Fantom prepares to fly – is it the next platform blockchain to achieve escape velocity?

In 2021, platform blockchains have captured the imagination of crypto investors. Retail investors, traders, and venture capitalists are throwing money at projects hoping to find the new Ethereum, Cardano, or Solana. Will Fantom be the next smart contract chain to achieve escape velocity?

Fantom (FTM) is one of the leading candidates from the emerging platform blockchain pack to next attract mainstream investor interest. On January 1st, Fantom’s native token FTM was the 164th largest asset in crypto. It had a market cap of US$47 million and each token was priced at US$0.0182. Six months later, by early June, FTM was the 92nd largest asset in crypto with a market cap of ~US$869 million, with each token priced at US$0.3418. At the time of writing, FTM has climbed to be 53rd largest asset in crypto with a market cap of ~US$3.31 billion, with each token priced at ~US$1.31.

Since the start of the year, the price of FTM has risen by ~7098%, while the market cap has risen by 6,942%. That represents face melting gains for a project that has established market relevance quickly in the last year and continues to grow.

A working product

Fantom has a working blockchain product that is live and in active use. DeFi Llama reports that the total value locked into the Fantom DeFi ecosystem is US$1.3 billion. This number is up ~108,000% in the last 5 months. The Fantom DeFi ecosystem is enjoying a period of Hockey Stick like growth with the real inflection point happening around mid-July of this year.

The most popular Dapp on Fantom is a Uniswap style AMM decentralized exchange called SpookySwap. It constitutes ~27% of Fantom’s DeFi TVL. Spookyswap also offers a bridging product that lets users move tokens over from chains such as Ethereum and the Binance Smart Chain.

Popular platforms that were built on other protocols, Curve Finance and Sushiswap, are available on the Fantom network.

Image: The Hockey Stick Growth Curve

A similar hockey stick growth pattern can be observed when looking at the number of active addresses on the network and in the total number of transactions on Fantom.

Source: FTMscan

Daily active addresses on the network have been surging since June and have gone parabolic in August. There are presently just over 10,000 new Fantom unique addresses being added to the network every day.

Source: FTMscan

Daily transactions on the Fantom network have also been growing rapidly. The growth of transactions and active addresses is higher than the amount of TVL. This is potentially bullish which indicates that new users of the Fantom network are active rather than passive. This should translate to higher fees generated and faster token velocity.

Worldwide Search interest for the terms ‘Fantom crypto’ and ‘FTM coin’ have surged in the last fortnight to hit new all-time highs.

Source: Google Trends

Source: Santiment

Other social metrics also suggest that social sentiment for Fantom is strong. Data from Crypto data provider Santiment show that sentiment for Fantom on Twitter has been almost exclusively net positive since June of this year. Active Fantom social users peaked during May of this year, this surge was likely correlated with the bull run when the price of FTM hit a new all-time high of ~US$0.917.

The price of FTM has since eclipsed these all-time highs hitting US$1.66 on September 10th. This more recent price pickup, however, has not been accompanied by a sharp rise in social activity. This suggests that other buyers outside of the normal retail crowd are pushing up the price of FTM this time around. Steady accumulation of FTM continues.

Given the rise in onchain activity, it may be crypto natives and DeFi users driving this most recent price rise as opposed to speculators who are more likely to be exposed to Fantom through social networks. According to Santiment, Fantom makes about ~0.20% of crypto social mentions, while FTM makes up about ~0.14% of the crypto market capitalization. This is not a significant mismatch by crypto standards.

The technology backing Fantom

The Fantom project began in 2018 and was founded by Korean developer Dr. Ahn Byung Ik. The management and development of the Fantom network is currently handled by the Fantom Foundation. The current CEO of the company is Sydney based Michael Kong.

Fantom is a programmable platform blockchain built to support Dapps. It was designed to be scalable and positions itself as a chain that can maintain fast, cheap transactions even when the network is busy. It uses a consensus algorithm called Lachesis.

As well as being fast and cheap, Fantom is marketed as a more environmentally friendly alternative to Ethereum because it achieves consensus through proof-of-stake as opposed to proof-of-work, the consensus algorithm still used by Ethereum. PoS is much less processing power-intensive than proof-of-work and requires less energy to function.

Source: Twitter, @rareliquid

Using the Fantom network will be intuitive for anyone who has interacted with the Ethereum blockchain before. Fantom’s mainnet deployment, Opera, has the exact same functionality as Ethereum because it supports the Solidity programming language and is integrated with the Ethereum Virtual Machine. Applications can be built to be completely interoperable with EVM chains, while still maintaining the transaction model of Fantom. The Fantom website has an excellent guide on how to use Fantom with Metamask.

Opera, an EVM compatible mainnet, was launched in December 2019. Fantom is a third-generation blockchain (as are Cardano, Solana, and Polkadot). It seeks to challenge the incumbent centralized, legacy financial network by learning from and improving the architecture used by first and second-generation blockchains such as Bitcoin and Ethereum.

Fantom differs from Cardano and Solana in that it directly builds on top of what has already been built for Ethereum.

Fantom is marketed as a cheaper, more scalable version of Ethereum. It uses an Asynchronous Byzantine Fault Tolerant (aBFT) Proof-of-Stake (PoS) consensus mechanism called Lachesis. Lachesis uses a Directed Acyclic Graph (DAG) model that is leaderless, unlike the Delegated Proof of Stake consensus model used on other EVM chains like the Binance Smart Chain.

The model allows for network data to be processed at different times with the network also capable of tolerating up to one-third of its participants engaging in faulty or malicious behavior without network processes being affected. Lachesis aims to balance fast transaction speed with good security.

Each network node on Lachesis contains its own DAG. They each record the chronology of event blocks and respective transactions. Each node achieves consensus independently from the rest of the network. Confirmed batches of event blocks are then compiled into finalized blocks that are later confirmed by the wider Fantom network.

Nodes on the Fantom network do communicate with each other occasionally about some transaction but there is no network-wide consensus that needs to be achieved on finalized blocks or to confirm the state of the network, unlike operations on proof-of-work networks. This architecture is the reason why Fantom is able to process transactions so quickly.

Fantom is a three-layer blockchain. The first layer is the Opera Core Layer, its function is to maintain consensus through the nodes. This is the DAG layer of Fantom and this is the means by which different transactions across the network can be confirmed simultaneously.

The middle layer of the protocol executes functions on the network. It issues rewards and payments and manages the ‘story data’ of the network. The story data tracks the past transactions of the network.

The final layer is the application layer. This layer maintains the public APIs that enable Dapp developers on Fantom to interact with their Dapps.

Fantom has noted that there are some advantages to building on Fantom directly as opposed to porting Dapps from Ethereum onto Fantom. One of these is the ‘story data’ feature of the protocol layer that allows for the tracking of past transactions on the network.

The project’s backers

In May 2019, Fantom announced that it would be partnering with the Binance Smart Chain to improve its interoperability by launching a multi-asset, cross chain interoperability project. The multi asset initiative was meant to bring in new token standards, which would include Fantom versions of Ethereum’s ERC20 standard and the Binance Smart Chain’s BEP20. Interoperability has always been a key focus of the project and this continued with the launch of Opera and Ethereum style apps.

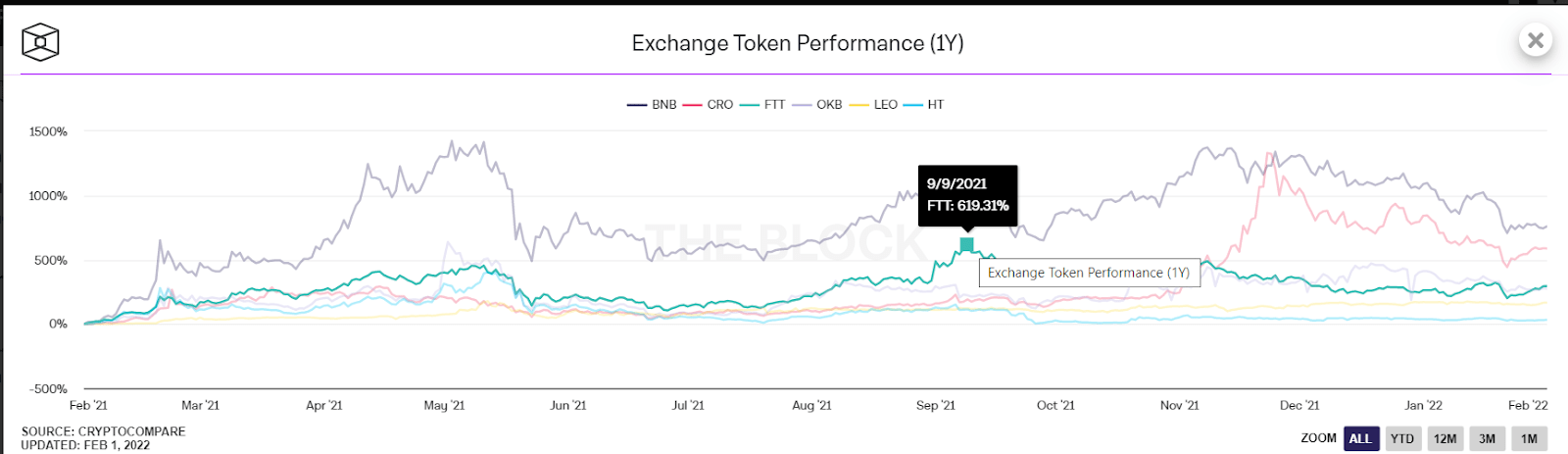

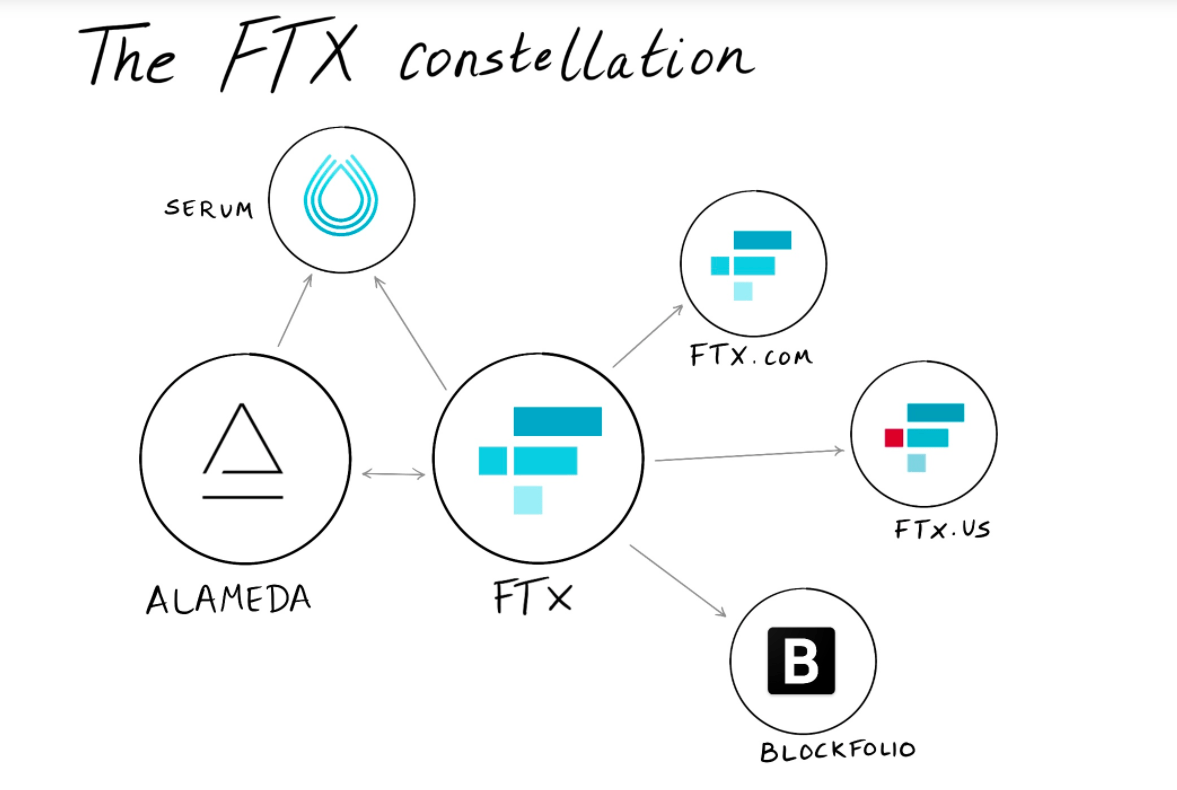

Fantom has big name VC backers like Sam Bankman-Fried’s Alameda Research, Arrington XRP Capital and BlockTower Capital. Its advisors include Andre Cronje, one of DeFi’s most notable developers. He has played a key role in building Ethereum-esque DeFi solutions for Fantom.

The Token

The FTM token is the native token of the Fantom network. It secures the network, and it is the primary network token used for payments and to assign governance rights.

Fantom is a proof-of-stake network where validators are assigned work on the blockchain, and the ability to earn rewards, in proportion to their holdings of the network digital asset. Fantom validator nodes must hold a min of 3,175,000 FTM to participate while stakers are to assign their tokens to a staking pool that earns rewards on their behalf. The minimum for a staker is 1 FTM. Nodes and stakers are assigned rewards regularly for their services to the network.

A secondary utility of the tokens is payments enabled by Fantom’s fast speeds. Finally, FTM is used as the gas to power any smart contract interaction on the network.

The Fantom staking mechanism

As mentioned, Fantom is a proof-of-stake blockchain where users can either run their own validator nodes or assign their stake to a validator which will earn rewards on their behalf. This means that anyone who holds FTM tokens can choose to delegate some of their SOL to one or more validators, who process transactions and run the network.

There is no minimum staking period for FTM. Additionally, Liquid Staking unlocks the value of FTM once it is staked. sFTM is minted in a 1:1 ratio to staked FTM and can be used as collateral in Fantom Finance, the platform’s DeFi suite.

StakingRewards.com lists Fantom as the 17th-largest blockchain by value of assets staked – with US$2,386,542,598 staked. There are just ~64% of token holders participating in Fantom, which implies 36% of token holders are passively holding their FTM and are likely just speculators.

Fantom is an emerging proof-of-stake still in its early adoption phase. This means rewards for stakers are still relatively high.

The current estimated interest rate for FTM holders who delegate their tokens to a validator is 9.6%. Adjusted for the inflation rate of network supply, however, this interest rate drops to 2.4%. According to Staking Rewards, validators running a Fantom Node will earn an interest rate of 11.34% but once adjusted for network supply inflation this drops to 4.1%.

Users can delegate their tokens to a staking pool that will, for a fee, participate in the network’s Proof-of-Stake consensus on behalf of the delegator. Or they can run a node themselves and directly participate in consensus. Staking rewards.com describes the complexity of delegating FTM to a staking pool as ‘easy’. The FTM wallet is a web application built for Fantom that allows users to allocate to a pool within minutes. Increasing stake and unstaking is simple and can be completed within the same wallet.

It describes the complexity of running your own Fantom validator node as ‘Very Hard’ and risky for staking rewards. There are very high hardware requirements (with AWS setups recommended, which also requires a high level of technical knowledge).

There are currently 43 live validators on the Fantom network, a relatively small quorum that implies relative centralization.

Conclusion

Fantom is pitched as a cheaper, faster, more energy efficient version of Ethereum. It can be viewed as a direct substitute for Ethereum using the same wallets, virtual machines and developer tools. It has stood against other EVM chains because of its unique consensus model, a long term focus on interoperability and perhaps because it is the next asset in line as part of the ongoing platform blockchain price pumps.

The network has big-name VC backers and it continues to attract developers to build on it. It does, however, appear to be relatively centralized compared to chains like Ethhereum and Solana. Additionally like other EVMs it is riding on the coattails of Ethereum and may be hung out to dry when Ethereum becomes more scalable following the implementation of sharding and the full transition to Ethereum 2.0.

Don’t miss out – Find out more today