Litecoin Price Analysis – A potential end to the bull trend

Fundamentals suggest network use in terms of both the number of transactions and daily active addresses has stagnated and begun to decline.

Litecoin (LTC) is a Bitcoin (BTC) fork created by Charlie Lee in 2011. The network has a target block time of two minutes and 30 seconds, as opposed to Bitcoins 10 minutes, a four-fold increase in total supply, and uses a different Proof of Work consensus algorithm called Scrypt. The crypto asset has increased almost 3x from the December lows but is currently down 81% from a record high set in December 2017. The market cap currently stands at US$4.53 billion with US$1.41 billion in exchange-traded volume over the past 24 hours.

Lee is a former Google employee and the brother of Bobby Lee, CEO of the now-closed Chinese cryptocurrency exchange BTCC. Lee worked as an engineer at Coinbase from 2013-2017. Despite selling all of his LTC holdings in December 2017, Lee continues to be involved in Litecoin development and the community at large, including spearheading the SegWit upgrade on the protocol and a Coinbase listing.

LTC uses SegWit (SW) enabled addresses to both decrease individual transaction size and cost, as well as increase the maximum block size to more than 1MB. The SW protocol upgrade also enables transactions to be used on the Lightning Network (LN), a bi-directional, off-chain, hub-and-spoke payment channel. SW usage on the LTC chain has averaged over 50% in the past few months. Earlier this year, LN channels on LTC exceeded 1,000 for the first time and the network capacity is currently over 300 LTC.

Lee has most recently discussed adding confidential transactions to the LTC blockchain via bulletproofs and MimbleWimble (MW). Both of these changes could be added through a soft fork and would offer privacy solutions with complete fungibility between transactions. Bulletproofs use zero-knowledge proofs while MW uses a specific type of transaction mixing to obscure transaction details. Bulletproofs are currently active on Monero (XMR), while MimbleWimble is currently active on the nascent Beam (BEAM) and Grin (GRIN) chains.

Source: https://thebitcoin.pub/t/mimblewimble-the-good-and-the-bad/49971

Lee is also an advisor for the HTC Exodus1 blockchain phone, first announced in May 2018, which can be purchased for US$699. The default web browser on the phone is Brave, which uses the Basic Attention Token (BAT) for microtransactions and the Zion crypto wallet. For cold storage recovery, the phone uses a social key system whereby the user can give a shard of the key to five friends. However, specific details surrounding the blockchain components on the phone have been sparse, and user reviews for the phone have been poor.

On the network side, the number of LTC transactions per day (line, chart below) has ranged between 22,000-30,000 since mid-2018. Transactions rose substantially in December 2017 and January 2018, which was most likely in response to the expensive and delayed transactions on the BTC network. There are currently only 136 pending LTC transactions.

The average transaction value (fill, chart below) fell dramatically throughout 2018 but has increased substantially in 2019 along with the increase in price. Currently, at just over US$8,700, average transaction values are down substantially from a high of ~US$59,000 in November 2017. As LTC price rises, average transaction values will also likely rise.

Source: coinmetrics.io

The networks block size (line, chart below) fell dramatically throughout 2018 and early 2019 but has increased rapidly over the past few weeks. Average transaction fees (fill, chart below) have increased as block size and price has increased, currently US$0.049, which is about 3% of the current BTC transaction fee. Litecoin Core v0.17.1 was released earlier this week, which lowered the default minimum transaction fee to 0.0001 LTC/kB.

Source: coinmetrics.io

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has been ranging between 25 and 50 since July 2018. An NVT below 20 would likely indicate organic and sustained bull market conditions based on this metric. Inflection points in NVT can be leading indicators of a reversal in asset value, although clearly not in this case, as price has risen substantially since January despite a rising NVT. An uptrend in NVT often suggests a coin is overvalued based on its economic activity and utility, which should be seen as a bearish price indicator, whereas a downtrend in NVT suggests the opposite.

Active and unique addresses are important to consider when determining the fundamental value of the network based on Metcalfe’s law. Daily active addresses (fill, chart below) have continued to decline since January 2018, but remain well above historic levels. However, LTC has far fewer daily active addresses than either BTC or ETH but 10x more active addresses than XRP.

The top 100 LTC addresses currently hold 42% of the available LTC supply, compared to 16% for BTC, 33% for ETH and 78% for XRP. In November 2018, 40 new LTC wallets appeared on the rich list, each containing 300,000 LTC. A few days later, Coinbase came forward and claimed those wallets as their new LTC cold storage addresses.

Other grassroots metrics include over 100 Litecoin groups on meetup.com with over 36,000 members total. The /r/Litecoin subreddit has over 202,000 subscribers and is ranked 987 based on total subscriber count. There are currently only 11 LTC-related job postings on LinkedIn.

Source: coinmetrics.io

Of the 84 million LTC to ever exist, 73.55% have been mined. Inflation per year currently stands at 8.88% and is set to decrease to 4.26% after the next block reward halving on August 7th of this year. The network currently has 1844 active public nodes, most of which reside in the United States and Germany.

Since mid-December, difficulty and hash rate have rebounded substantially, both recently reaching a new all-time high. Scrypt ASIC miners available for LTC include the Bitmain Antminer L3+ and L3++, FusionSilicon X6 Miner, and the Innosilicon A4, A4+, and A6, all of which are profitable at an electricity cost of US$0.06 cents/KWh. Overall, mining profitability is currently at an all-time low. Factors that influence mining profitability include; price, block times, difficulty, block reward, and transaction fees.

Source: bitinfocharts.com

Turning to developer activity, the LTC project has 37 repos on GitHub. Over the past year, 184 developers have contributed a cumulative 518 commits with two commits in the past 90 days on the main repo, litecoin-project/litecoin (shown below). Compared to previous years, 2019 has seen a marked reduction in dev activity, however, Charlie Lee has stated “we don’t work on the master branch” of the GitHub repo.

Most coins use the developer community of GitHub where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Source: https://github.com/litecoin-project/litecoin

Exchange traded volume during the past 24 hours has been predominantly led by the Tether (USDT) and Bitcoin (BTC) pairs with the U.S. Dollar (USD) and Ethereum (ETH) pairs also sharing a substantial but smaller volume. The Chinese Yen (CNY) pair holds no premium over the USDT pair.

LTC has continued to gain exchange listings, custody solutions, and exposure over the past year, including new LTC pairs on Coinbase, Poloniex, Bittrex, Gemini, CMC markets, OKEx, Binance, Huobi, EscoDEX, QuantaDEX, and DragonEX. Litecoin.com also added a buy function with pairs in USD, EUR, and GBP, along with a logo redesign. CoinGate and Travala.com both enabled LTC payment support for merchants and hotels. The UK CFD exchange, FXCM, added an LTC/USD pair and LTC was added to the Coinbase Wallet. This year, ErisX, a CFTC-regulated Designated Contract Market, is attempting to launch LTC spot trading and a futures contract. Fidelity and TD Ameritrade may also launch an LTC trading product in the next few weeks.

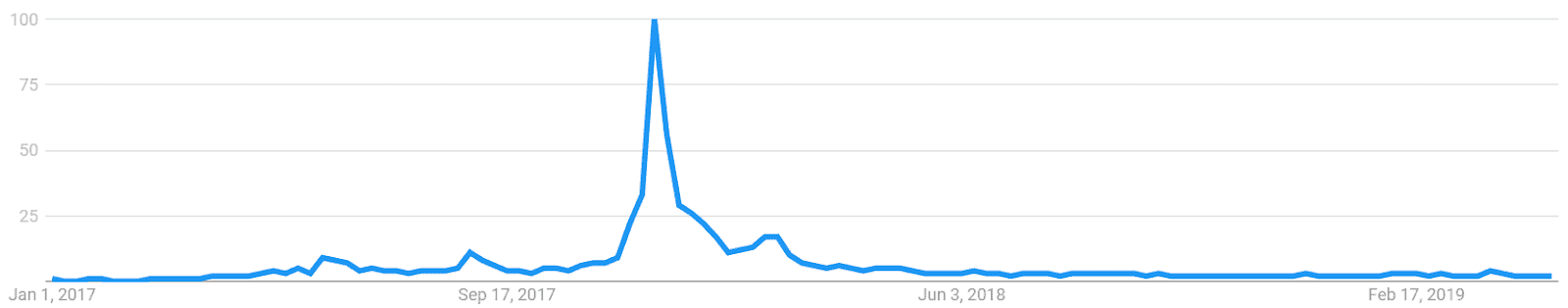

Google Trends interest regarding the term "Litecoin" has remained down over the course of 2018 and 2019. A slow rise in searches for "Litecoin" preceded the bull run in Q4 2017, likely signaling a large swath of new market participants at that time. A 2015 study found a strong correlation between the Google Trends data and Bitcoin price, while a 2017 study concluded that when the U.S. Google "Bitcoin" searches increase dramatically, Bitcoin price drops.

Technical analysis

LTC has outperformed most cryptocurrencies and assets since the beginning of the year on exuberant volume and price action. A roadmap for the potential for bullish continuation or pullback potential can be deduced using exponential moving averages (EMAs), Volume, Pitchforks (PFs), Chart Patterns. and the Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

On the daily chart, the 50-day and 200-day EMAs crossed bullishly on March 27th, ending the 310-day bearish trend. The 200-day EMA is currently US$61 and should act as support for any upcoming pullback. The historic volume profile (horizontal bars) shows a high volume area at US$54, which will also now likely act as support. Total long/short open interest on Bitfinex for the LTC/USD pair (top panel, chart below) is net short. There are currently no active RSI or volume divergences.

A bullish PF has formed over the past few months, with several touches of the median line (yellow) as well as the upper and lower diagonal zones. Over the past week, price has fallen out of the PF, suggesting an end to the multi-month bull run. The median line should continue to act as a magnet if price can breach the US$100 level.

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame, with doubled settings (20/60/120/30) for more accurate signals, are bullish; price is above Cloud, Cloud is bullish, TK cross is bullish, and Lagging Span is above Cloud and in price. Overall, despite the bullish snapshot of Cloud metrics, a long position entry here is likely to be more profitable than waiting for a TK cross and recross. If price enters the Cloud, a pullback to US$64 is likely based on Cloud support.

Lastly, the LTC/BTC pair on the daily chart has quickly turned from bullish to bearish over the past month as price has fallen below the Cloud and below the 200-day EMA. There is also no bearish divergence to suggest an end to bearish momentum. Historic volume support and psychological support now sits around 0.01 BTC.

Conclusion

Fundamentals suggest network use in terms of both the number of transactions and daily active addresses has stagnated and begun to decline. Despite this, hash rate continues to increase and may bring additional sell pressure as miners look to unload to get a return on investment. Developer activity on the main GitHub repo has been nearly non-existent over the past three months, despite a recent Litecoin Core upgrade. The most important price momentum over the next six months is likely the block reward halving in August this year.

Technicals suggest a slowing and potential end to the LTC/USD bull trend and a definitive end to the LTC/BTC bull trend. LTC/USD shows strong support between the US$55-US$65 zone, while LTC/BTC shows a high probability of bearish continuation to the 0.01 BTC level. Any further upside for the LTC/USD pair will likely reach for the next psychological resistance of US$100. Since 2015, the LTC/BTC has been unable to sustain a price above the 0.02 BTC level.

Subscribe to BNC’s newsletters for insights and forecasts direct to your inbox

Don’t miss out – Find out more today