How to buy Bitcoin with the Cash App

For US residents, Square’s Cash App is possibly the easiest way for newcomers to enter the crypto market and buy Bitcoin - here’s how to do it.

The Cash App began as a peer-to-peer mobile payments service in 2013 that allowed people to send and receive money using a credit card or bank account. It has since evolved to allow users to pay bills, buy goods, invest in stocks – and from 2018, to buy and sell Bitcoin.

Who can buy Bitcoin with the Cash App?

To be eligible for virtual currency purchases on the Cash App, users must:

- be a resident of the United States.

- be an individual person, not an entity, using the service for personal use.

- be at least 18 years, and the age of majority in your state of residence, or older to use the service.

- use the services in the United States.

You can use the Cash App to buy Bitcoin in all 50 states but it won’t be anonymously. The terms and conditions for virtual currency on the Cash App explains that for certain transfers of virtual currency or government-issued currency “you may be required to provide Square with certain personal information, including, but not limited to, your name, address, telephone number, e-mail address, date of birth, taxpayer identification number, government identification number, and information regarding your bank account (e.g., financial institution, account type, routing number, and account number), source of funds and employment.”

How to buy Bitcoin with the Cash App

1. Download the Cash App from either the Apple App Store or Google Play and install it.

2. Begin the sign up process with either a phone number or an email address.

3. Add a personal bank account number or a debit card to your account.

4. Enter your name.

5. Pick your unique $Cashtag. This is the unique username that you’ll be able to receive funds to. This is also where users can earn a referral code which gives them bonuses whenever a friend signs up using their unique referral code.

6. Add your address details.

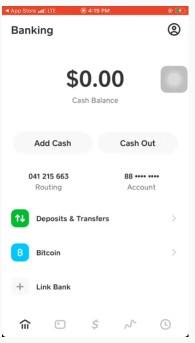

7. Funds must be added to your Cash App account before you can buy Bitcoin. From the home screen pick Add Cash and then decide the amount you want to add. To finalize the process a user needs to confirm their name, date of birth, social security number and home address. Once these details are loaded funds are can added to your Cash App balance.

8. To buy Bitcoin, tap the home screen and pick the Bitcoin option that sits just under Deposits & Transfers. Then pick the ‘Enable Withdrawals and Deposits’ option. The Cash App now requests additional information such as your email, the reasons you are buying bitcoin, and questions about your income and employment. After this you’ll be asked to verify your identity by scanning both sides of a state ID or drivers license. Finally take a clear, well-lit photo of your face. Processing I.D for verification can take up to 48 hours. Until verification is finalized users will see a “verification in progress” message on their screens.

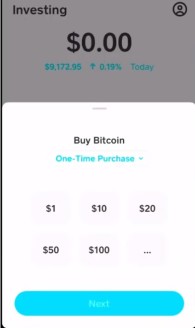

9. After verification is complete, to buy Bitcoin go the ‘Investing’ section of the Cash App. On the next screen there is an option to pick either Bitcoin or stocks. Pick Bitcoin. You’ll then see a price chart of recent performance with a BUY button.

10. Hit the “Buy” button. You will have an option to either make a one time purchase or set up recurring purchases. Select an amount (in dollars not satoshis) to buy and hit ‘Next’. On the next screen hit “Confirm”.

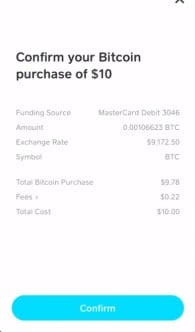

11. On the confirm screen you’ll seen an overview of your order outlining the amount of BTC, the current spot price, fees to be paid and the amount of Bitcoin to be received. Users can then tap confirm to buy their BTC.

12. Once processed, select “done”. Users can then view their Bitcoin holdings using the Home tab. A user’s wallet address is displayed which is needed to withdraw or deposit Bitcoin from an external Bitcoin wallet. Cash App users don’t have to trust a third party with their Bitcoin and have the option to withdraw their funds to a personal wallet and retain direct control of their BTC.

In the Bitcoin section of the Cash App there is an option to “Withdraw Bitcoin”. Choose your amount and hit “Withdraw”. Users then have the option to either scan a QR code or manually enter a Bitcoin address. Confirm the transaction and the process is complete. Bitcoin withdrawals normally take between 30-40 minutes and the transaction can be tracked using an explorer like https://www.blockchain.com/explorer

Users can also deposit into their Cash Address using either a QR code or manually copying a Bitcoin address. Once Bitcoin arrives in a users account they have the option to convert it into USD and then transfer it into their bank account.

The Cash Apps weekly Bitcoin purchase limit is US$100,000. Users can deposit up to $10,000 worth of bitcoin in any 7-day period .You can withdraw up to $2,000 worth of bitcoin every 24 hours and up to $5,000 within any 7-day period. Users are limited to five purchases per 24 hours.

What are the Cash App fees?

The Cash App charges a fee whenever a user buys or sells Bitcoin, this fee is listed on the trade confirmation before a transaction is completed, so you can choose not to proceed if you think the fee is too high. The application charges two kinds of fees for each Bitcoin transaction: a service fee for each transaction and, depending on market activity, an additional fee determined by price volatility across U.S. exchanges. Bitcoin purchases and sales made through the Cash App are carried out at a mid-market rate that is determined by exchange prices.

Cash App parent Square pushes back on proposed FinCEN rules for crypto

Cash App parent company Square Inc has recently pushed back against proposed new regulations from FinCEN relating to "Requirements for Certain Transactions Involving Convertible Virtual Currency or Digital Assets". FinCEN released its new policy guidelines on December 23rd – with only a 15 day period allowed for interested parties to comment.

Amongst other things the proposed new rules would have required organizations like Square to conduct invasive ‘Know Your Customer’ evaluations of non-customers transferring cryptocurrencies through the app. In a January 4th letter to FinCEN, Sqaure said the 15 day comment period was woefully inadequate and that the proposed new regulations would "inhibit financial inclusion, present practical problems, is arbitrary and unduly burdensome, and will drive innovation and jobs outside of the U.S. and regulated institutions." FinCEN has since announced an extension of the comment period to March 29th.

Don’t miss out – Find out more today