How to develop the ultimate ICO pitch

It's no longer the case that blockchain startups can run a successful ICO with just an idea and a token. In this article, you will learn how to assemble the fundamental components of a successful ICO pitch deck.

A persuasive ICO deck or pitch that addresses investor considerations is key to successfully selling your token. However, most startups spend too much time with an expert technical team building the perfect blockchain-based technology, only to find that they’re unable to develop and present a compelling ICO pitch to raise funds.

Here are some of the key components we’ve found from working with successful blockchain clients that make up the general structure of a successful ICO pitch:

1. Prove you’re solving a real problem by leveraging the blockchain

The increasing popularity of ICOs has resulted in numerous projects where the application of blockchain technology appears to be an afterthought and potentially unnecessary. Getting clear as to why you’re building the blockchain application and illustrating the magnitude of the problem you’re solving will help you get initial buy-in from investors.

“ICOs have gotten a bad rep because many perceive them as a cash grab,” says Jack Yeu, CCO at Switcheo Network. “If your identified ‘problem’ can be solved by using a database instead of your solution, is it really a problem worth investing in?”

In your pitch, it should also be made clear that your solution is relevant to a problem that people are facing at this current moment versus something that people theorise might happen.

2. Sound token economics

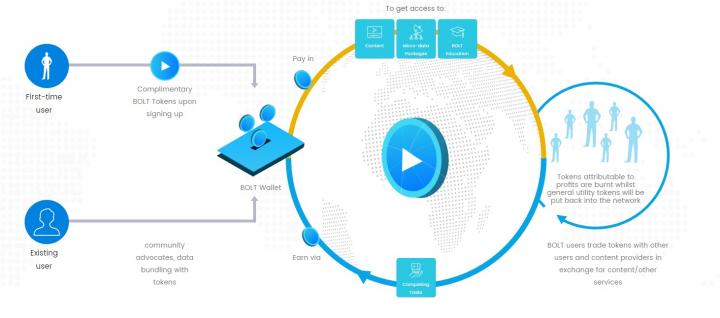

Most crypto-investors are usually interested in one thing —the value appreciation of the tokens that they purchase. To allay doubts of a dud token investment, blockchain founders need to be able to clearly articulate how their tokens are created, how they will be used and why they’ll grow in value over time.

More popular as of recent, blockchain companies running ICOs mostly create utility tokens that can be spent or exchanged for services, rebates or goods. That way, tokens get burnt after use and become more scarce. The result? The token’s worth increases naturally.

Source: BOLT Token website

Making a case for the longevity of your token value means illustrating what the circulation of the currency will look like as well as highlighting scenarios for increasing demand, adoption and scarcity. Communicating how the tokens work in the grand scheme of things will increase your chances of swaying investors.

3. Highlight the competence of your team

As with any company or solution, it’s the people and teams behind it that make or break the project. Ask yourself these questions:

- What are the technical strengths of my team?

- Do the members have any notable achievements or associations?

- Are their experiences relevant to the blockchain solution in development?

Token holders want to invest in not only the longevity of the technology but also the people behind it. Identify the greatest strengths within the team and keep the format of the team profiles consistent. Another tip is to avoid making general boastful statements like: ‘creator of multiple successful startups’. Instead, always use quantitative numbers or facts to substantiate any statements. (e.g. former CEO at X, 20 years in IT).

Source: LAToken Pitch Conference Pitchdeck

Here’s one example from LAToken (raised $20M). The format of introducing the team is consistent. It states their position and their experience and describes their roles.

4. Detail your ‘post-ICO’ plan

Some investors buy tokens to HODL for the long-haul and not just sell immediately after the ICO is over in anticipation of value growth. As such, they’ll want to know exactly what founders plan to do in the months or years ahead. This is called your ‘roadmap’ and it should include:

i) Marketing and Growth Plans

Community members want to know how you’ll continue to acquire and retain new token holders to bring added liquidity and value to tokens on sale. This helps to instill confidence in holders that the tokens they own will continue to stay relevant and valuable.

ii) Project Timeline

Having clear set dates (e.g. 2018 Q4) helps keep founders accountable for their promises made before the ICO and lets investors closely track the progress of solution development. A simple linear illustration in these cases usually works best.

Source: Inmediate.io – Blockchain Insurance Ecosystem

5. Financial plans and ICO proceeds

This is perhaps the most important piece of information for any token investor — the mechanics of the raise and how ICO proceeds will be distributed. Prospective investors need to know the factors to consider in their purchase. This means including the token price, whether there are hard caps and limits to the number of tokens and also how these will be distributed to their wallets.

Unfortunately, there have been a number of blockchain companies that have taken token holders for a ride, by misspending proceeds or never get any closer to realising their solution idea.

“Investors have become more wary of ICOs with token caps that are too high. Hence, we decided earlier on that we’d only raise what we needed” says Switcheo’s Yeu, “The question you need to truly answer as a founder is whether you really need that much money?”

A transparent breakdown like the one above from Inmediate.io is a good example of accounting for proceeds to be raised during an ICO and what a successful token sale would entail. Navigating this new world of cryptocurrency and blockchain can be confusing when you’re trying to get traction in the initial stages. However, as with any difficult endeavor, strategies that work will leave patterns and we can learn from these successes and apply the lessons to our own projects.

About the author:

Eugene Cheng is a Partner and Creative Lead at HighSpark – a strategic presentation and training company that works with Fortune 500 companies and blockchain startups to communicate more powerfully. Eugene writes about blockchain trends, business and marketing for leading publications like Lifehack, Techinasia, e27 and more.

It’s no longer the case that blockchain startups can run a successful ICO with just an idea and a token. In this article, you will learn how to assemble the fundamental components of a successful ICO pitch deck

Don’t miss out – Find out more today