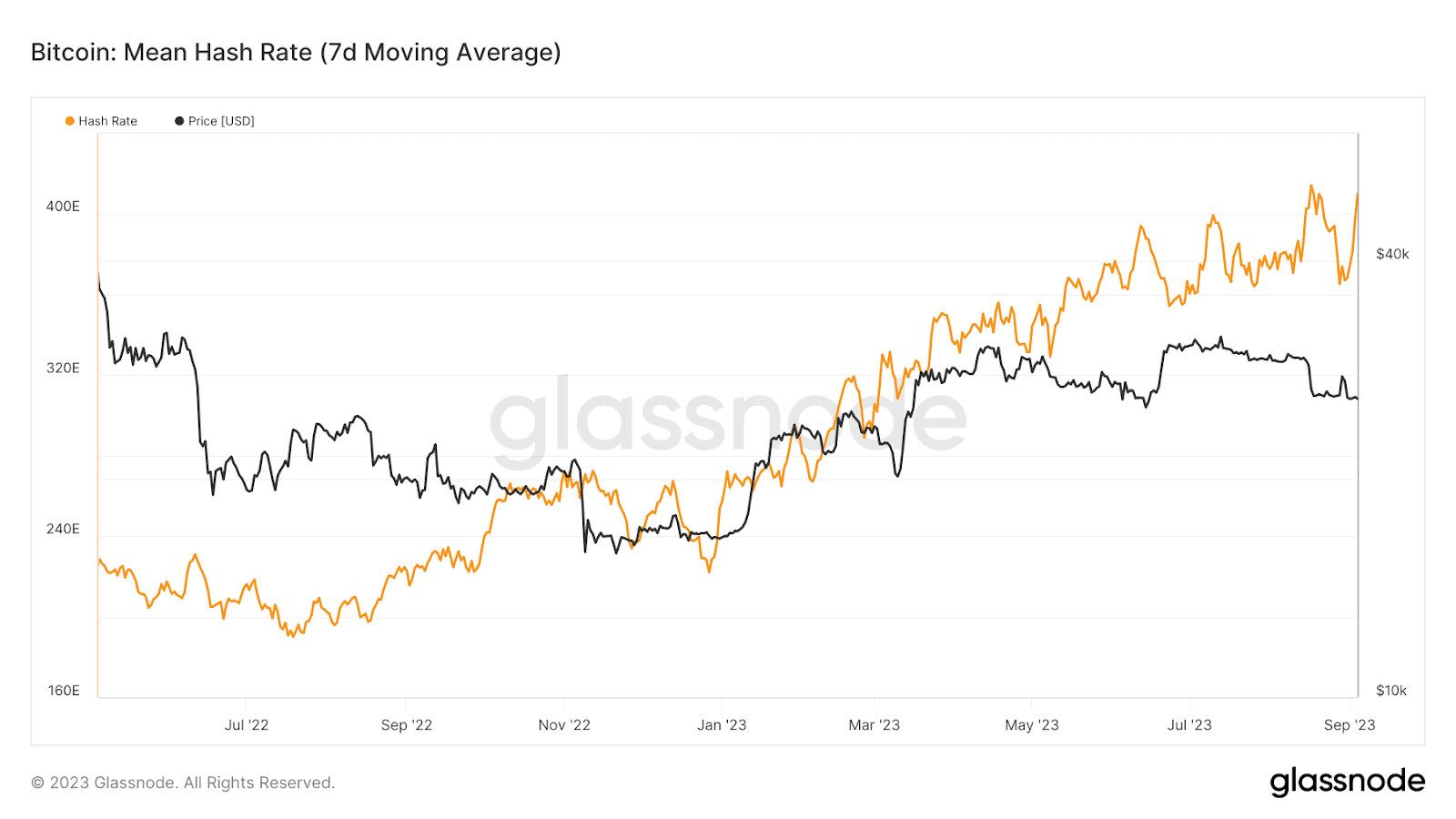

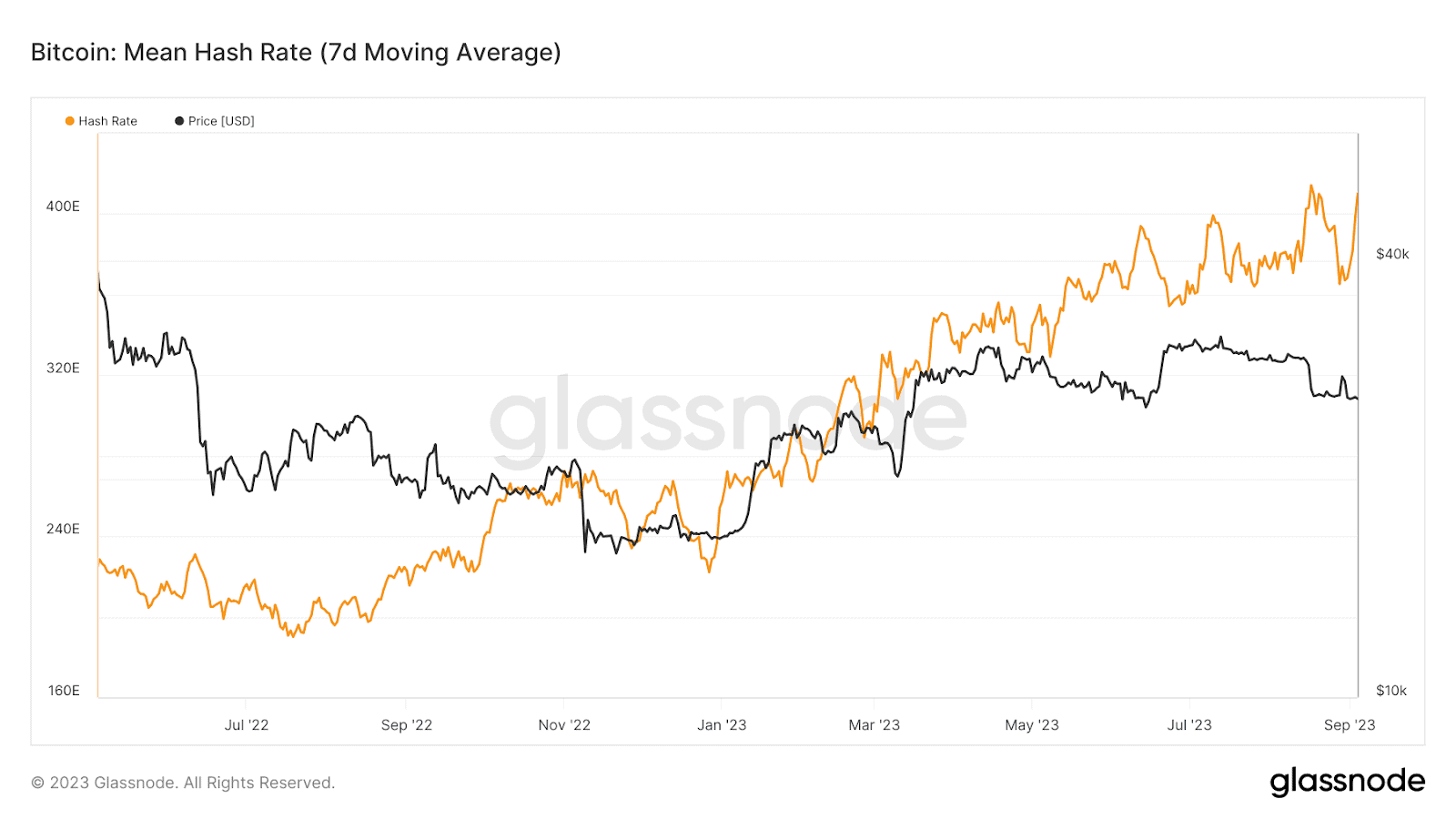

Demand to mine the Bitcoin network high despite mixed market conditions

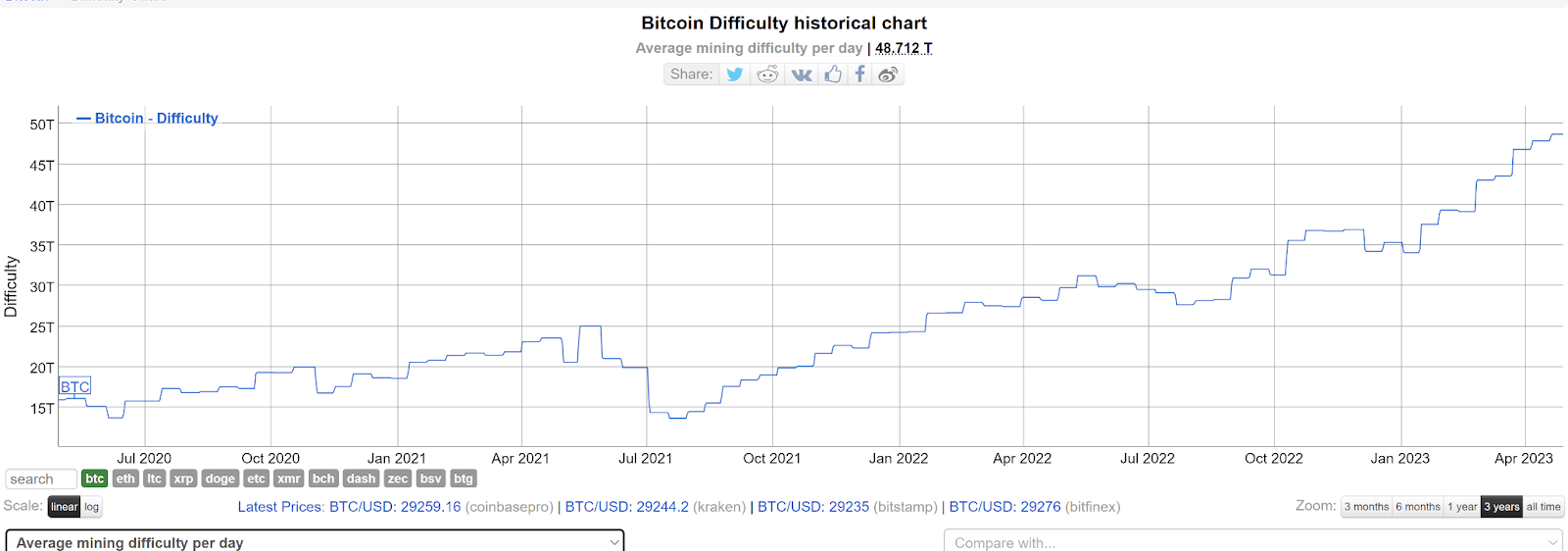

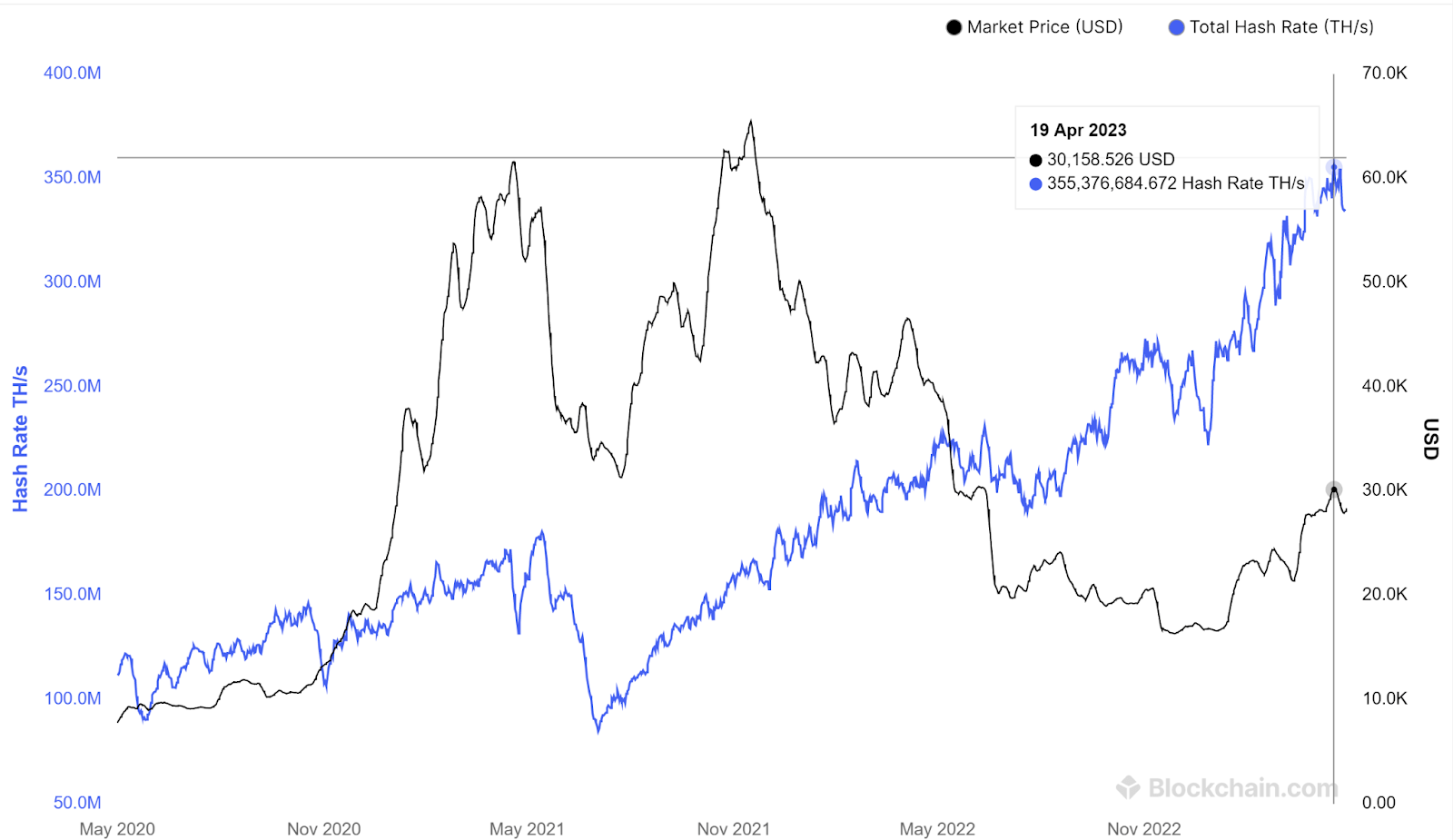

The Bitcoin (BTC) hashrate and mining difficulty has risen continually through 2023 irrespective of price activity. It has risen during bullish, bearish, and trendless periods. We look at the current state of mining interest.

Bitcoin mining is the use of computing power to solve complex mathematical problems that verify transactions and allow new blocks to be added to the Bitcoin network. The individuals and collectives that deploy this computational power are called miners. For their services to the network, they are rewarded with newly minted BTC and transaction fees. For greater efficiency, miners ‘pool’ their resources together and set up mining pools.

Source: Glassnode

Source: Glassnode

The rising hashrate and difficulty trends are even more surprising given that currently the Hash Price for Bitcoin miners is staggeringly low. Hash price is the revenue generated by miners on a per tera-hash basis (A tera-hash is the standard measure for computing power on the Bitcoin network). Hash Price is measured as equalling Miner’s daily revenue / Hashes (TH) per day. This means that despite earning less per amount of computing power and hardware deployed than ever before, miners are continuing to mine the Bitcoin network with extreme vigor.

A high hashrate is an indication of a healthy Bitcoin mining environment. It means a growing number of miners are joining the network and competing with each other to process transactions and solve the block reward puzzles. This proof-of-work makes the Bitcoin blockchain secure and immutable. Mining Difficulty has to adjust alongside a rising hashrate to ensure that the Bitcoin network maintains its rate of a block published every 10 minutes.

The trend of rising hash rate despite falling revenue per terahash implies more efficient processing hardware, and that mining operations are achieving economies of scale that allow them to function at more efficient margins. Large mining pools like Foundry USA, AntPool, and F2pool dominate the hashrate distribution of the Bitcoin network.

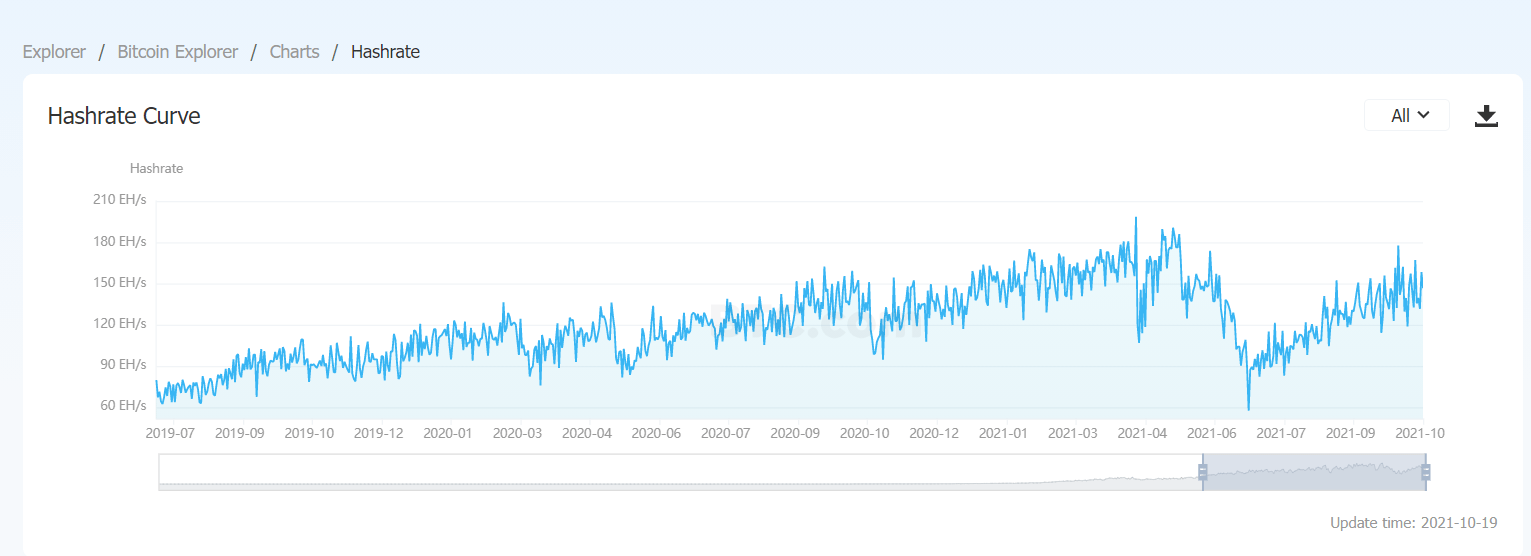

Source: Blockchain.com

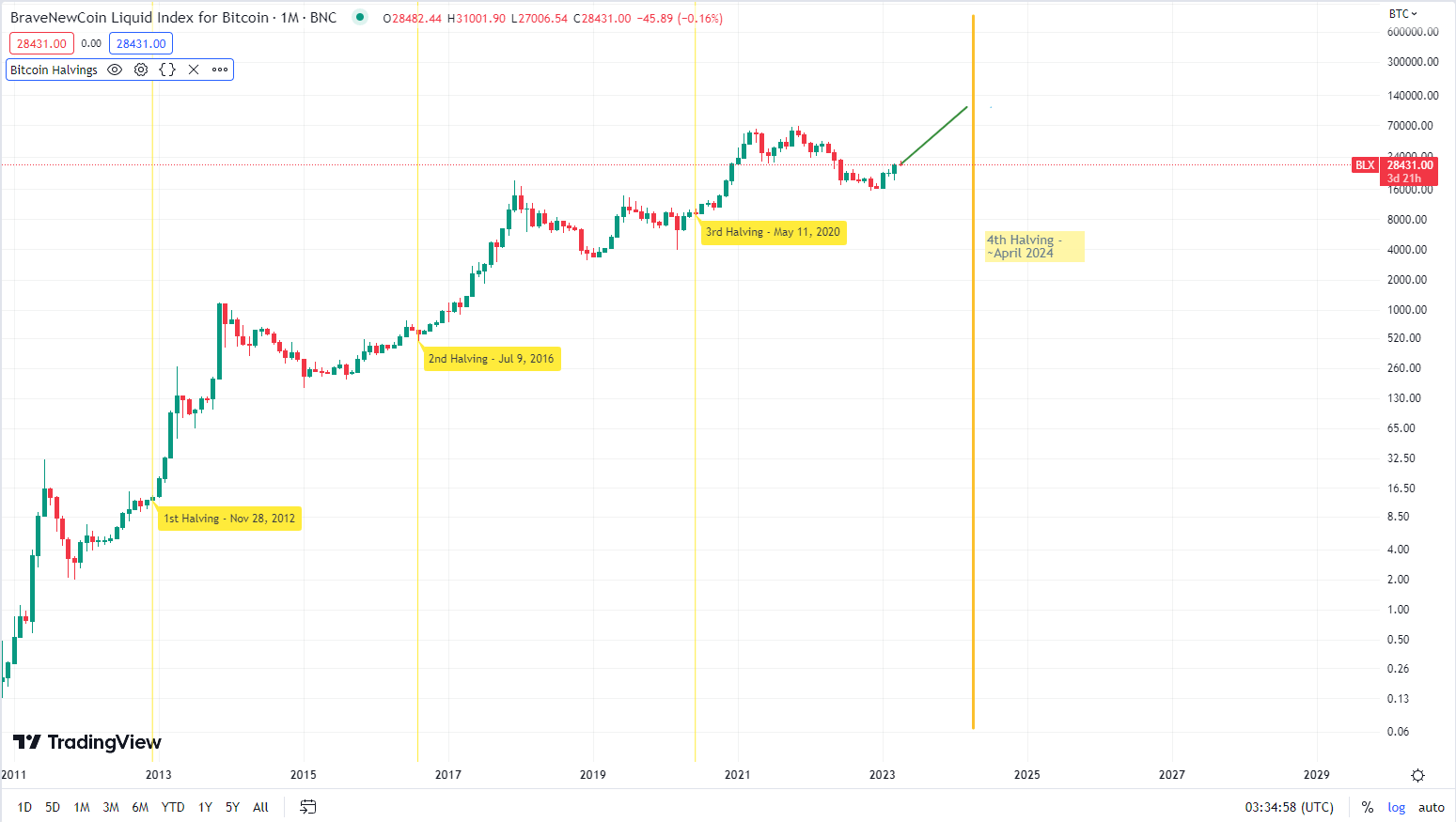

Looking externally, market factors such as the upcoming Bitcoin halving may also be driving this forward momentum.

The next Bitcoin halving is set to occur between April and May 2024. The bitcoin halving is pivotal in crypto markets because of the strong positive effect it has on the price of BTC. It occurs approximately every 4 years and cuts the supply rate of new Bitcoin in half. The halving reduces the rate of inflation and like clockwork, creates upward price pressure for Bitcoin.

At block height 840,000 expected to occur in April 2024, Bitcoin’s block reward, for successfully mined blocks, will halve from 6.25 coins to only 3.125 per block. This will continue at the same rate for another 210,000 blocks. Roughly another four years.

Miner rewards from new bitcoin minted will half (in BTC, not US Dollar terms) in ~7 months and miners are likely cashing in now, aware that their earnings may dip soon. Another factor in the increase in mining activity is more speculative. The price of Bitcoin has a strong track record of rising post-halving so filling their bags in spite of price, is likely to work out in the long run based on history.

Generally, price momentum builds in the lead-up to a halving and gathers steam to peak in the months following the halving. Bitcoin’s position as a verifiable scarce asset, with some demand, means that as it becomes more difficult to acquire with each new halving, its value increases.

After the last two Bitcoin halvings strong gains have been triggered around six months after the halving. Source: Bravenewcoin.com

It is notable that after each halving Total miner revenue falls (BTC) and transaction fees as a percentage of miner revenue rises.

Source: Glassnode

Source: Glassnode

Higher revenue from transaction fees, as a percentage, occurs not just because less bitcoin is minted per block. It may also be because of the higher demand to use the network.

Transaction Fees rise when there is more demand to use the Bitcoin network and more users seeking the services of miners. Miners with a more long-term mindset may accept less revenue in the short term if it comes with a higher percentage earnt through transaction fees because this implies a healthy network with increased demand.

Geographic distribution and Energy consumption

The Cambridge Bitcoin Electricity Consumption Index (CBECI) is an ongoing project created and maintained by the Cambridge Digital Assets Programme (CDAP) Team at the Cambridge Centre for Alternative Finance, an independent research institute based at The University of Cambridge, Judge Business School.

It has created approximations for Bitcoin’s energy consumption and geographical distribution using resources like partnerships with mining pools (Mining pools do not need to provide operational and financial data because they are not public companies), alongside assumptions and inferences.

The CBECI announced that it has recently updated its methodology to enhance its accuracy and reliability. They explain that the key to these updates has been focusing on recent developments in Bitcoin mining hardware and their effect on hashrate. Researchers have worked on creating a methodology that simulates a daily hardware distribution based on performance and power usage data of real hardware.

Source: CBECI

The CBECI estimates that the annual consumption of Bitcoin is 123.68 Terawatt-hours/TWh. The total yearly electricity consumption is an annualized measure that corresponds to the total amount of electricity used over a period of one year, assuming continuous power at the current rate. A 7-day moving average is applied — This value has steadily increased over the course of the year, which is unsurprising given the rising hash rate.

Comparing Bitcoin’s electricity with Nation States, although imperfect, is a relatable signpost to assess how much energy the Bitcoin network uses. The Bitcoin network currently consumes more energy in a year than the Netherlands but less than Argentina.

The CCAF’s 3rd Global Crypto Asset study, published in September 2020, states that around 39% of proof-of-work mining is currently powered by renewable energy.

Source: CBECI

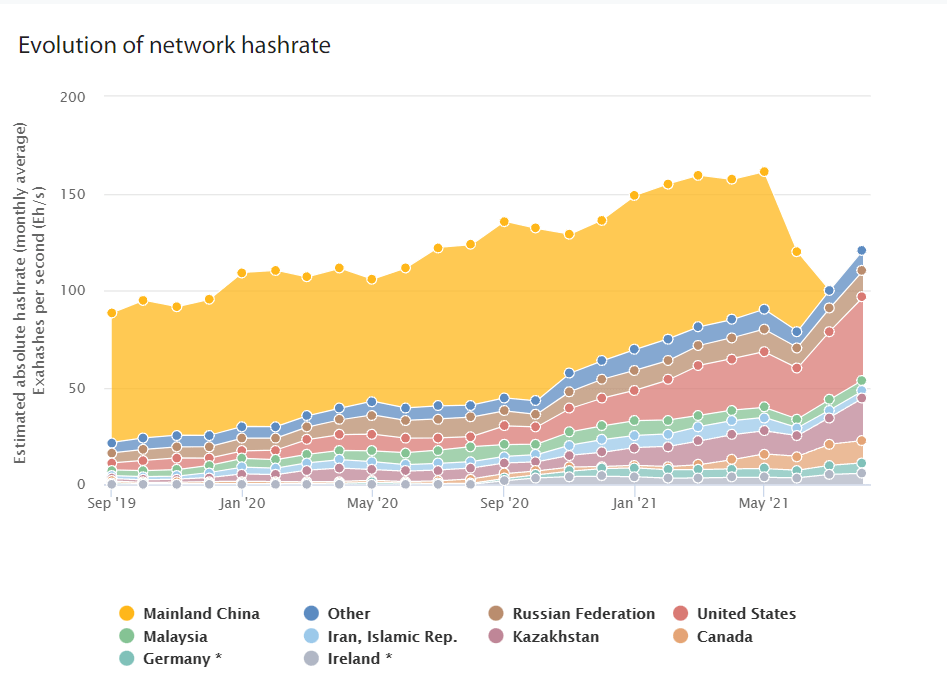

Based on the most recent data captured by the CBECI, the two largest contributors to Bitcoin hashrate in the world are the USA and China. As of January 2022, the US produced ~37.8% of the Bitcoin network’s hashrate, while China produced 21.1%.

Up until 2021, China dominated the Bitcoin mining landscape. This was until a national ban made any form of Bitcoin mining illegal. Following the ban and between July and August 2021, China’s contribution to Bitcoin’s hash rate was 0%. Prior to these months, China’s contribution to the Bitcoin hashrate was generally between 65-70%. It appeared that because of the illegality of mining operations, most miners in China fled and the hashrate loss was picked up by the United States and Kazakhstan.

There have been rumors for some time that despite the ban, mining operations in China have continued via underground operations – as the CBECI explains in its methodology. “Access to off-grid electricity and geographically scattered small-scale operations are among the major means used by underground miners to hide their operations from authorities and circumvent the ban.”

Delos Digital profile

Opportunities to gain exposure to the resilient growth of Bitcoin mining can be achieved through ventures like Delos Digital B.V. It is a strategic Bitcoin mining venture based in the Netherlands, that has successfully deployed operations in regions including Russia, China, and Kazakhstan. The firm has shown adaptability and proficiency in diverse regulatory landscapes.

The group is broken up into 2 subsidiaries —

- Pantheon Mining: This arm caters to the specialized investment needs of high-net-worth individuals, family offices, and institutional investors.

- Kodoma: This sector is engineered to extend Bitcoin Mining to retail investors, offering fractional ownership facilitated through innovative smart contracts.

Currently, the firm has strategically located operations in countries such as the UAE, Sweden, Norway, Finland, and Paraguay to fortify the firm’s global positioning.

Conclusion

Bitcoin’s vast computational network continues to whirl with seemingly never-ending increasing intensity, it underscores the resilience and adaptability of this revolutionary technology.

Consistency despite irregular price activity, shifting landscapes of geopolitics, technological advancements, and varied economic incentives underpin the Bitcoin mining landscape. With the upcoming Bitcoin halving fast approaching another ingredient is being added to the recipe.

As miners adapt, investors are watching eagerly. For now, it is a waiting game.

Don’t miss out – Find out more today