ICO Investment — Due diligence basics

Figuring out how to invest in an Initial Coin Offering (ICO) is harder than it looks. Before you can invest, for example, you have to choose one from the hundreds that are being launched every month. If this is your first ICO it’s easy to feel intimidated by all the technical details, or worse, persuaded by pretty websites and shiny press endorsements. But with a little common sense and some digging, it’s fairly easy to spot the scams and find some solid investments. Here are some steps I recommend you follow before making any ICO investment.

Figuring out how to invest in an Initial Coin Offering (ICO) is harder than it looks. Before you can invest, for example, you have to choose one from the hundreds that are being launched every month. If this is your first ICO it’s easy to feel intimidated by all the technical details, or worse, persuaded by pretty websites and shiny press endorsements. But with a little common sense and some digging, it’s fairly easy to spot the scams and find some solid investments. Here are some steps I recommend you follow before making any ICO investment.

1. Read the whitepaper

Every ICO has a whitepaper. Typically this will be a pdf of 20-40 pages that lays out most of what you need to know about a new coin or token. This should include what problems the coin solves, the technical details of its development and what the team’s plans are post funding. All whitepapers are laid out a little differently, but a lot of heartache can be avoided by using some old fashioned common sense to determine whether or not you think this is a good investment.

The whitepaper often has multiple audiences, so don’t be surprised if there’s technical sections that are difficult to understand. That’s totally normal. On the other hand, some whitepapers are full of fluff and should immediately raise a red flag. Once you’ve read through the whitepaper you’ll have a better sense of the company’s industry, competitors, founding team, and development roadmap.

2. Follow (stalk?) the founding team on LinkedIn

The best structures start with a solid foundation and cryptocurrencies are no different. Before you can confidently back the right coin it helps to know who you’re getting in bed with. For an ICO to truly be a success long-term, there has to be a dedicated team behind it. Before I back any ICO, I like to review the professional experience of each of its team members and I look for answers to a few key questions:

- What companies have they worked for?

- What schools have they attended?

- How long has the company / team been together?

- What experience do they have with blockchain / cryptocurrencies?

- Does the CEO have experience leading technical teams?

- How active are they on social media, forums, etc.?

- Do they have a history of conflict?

3. Review the roadmap

Another key piece of information that will help inform your investment is the roadmap. which you should find in the company’s whitepaper. The roadmap is exactly what it sounds like — a description of where the organisation plans to go and a timeline of when it aims to achieve meaningful milestones.

These milestones vary depending on the goal of the company but should give you a general idea of what will be completed leading up to, during, and post ICO. Just because a company has a good idea it doesn’t mean you should invest in them. Personally, I’m skeptical of companies that start an ICO without a working prototype.

The final piece of information I try and find in the roadmap or whitepaper is when the new coin will be listed on an exchange. Regardless of how good the idea or company is, the payoff comes when you can finally exchange the new coin for a profit.

Lately, I’ve seen several websites list which exchanges will offer their currency as soon as the ICO ends. This isn’t a must-have before investing but it is an indication that the company behind the coin has their ducks in a row and has already worked that out with the exchanges. Since adoption and demand play a huge role in the price of the coin post-ICO, the greater the trade volume of the exchange the better.

Check exchange trade volume on CoinMarketCap.

4. Research popularity and sentiment

For better or worse, speculation fuels all kinds of markets. As an investor, it’s okay to make investments based on speculation. For example, every time Bitcoin has a hard fork, anyone holding BTC receives an equal amount of the new currency. And every time that’s happened to date the new currency has been worth several hundred dollars. So based on this speculation, I might buy up lots of Bitcoin when I hear news of an impending fork.

Speculation can be very useful when trying to time the markets. Hype, on the other hand, is rarely helpful and usually involves deception. Hype is when a celebrity endorses an ICO simply because they get paid to. But with a few common tools we can quickly discern between the two.

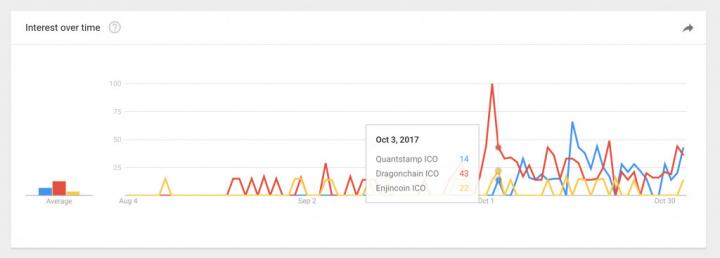

Google Trends (Quantitative)

- Quickly research how many people are interested in an ICO

- Easily compare the interest in multiple ICOs

Twitter Search (Qualitative)

- See how people are responding to the ICO

- What is the overall sentiment of the company and its proposed project?

We live in an era when the average investor is given the same opportunity for gains (and losses) as institutional investors and hedge funds — and with appropriate due diligence, your ICO investments can be an incredible opportunity, rather than a coin toss.

Jared McKinney is the founder of Bitcoin Noobs, a site featuring crypto exchange reviews and advice for sector newcomers.

Don’t miss out – Find out more today