Tezos Price Analysis: Blockchain evolves with first self amendment protocol

The Tezos blockchain is unique because it is built with a functional programming language that allows the network governance procedure to be directly baked-in code. This considered, the launch of the network’s self amendment protocol vote in late February is a major step for Tezos, however, Dapp building and adoption of Tezos as a platform solution remains underwhelming.

Tezos (XTZ) is an Ethereum alternative blockchain platform designed to support an ecosystem of smart contract projects and Dapps. While the project was in the headlines a lot in 2018 after legal troubles surrounding the control of funds raised in its 2017 ICO, developers and the token holding community have moved forward since then. The full Tezos mainnet successfully launched in September 2018 and less than two weeks ago the first on-chain vote for triggering a chain self amendment, Athens, was launched.

The price of the native token XTZ is currently around ~US$0.44, and has fallen by ~98% from an all time high of ~US$10.73 achieved in 12/17/2017. It currently ranks 22nd on the Brave New Coin market cap table, but sits outside of top 50 when organized by daily trading volume. One reason for this is because it is not tradeable on a number of major international crypto exchanges including Binance, OKEx and Huobi.

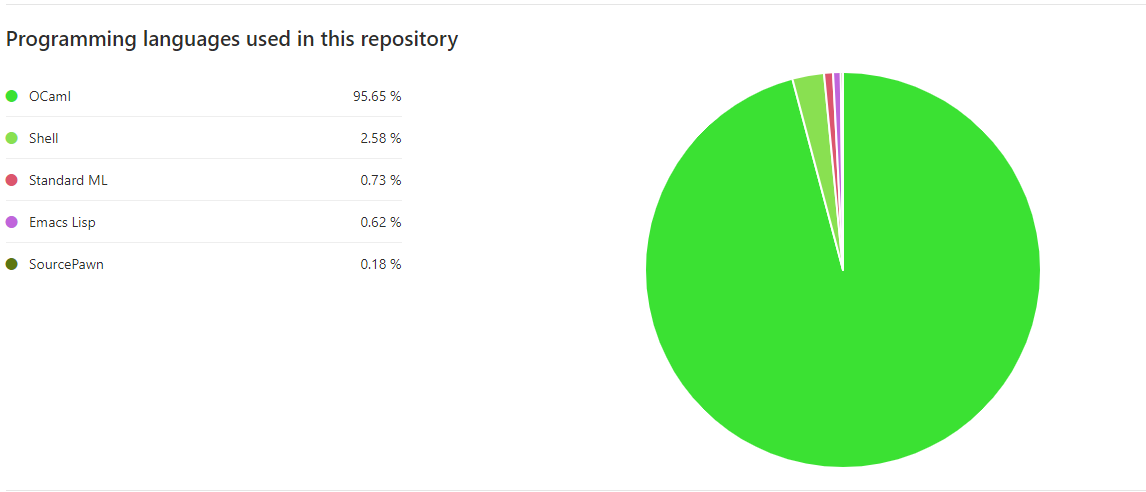

The Tezos blockchain has the unique value proposition of being the first ‘self-amending’ blockchain. Tezos is programmed using the OCaml language, and at a basic level appears very similar to the Ethereum network.

Source: Tezos Gitlab repo, other languages used for testing.

Both offer Turing complete smart contract languages which allow for programmable loops. Ethereum prevents infinite loops using the gas system; while Tezo limits the number of steps a computation can use, however, smart contracts within Tezos can call other smart contracts within the ecosystem, meaning this limit can be extended. XTZ, like ETH, is used for powering computations.

Where Tezos differentiates itself, is given that it is programmed in a functional language, its protocol can be changed directly by stakeholders. What the Tezos blockchain offers in theory, is decentralized governance via an immutable blockchain that directly bakes protocol decision making and updating into the network’s core program, circumventing elements of bureaucracy and internal politics.

Changes are verified within the protocol itself, as opposed to the informal, or governance-by-fork style used by major networks like Ethereum and Bitcoin. Historically it has been acceptable for open source software projects to fork and operate with one set of users using the code in one way and another a different way, if a portion of the community disagrees with the direction of a project.

Because cryptographic network assets directly benefit from network effects (security, immutability), network and user splits have been detrimental to the value of blockchains (existing and post-fork) – as evidence most recently in the Bitcoin Cash debacle.

Tezos aims to always coordinate around one chain, and implement the best possible updates for it as they become available. Implementing changes to the Tezos network is a long process, however, with multi-stage voting that takes around three months to complete.

608 million were distributed and circulated when the Genesis block was issued in June 2018 with the remaining XTZ being released to governance participants at an inflation rate expected to be around 5%. There is no limit on supply simply the non-dilutionary inflation.

This is a another unique characteristic of the Tezos model: staking your tokens to become a delegate, or delegating your tokens to a delegate, means your XTZ holdings grow with inflation at a ~5% rate, otherwise they become diluted.

Not staking doesn’t mean losing your tokens, or missing out on profits because of external market driven price movements, but it does mean losing out on these passive returns. This means an incentive is created for all holders to participate in network decision making. Presently 78% of Tezos tokens are assigned for staking (Source: Tzscan.io).

‘Participation’ comes in a number of different forms on the Tezos network. Delegates are Tezos accounts assigned the responsibility of managing a node and handling protocol amendments, software updates & patches.

They pay a bond as security, and need to own at least 10,000 XTZ to become a delegate or baker (making Tezos a PoS network). They also charge network users for their services as network amenders and block producers.

If a user cannot afford the bond, or are not technically inclined, they can delegate their XTZ to a delegation service, a network operation in itself, and still receive the inflation benefit. The users retain the right to their tokens during delegation, and value is added to a delegates pool.

Protocol amendments are adopted over election cycles every 131,072 blocks, or approximately every three months. If 80% of the delegate quorum votes to approve the proposal, it is implemented into the code of the network.

Delegates need to become bakers first, bakers are the network’s block producers, and are randomly assigned to the Tezos network to mine on it and verify transactions. A group of 32 randomly selected nodes become endorsers, and vote on the validity of blocks. Bakers provide a bond, like delegates, which is lost if they attempt any malicious activity (i.e.publishing empty blocks).

Block rewards are dependent on inflation rate, which relies on the number of tokens staked, while Endorsers receive two XTZ per block they endorse.

Visible backers of the Tezos solution include the Winklevoss twins (who include it as one of only four digital assets included in their investment portfolio along with Bitcoin, Ethereum and Zcash) and Meltem Demirors of Coinshares. Tezos founders, Arthur and Kathleen Breitman can also be considered influencers in the space, often having featured speaking positions at crypto conferences.

Recent developments

The current implementation of the Tezos voting protocol is straightforward and designed to maximize participation. The first case of a self amending protocol capability of Tezos may soon be launched with the beginning of vote-taking for the Athens network update on February 28th.

There are two competing proposals built into Athens. The first, increases the Gas limit on the network, which would likely result in more transactions and complexity in each block but this leads to greater CPU usage requirements for nodes. The update will likely increase the fees earned but also paves the way for more complex Dapps to be built on Tezos.

The second proposal is to reduce the current roll size (amount required to bake) from 10,000 XTZ to 8,000 XTZ. A significant implication is that this would reduce the minimum investment required to participate directly in network consensus and should push for more holders to solo-bake as opposed to delegating tokens to a representative baker and pass over fiduciary responsibility. The protocol update would seek to extend network participation to more users and make onchain governance more representative of the entire Tezos ecosystem.

There is an active discussion platform on Kialo debating the protocols and helping users make informed decisions on the updates, as well as resources on Medium and the Nomadic labs blog that break down the self-amendment process in detail. Whichever proposal receives greater backing moves forward to another round of voting

As per current voting statistics, with over 50% of votes already filled in ~70% of voters have approved the protocol updates to decrease roll size.

The current progress of the first self-amendment vote is exciting for many in the XTZ community because it is a tangible example of onchain governance in action, and can be considered the next big step for the Tezos network following the release of its mainnet last September.

Whether or not the protocol updates, if implemented, do actually make the network function more efficiently or create wider representation by encouraging more self-baking possibly matters less for XTZ value than if the voting process shows that a democracy-by-code philosophy can function smoothly within a blockchain token network.

For this reason the ongoing Athens proposal is strong bullish fundamental short/medium run flag. The price of XTZ has risen ~10% since the self amendment proposal was implemented into the blockchain.

Other recent network news that has driven value into XTZ outside of the Athens upgrade include: News earlier in the month that Elevated Returns would be launching $1 billion dollars worth of property STO’s on the Securitize platform and leveraging the Tezos blockchain, and Coinbase hiring developer and Tezos staking model architect Luke Youngblood, perceived as an institutional endorsement of the Tezos staking solution.

Network activity

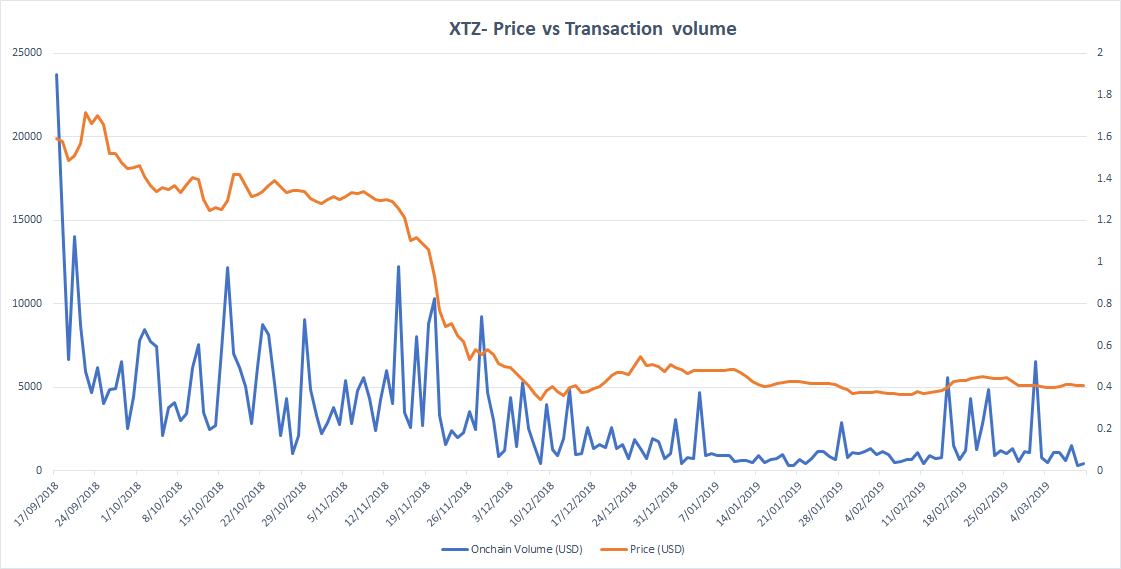

Because the Tezos mainnet was only launched in September 2018, data is limited and traditional predictive fundamental metrics like NVT signal and PMR are difficult to use, however, network usage metrics do give indications of short term fundamental momentum within the Tezos blockchain.

Data Source: Tzscan.io, market data: Brave New Coin

In US dollar terms, the onchain transaction volume of XTZ has fallen sharply along with price since the Tezos mainnet launched in September. While there have been some instances where short term price has jumped along with a rise in transaction volume, this relationship appears to be tenuous and inconsistent.

Tezos has not yet gained traction with the wider blockchain Dapp and smart contract developer and user community. Platform blockchains like Ethereum, EOS and Tron have a far deeper base of projects and network usage at this stage.

This post on reddit reflects the frustration of the XTZ token holding community about the lack of early adoption of the Tezos blockchain as a platform to build projects on. Potential factors behind this lagging adoption include a small user based skilled in OCaml programming, and doubt surrounding the security of a Proof-of-Stake blockchain.

The first functional smart contract on Tezos, an automated insurance solution, was only released two weeks ago. XTZ will hope that releases like this and the Elevated Returns STO deal drive momentum for tangible token use. A list of ongoing Tezos projects can be found here.

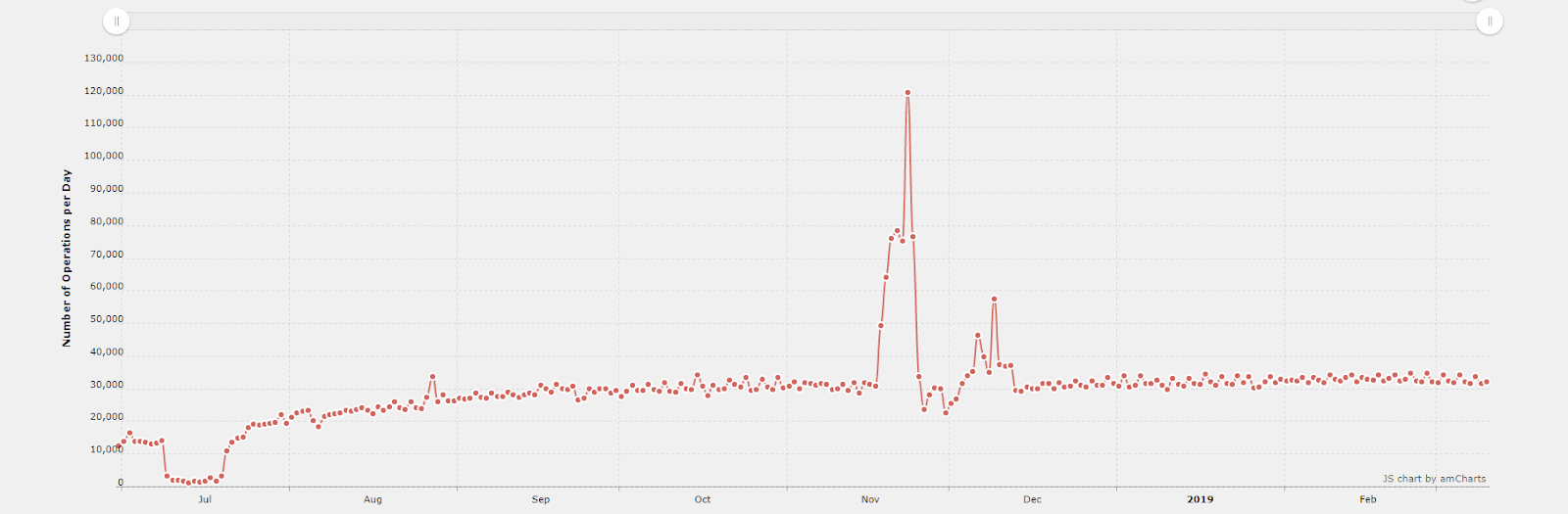

Source: Tzscan.io

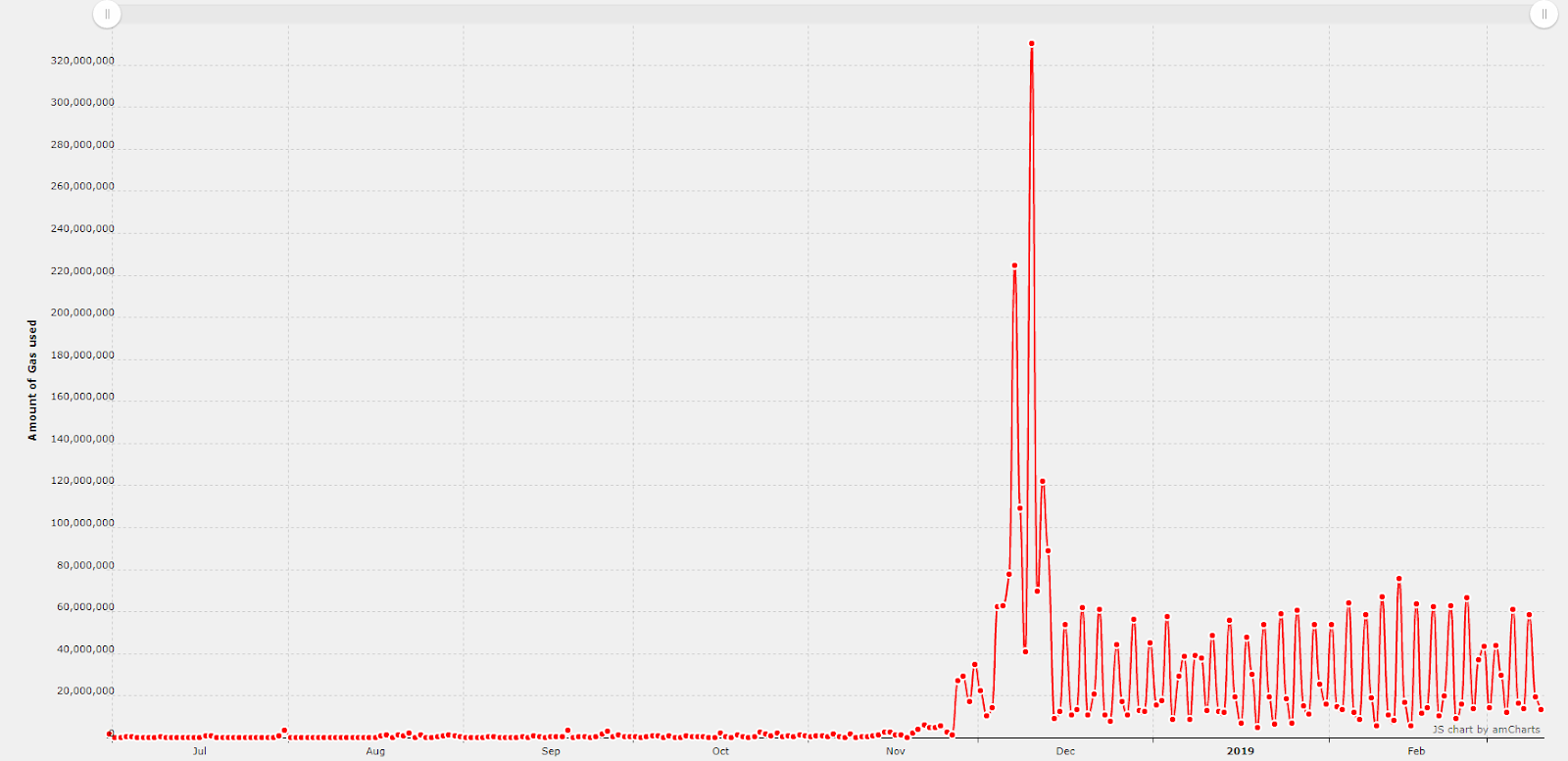

Source: Tzscan.io

While onchain volume for the Tezos blockchain has fallen sharply in dollar terms since the mainnet was launched in September, there has been some growth in network activity in terms of operations per day and daily gas amounts.

Developer activity

Most coins use Github as their open development platform, however, Tezos uses the direct alternative Gitlab. Gitlab lets projects assign roles with specific authentication levels, whereas in Github permission is set at read or write.

Using Gitlab may be logical for Tezos because code development for the project is led by a single research and development team, Nomadic Labs, based in Paris. The team has 30 permanent staff all focused on the research and development of Tezos with a number of the team leaders coming from OCamlPro – the leading OCaml development shop in the world.

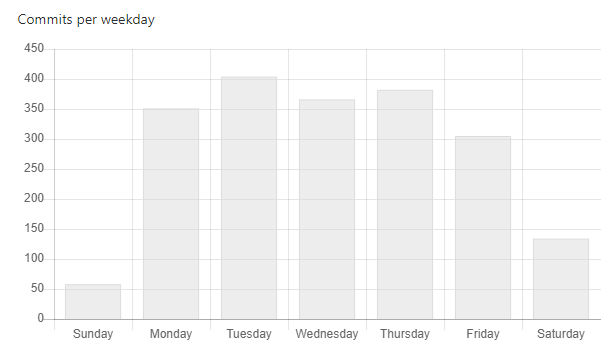

Files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

The main Tezos repo has implemented 2,000 commits between November 20th and March 2nd, with an average of 4.2 commits per day across 70 authors. Interestingly, developer activity on weekdays far exceeds activity on weekends, implying that Tezos development is very much a full-time job for some.

Source: Tezos Gitlab

Social activity

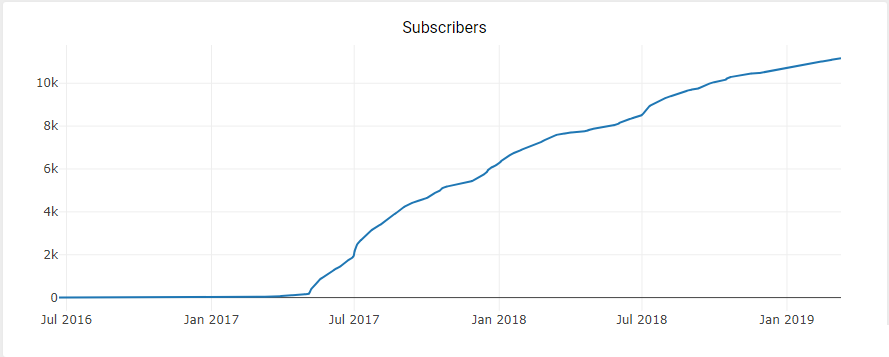

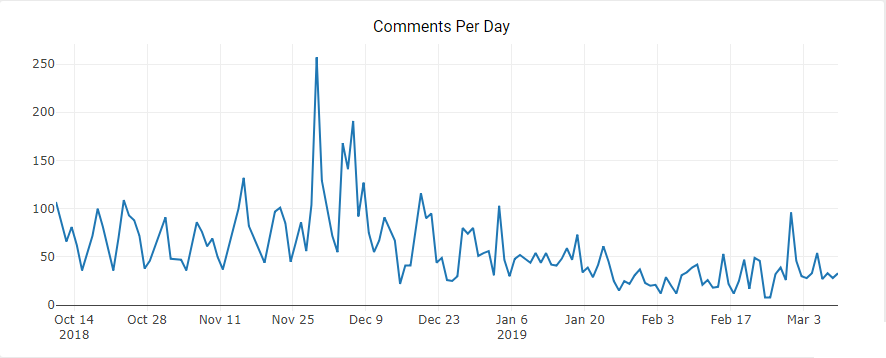

The main Tezos Reddit community is /r/Tezos, which currently has ~11,100 subscribers and is ranked as the 8208th most popular subreddit. The most popular posts include an ‘Ask Me Anything’ from community developer Stephen Andrews and an announcement of the XTZ Kraken exchange listing. Popular keywords include ‘Baking’, ‘Governance’ and ‘Gitlab’.

Unlike some crypto communities /r/Tezos has shown steady growth in subscribers since late 2018 and through 2019. The recent mainnet launch & protocol updates, and late year listings (October 2018) on major exchanges like Kraken may have been contributors to this sustained growth in community activity.

Comments per day on the subreddit, however, are down slightly since the start of the year. This suggests that many new users may be observers of Tezos discussions and not yet ready to contribute.

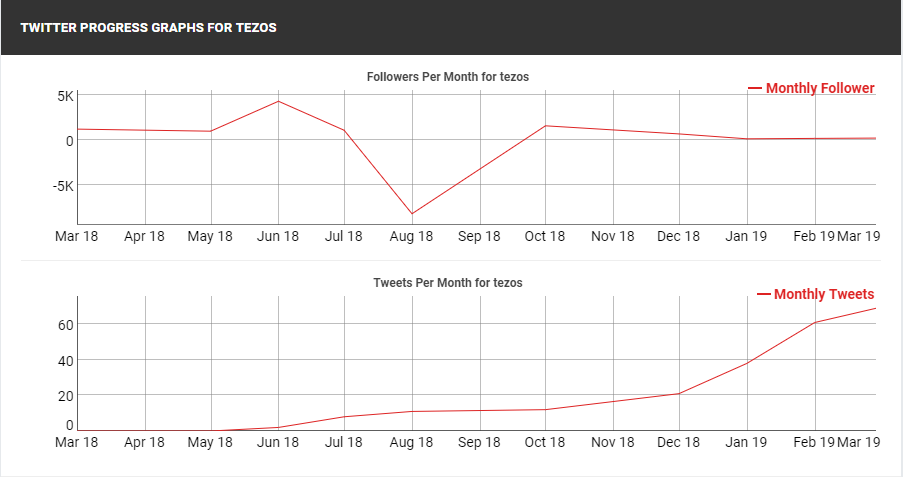

Turning to Twitter, the @tezos Twitter account currently has ~39,000 followers and is ranked as the 162,333rd largest account on Twitter.

Since March 2018, the number of @tezos followers has stagnated and during an extended period between July and October the account was actually losing followers on most days.

Despite the tepid follower metrics, the number of tweets coming from the account has grown considerably over the last year. This suggests more news and network updates have been available and is positive fundamental sign of activity within the project.

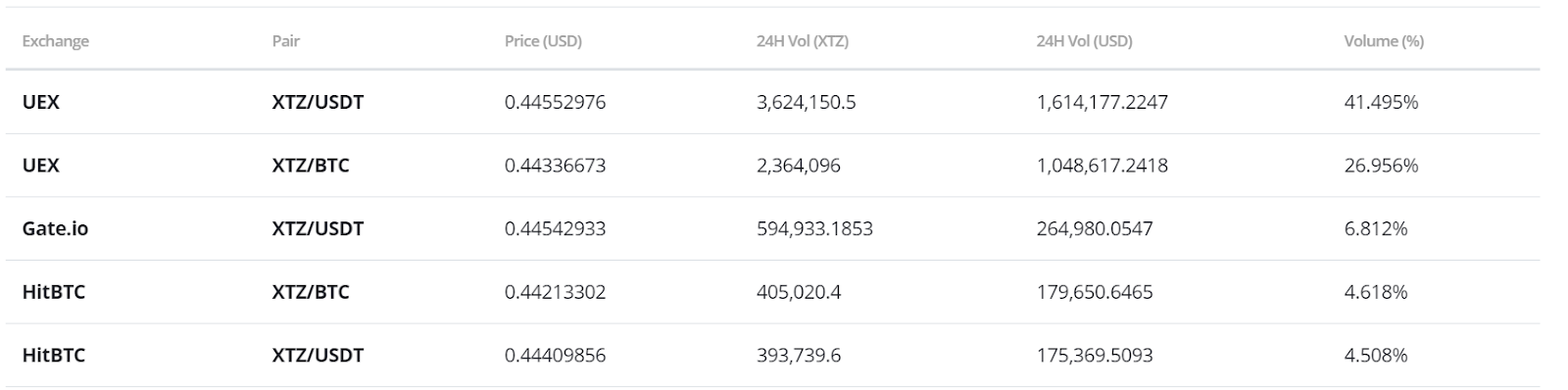

XTZ Trading pairs and exchanges

Source: Bravenewcoin.com

The most popular trading option for XTZ is the USDT, handling over 50% of daily trading volume. The second most popular market is the XTZ/BTC pair and together the top two pairs make up over 90% of daily trading volume. Fiat transactions with XTZ are offered in multiple options, with USD, Korean Won and Euro trading pairs available. The USD value of daily volume of the entire XTZ market is ~3.9 million.

Source: Bravenewcoin.com

The most active platform for XTZ trading is the Singapore based UEX exchange, which also offers crypto borrowing and lending services. Historically relevant and popular exchanges Kraken and Bitfinex also offer XTZ trading options.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart, XTZ has been contained within a negative linear price trend with a Pearson’s R correlation between time and price of ~$0.88 since 2018 (not shown). However, on the 4 hour chart, a golden cross (circle) occured on March 11, with price currently above both EMAs near ~$0.46.

On the 4H chart, the 15 period TRIX and volume flow indicator (VFI) are both gaining momentum with TRIX climbing above 29, and VFI looking to breach above 0.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals is mixed; price is in the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is below the Cloud and above price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

On March 9th, price attempted to complete a Kumo breakout, but failed to break above the Cloud (circle). XTZ’s short term momentum, seen above, may allow price to re-attempt a breakout. However, the current RSI is nearing overbought territory (arrow), which reduces the likelihood that any Kumo breakout will hold. If price does complete a breakout, it will need to hold above $0.48, with price targets of $0.52 and $0.56, while support levels are $0.43 and $0.40.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is bearish; price is in the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and above price.

The slower settings present a far less optimistic outlook for a price breakout given the large resistance ahead. In the unlikely event of a Kumo breakout, price would need to break above $1.01 with price targets of $1.20 and $1.35.

However, if the golden cross and Kumo breakout on the 4H chart can hold, price may have enough momentum to re-test $0.52, prior failed resistance, which is ~13% higher than its current price, before succumbing to overbought reversion.

Conclusions

The price of the XTZ token has performed strongly over the last few weeks, backed by a key fundamental update and favourable market conditions – with a number of other altcoins also enjoying strong gains.

The launch of the network’s first within blockchain self amendment protocol on February 28th is a key step for the network as the first tangible example of the core Tezos value proposition; formalized, baked-in, fork-avoidant governance.

In the medium term, more adoption of Tezos as a blockchain to build Dapps and smart contracts will likely be needed to push price towards previous historical highs.

The technicals for XTZ show near-term momentum and longer-term bearishness. Both, the prudent short term trader (10/30/60/30) and longer term trader (20/60/120/30), on the 1D chart, will await a positive TK cross and Kumo breakout above $0.48 and $1.01, respectively, before entering a long position. Both trader’s support levels are $0.43 and $0.40.

Don’t miss out – Find out more today