The potential of crypto credit markets and how to use them

The infrastructure for decentralized lending and credit markets is falling into place for an alternative credit market that moves countercyclical to the wider economy and could provide an opportunity for hodlers to take advantage of the crypto recession.

Similar to how equity is being tokenized with security tokens, debt is also being issued on the blockchain with tokens representing lenders’ terms and conditions and creating profit opportunities for creditors, debtors, underwriters and arbitrageurs in the market.

Decentralized finance is an exciting new landscape to explore with many new and unfamiliar features and concepts so we will navigate it here from the perspective of a first-time borrower, starting with the core currencies and protocols that enable it to the different lending platforms and their respective dashboards to become familiar with the important metrics within their systems. To save any confusion note there are numerous dashboards for each project built by the community which use slightly different formulas/parameters to arrive at the same metrics, so there is can be some dispartity in values across the dashboards.

WETH, PETH and WBTC

Wrapped ether (WETH) is an ETH token represented on an ERC20 contract backed 1:1 with ETH, created last year. As Ethereum’s native currency ETH was created after ERC20 became the industry standard for smart contracts, ETH isn’t compliant with its own network’s ERC20 standards and so cannot be traded on decentralized exchanges against other ERC20-based altcoins. WETH is ETH converted to ERC20 giving it a lot of the same functionality of other altcoins, and the original ETH is locked away while its WETH equivalent is in circulation but can be unwrapped again by converting it back again through a decentralized platform such as Radar Relay etc.

WETH is a medium-term solution to this compliance paradox while the ETH codebase is being updated to make it compliant with ERC20 standards and other ERC standards.

As mentioned, WETH can be used on decentralized platforms and on Maker DAO it can be pooled with other collateralized ether funds to create PETH (Pooled Ether) that is locked up as collateral to draw the DAI stablecoin. Users can convert their ether to WETH using Radar Relay or 0x Portal before turning it to PETH on Maker DAO.

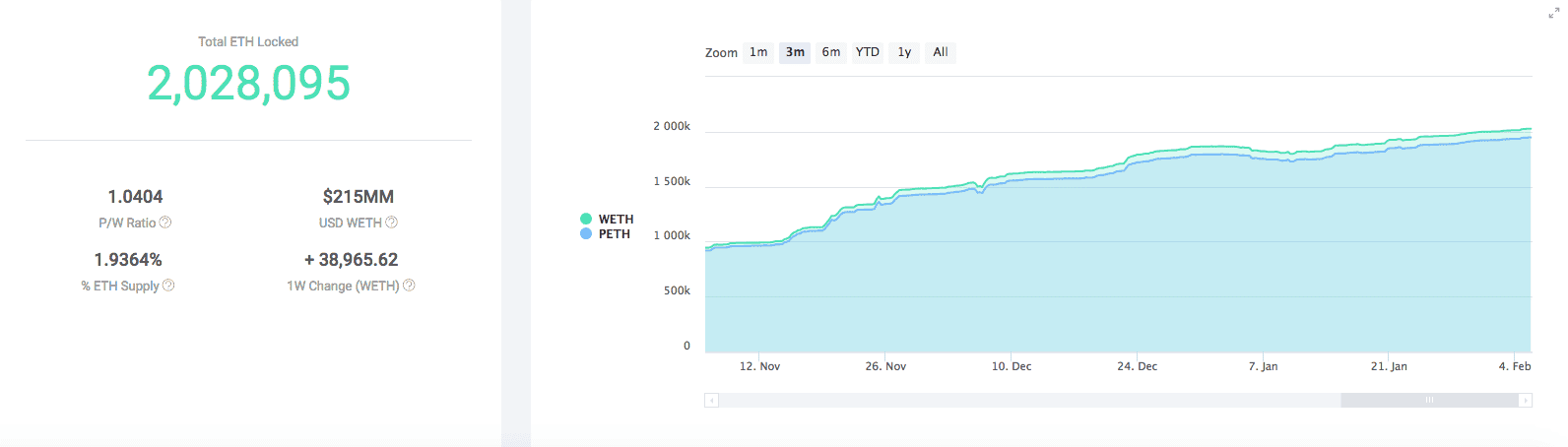

An overview of how much pooled Ether (PETH) is in the Maker system and the ratio of PETH to WETH. With the P/W ratio at 1.0404, PETH is stronger. Source: MKRTools

The PETH/WETH ratio started at 1.000 and PETH is created when CDPs are liquidated; in a liquidation the defaulter is charged an extra 13% penalty fee on top of their collateral and is converted to DAI to cover their debt. When selling the collateral buys more DAI than needed to cover the debt the surplus buys PETH. The PETH to WETH ratio is a barometer for excess liquidations.

Wrapped BTC (WBTC) went live just last week and is essentially the same thing as WETH, a token for bitcoin issued on an ERC20 contract on the Ethereum network. WBTC is issued 1:1 with bitcoin backing it in a decentralized custodian.

The most obvious initial use case for WBTC is bringing bitcoin liquidity to decentralized exchanges which are all on the Ethereum network for trading pairs using bitcoin.

However, WBTC standardizes Bitcoin to the ERC20 format opening BTC up to more merchant payments and integration into DApps. The most promising use case for WBTC is the credit and lending markets such Compound and Dharma; or to create financial derivatives on dYdX or Set Protocol. We we look at these in more detail later.

What are the crypto credit markets?

Infrastructure is fast growing for crypto credit markets. With the introduction of collateralized debt positions (CDPs) Maker’s stablecoin DAI has been a game-changer and the driving force behind the nascent crypto lending markets by allowing users to lock up their ETH in CDPs and being issued with the USD stablecoin DAI. To get DAI, users most post collateral at least 1.5x the value of their debt.

Growth in DAI and the wider crypto-backed stablecoin market has been quite rapid and is indicative of belief in the crypto ecosystem. The decentralized stablecoin is also integral to prediction markets such as Augur and Gnosis for payouts and settlements.

The chart above shows both fiat-backed (USDT, TUSD, PAX, USDC) and crypto-backed USD stablecoins (DAI, BitsUSD, SUSD) have gained much ground in liquidity over the past two years as shown on the logged scale in the chart. Since 2017, fiat-backed have grown over 100x in daily volume, while crypto-backed hit a 1,000x peak at certain points in 2018.

Considering the crypto-backed market is still a fraction the size of the fiat-backed pack, one now dominaties. Maker DAI, which since launching in January 2018 now dominates the exchange volume among the most long-standing decentralized stablecoins, SteemUSD and BitUSD. This is testament to its strong dollar peg but also the new utility it brings to the ecosystem beyond purely trading on centralized exchanges.

While DAI can be acquired on a secondary exchange without the hassle of creating a CDP the main use case for creating a CDP is to get a loan in USD on ether holdings, similar to a home equity loan, and paying back that loan in DAI (crypto USD).

Has Maker started ‘the next big thing’ in crypto?

Dai this week reached a milestone with over 2 million ETH now locked in the Dai credit system, which constitutes over 92% of all Wrapped ETH (WETH) and 1.91% of the entire ETH supply. At the time of writing that represented about $218,000,000 USD worth of ETH backing more than $75,440,000 worth of Dai.

MakerScan is one of several Maker dashboards and shows that the number of CDPs made per month has ramped up since November.

The number of collateralized debt positions (CDPs) in existence has shot up to ~7441 in total from their inception in March last year with the past three months being record months for new CDP creation. Between January and the start of February there were twice as many new CDP created than the next highest month, December-Jan, with 1,866 contracts created.

The fact that January was a record for ‘converting’ ETH to DAI (aka crypto USD) is even more remarkable considering the price of ETH has been on a downtrend throughout the month from a high of ~$165 to ~$106 currently.

Either this is a sign of the bullish conviction ETH holders have in its future price or perhaps it may be traders doubling down to avoid being margin called or liquidated from other positions. The creator of a CDP is inherently long ETH as it is locked away as collateral and the creator must maintain an adequate ratio of ETH to DAI to prevent them from getting "margin called" and their locked up ETH being sent to auction.

The price of ETH (above) has moved in opposition to the amount of CDPs being created (below).

Few CDPs were created in the late bull market in February last year when ETH was ~$1,000 and the majority of contracts have been made at yearly lows in December and January at a price between $100 – $160. As all CDP contracts are paid back in DAI (=1USD), it looks like ETH holders are taking advantage of its current low price to lock in a low repayment rate in the anticipation that their locked up ETH will appreciate in USD terms and their DAI-denominated debt will become cheaper to service and continue to create more credit/debt.

If the ETH price was to go up above ~$200 there is a possibility the Maker credit market could propel ETH prices even higher as people "remortgage" their ETH: As the ‘Collateralization Ratio’ increases, users can generate more DAI and use that DAI to buy yet more ETH to put in a CDP.

This in turn expands the ‘Max Available to Generate’ in DAI and therefore USD.

A CDP is easily created in Maker’s CDP Portal by accessing WETH stored in a Meta Mask hot wallet. Source: Maker CDP Portal

This is a hypothetical situation but judging by the rate that CDP contracts are being topped up and lack of CDP defaults it is already a common strategy. In the above snapshot the price of ETH would have to drop to $74.99 before the contract is liquidated.

Real world use case for crypto lending: Countercyclical lending

Maker claims real-world use case anecdotes of its people using leveraged CDPs to buy cars, repay car loans, repaying mortgages and even buying a coffee cart.

Crypto lending is decentralized and therefore insulated from the wider economic and credit cycles of banks, interest rates and fiat fluctuations. House prices and asset prices in general are positively correlated with credit growth in economies.

What causes recessions is when the credit lending that previously drove economic "growth" dries up, due to banks getting the jitters or, as was the case with the Australian banking sector, being exposed by a government commission for lending malpractice and forced to clean up their act.

A negative feedback loop begins as spenders can no longer get the credit they were used to for buying new cars or upsizing to a new home and the price of their current assets starts to drop, putting them in negative equity. This is a double-edged sword in a recession as most people (the low and middle classes who are the primary spenders) can no longer borrow from banks to buy assets at bargain prices in the trough of a downturn.

In a market recession, crypto lending could be an alternative form of borrowing to buy real-world assets when credit in the real world has dried up, similar to alternative credit systems such as the WIR Bank in Switzerland.

The alternative Swiss credit market using the WIR currency shows it moving countercyclical to the Swiss economy, its velocity, or turnover, expanding as the real economy, GDP, contracts. Source: Research Gate

Turnover of WIR, according to its annual reports, and growth of Swiss imports as a percentage of GDP shows a negative correlation to the strength of the Swiss economy and Swiss currency from 1990 onwards after a severe recession. Swiss GDP and money supply growth is pro-cyclical – increasing as the economy grows and vice versa – and the WIR moves countercyclically, in opposition to economic growth.

This data shows the WIR is most used when ordinary money (CHF) is in short supply during a recession when it’s most needed. The WIR caters to a niche market, the small and medium enterprises in Switzerland, as a alternative source of funding outside of the banking system.

Cryptocurrency cycles, measured by prices, are much shorter than economic cycles and have been driven by endogenous forces outside of the wider economy. Similar to the Swiss WIR cryptocurrencies serve a very niche market within national economies and the original premise is to be an alternative central banks and the wider economy so we would hope to see it continuing to move countercyclically as it has done.

Contract liquidations, acquisitions and arbitrage in Maker and Compound

As much as the redit markets provide great opportunities for debtors to realize some USD value it is a double-edged market as one "person’s debt is another’s asset".

CDP holders should be aware of the risk they carry of being automatically liquidated by the platform itself (Dharma, Maker, Compound) when their contract goes below the recommended minimum 150% collateralization ratio and also that their contracts are being monitored by other users seeking opportunities to take over your contract and assets at a discount, akin to house foreclosure auctions.

To maintain market stability the Maker system provides several arbitrage mechanisms to keep the market in equilibrium. One is to incentivize users to take over risky (below 150% collateral) contracts with a 3% discount on the underlying assets, known in code as a Bite operation.

A quick overview of the contracts with high debt, high collateral and those recently liquidated or bitten on MakerScan. Those contracts in the Risky category have a ETH to DAI ratio below 150%.

Although the monitoring and execution of vulnerable contracts can be done by external agents manually, users can create automated bots known as Keepers developed in Python (Pymaker) that take over contracts, arbitrage the assets on a decentralized exchange or act as a market-maker on multiple exchanges among other functions.

Another stability mechanism is the the stability fee that accrues at 0.5% per annum on all existing debt contracts which it is denominated in DAI but can only be paid in MKR.

On MakerScan contract hunters can view the outstanding risky contracts and the most recent "bites", which is the function used when a third party liquidates a risky contract which can also be viewed on another MakerDai Explorer where traders can also execute the foreclosures.

The metrics for all CDPs which can be filtered to show only those closed, open, unsafe in the tabs. Users can click the actions to the far right. Source: MakerDai Explorer

There are seven actions/functions that can be made on Maker contracts:

- Lock = collateralize WETH

- Free = withdraw collateralized WETH

- Draw = withdraw DAI

- Wipe = pay off DAI debt

- Shut = close your contract

- Give = send CDP to another address

- Bite = close someone else’s undercollateralized contract.

Users can either call a "bite" on a risky contract which gives them the right to buy the assets at a 3% discount, or alternatively anyone can buy the collateral at auction if the CDP is automatically liquidated by the platform. The Maker platform determines automatic liquidations by comparing the Liquidation Ratio with the current collateral-to-debt ratio of the CDP. According to the Maker whitepaper "Each CDP type has its own unique Liquidation Ratio that is controlled by MKR voters and established based on the risk profile of the particular collateral asset of that CDP type."

The frequency at which bites are being executed has accelerated since December 2018 the size of the contracts have been relatively small judging by the size of the circles. Source: MKRtools

The rate of "bites" has been accelerating in the recent months along with the falling price of ETH though the size of those contracts has been smaller than in the early stages when ETH’s prices were higher. So far this week there has been ~$10,000 in CDP collateral liquidated. The increasing frequency of bites would suggest that shopping for "foreclosures" is a strategy growing in popularity during this bear market.

There is a similar arbitrage opportunity for distressed contracts on Compound Finance. Compound Finance is a lending platform that gives users to borrow five different crypto assets at different rates which can be collateralized with not just WETH but BAT, DAI, REP, or ZRX.

The annual borrowing rates for assets on Compound Finance.

For instance, a user can create DAI with a CDP and lend that DAI out in a Compound contract at ~2.4%.

Similar to Maker CDPs, Compound contracts have a 150% minimum collateralization ratio. Those Compound contracts that are in danger of coming within the 150% ratio can be viewed through a Compound Liquidator dashboard and gives users the option to acquire assets at Compound’s 5% liquidation discount which can then be sold through a decentralized exchange or hold them.

This Compound Liquidator dashboard gives users the opportunity to take over contracts or top them up.

Unlike Maker contracts which currently only hold one collateralized asset (WETH) the Compound contracts can be comprised of one of five different assets, WETH, DAI, BAT, ZRX or REP. Users have the option to either liquidate the assets at a 5% discount or to top up the asset on behalf of the borrower to return their account collateralization ratio back to the 150% minimum.

The Curious Giraffe dashboard for Compound shows the vast majority of borrowing is in DAI.

The total amount of borrowing on Compound is over $2.6m across all assets, according to the official website.

DEX leveraged trading: Dharma and dXdY

New platforms for decentralized lending and leveraging of ether and ERC20 tokens (and now Bitcoin with the launch of WBTC) allow users to create margin contracts to use on decentralized exchanges or to directly integrate with their DEX of choice. The inability to leverage trades has been one of the big drawbacks for decentralized exchanges.

The Dharma Protocol is a decentralized lending/borrowing Dapp built on top of Augur that functions in the debt market similar to how the 0x Protocol facilitates decentralized exchanges – it facilitates debt issuance and relays debt contracts to potential creditors and Dharma Debt Orders are analogous to 0x’s Broadcast Order Messages.

Most of the loans that originate on Dharma are for leveraged trading. For going long a user would put a percentage of the tokens they owns into the decentralized at a margin rate agreed by underwriters, who approve and attest to the conditions and creditworthiness (or default risk) of a borrower. Users can also issue debt or crowdfund by issuing debt, not unlike an ICO.

dYdX is a platform dedicated to margin trading and creating decentralized financial derivatives so users can buy, sell or create options on crypto assets through decentralized exchanges, where currently there are none. It also uses a hybrid trading approach pioneered by the 0x Protocol.

Conclusion

With the emergence of all the abovementioned technologies, the foundations appear to be laid for a new use case for Ethereum and, to a lesser degree, bitcoin could also gain from this decentralized credit market with WBTC.

The concept of leveraging crypto in the bear market being a good ‘countercyclical trade’ at a time when stocks, houses and all other assets are at all time highs relies on the next crypto bull cycle taking off when the wider economy is headed for recession, which is a very probabilistic scenario. But given the crypto market’s previous 4 historical booms and busts since 2010 have occurred completely independently of the longest business and asset bull cycles in history suggests this is an opportunity worth bearing in mind.

Despite the web of dashboards and platforms creating contracts is easy and fast considering the number of currency conversions involved and worth playing with in small amounts to get an idea for what could be the future of peer-to-peer finance autonomous of banks or central banks’ interest rates.

Subscribe to BNC’s newsletters for insights and forecasts direct to your inbox

Don’t miss out – Find out more today