LooksRare – The NFT token everyone is looking at

The launch of the LooksRare NFT platform is turning heads in the Non-fungible Token (NFT) ecosystem, with its trading volumes apparently eclipsing incumbent OpeaSea within days. A closer look, however, reveals there’s more (or less) to this phenomenon than first impressions suggest.

The launch of the LooksRare platform on January 11th has made a strong impression on the Non-fungible Token (NFT) and cryptocurrency ecosystem. LooksRare is a peer-to-peer NFT marketplace that aims to be community-driven. It achieves this ethos by directly rewarding buyers and sellers with native tokens for their trading activities on the platform.

Source: LooksRare

In just two weeks since its launch, the LOOKS token price has outperformed its major competitors and has had multiple days where its trading volume has exceeded that of the dominant incumbent NFT marketplace, OpenSea.

This is particularly impressive considering that OpenSea is a platform that has existed for four years and has an existing base of loyal users. It recently announced that it had completed a US$300 million in Series C funding at a $13.3 billion post-money valuation.

LookRare vs OpenSea. Source: Footprint Analytics

The most notable difference between OpenSea and LooksRare is the latter’s use of a native token, LOOKS, to reward active users of the platform.

- Users who buy and sell NFTs from eligible collections earn LOOK tokens

- 100% of platform transaction fees go to users who stake LOOK

- Creators get royalty payments in LOOK when their items are sold

The other major difference is that OpenSea charges a 2.5% fee for all transactions while LooksRare charges 2% per transaction. Additionally, the fees OpenSea charges go to the operators of the platform, while the LooksRare fees go to holders of LOOK tokens.

The LOOKS token was airdropped to historical users of the OpenSea platform on January 11th. The same day, the LooksRare platform was launched.

LooksRare recorded all trading volume conducted by all Ethereum users of OpenSea between 16th June 2021 and 16th December 2021 and dropped LOOKS tokens based on activity during this period. Only Ethereum and not Polygon network activity was considered.

In order to claim LOOKS tokens, however, eligible OpenSea traders also had to list either a ERC-721 or ERC-1155 NFT on LooksRare.

Popular Twitter trader Moonoverlord pointed out that a large number of airdrop recipients sold their tokens quickly to whales who were seeking to accumulate as many LOOKS tokens as they could.

The approach taken by LooksRare is similar to the one taken by OpenDAO in December 2021. The OpenDAO airdropped historical OpenSea users with its native SOS tokens. The goals of the two projects are very different, however, with OpenDAO seeking to build a DAO project that will, in parallel, support the growth of OpenSea. LooksRare is seeking to build a direct competitor to OpenSea.

Additionally, LOOKS has far outperformed the SOS token price-wise. Since its launch on December 24th, the price of SOS is up ~23% rising from an opening price of ~US$0.00000140 to currently trading for $0.00000174. It is, however, down ~84% from its all-time-high touched on December 25th.

LOOKS is up ~177% since it launched on January 11th. It opened trading for ~US$1.54 and currently trades for US$4.26. Its all-time high price was US$7.10 touched on January 21st, since then it has fallen by 40%.

Source: CoinGecko

Additionally, unlike SOS which had a sharp spike in trading volume around the time of its launch which quickly fell away, the volume of LOOK has been far more consistent suggesting a deeper base of committed bulls. LOOK has surprised observers by performing solidly during a period when wider crypto markets have moved bearishly and other major airdropped tokens like SOS, WTF, PSP, and ENS have struggled.

High percentage of LooksRare’s volumes are likely wash trading

While the daily US dollar trading volumes on LooksRare far exceed those on OpenSea, this statistic appears strange after observing daily active users on LooksRare. LooksRare has about 1% of the number of daily users that OpenSea has, how is it producing more trading volume?

Source: Dune Analytics. User @hildobby

Source: Dune Analytics. User @hildobby

The answer perhaps lies within LooksRare’s trading reward model. Users who trade NFTs from eligible collections on LooksRare earn rewards in the form of LOOKS tokens. Buyers and sellers of an item earn rewards for the volume they generate.

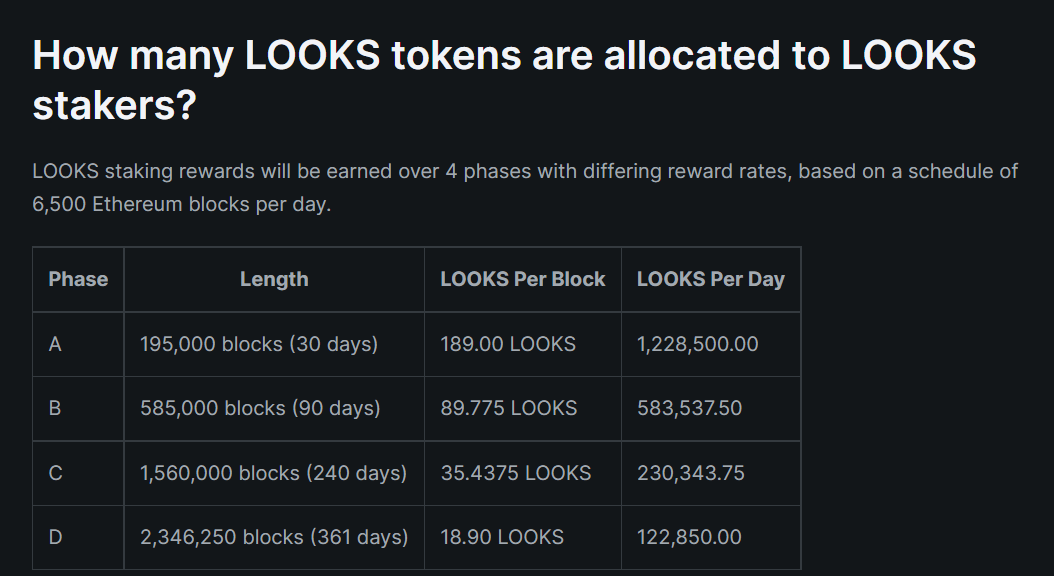

Trading rewards on LooksRare are calculated daily and are rewarded to users two hours after the end of each day. The entire schedule of trading reward emissions will be issued over 4,686,250 Ethereum blocks, ~721 days, assuming there are 6,500 blocks per day. After this point, all LOOKS token issuance and the ecosystem should be self-sustaining.

The system seems immediately gameable and prime for washing. Users can buy and sell NFTs to themselves, not lose any assets and earn free LOOKs tokens from trading rewards. This can be doubled up because buyers and sellers both earn rewards.

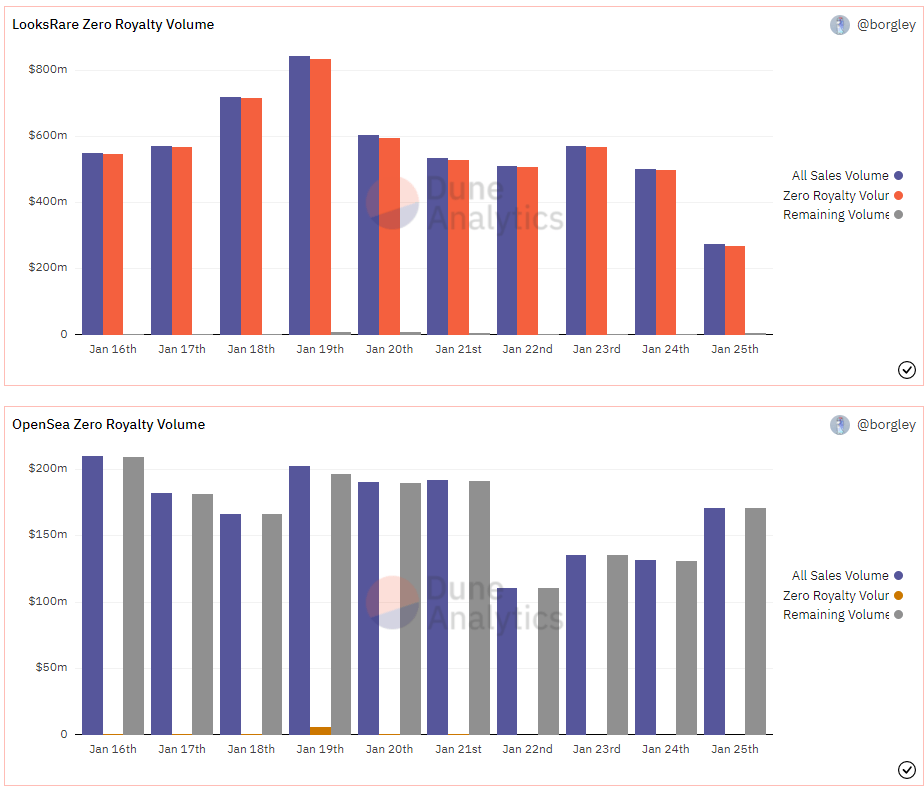

Another indicator that buyers and sellers are washing is Zero Royalty NFT volumes on the platform. Some NFTs on LooksRare are issued verified creators who earn a LOOKS royalty reward from transaction fees generated by secondary sales of their work. With Zero royalty NFTs there is no cut that goes to the original creator.

Almost all of the sales volume on LooksRare is driven by Zero royalty NFTs. This suggests that what is driving the volume on LooksRare is not a demand to exchange quality art but more a way to wash and farm native tokens in the most efficient way possible.

Source: Dune Analytics. User: @borgley

Another element to the rewards flywheel is staking. LOOKS token holders can stake their tokens and be rewarded through both of the following. ETH fees generated on the platform every day are distributed to token holders, and LOOK tokens are distributed on a pro-rata basis set by a predetermined schedule that is similar to how trading fees are allocated.

For wash traders who also stake LOOK tokens, washing also means they earn more staking rewards further implying that there may be some gaming of the LOOKS token rewards system occurring. They are earning ETH and LOOKS from staking on top of the trading fee rewards.

Impressive APY staking rewards being offered to LOOKS stakers

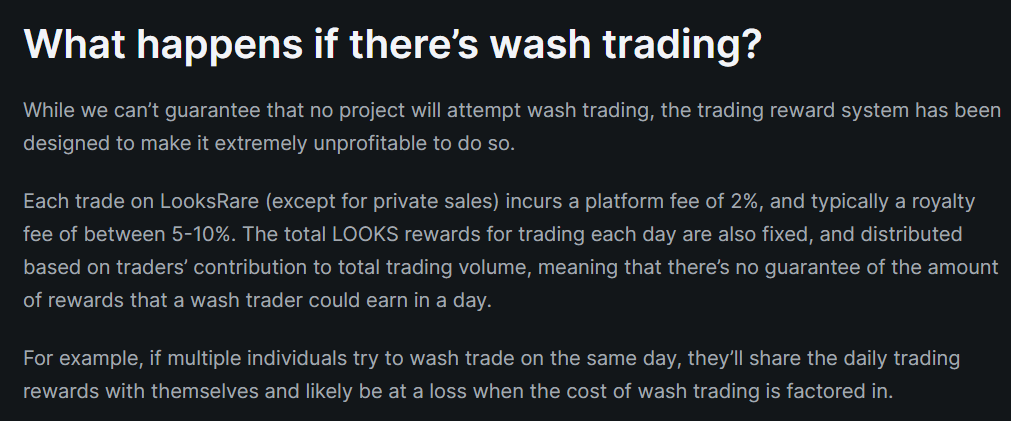

Within its documentation, LooksRare acknowledges that wash trading may occur because of the incentives of its reward trading program. The documentation explains, “While we can’t guarantee that no project will attempt wash trading, the trading reward system has been designed to make it extremely unprofitable to do so.”

It appears, however, that as long as the price of LOOKS keeps rising or maintains a high price then wash trading will be profitable and continue to occur. In a twitter thread user @ElYogui_PA explains the breakeven amounts of trading volume and corresponding LOOKS token prices.

NFT marketplaces and the explosion of a sector

A non-fungible token (NFT) is a type of cryptographic token which represents something unique. Or put another way, non-fungible tokens are not mutually interchangeable by their individual specification in the way that crypto assets such as Monero are. Non-fungible tokens can be used to create verifiable digital scarcity. NFTs are especially useful for any applications that require unique digital items such as digital art, digital-collectibles, and in-game items.

NFT Marketplaces like LooksRare and OpenSea allow users to easily exchange a variety of NFTs. They are one-stop shops to buy art, collectibles, items to be used within blockchain games, and plots of land within VR worlds. A user can buy a Decentraland LAND NFT on LooksRare and it will simultaneously be accessible for use within the Decentraland VR platform.

NFT marketplaces like LooksRare and OpenSea are the rails that have accelerated the rapid ascent of the NFT ecosystem by being hubs that facilitate the free movement of all kinds of NFTs.

A key signal of the growth in popularity is recent Google trends data. Worldwide search interest for the term ‘NFT’ exceeded those for the term ‘Crypto’ for the first time in January 2022.

Source: Google Trends

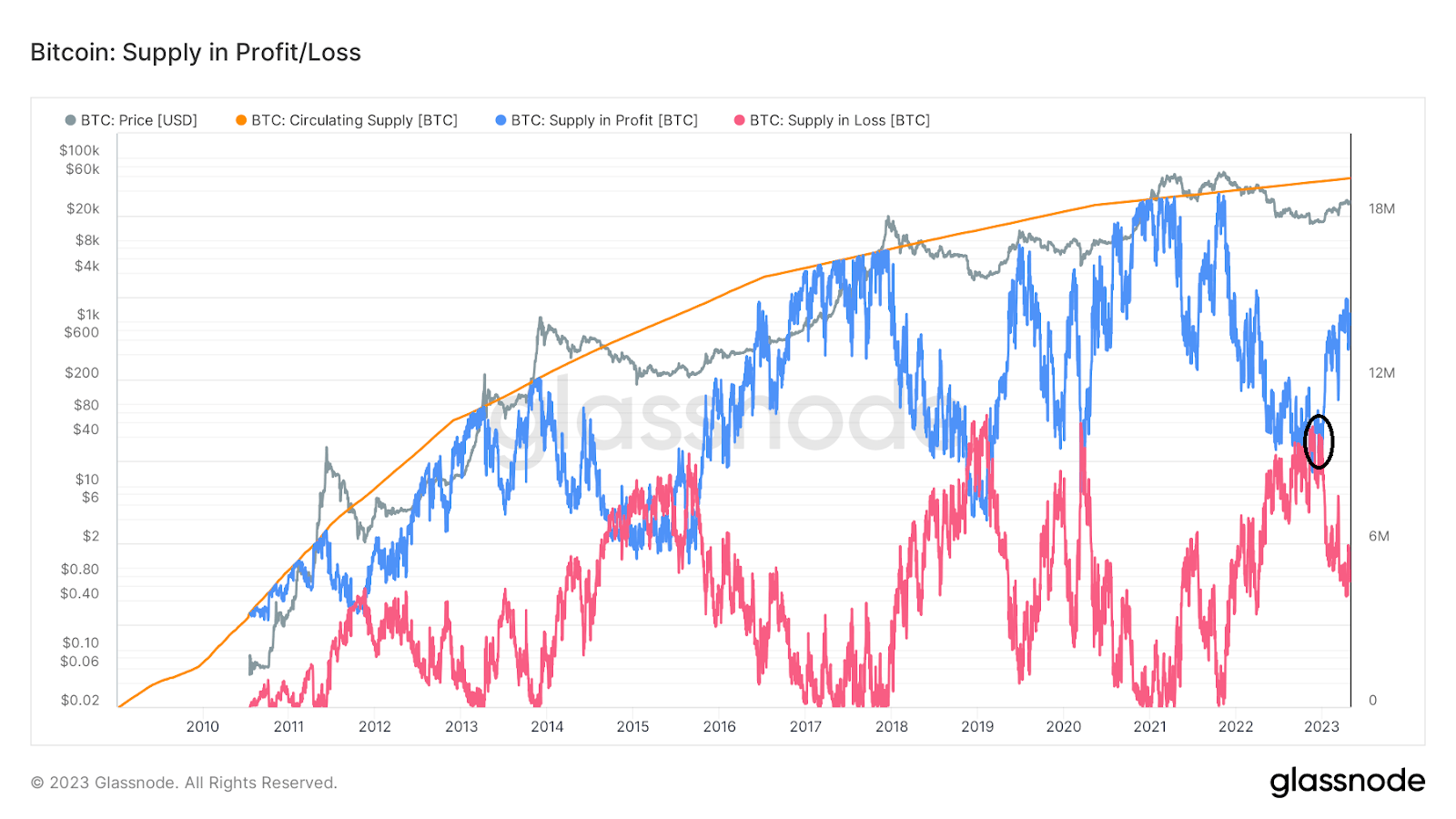

A factor in why NFTs are growing in popularity in comparison to the wider crypto space is their ability to hold value in adverse economic conditions.

So far through late 2021 and early 2022, digital assets like Bitcoin and Ethereum have performed bearishly as negative macro concerns surrounding high inflation and the Omicron variant of COVID19 have spooked investors. Since November 1st 2021, the price of Bitcoin (BTC) has fallen by ~40% while the price of Ethereum (ETH) has fallen by 43%.

Source: Brave New Coin. Bitcoin Liquid Index 90 Day Bitcoin/USD price

Source: Brave New Coin. Ethereum Liquid Index 90 Day Ethereum/USD price

NFTs on the other hand, have managed to stay above water and hold value during this difficult period for crypto markets. Nonfungible.com reports that since the week of November 1st the average sale price of an asset of an NFT has dropped by a more digestible ~17%.

The weekly average Sale price of NFTs. Source: Nonfunigble.com

In general, the price path for NFTs during the ongoing chaotic macroeconomic period has been much smoother than the rest of the crypto space.

Art startup Masterworks, in a blog post, explained some of the unique mechanics that help a sector like the art market hold value during economic downturns. “One explanation for the resilience of the art market is its unique ability to self-regulate supply and demand. When there is relatively high liquidity in the market and the economy is healthy, art changes hands more frequently,” they say.

The blog continues, “In more uncertain times, the owners of expensive artworks, who are among the wealthiest in the world, tend to hold on to their Warhols and Monets until markets become favorable once again.” This mechanism means the supply of expensive art by established artists is constricted and the value of work by established artists remains high.

We observe a similar pattern in the NFT market. Premium NFT artwork has become more expensive with owners of items from blue-chip collections like Cryptopunks and Bored Ape Yacht Club (BAYC) listing high sales prices. Fewer items are being sold but the prices being paid appear to be getting higher.

Blue Chip NFT collections are outperforming ETH in 2022. Source: Delphi Digital

The average US dollar sale price of Bored Apes in the last 3 months. Source: Nonfungible.com

BAYC number of items sold. Sales remain relatively flat and low but the prices of blue-chip NFT assets continue to shoot up. Source: Nonfungible.com

Source: LooksRare

Presently, LooksRare and the LOOKS token may be benefiting from some of the positive tailwinds being generated by the wider NFT space. Since OpenSea, the largest cross NFT marketplace in the world does not have its own token, LOOKS becomes the de facto proxy token that can be used to go long on the success of the NFT sector.

Conclusion

LooksRare is one of the few Crypto success stories of an otherwise bleak 2022 for the space. While other recently airdropped tokens like SOS have performed tepidly, the price of LOOKS has generated momentum and risen in otherwise bearish market conditions. Other investors have watched on with envy as early buyers of the LOOKS token have enjoyed alpha gains in 2022. The LooksRare platform has created a splash in the space by challenging the NFT marketplace dominance of mega-startup Opensea.

Like other DeFi projects, it has copy-pasted and tweaked the model of an incumbent to achieve instant popularity. The elevator pitch for LooksRare is ‘OpenSea with a reward token’. At first glance, its eye watering volume in just a few weeks since launching could be interpreted as the LooksRare business model finding a gap in the market.

On closer inspection, however, it appears that most of the enormous volume is inorganic and driven by washing. The model for LOOKS resembles previously used models in the crypto space like trade mining. To be fair to the platform, it is unsurprising that for such a new exchange, much of the volume is inorganic and its reward model is being gamed. This gaming should level off if new users organically join the platform.

Don’t miss out – Find out more today