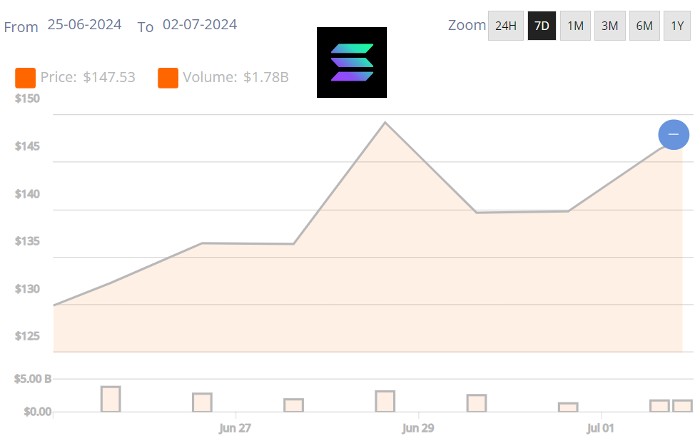

Solana Pumps As VanEck Files for Spot Solana ETF

Solana has experienced a notable price increase of approximately 10% over the past week. This surge followed the announcement that VanEck, a pioneer in Bitcoin exchange-traded funds (ETFs), has filed for a spot Solana ETF with the SEC.

This filing marks a significant development in the cryptocurrency investment landscape, highlighting growing institutional interest in Solana (SOL).

VanEck’s Strategic Solana Move

Solana surges on VanEck ETF announcement. Source: Brave New Coin Market Cap Table

Matthew Sigel, VanEck’s Head of Digital Assets Research, announced on June 28th that the firm had officially submitted the ETF filing. Sigel elaborated on the rationale behind the move, stating, “We think this combination of high throughput, low fees, robust security, and a strong community vibe makes Solana an attractive option for an exchange-traded fund, offering investors exposure to a versatile and innovative open-source ecosystem.” VanEck’s confidence in Solana is evident as they assert that SOL can be viewed as a commodity similar to Bitcoin which has several established spot ETFs in the US and beyond.

The proposed ETF, named the VanEck Solana Trust, aims to track the performance of SOL while excluding operational expenses. It is expected to be listed on the Cboe BZX Exchange and will value its shares daily using the MarketVector Solana Benchmark Rate index. This index is constructed based on prices from top Solana trading markets identified by MarketVector.

Solana’s Unique Position

Solana has garnered attention for its high-speed and low-cost transactions, making it a viable platform for deploying smart contracts and decentralized applications (dApps). Its unique method of ordering transactions, known as Proof of History (PoH), allows for higher throughput compared to other blockchain networks. This technology has positioned Solana as a preferred choice for launching meme coins such as BONK and conducting airdrops efficiently.

The Solana blockchain is powered by its native token, SOL, which facilitates transactions and interactions within the network. The platform’s capability to speedily handle a large volume of transactions has attracted a vibrant community and significant developer interest.

Details from the VanEck Solana SEC Filing

According to the SEC filing by VanEck, the VanEck Solana Trust is designed as a passive investment vehicle that mirrors the price of SOL. The Trust will hold SOL and will not engage in any speculative activities, hedging, or leveraging to mitigate risks. Instead, it will purely reflect the market price movements of SOL, aiming to provide investors with a straightforward method to gain exposure to Solana without the complexities associated with direct ownership or trading on digital asset platforms.

The filing highlights that the Trust is not registered as an investment company under the Investment Company Act of 1940 and is not considered a commodity pool under the Commodity Exchange Act. Consequently, the Trust is not subject to regulation by the Commodity Futures Trading Commission (CFTC).

Operational Framework and Custody

The VanEck Solana Trust will operate without utilizing derivatives, swaps, or futures contracts. This approach minimizes counterparty risks and maintains the Trust’s focus on directly holding SOL. The Trust will also not engage in staking activities, meaning it will forego any potential staking rewards, which could otherwise enhance returns for direct holders of SOL.

The Trust will rely on a regulated third-party custodian for holding its SOL assets, ensuring security and compliance with regulatory standards. By using the MarketVector Solana Benchmark Rate, the Trust will maintain accurate and reliable pricing for its shares, drawing data from a select group of leading Solana trading platforms.

Market Impact and Investor Access

The introduction of a spot Solana ETF by VanEck represents a significant milestone, potentially making SOL more accessible to traditional investors through conventional brokerage accounts. This move is expected to enhance liquidity and stability in the SOL market by providing an institutional-grade investment vehicle.

As they did with Bitcoin, investors will benefit from the ease of accessing Solana through the ETF without dealing with the technical challenges of managing digital wallets or navigating cryptocurrency exchanges. The Trust’s design aligns with the broader trend of integrating digital assets into mainstream financial products, reflecting the increasing maturity and acceptance of blockchain technology in the financial industry.

Conclusion

VanEck’s filing for a spot Solana ETF underscores the growing confidence in Solana’s blockchain capabilities and its potential as a mainstream investment asset. As the ETF progresses through regulatory approvals, it is poised to open new avenues for investors.

Don’t miss out – Find out more today