Meeting the challenge of finding a ‘fair’ price for Bitcoin

With hundreds of exchanges and thousands of trading pairs, reliable price discovery for Bitcoin and other cryptocurrencies is an ongoing issue for traders. The integration of Brave New Coin’s market data into BNC Pro, however, offers a groundbreaking solution.

Cryptographic assets are inherently different when compared to traditional financial assets due to the uniqueness of their ‘fundamentals.’ Fundamentals are traditionally characterized as the value of an asset based on the income stream that can be earned from it over time. With companies, this income stream is cash flow, from a piece of property it is rent.

Crypto assets like Bitcoin do not provide dividends or rent, and they are not backed by a nation-state with economic outputs the way fiat currencies are. Today, assets like Bitcoin (BTC) and Ethereum (ETH) are primarily valued based on factors such as whether they will become true safe-haven assets, or their underlying blockchain will support global digital payments networks, or if they will be a significant part of the supporting infrastructure for the new internet.

The stakeholders who evaluate these prospects and determine the value of crypto assets are diverse. They include the true believers in the technology, speculators seeking to take advantage of swings in sentiment, and skeptics who think crypto’s future prospects are overvalued.

This price discovery primarily plays out on exchanges – Coinbase and Binance are two of the largest, but there are hundreds of crypto exchanges across the globe. Exchanges either support crypto-to-crypto trading or crypto to another liquid asset (generally a fiat currency).

What’s it worth?

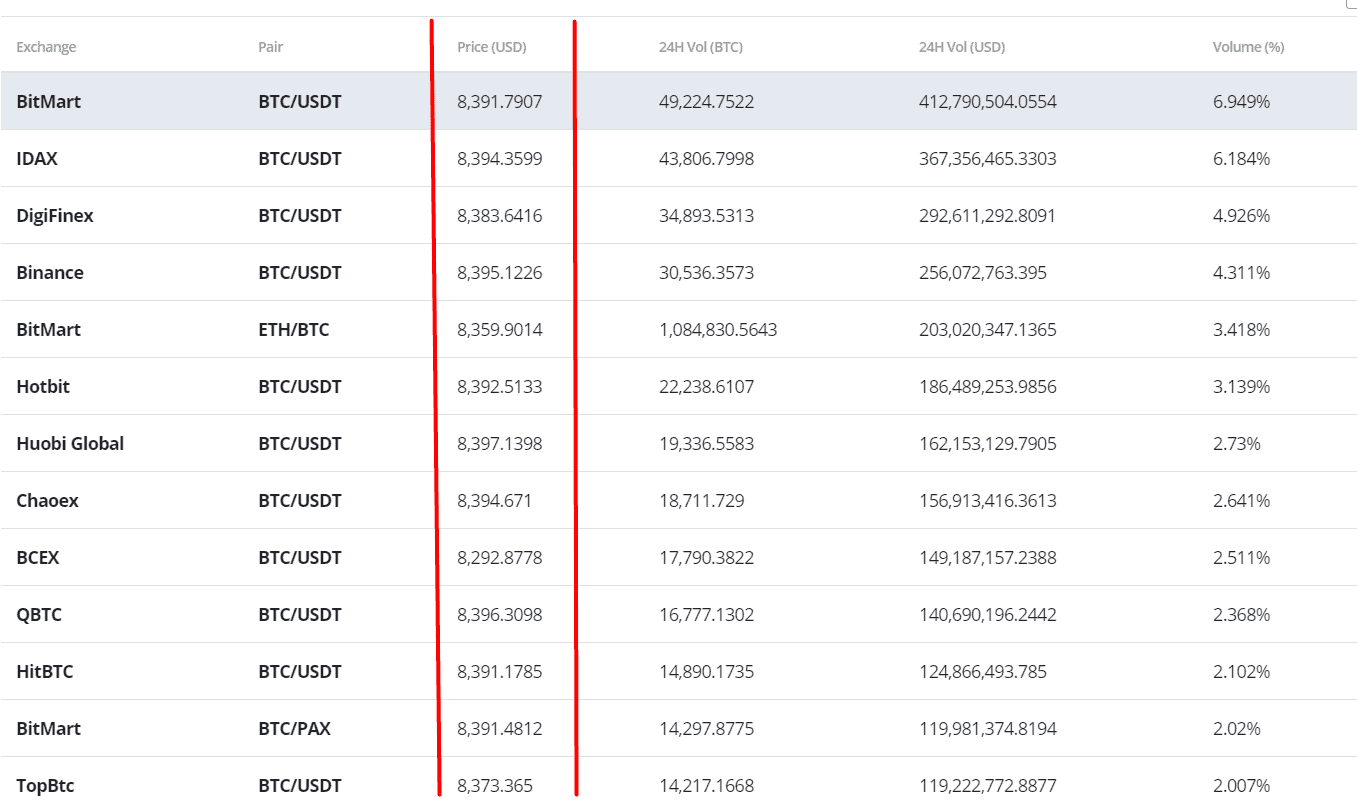

Determining a fair price for Bitcoin or any other digital asset is challenging. Bitcoin is inherently digital and therefore it is easy to set up trading infrastructure for it. Today there are 1000s of unique trading pairs for BTC, tradeable across hundreds of exchanges. In turn, each of these pairs trades across its own set of peers and order books, meaning they all report different prices for the same asset.

With so many different prices reported for BTC it is difficult to determine a single ‘fair’ price. Source: Brave New Coin.com

This problem is exacerbated by the lack of clear ‘fundamental’ indicators associated with the value of digital assets. There is no cash flow equivalent that can be used to help determine what Bitcoin’s true value is, so traders are left looking at prices reported by exchanges to determine what Bitcoin is worth.

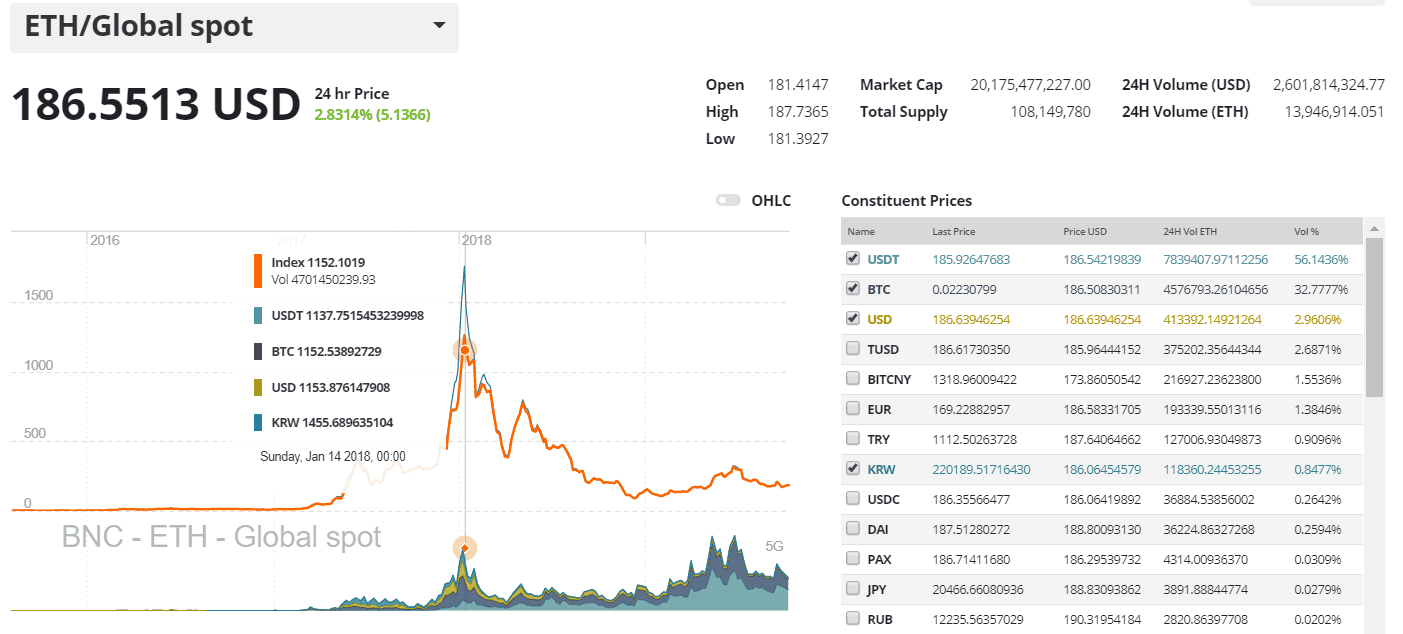

The crypto asset trading space is segmented across the world. For example, exchanges like Liquid and Bitflyer service traders in Japan, Coinbase & Gemini service North America and Upbit and Bithumb service South Korea. Often, these regional differences materialize as extended periods where the price of single assets differs significantly across the segmented regional exchanges – consistently breaking the ‘law of one price’.

An example of a period where the ETH/KRW traded at a significant premium (after standardizing price using US dollar exchange rates) versus other liquid ETH pairs. Source: Brave New Coin.com

Regional differences in prices of singular digital assets occur because:

-

Country specific capital controls prevent the efficient movement of assets between regions. Arbitrage spreads would materialize for shorter time periods if capital was allowed to flow more freely between regions.

-

Regions with poor financial systems or less access to investment products are often more sensitive to periods of price bullishness because they are likely to benefit most from a potential pick-up in adoption. This is why markets associated with regions like Turkey or South Korea often experience significant periods of a price premium compared to markets in North America and Europe.

Additionally, the crypto exchange space is fluid. Major exchanges regularly drop off or emerge, affecting the ‘true’ global price of an individual asset. This means valuation methodologies need to adjust constantly to reflect the changing crypto trading landscape. For an individual investor to filter through the noise of numerous regional prices and determine a singular global price for assets is daunting.

Brave New Coin’s price discovery methodology

A lot goes into determining a singular price for a digital asset. The methodology used by Brave New Coin to consolidate the numerous reported prices for digital assets involves assessing order book depth, historical volumes, and discrepancies, and consolidating bid and ask prices. Qualitative assessments are also made regarding the credibility of certain exchanges or price feeds because of counterparty risks or unusual volume patterns.

In such an environment, BNC Pro’s integration of Brave New Coin’s market price data offers traders and investors reliable pricing information for over 1500 assets and 6000 pairs – curated and filtered for outliers and spurious data, and accessible via a single terminal-like experience.

The integration of BNC market data into BNC Pro delivers reliable pricing information for 1000s of assets and pairs via a single platform

Accuracy and transparency are becoming cornerstone requirements and differentiators for the crypto investment market. With noise from the heavily fragmented crypto market removed, traders and investors can make more rational decisions around fair pricing. Individual user investment returns are also calculated using BNC’s global spot price methodology, meaning investors have a clear picture of their P&L in USD terms.

BNC Pro’s premium features are accessed using the BNC Token.

Don’t miss out – Find out more today