Tezos Price Analysis: Blockchain project grows in 2019

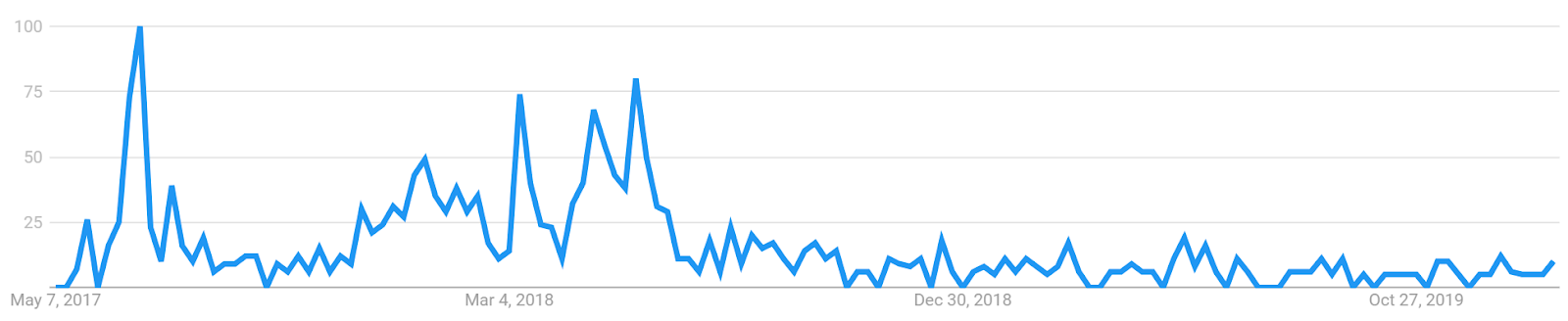

The XTZ token has been one of the best performing altcoins in Q2 2019, driven by strong fundamental indicators such as the soon to be completed first community-backed formalized protocol amendment, and inclusion at Coinbase Custody. The Tezos blockchain, however, remains an immature project, and is rarely used as a platform blockchain.

Tezos (XTZ) is a blockchain platform designed to support an ecosystem of smart contracts and decentralized applications. The Tezos mainnet successfully launched in September 2018. The network’s first self-amendment protocol, Athens, is due to launch in June.

The project generated negative headlines in 2018 following a legal battle for control of the funds raised in its 2017 ICO. After a protracted and distracting legal stoush, the matter was successfully resolved. Developers and the token holding community have since moved on and the optimism that characterized the project’s early days has returned.

The price of XTZ token is ~$1.63 as per Brave New Coin’s global spot prices and currently occupies the 16th position on the market cap table. The price of XTZ has risen ~20% in the last 7 days and ~22% in the last month. In July 2017, the XTZ ICO raised a sizable USD $232 million. The token’s price is up over 200% from the initial ICO price.

The Tezos blockchain has the unique value proposition of being the first ‘self-amending’ blockchain. Tezos is programmed using the OCaml language. The Tezos ecosystem is similar to the Ethereum network in that both are designed to support smart contracts and decentralized applications. The two projects offer Turing complete smart contract languages that allow for programmable loops. Where Ethereum uses the Solidity programming language, Tezos uses Michelson. XTZ, like ETH, is used for powering computations.

A major point of difference between Tezos and Ethereum is the external contract calling convention in Michelson that disallows reentrancy. A major danger with Ethereum external call functions is that mistakes in their coding provide opportunities for malicious actors to enter them and make changes. Reentrancy attacks were behind the Ethereum DAO hack and the possibility of reentrancy attacks within an EIP (Ethereum improvement proposal) delayed Ethereum’s Constantinople hard fork in January 2019.

Tezos is programmed using a functional language. Its protocol can be changed to reflect the decision making of stakeholders. Voting protocols are directly written into the Tezos code with voting operations like token staking reflected as network operations.

The Tezos project’s ultimate goal is decentralized governance. This is achieved via an immutable blockchain that directly bakes protocol decision making into the network’s core program, circumventing bureaucracy and internal politics. Self-amendment protocols occur in intervals. Each round of community discussions (to decide whether or not to restructure the Tezos ledger) takes three months to execute if successfully passed.

Changes are verified within the protocol itself, as opposed to the informal, governance-by-fork style used by networks such as Ethereum and Bitcoin. Historically, if a community is irreparably split over the direction of an open-source blockchain project, it has been accepted practice to fork the project as a last resort.

Because blockchain-based crypto assets benefit from network effects (security, immutability, number of users), network and user splits due to hard forks have been detrimental to the value of these (existing and post-fork) projects. The Bitcoin Cash, Bitcoin SV, and Ethereum Classic forks are examples of this.

Instead of forking, Tezos aims to always coordinate discussions around the one chain, implementing the highest quality updates for it as they become available. Making changes to the Tezos network is implemented via a multi-stage voting process that takes three months to complete.

608 million XTZ were distributed when the Genesis block was issued in June 2018. The remaining XTZ was released to governance participants at an inflation rate expected to be around 5%. There is no limit on supply, simply non-dilutionary inflation.

Tezos operates using a proof-of-stake model for network transaction activity and governance. A user can stake their tokens to become a delegate or delegate their tokens to a delegate. Their XTZ holdings will grow with inflation at a ~5% rate, otherwise, they become diluted.

If a user elects not to stake, they won’t lose their tokens or miss out on profits because of external market-driven price movements, but they will miss the opportunity to make a passive return. Staking creates an incentive for all holders to participate in network decision making. At present 81% of Tezos tokens are assigned for staking (Source: Tzscan.io).

‘Participation’ comes in a number of different forms on the Tezos network. Delegates are Tezos accounts assigned the responsibility of managing a node and handling protocol amendments, software updates and patches. They pay a bond as security and need to own at least 10,000 XTZ to become a delegate or baker (making Tezos a PoS network). They also charge network users for their services as network amenders and block producers.

If a user cannot afford the bond or is not technically inclined, they can delegate their XTZ to a delegation service, a network operation in itself, and still receive the inflation benefit. The users retain the right to their tokens during delegation, and value is added to a delegates pool. Protocol amendments are adopted over election cycles every 131,072 blocks, or approximately every three months.

Delegates need to become bakers first. Bakers are the network’s block producers and are randomly assigned to the Tezos network to mine on it and verify transactions. A group of 32 randomly selected nodes become endorsers, and vote on the validity of blocks. Bakers provide a bond, like delegates, which is lost if they attempt any malicious activity (i.e.publishing empty blocks).

Block rewards are dependent on the inflation rate, which relies on the number of tokens staked, while Endorsers receive two XTZ per block they endorse.

Backers of the Tezos solution include the Winklevoss twins (who include it as one of only four digital assets included in their investment portfolio along with Bitcoin, Ethereum and Zcash) and Meltem Demirors of Coinshares. Tezos founders, Arthur, and Kathleen Breitman can also be considered influencers in the space, as sought after speakers at crypto conferences.

In late March 2019, major crypto exchange and brokerage Coinbase began offering Tezos baking investment solutions to Coinbase Custody’s institutional clients. Coinbase Custody is designed to provide a trusted partner to manage and store crypto assets on behalf of its clients. The Coinbase Tezos solution has gained interest because it offers offline staking and governance participation.

Proof-of-stake blockchains have powerful investment implications because they offer passive income for completing simple tasks such as voting. Barriers include technical ability and asset storage considerations. Regulated custodians cater to risk-averse institutions seeking exposure to participation focused crypto networks like Tezos, Decred or Augur, without wanting to deal with the storage or participation duties themselves.

At Coinbase Custody, all XTZ funds are stored offline. The Coinbase team executes the network participation actions required to trigger passive income. Coinbase Custody offers staking services as a non-discretionary fiduciary activity to its clients.

Coinbase Custody clients will have the opportunity to participate in governance decisions offline using the MakerDAO Smartproxy model. Both Maker and Tezos offline governance solutions will be offered by Coinbase Custody.

The Coinbase Custody governance portal

Coinbase recently released details on the progress of their network participation on Tezos, on behalf of Coinbase Custody customers. The update indicates that the Coinbase baking setup is working and successfully generating passive income for its clients.

Coinbase says that after fees to fiduciaries, clients will earn about 6.6 percent annually. Crypto staking rewards aggregator, stakingrewards.com, estimates the average yearly return for Tezos at 7.09%. The site also rates Tezos staking ‘complexity’ (maintenance and cost) as ‘easy’, the reward rate (ROI & stability) as ‘good’ and the ‘risk rate’ (market cap & liquidity) as ‘stable’.

https://twitter.com/brian_armstrong/status/1130508625502441473

The Coinbase Custody XTZ release has boosted the speculative trading and token value of Tezos and XTZ. It opens the door for a wider group of potential institutional stakeholders to join the network with sizable XTZ investments. It the product garners popularity it could generate significant investment into the network and extend and enhance the prospects of Tezos. Since Coinbase announced its Tezos offline staking solution for institutional investors the price of XTZ has risen ~108%.

Tezos staking solutions are also offered by the Binance backed Trust Wallet. XTZ is not yet available for trading on the Binance exchange.

Tezos’s strong recent growth has coincided with the beginning of the network’s self-amendment procedure Athens A. The process for the potential implementation was first proposed on February 28. Following this, Athens has passed the exploration and testing phases and is now close to passing the final stage, promotion.

During the initial ‘Exploration’ phase, bakers cast a ballot of ‘yay’, ‘nay’, or ‘pass’. For the vote to succeed and move to ‘Testing’, a quorum requirement (minimum number of bakers participating in consensus) must be met. At least 80% of the total ballots possible must be cast. If 80% participated by casting a ballot, then of those that did cast yay or nay, the yay must have at least 80% supermajority.

During the testing period, there is no voting. Following testing the protocol moves to the final ‘Promotion’ period which once again follows a similar voting process to ‘Exploration’, with bakers again casting yay/nay/pass ballots with the same quorum and supermajority requirements. If this succeeds, at the end of the promotion period, the Tezos nodes switch over to the new protocol code that was provided in the proposal.

At this stage, it appears that Athens will successfully move through the promotion period and the protocol changes will be implemented. With about 9 days left, Athens is close to hitting the quorum requirement with 77.28% of the required 81.39% already met. Of those who already voted, there is currently a clear ‘yes’ supermajority that is past the 80% threshold, currently sitting at 99.87% with 26,656 ‘yay’ votes to ‘35’ nay votes.

Source: Tzscan.io

As per testing by the core Tezos blockchain development team, Nomadic labs, there will be a one-time increase in disk space when the switch from the old chain to Athens, they have also concluded that affects on network performance would be inconsequential.

There are two proposals built into Athens. The first increases the Gas limit on the network, which would likely result in more transactions and complexity in each block but this leads to greater CPU usage requirements for nodes. The update will likely increase the fees earned but also paves the way for more complex Dapps to be built on Tezos.

The second proposal is to reduce the current roll size (amount required to bake) from 10,000 XTZ to 8,000 XTZ. A significant implication is that this would reduce the minimum investment required to participate directly in network consensus and should push for more holders to solo-bake as opposed to delegating tokens to a representative baker and pass over fiduciary responsibility. The protocol update would seek to extend network participation to more users and make on-chain governance more representative of the entire Tezos ecosystem.

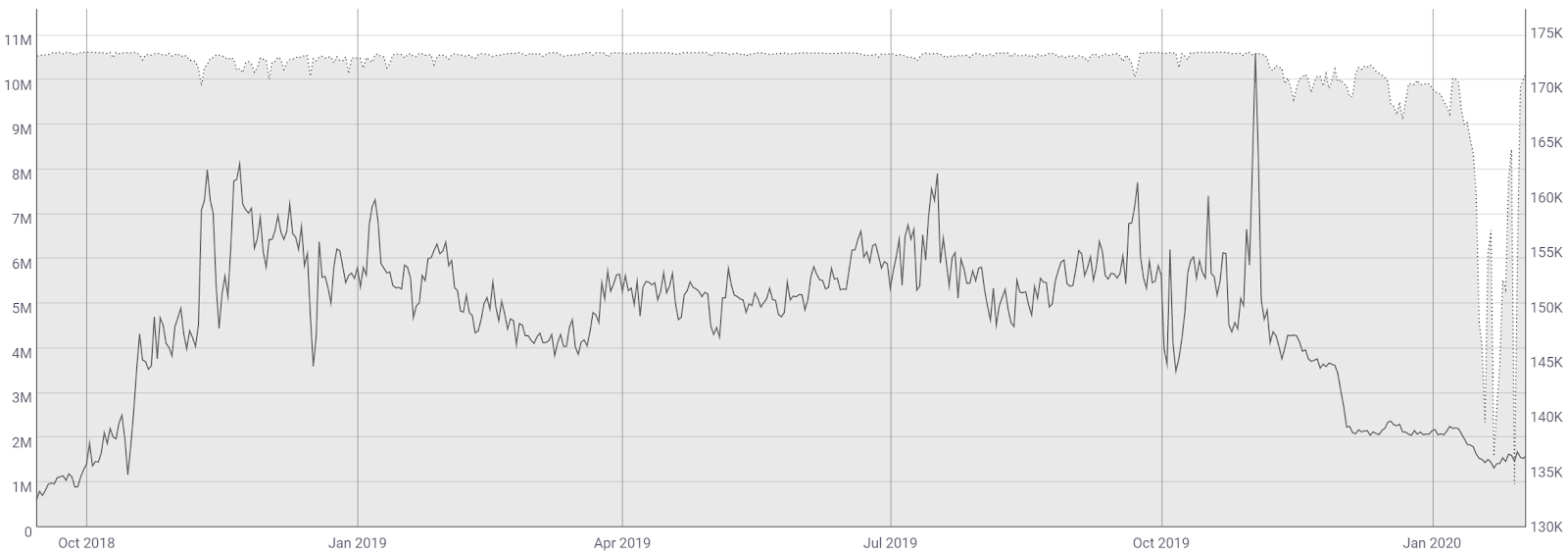

The number of bakers per day operating on Tezos appears to have plateaued in 2019. A cheaper buy-in for self baking may encourage more users to begin baking as opposed to allocating stake to others. Source: Tzscan.io

The current progress of the first self-amendment vote is exciting for many in the XTZ community because it is a tangible example of on-chain, formalized and fork resistance governance in action. It is also indicative of the strong growth in the Tezos network following the release of its mainnet last September.

Whether or not the protocol updates (if implemented) make the network function more efficiently, or create wider representation by encouraging more self-baking, matters less for XTZ value than if the voting process shows that a democracy-by-code philosophy can function smoothly within a blockchain network. It also evidences the efficacy of a governance participation token reward model and may increase the incentives for some to buy into the network.

The ongoing Athens proposal appears to have been a bullish fundamental short/medium driver. The price of XTZ has risen ~300% since the self-amendment proposal process began.

Onchain activity

Source: Stakingrewards.com

Because the Tezos mainnet was only fully launched in September 2018, data is limited and traditional predictive fundamental metrics like NVT signal and PMR are difficult to determine. However, network usage metrics do give indications of short term fundamental momentum within the Tezos blockchain. There are also question marks surrounding the true circulating supply/market cap of Tezos.

Onchain Data source: Tzscan.io

A potential bullish flag is that the on-chain volume of XTZ appears to have hit a bear market bottom in January 2019, rising since then in both XTZ and USD terms. This may suggest growing momentum within the network coinciding with price gains and key ongoing network updates.

Source: Tzscan.io

Similarly, the amount of Gas used by the network appears to be steadily increasing.

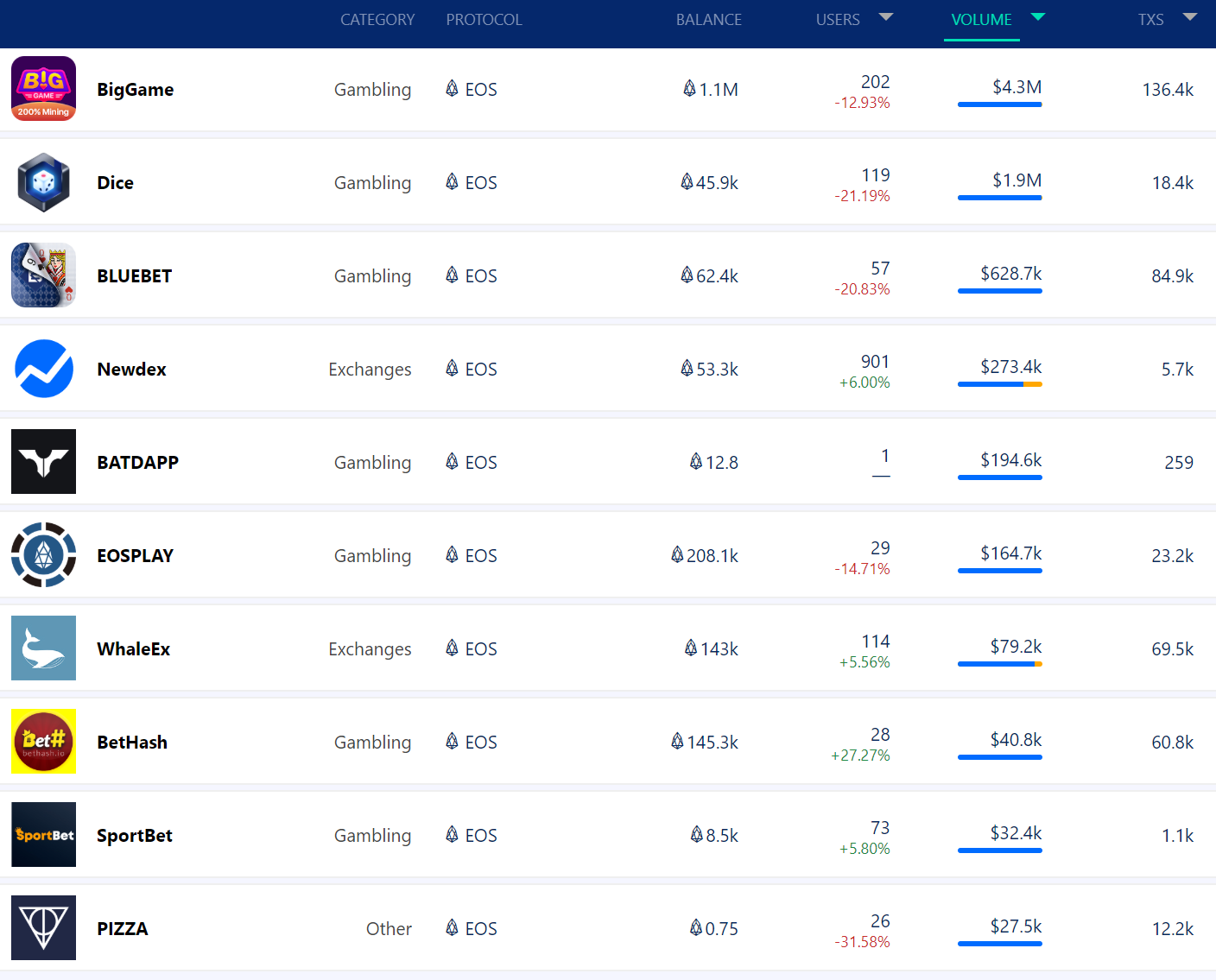

Tezos has not yet gained traction within the wider Dapp and smart contract developer and user communities. Platform blockchains like Ethereum, EOS, and Tron have a deeper base of projects and network usage. This is due to the learning curve for devs building Michelson smart contracts, and doubt surrounding the security of a proof-of-stake blockchain

This reddit post reflects the frustration the XTZ token holding community feels due to the lack of early adoption of the Tezos blockchain as a platform to build on. There is currently a negligible list of Dapps building on top of Tezos. However, there are recent signs that a new wave of Dapps may arrive shortly.

There has been positive news on this front. Aspencoin, a security token that represents partial ownership in the luxury St.Regis resort, announced it will switch from building tokens on Ethereum to Tezos. On May 15th, it was announced that a Bangkok based securities broker had been given the green light to begin issuing tokenized real estate on the Tezos blockchain beginning in the summer of 2019. The team behind financial group Elevated Returns and their compliance partners Securitize have organized both deals.

Developer activity

Most coins use Github as their open development platform, however, Tezos uses the direct alternative Gitlab. Gitlab lets projects assign roles with specific authentication levels, whereas in Github permission is set at read or write.

Using Gitlab may be logical for Tezos because code development for the project is led by a single research and development team, Nomadic Labs, based in Paris. The team has 30 permanent staff all focused on the research and development of Tezos with a number of the team leaders coming from OCamlPro – the leading OCaml development shop in the world.

Files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Between February 8th and May 20th, the master repo for the project has had 2000 commits and averaged 4.3 commits per day.

Source: Tezos Gitlab

Interestingly, developer activity on weekdays far exceeds activity on weekends (and appears to fall off as Friday approaches), implying that Tezos development is very much a full-time job for some.

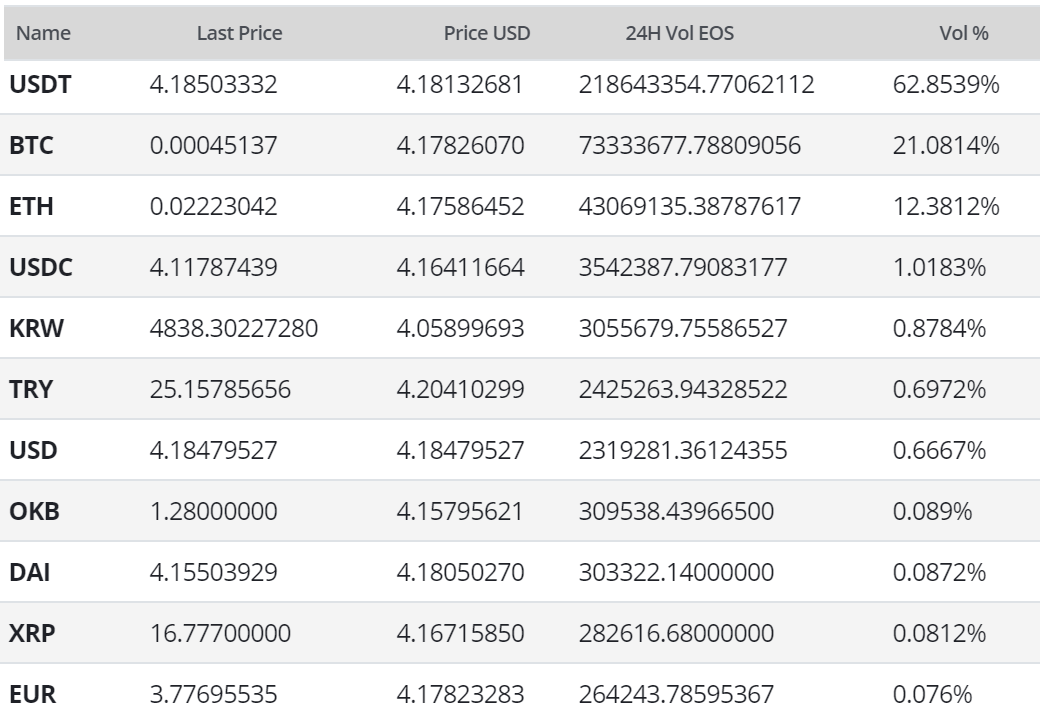

Exchanges and Trading pairs

The most popular trading option for XTZ is BTC with the pair currently handling over 50% of daily trading volumes. The second most popular market is the XTZ/USD fiat market. Together the top two pairs make up close to 60% of the daily trading volume. The USD value of the daily volume of the entire KNC trading market is ~USD 3.9 Million. The XTZ/EURO market is also well used. Other pairs do exist in the form of Korean Won, British pound and Canadian dollar onramps, however, these markets are rarely used and illiquid.

Trading on the Kraken exchange dominates the XTZ trading ecosystem. It operates the top 3 pairs in the marketplace with the XTZ/USD, XTZ/BTC and XTZ/EUR. XTZ is also tradeable on prominent exchanges such as Bitfinex and Poloniex.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart, XTZ has followed a negative linear price trend with a Pearson’s R correlation between time and price of ~0.82 (not shown), which allowed a death cross to persist until late-April 2019. However, since early-February, XTZ has seen a ~322% surge, which has price currently sitting near $1.53, above both 50 and 200 day MA, and with a golden cross.

On the 1D chart, throughout the price surge, XTZ has closely followed Fibonacci retracement levels. Recently, price failed to break above the 1.618 level of $1.84. This failure coupled with stagnating buying volume may result in a brief retest of the 1.0 Fibonacci level near $1.28.

Lastly, on the 1D chart, the volume flow indicator (VFI) is still above 0, but plateauing. An increasing VFI will be needed for both holding current support levels and eventually pushing higher.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are bullish: price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price completed a Kumo breakout in mid-March 2019 and has persisted with a relatively strong linear trend. However, given the recent price weakness and failure to break new highs, a test of Cloud support seems likely in the near term. Further emphasizing this near term outlook, RSI is 68 (overbought territory) and trending downward (arrow). Additionally, Cloud support coincides with Fibonacci support near $1.27, described above.

There are a few positive factors for XTZ, including:

- VFI is still in the bulls’ favor

- Existing Kumo breakout with price above Senkou B support of $1.47.

In the event of a Senkou B support holding, coupled with new buying volume, price targets are $1.68, $1.93 and $2.09. If price continues to drift lower, support levels are $1.42, $1.23, and $1.11.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are bullish: price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and price.

The slower settings yield similar results; including price targets and support levels, with a Kumo breakout intact, but with warning signs flashing.

Conclusion

The price of the XTZ token enjoyed a strong end to Q1 2019 and this has continued through Q2 2019. The gains have been backed by several key fundamental events, such as the Athens update, and Coinbase Custody product suite solution. The Coinbase solution opens the door for institutions to participate in the Tezos ecosystem, while still storing their funds offline, an ideal and clever new development.

Tezos is currently functioning as intended with formalized governance baked into the blockchain and running smoothly. The chain is adapting to reflect the changing views of its stakeholder community.

In the medium term, more adoption of Tezos as a blockchain to build Dapps and smart contracts will likely be needed to push prices towards new highs and legitimize its potential as a platform blockchain competitor to Ethereum. It appears most of XTZ’s current value has been driven by speculative assessments of future utility.

The current technical indicators for XTZ are conflicted with both bulls and bears seeing positive elements. On the 1D chart, both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30) may view the existing Kumo breakout as sufficient for entering a long position. A more conservative trader may wait to see near term support levels (Cloud and Fibonacci) hold before entering a long position. Successful maintenance of the Kumo breakout will yield price targets of $1.68, $1.93 and $2.09. Failure will highlight support levels of $1.42, $1.23, and $1.11.

Don’t miss out – Find out more today