ETFs Fuel Crypto Adoption Growth in Australia

The latest Independent Reserve Cryptocurrency Index (IRCI) for Australia, released this week, sheds light on the evolving landscape of cryptocurrency attitudes and behaviors among Australians. The fifth edition of the survey, conducted annually, provides key insights into awareness, adoption, trust, and confidence in the cryptocurrency market.

Now in its fifth year, the Independent Reserve Cryptocurrency Index (IRCI) 2024 is an annual cross-sectional survey of over 2,100 Australians conducted by PureProfile. It is a sample of everyday adult Australians, reflective of the gender, age and geographic distribution of the nation.

The index is a single rating out of 100 designed to reflect four key aspects of Australian attitudes towards cryptocurrency:

- Awareness

- Adoption

- Trust

- Confidence

The latest Independent Reserve Cryptocurrency Index (IRCI) for Australia, released this week, sheds light on the evolving landscape of cryptocurrency attitudes and behaviors among Australians. The fifth edition of the survey, conducted annually, provides key insights into awareness, adoption, trust, and confidence in the cryptocurrency market.

Key Findings

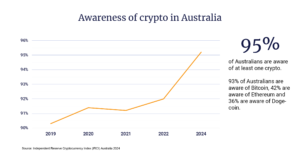

- Increased Awareness: The survey indicates that 95% of Australians are now aware of at least one cryptocurrency, marking a significant rise from 92% in 2022.

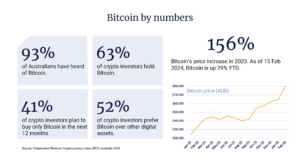

- Bitcoin Dominance: Bitcoin remains the most recognized cryptocurrency, with 93% of respondents familiar with it. Ethereum follows as the second most known cryptocurrency at 42%, followed by Dogecoin at 36%.

- ETF Approval Impact: The approval of Bitcoin spot ETFs by the SEC has positively influenced Australians’ perception of Bitcoin, with 25% reporting a more favorable view post-ETF approval.

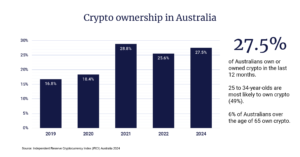

- Investment Preferences: 63% of crypto investors hold Bitcoin, indicating its dominance as the preferred cryptocurrency for investment. Additionally, 27.5% of Australians have owned or currently own crypto in the last 12 months.

- Future Price Predictions: Crypto investors are optimistic about Bitcoin’s future, with 29% predicting a price range of over A$100,000 by 2030.

- Adoption Trends: Cryptocurrency ownership has increased to 27.5% in 2024, with notable growth among the over 55 age group. Bitcoin remains the top choice for investment, with 63% of investors holding it.

- Profitability and Investment: The survey shows a steady increase in the number of Australians making a profit on their crypto investments, reaching 37%. However, profitability remains lower than during the bull market of 2021.

- Drivers and Barriers: Friends, family, and media influence remain primary drivers for Australians entering the crypto market. Economic uncertainty and financial constraints continue to be barriers to investment for some Australians.

- Perception of Bitcoin: A growing number of Australians (69%) consider Bitcoin to be money, a store of value, or an investment asset, reflecting a decrease in skepticism towards the cryptocurrency.

Adrian Przelozny, Group CEO at Independent Reserve provided context for the survey. He wrote, “2023 saw a seismic shift from crypto winter to a spring bloom. Since the previous survey, a palpable shift in sentiment has swept across the industry, fueled by Bitcoin. Anticipation of the first Bitcoin spot ETFs triggered an early crypto spring as Bitcoin’s value grew over 150% in 2023. Bitcoin propelled many investors into profitability, solidifying its position as the undisputed digital gold, and with the next Bitcoin halving approaching in April, 2024 promises to be a bullish year.”

Przelozny noted that the local regulatory scene is gaining traction, with the proposed mandatory Australian Financial Services Licences (AFSLs) for crypto exchanges.

“This landmark development promises to bring the industry greater confidence and certainty, paving the way for institutional investment and broader adoption. Despite the challenges the crypto industry faced in 2023, such as the fallout from the FTX saga and the collapse of Signature Bank, this year’s IRCI data demonstrates that Australians’ interest and investment in crypto remain high and continue to gain momentum. Sentiment has demonstrably shifted, and we’ve entered a phase of renewed optimism and growth.”

Conclusion

The IRCI Australia 2024 survey paints a picture of growing optimism and awareness in the Australian cryptocurrency market. With increased adoption, positive perceptions of Bitcoin, and growing confidence in the market’s future, the findings suggest a continued evolution of cryptocurrency from the fringes to the mainstream of Australian finance. However, challenges such as economic uncertainty and regulatory concerns persist, indicating the need for continued education, regulation, and consumer protection measures to support further growth and adoption in the market.

Don’t miss out – Find out more today