The digital asset review

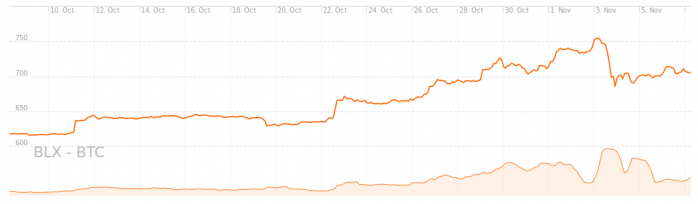

The price of bitcoin surpassed US$750 last week as the Chinese central bank and local regulators proceeded to restrict the trading of wealth management products (WMPs). The crackdown coincided with a steady decline on the Shanghai Stock Exchange, which may have acted as the catalyst for the increasing demand for bitcoin.

The price of bitcoin surpassed US$750 last week as the Chinese central bank and local regulators proceeded to restrict the trading of wealth management products (WMPs). The crackdown coincided with a steady decline on the Shanghai Stock Exchange, which may have acted as the catalyst for the increasing demand for bitcoin.

Citigroup, a major financial institution and the operator of Citibank, estimated that around US$1.9 trillion in assets would be affected by the Chinese central bank’s trial monitoring of WMPs. Due to this unexpected regulation, local investors and traders began to seek alternative assets and stores of value. The announcement from the central bank of China was on the 26th of October, the day before bitcoins surge past $700.

The [BTC/CNY] trading pair currently dominates the market, having lead the charge on rallies over the past few weeks. Bitcoin reached a 5-month high on November 3, breaking the US$753 margin for the first time since mid-June.

However, bitcoin almost immediately plunged in value after some false reporting by mainstream media outlets. Major financial news networks including Zerohedge, which has an audience of 42 million monthly readers, inaccurately described the Chinese government’s stance on bitcoin by stating that Chinese officials were planning to, “Impose capital controls on bitcoin.”

Major [BTC/USD] bitcoin exchange BitFinex compounded things by picking the worst possible time to go down for maintenance, on midnight Nov 3, taking significant US based liquidity out of the market during the price correction.

After the initial decline in value the price of bitcoin recovered, bouncing back to US$713. The BTC/CNY pair is still demonstrating significant dominance in daily trading volume, however the ‘China premium’ has narrowed, and is close to the USD spot price. Many private trading firms have commented that this correction is a good thing, as it times nicely with upcoming news, and may fuel a fresh rally to all time highs later this year.

Apart from the Chinese news, some of the factors that have contributed to what some are calling the beginnings of a ‘Mega Bull Run’ are:

- Successful release of Bitcoin Core 0.13.1

- Increasing adoption of Segregated Witness, a soft fork designed to optimize the bitcoin network and eliminate malleability. According to 21 Inc’s Bitnodes, 21.1% of nodes have already updated to Bitcoin Core 0.13.1

- Controversial launch of ZCash and its turbulent first week, stopping all speculation that it is a ‘bitcoin killer’.

- Decline in the value of the Chinese yuan — has fallen 1.4% against USD since September 30.

In Blockchain news, major corporations including Hewlett-Packard Enterprise (HPE) voiced their opinions on blockchain development. The US$65 billion company stated that decentralization and irrefutability are crucial for blockchain networks and platforms to function properly without facing major security issues.

IMS Health, a US$3.3 billion healthcare company, also expressed their enthusiasm towards blockchain technology. The company’s chief digital officer Richie Etwaru, recently said at the Connected Enterprise conference that the blockchain technology is to the healthcare industry what AOL chat was to the internet.

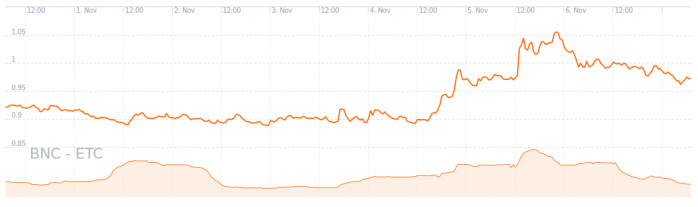

In crypto assets this week the price of Ethereum Classic has increased due to an announcement from the largest Bitcoin exchange, Bitcoin China (BTCC). The exchange is supporting [Ethereum Classic (ETC)] instead of [Ethereum (ETH)]. The announcement was first revealed by the BTCC team and confirmed by its COO Samson Mow. The price of Ethereum-Classic increased by around 8.7% after the announcement, reaching US$1.05.

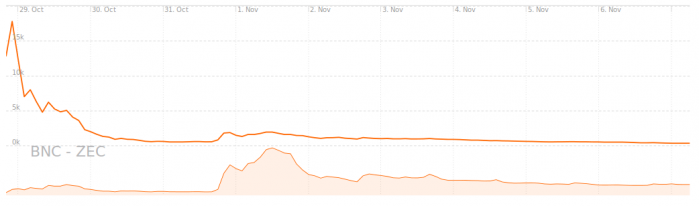

The anonymity and privacy-focused digital currency, [ZCash (ZEC)], developed and deployed by a team of cryptographers led by Zooko Wilcox, had a disappointing week despite its hype and anticipation in the cryptocurrency community.

On the day of the launch, ignoring the first hour of ‘chart painting’ trades where 1 ZEC was traded for 3200 Bitcoin, ZCash was valued at US$1,200 and peaked at US$1,761 the next day. The Money Mechanics of ZEC include ‘a slow start,’ where only 80 units of ZEC were created in the first 24 hours, exponentially increasing to 100’s of thousands after the first week.

Supply and demand force presented themselves as expected with a steady decline as ZEC supply rapidly increases. The community and various bitcoin developers heavily criticized ZCash’s ‘trusted setup,’ which Bitcoin lead developer Greg Maxwell warned users against back in 2013.

“Bitcoin emerged at a surprisingly mature state, the BCN/MRO/FTM stuff isn’t yet anywhere near as mature. But certainly darkcoin is totally uninteresting compared to this stuff. They’re also free of the trusted initialization challenges zerocash has,” said Maxwell.

Miners and developers have also criticized the founders reward concept, which forces miners to pay a 10% levy to the ZCash development team. Commentary from the larger trading pools was supportive of this reward program as it incentivizes development, which in theory should add to ZEC’s value proposition over time.

Some Bitcoin Core contributors including Rhett Creighton have proposed the creation of ZClassic, which is a fork of ZCash without the founder’s reward.

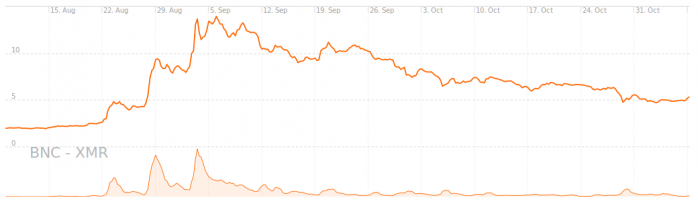

A competing privacy and anonymity-focused cryptocurrency, [Monero (XMR)], was on a downward trend until the launch of ZCash. After the price of ZCash began to decrease, Monero started to recover in value.

Monero price widely fluctuated in October as some major darknet marketplaces removed support for the currency. However, Alphabay and other darknet marketplaces restored support after struggling to deal with various software updates.

The price of Monero has since recovered, and is currently valued at US$4.8, demonstrating a 23% weekly loss for its investors.

Don’t miss out – Find out more today