How To Launch A Token: PEPE And The Power Of The DEX

With the rise of DeFi and Automated Market Makers, it is easier than ever to take a token to market - and as with IPOs in the equity markets, a token listing on a major crypto-exchange and the hype building up to it can generate a lot of interest and value in an asset.

In 2017 to 2018, hundreds of new digital tokens emerged on the scene thanks to a booming Initial Coin Offering (ICO) market. These ICO projects generally conducted token sales through a website with custody and token transfers based on trust. This required the development and management of a centralized site just to conduct the sale.

After the sale was conducted via the website, another key point of difference of the ICO model was that after the launch sale finished, projects still needed to find an exchange or secondary market for trading their tokens. This was problematic for ICO-funded projects as most of the most popular exchanges charged tens to hundreds of thousands of dollars to onboard a new token (many still charge). Listing on multiple centralized exchanges was often required to gain access to enough active traders to bring sufficient liquidity into trading pairs. It was an expensive and time-consuming exercise.

As a result, many of these new digital tokens and currencies (both good projects and bad) were never made available to potential investors because they failed to get crypto exchange listings. At the time the major crypto exchanges were all centralized – controlled by a single entity that acted as an intermediary between cryptocurrency buyers and sellers. Centralized exchanges act as custodians and users trust them to hold their assets securely, as they would a bank.

Without the support of major exchanges, buying and selling digital assets, while not impossible, was much more challenging. Hence, there was a clear correlation between the success of a cryptocurrency and the number (and quality) of crypto exchange listings it secured. In 2023 that is still true – to an extent – but how and where to get those listings has changed significantly.

How To Get Crypto Exchange Listings In 2023

The market has shifted since 2017. There are now new ways to launch tokens and access liquidity as well as community support without needing to tap into major centralized exchanges. The necessity for tokens to have the support of large exchanges to gain traction has reduced because of the emergence of decentralized finance (DeFi).

DeFi is a new financial paradigm that leverages distributed technology to connect peers with each other so that they may offer each other services like market making, borrowing and lending, and insurance. In traditional finance, and in the earlier days of digital assets, middlemen and exchanges were needed to support these kinds of financial services.

With an Initial Defi Offering (IDO), a trading market is created at the same time as a token is launched because creating secondary markets is automatic and permissionless on decentralized AMMs. This results in an active market for trading and liquidity accessible to participants immediately after the initial token sale – solving issues like liquidity and price uncertainty.

Since price and counterparties don’t need to be considered and trading happens automatically, launching a project via an IDO on an AMM-powered decentralized exchange is a much easier capital raising process than earlier token offerings models like Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs).

The IDO/DeFi/Uniswap Models – Redefining Token Launches

Increasingly blockchain projects are choosing to launch their native tokens on decentralized exchanges (Dexes), like Uniswap which allow tokens to launch without having to pay the hefty exchange listing fees and processes associated with launching on centralized exchanges.

This ‘Defi first’ model has been used to launch a number of tokens that gained hype and value well before eventually listing on centralized exchanges. This list includes numerous well-known tokens such as Compound (COMP), Arbitrum (ARB), Shiba-Inu (SHIB), and many others.

Liquidity pool-based platforms such as Uniswap have increasingly become the system of choice for distributing this new class of crypto tokens, and trade volume on these decentralized exchanges began surging in 2020. Liquidity-pool-based dexes use the Automated Market Maker (AMM) model to pair buyers with liquidity. In decentralized finance, peers interact with smart contracts that lay out automated rules of engagement. Peers have no choice but to play within these bounds because smart contracts are hard-coded.

How Uniswap Works

Uniswap, the creator of the AMM model, uses an alternative method to settle cryptocurrency trades. Instead of pairing up buyers and sellers, tokens are bought and sold at a rate determined by an automated demand and supply-based bonding curve. With this mechanism, as tokens are purchased, the price goes up. As tokens are sold, the price goes down. In both cases, the exchange rate is determined by a supply curve instead of a market of orders placed by buyers and sellers.

Thus, a Uniswap listing allows for even potentially illiquid tokens to connect with buyers because there does not necessarily need to be a seller on the other side. As long as there is a supply of both the launched token and the counterparty token users just need to dip into the pool of liquidity and accept the automated price.

Newly launched pools on AMMs contain newly generated ERC20 (or some other token standard) tokens and counterparty token (like ETH, USDC etc). Since AMMs like Uniswap do not have centralized control, token issuers can freely launch tokens on these platforms without anyone’s permission as long as the smart contracts for the tokens are valid.

After the pool has been created, liquidity can be deposited by the token launchers, market makers, and anyone in the community that can access the exchange. AMMs have models where liquidity providers are rewarded based on trading fees pool accumulation and the size of a liquidity provider’s position in a pool. Lucky LPs will get in early on pools that eventually become popular.

Launching this way has become a more appealing way for projects because they can launch their tokens for relatively low stakes. Presently, a number of AMMs including major players like Pancakeswap have a launchpad feature.

The launchpad feature allows emerging projects to also receive promotional support from an AMM like Pancakeswap or Sushiswap and also add features to a token launching with a liquidity pool. For example, this may include adding a whitelisted initial private sale where only pre-registered users/wallet addresses can participate before a wider public sale.

They are permissionless – allowing any DeFi builder to make use of a publicly available smart contract-based trading infrastructure to launch tokens via decentralized smart contracts. This type of token launch is often called an initial DeFi Offering or IDO. Tokens can be launched on an AMM and once created users can continue trading with tokens using the created pool.

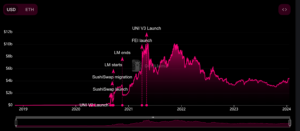

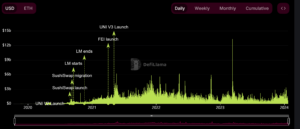

Source: DeFiLama

Source: DeFilama

The charts above display the monthly volumes across all versions of Uniswap, and the total cumulative volume across Uniswap since its inception. The total cumulative volume, displayed in the 2nd chart indicates that the total volume ever traded on Uniswap has just exceeded US$1.5 trillion. Total monthly volumes on Uniswap, over the last 3 months, have ranged between US$20-US$60 billion.

Currently, daily volumes on Uniswap, across all Uniswap versions currently, are ~US$900 million but have been as high as US$13 billion in the last year. Currently, daily volumes on Binance sit at US$4.9 billion, while Coinbase, the only exchange in the world that is publicly traded on a major stock exchange, sits at around US$600 million.

The volumes on Uniswap are comparable to some of the largest exchanges in the world. An additional benefit for launching on an AMM is that generally, users do not need to provide KYC/AML information, not even an email address to use them.

They simply need to connect to the decentralized exchange with a web3 wallet like Metamask, which is private and they can log in with secured details. Using AMMs is often the preference of privacy-centric crypto users, even if the option to use a centralized exchange exists.

How To Launch A Token Today: The PEPE Case Study

We now appear to have a more hybrid model for launching new tokens that support protocols and decentralized exchanges. The model consists of an initial launch, via a decentralized platform, before receiving an additional surge in popularity after a listing on a centralized exchange.

The recent trajectory of memecoin Pepe (PEPE) is a good example of this phenomenon. Pepe is an example of a memecoin—blockchain-based tokens that are based on popular pieces of internet culture. They are generally characterized by having minimal utility and extreme volatility.

Pepe was launched in mid-April 2023 on Uniswap and could be bought with Ether (ETH). No listing team was needed to approve the Pepecoin and no listing fee had to be paid to an exchange, so Pepe was able to launch to a large audience of users with relative ease.

Pepe, despite only listing on Uniswap, was still able to gain hype, traction, and buying momentum despite only launching to the Ethereum decentralized finance community.

At launch the Pepe token began trading for 0.000000001. Without any listings on any centralized exchanges, the price of PEPE quickly rose to 0.000000748. This constitutes a quite staggering 74,700% increase. This was followed by a listing on May 1st on OKX – one of the largest exchanges in the world. Driven by hype and community demand this pushed the price of the token to 0.00000167, a further increase of 123.3%.

Soon after this was followed by a listing on the largest exchange in the world, Binance, on May 5th. The hype surrounding this major listing pushed the Pepe price to 0.0000043, a further increase in value of 158.1%.

Between its opening and its early peak, the price of PEPE rose by 430,900%. From an starting price of 0.000000001 to 0.00000431. This explosive period lasted around three weeks and was driven by both a strong hype cycle and an accumulation of listings that became larger and spread across more well-populated exchanges.

The PEPE price currently sits at 0.00000108, well below the all-time highs hit weeks ago. While PEPE for some time was the most traded token on Uniswap, it is now the 19th most traded token.

Source: Coingecko

PEPE made things look easy but just like with ICOs, token price rises occur because of buying pressure. For early-stage crypto projects that are often conducting IDOs for funding pre-product, this is often driven by marketing, social media penetration, and branding.

Pepe had all of these things, the project went viral on Twitter and the Pepe Frog was already universally known on the internet making it easier for PEPE to gain traction and popularity. Additionally, it should be noted that despite the popularity of Uniswap both as a platform to launch tokens, and to trade already launched tokens, what really created exit velocity for PEPE was listing on centralized exchanges.

Conclusion

The evolution of token launches from the ICO era to the current DeFi and IDO trend has revolutionized the way new projects raise funds and interact with investors. The rise of Decentralized Exchanges (DEXs) and Automated Market Makers (AMMs) like Uniswap have changed how tokens launch and removed the necessity of tokens to launch on centralized exchanges to reach the mainstream market.

The case of Pepe (PEPE) illustrates how the democratization of token launches can be a boon for crypto projects. It enabled PEPE to rapidly generate hype and gain investor traction without the need for expensive listing fees or the approval of centralized entities. Despite its seemingly easier launch process, the IDO model still heavily relies on marketing, community building, and brand recognition for its success, as the PEPE example clearly showed.

However, the role of centralized exchanges in the cryptocurrency market cannot be entirely dismissed. As seen in the PEPE case study, listings on major centralized exchanges can provide an additional boost in popularity and liquidity, demonstrating the coexistence and symbiotic relationship between the DeFi and traditional crypto market infrastructures.

Don’t miss out – Find out more today