Inside the fundraising model that’s about to open up a $1 Billion market to blockchain startups

In the blockchain space this summer, three white hot letters are buzzing on everybody’s lips: ICO, or Initial Coin Offering. Droves of blockchain developers are scrambling to put together white papers to architect the next big solution since Bitcoin.

In the blockchain space this summer, three white hot letters are buzzing on everybody’s lips: ICO, or Initial Coin Offering. Droves of blockchain developers are scrambling to put together white papers to architect the next big solution since Bitcoin.

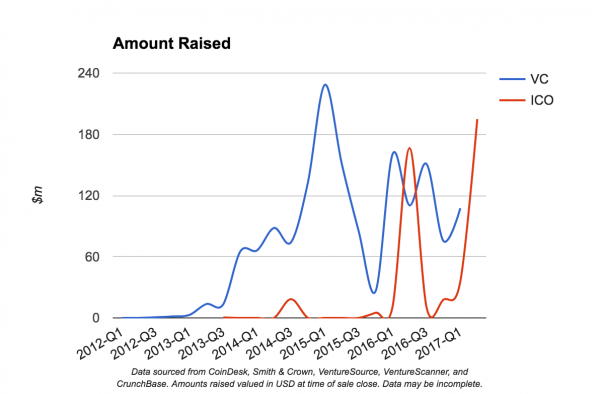

Venture capital funding plateaued in the midst of the bear market following the burst of the altcoin bubble in 2014. As Bitcoin dipped below $200 generalist VCs looked to other industries for more attractive investments. Yet the entrepreneurial fire within the blockchain space kept roaring, seeking out creative alternatives for backing.

At the same time, the general public who may have been late to the Bitcoin party are actively seeking nascent projects with promises of huge potential upsides. Enter the ICO, a crowdfund-based bridge that connects a previously disjointed group of people. The process provides capital from the general public to the fund-seeking teams, in exchange for digital tokens.

Not to confuse owning tokens with owning shares in a company, or a conventional stockholding, ICO investors are granted tokens rather than equity, before those tokens – or products, for that matter – have been released into the market.

This relatively new fundraising model to bootstrap a project’s technical development has become something of a burgeoning industry in the nascent blockchain ecosphere, and has since garnered both criticism and praise from notable members of the cryptocurrency community.

The lead maintainer of the Monero project, Riccardo Spagni – better known as his handle “fluffypony” – criticises development teams for pursuing the “low hanging fruit’ of ICOs, rather than go through the venture capital route of pitching accredited investors with the resources to properly vet and support projects.

The draw toward ICOs is how incredibly lucrative they are becoming, and how low the bar is for a project to raise millions of dollars in funding with not much more than a white paper.

During the panel discussion “Beyond Bitcoin and Ether – The Long-Tail of Blockchain Assets” at Consensus 2017, Spagni recalls that ICO valuations last year were estimated at about $4 million dollars, compared to this year’s $50 million dollar valuations, on average.

“I wish someone would do a legit ICO […] They’re doing it as wide of side stepping regulation.”

— – Riccardo Spagni

The frenzy has begun as the crowd feeds on its own irrational exuberance, as Alan Greenspan called it, or the Fear Of Missing Out (FOMO), as millennials call it. But those development teams going the ICO route are not entirely to blame.

The very first ICO was born in 2013; Mastercoin (now Omni) tokens were sold to the public in a month-long fundraiser that raised over $500,000, demonstrating to other would-be blockchain projects that a crowdfunded model was not only feasible but perhaps more attractive, as far as barriers to capital were concerned.

The venture-backed funding route, for comparison, is arduous and time consuming. In the initial idea phase, where most projects launch ICOs, projects typically raise up to $1 million, subject to some regulations. It is not until a startup has progressed to a third round of capital raising, Series C, do they start raising capital in the $30 million range, long after the startup has earned a pedigree of success in the market with fully formed products already generating revenue.

Retail investors join in when a company starts selling shares in an Initial Public Offering (IPO). By that time, those public companies must adhere to strict regulations, including quarterly financial reports.

”In the 1920s, companies often sold stocks and bonds on the basis of glittering promises of fantastic profits and without disclosing any meaningful information to investors. Following the stock market crash of 1929, the U.S. Congress enacted the federal securities laws and created the SEC to administer them.”

— – Securities and Exchange Commision

Compare that to the as-yet unregulated ICO environment. The Ethereum platform has made crowdsales as easy as copying and pasting code to generate new tokens. Gnosis (GNO) alone raised a whopping $12.5 million in a crowdsale this quarter, hitting its target within minutes on 24 April 2017, and they are not even past beta. Qtum, a hybrid blockchain solution with a whole lot of media coverage, raised $15.6 million in 5 days this March.

Most impressive of all token sales, however, was the launch of The DAO in 2016 – the largest ICO to date – which raised a record-breaking $150 million. But we all know how that ended.

With countless spectacular projects come spectacular failure. Andreas Antonoupolos speculates that 99% of all ICO-funded startups will fail to deliver a product.

Brock Pierce, the mastermind behind the ICO model and founder of Blockchain Capital, seeks to reign in the beast he unleashed into the blockchain wild by writing the template about how token sales should be executed, legal measures and all.

This past April, Pierce introduced the BCAP, Blockchain Capital’s own token, which was built for that purpose. “We spent about a million dollars on legal and I got so many discounts and so many favors amongst securities lawyers; it would’ve cost $3 to $5 million to do what we did,” Brock explains. “This was a gift.”

The entrepreneur is attempting to show people what can be done and how to do things. “Everyone should be doing KYC,” he asserts, and “Everyone, for the most part, should probably not take any money from Americans.”

“9 out of 10 should avoid the US because 99% of your risk comes from America with only 20% to 30% of your capital….So only the top products that can spend real money on attorneys, check all the boxes, and do things thoughtfully should be touching the US during their offerings.”

— – Brock Pierce

While the BCAP was a globally open fundraiser, it was exclusive offered to “accredited” investors in the US, as defined by the Securities and Exchange Commission (SEC). Blockchain Capital issued its $10 million in BCAP tokens in an act of stringent self-regulation, performing credit and background checks of its US investors, due diligence that many token issuers fail to apply.

In aggregate, the ICO market to date has raised upwards of $380 million, according to Forbes Magazine. That number is projected to grow to $1 billion at the close of 2017, according to an estimate provided by insider William Mougayar, general partner at Virtual Capital Ventures and organizer of the Token Summit conference held last week.

Pierce believes that venture capital as we know it is done. The excessive speculation in the blockchain ecosystem that we are in the midst of is only starting to take a foothold in the economy. We are in the beginning stages of a paradigm shift, and ICOs are the means forward.

“I think I just killed venture capital forever as the model works,” Pierce claims. “Venture capital is an industry that invests in technology and internet and it benefited greatly. But how has it evolved in the last fifty years? It hasn’t. We allegedly invest in innovation and disruption, but how are we disrupting ourselves? How are we doing the Charles Schwab?”

Pierce asserts that he’s not really a Venture Capitalist, “”though I play one.” He classifies himself as an entrepreneur: “When I see a problem and I see a better way to do things, I want to do it; I care more about that. I’d rather put myself out of business than maintain the status quo. I think what I’ve done is the end of all VC, all private equity, all rates, because these are industries that are illiquid. If you can take the same product and have liquidity, would you? Yes. Everybody wants liquidity; liquidity is an incredibly enhancing aspect of anything.”

While nothing is for certain, one thing that seems obvious to Pierce is that, “IPOs are dead.” NASDAQ and the New York Stock Exchange as we know it are going out of business, he claims, “they may buy something and evolve into a new brand but their current model is done, they were built for a world of paper.”

“The current stock markets are local. Our market is global. When you can do a global offering or a local offering, forget where the markets are today, think in the future. Which is better?”

— – Brock Pierce

“Why would I want to do a local listing when I can do a global listing using more efficient technology?,” Pierce speculates. “Because the efficiency has improved, everyone’s going to go public at much earlier stages: A and B, once they’ve got a proof-of-concept.”

Bubble or no bubble, ICOs are revolutionizing how startups are funded, and this model ultimately breaks the boundaries of borders, opening up a vast global audience of investors to all things as they relate to blockchains. And this property, above all other properties of the ICO fundraising model, eclipses the domain of traditional fundraising.

Don’t miss out – Find out more today