Blockchain money transfer speeds put legacy systems to shame

A new report by BlockData says blockchain money transfers are 388x faster and 127x cheaper than legacy financial systems – shedding new light on how blockchain-based financial solutions are poised to disrupt the remittance system status quo.

Bitspark vs. Hong Kong

Hong Kong’s bustling population of 7 million only has about 350,000 migrant workers, but on Sundays, it feels like every single one of them has managed to cram into the same 12 square kilometers of the Central district. Their mission is always the same, send money back home to the Philippines or Indonesia in the most affordable and secure way possible.

Deconstructing the invisible Bitcoin remittance solution

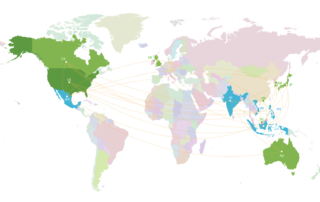

When Bitcoin was created in 2009, its most obvious use was for sending money across the planet, as easily as sending an email. The potential benefits for the 230 million migrants all over the world that send US$430 billion in remittances back home each year could be enormous. But beyond all the rhetoric, the practical implementation has yet to be sorted out.

Bitcoin remittances ‘20 percent’ of South Korea-Philippines corridor

Bitcoin adoption within the international remittance market is starting to show its first real signs of life. According to the founder and CTO of BloomSolutions, Luis Buenaventura, bitcoin powered remittances now account for 20% of the Asian remittance corridor between South Korea and the Philippines. “$35-40M a year is bitcoin, probably more than that,” he told BNC during an interview. According to the world bank, US$215 million passed through the corridor last year.

Bitwage continues expansion into South America

The Bitwage Invoicing service is built on a simple idea, use bitcoin instead of legacy international payments. Using the service, Brazilian contractors and freelancers can now get paid in a range of foreign currencies, and receive Brazilian real into their local bank account.

Western Union won’t make the same mistake with Blockchain

Digital Currency Group is an investment firm founded in March 2015, by prolific Angel Investor Barry Silbert. The company has invested in 72 different companies, more than two-thirds of which operate in the bitcoin space. In the last four months alone, the company acquired the biggest bitcoin news site, CoinDesk, and along with it, the biggest bitcoin conference. The company already had investments in Bitpay, the industries leading payment service provider, as well as coinbase and Kraken, two of the largest platforms for trading bitcoin.

Global remittances slow, while regulation restricts access

In the latest edition of the World Bank’s Migration and Development Brief, released earlier this month, remittance only grew marginally last year. Remittances to developing countries amounted to $431.6 billion in 2015, an increase of 0.4 percent over 2014. Although still growth, the pace is the slowest since the global financial crisis. Global remittances, which include those to high-income countries, contracted by 1.7 percent in 2015, to $581.6 billion.

How Can Cryptocurrency and Blockchain Technology Play a Role in Building Social and Solidarity Finance?

The decentralized digital currency Bitcoinâand its underlying âblockchainâ technologyâhas created much excitement in the technology community, but its potential for building truly empowering social and solidarity-based finance has yet to be tested. This paper provides a primer on the basics of Bitcoin and discusses the existent narratives about the technologyâs potential to facilitate remittances, financial inclusion, cooperative structures and even micro-insurance systems. It also flags up potential points of concern and conflict; such as the tech-from-above âsolutionismâ and conservative libertarian political dynamics of some of the technology start-up community that surrounds Bitcoin. As a way of contrast the paper considers âblockchain 2.0â technologies with more overtly communitarian ideals and their potential for creating âcooperation at scaleâ. It concludes with suggestions for future research.

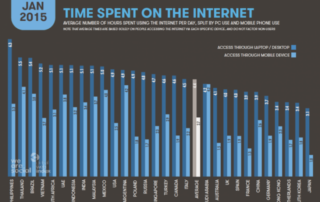

Remittence Prices Worldwide: An analysis of trends in the cost of remittance services

This report uses data from RPW's most recenct release to analyze the global, regional and country specific trends in the average cost of migrant remittance.

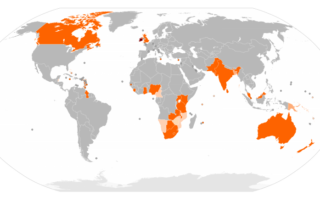

De-Banking Is Spreading: Commonwealth Investigates Using Digital Currencies to Solve Problems

The legacy remittance market is in trouble and the problem is spreading, banks are closing remittance providers' accounts, forcing people to either pay more or turn to underground operators.

ZipZap and Rebit Team Up on the $2 Billion Canada-Philippines Remittance Corridor

A partnership between Philippines-based rebittance solution Rebit and smartphone-based remittance provider ZipZap targets the Canada-Philippines remittance corridor with a quicker, end-to-end, fiat transfer and no fixed fees.

Bitcoin Could Thrive in Puerto Rico and Taiwan as Paypal Restricts Services

PayPal has been pulling out of some specific markets over the past few weeks, citing local law changes. Both Puerto Rico and Taiwan seem promising for the adoption of Bitcoin, although for different reasons.

Abra Raises $12M, Bitcoin Powered Remittance App Available “Soon”

[Abra](http://www.goabra.com) is making cash mobile, enabling anyone to store digital cash, valued in any currency, directly on a phone with no bank required. The company’s “highly oversubscribed” series A round brings the investment total to US$14m.

Ghanan Remittance Startup Beam Drops Bitcoin For Debit And Credit Cards

A Ghanan remittance startup has pivoted to remove digital currency bitcoin from its service and instead offer expat Ghanaians the ability to buy gifts and services for their loved ones back home.

What Makes the Philippines the Ideal Market for Bitcoin

With their unique remittance situation, high smartphone usage and weak banking infrastructure, it's no wonder that the Philippines is a hotbed of Bitcoin activity.

Bitspark Glides Through Innotribe’s Semi-Finals

Innotribe provides early insight on innovations that could disrupt current business models and create new opportunities. Through the Startup Challenge, Innotribe introduces today’s brightest startups, including those utilizing blockchain technology.