Understanding the current state of the Bitcoin market with the Bitcoin Futures curve

As the demand for crypto derivatives grows, so too does the demand for crypto market data. This article explains a new derivatives data product that has been developed by Brave New Coin in response.

A new crypto derivatives data product has been developed by Brave New Coin in response to the noticeable growth in crypto derivatives and the corresponding demand for crypto market data. In traditional financial markets, the value of the notional market derivatives dominates over the spot market.

This is not yet the case in crypto, however, there is a growing need for derivatives as hedging tools, yield generators and because they allow for price speculation without exposure to physical custody. Derivative Arbitrage profits are higher when markets are more inefficient. Crypto derivative arbitrage profits are currently high. Increasing complexity in terms of products and operations is reducing these margins.

An additional factor is that because Bitcoin is dominated by a spot market, the emergence of crypto derivatives has given traders a way to bet on price drops. Hale et al (2018), writing for the Reserve Bank of San Francisco, argue that the emergence of a robust Bitcoin futures markets has changed the way BTC is priced. He explains that historically, until the launch of things like the CME Bitcoin futures product, the BTC market was dominated by ‘optimistic’ speculators.

New Bitcoin Futures Data Product

The new BNC data product offers data for three key types of crypto derivatives contracts: crypto options, crypto futures, and crypto perpetual swaps.

Bitcoin Options

Options give traders the right to buy or sell an agreed amount of Bitcoin at a set date for a specific price.

Bitcoin Futures and Crypto Futures

A futures contract is a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future.

Perpetual Swaps

The perpetual swap is a unique derivative contract that is only offered in the crypto derivative space (although they were first proposed in the traditional markets way back in 1992). A perpetual swap is an agreement to non-optionally buy or sell an asset at an unspecified point in the future. Perpetual swaps differ from traditional futures in that they don’t have fixed settlement dates and can be held continuously without needing to be formally rolled over.

Crypto Sentiment Insights From Crypto Derivatives Data

A variety of macro insights can be drawn from derivatives data— for example, assessing the volume of puts and calls can tell us about the sentiment of the ‘smart money’ around a particular date in the future.

The funding rate for perpetual swaps indicates what is the ‘crowded trade’ and whether markets are bullish or bearish.

The future curve lays out the price at which a contract for future delivery or payment is concluded. It offers insights into where the market expects the price of an asset to be in the future based on factors like cost-of-carry and speculation.

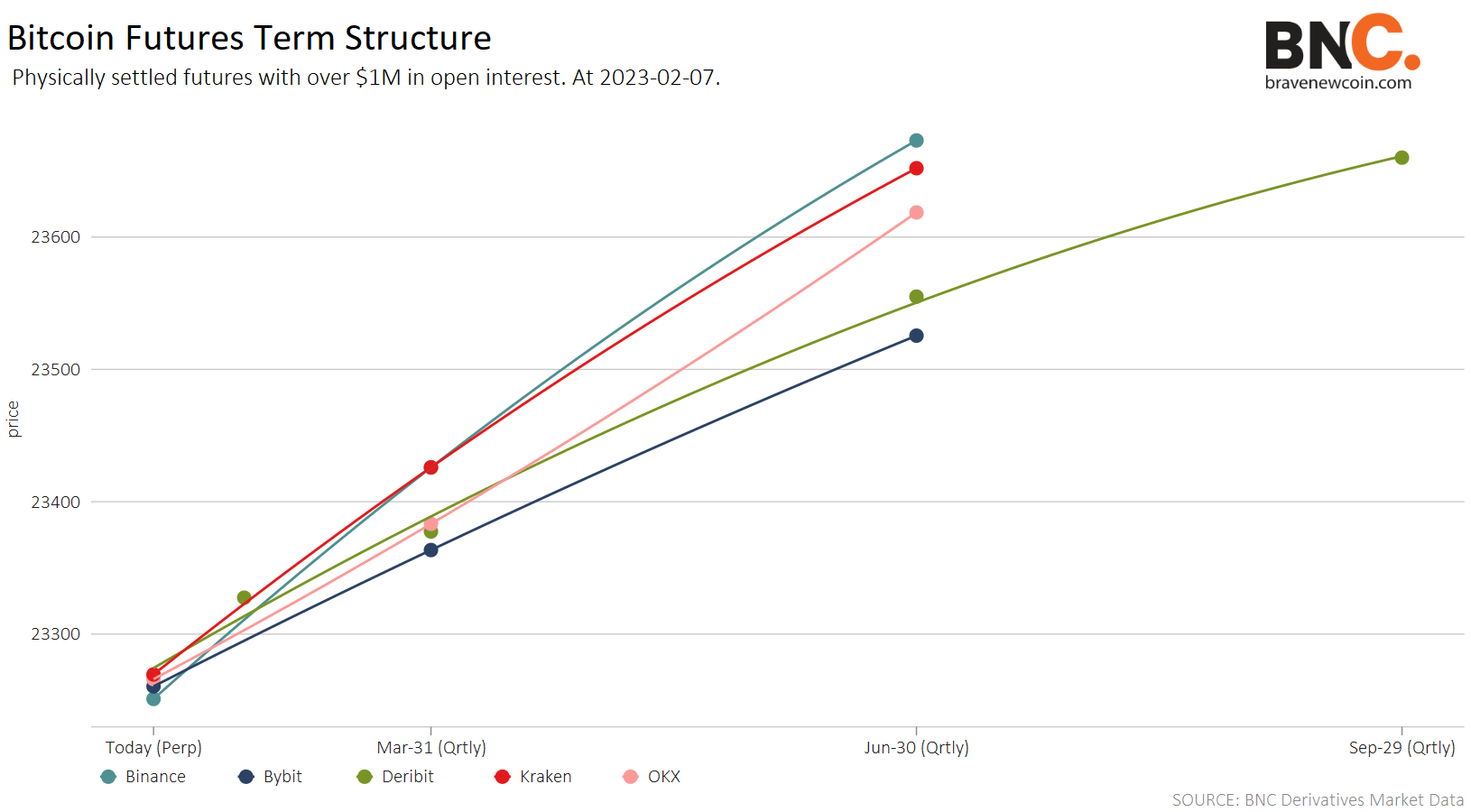

Understanding the current state of the Bitcoin market with the Futures curve

Source: Brave New Coin Derivatives market data

Future curve data from a range of popular Crypto futures exchanges suggests the Bitcoin market is in a state of Contango – a situation where the futures price of a commodity is higher than the spot price. Contango generally happens when markets expect the price of an asset to rise in the future (it should be noted that all the futures contracts listed above are physically settled).

On the futures curve diagram above, the price in US dollars is on the Y axis and the date of expiry is on the X axis. Each point represents a contract available on exchanges such as Kraken, Deribit, OKX, Bitmex, Bybit, and Binance.

The futures prices of an asset carry a premium because of the cost-of-carry. Cost-of-carry is the cost associated with holding, storing, or carrying a security or physical commodity. This may be storage costs or deprecation. With assets that have storage costs, investors are willing to pay more for a future to forego the cost of carry. Bitcoin, however, is a lightweight asset that does not have storage requirements, nor does it depreciate.

There are, however, some unique carry costs associated with Bitcoin. A primary one is counterparty risk. Bitcoin is most accessible through offshore and loosely regulated exchanges such as Binance and Bitfinex. As the FTX incident from late 2022 showed, trading with an exchange is risky and stored funds can evaporate instantly. For this reason, committing to a contract that delivers Bitcoin in the future may come with a premium. This is also why investment vehicles like Grayscale Bitcoin Trust often trade at a premium.

Another possible reason for Contango is speculation that the Bitcoin price will rise in the future. This suggests crypto sentiment in markets is positive. Bitcoin has a strong history of consistent price gains over time, backing up the trader’s positivity.

If investors expect the price of an asset to rise in the future and it has a high cost of carry, they are willing to pay more for it in the future. BTC meets both these requirements and as such the Bitcoin futures price often trades at a significant premium to the spot price.

Over time the futures price converges to be closer to the spot price as the date of the expiry gets closer. This creates an effect where if the price of the underlying remains constant, longing the future will lead to a loss as the price converges to the spot.

The negative roll comes into play particularly if traders choose to roll over contracts. If a trader wants to roll over into a later date, they have to pay for the Contango premium and the later expiry future is more expensive than the spot price of the asset. The trader must then pay more to maintain the same number of contracts.

This is particularly important for the Futures-based Bitcoin ETFs like the ProShares Bitcoin Strategy Exchange Traded Fund (BITO) trading on the NYSE Arca. The ProShares ETF is a futures-based product that tracks the price of Bitcoin CME Futures.

The fund achieves this capital appreciation through managed exposure to CME Bitcoin futures contracts. The fund does not invest directly in Bitcoin. It is a futures-based ETF and not a spot-based one where the ETF provider actually buys physical assets to back the underlying shares. This means the fund supporting the ETF needs to deal with the negative roll when contracts need to be pushed back to buffer the ETF.

In 2013, Motley Fool warned against buying the United States Natural Gas ETF because it had been trading at a loss against the spot price of natural gas. At the time of the Motley Fool article, the United States Natural gas ETF stood to lose 1.5% in a single month’s futures roll.

How much a futures-based ETF may be affected depends on the size of the market of the underlying asset. In traditional finance, high-frequency traders move in rapidly to take advantage of the difference in price between futures and spot. These arbitrage opportunities quickly shrink the price gap.

In the Bitcoin and cryptocurrency market, however, there are still far more retail players than institutional players meaning there is generally not enough big-money capital to close the gap between the futures price and spot price.

Charlie Morris of ByteTree Asset Management says he expects the BITO ETF to underperform spot BTC by 8.4% annually, before fees.

The BITO futures ETF has outperformed spot BTC over the last three months. The separation began to form around the time that FTX collapsed. This suggests that the cost-of-carry of Bitcoin has increased because of the risks associated with carrying it. This is why investors are willing to pay more for a non-physical asset like an ETF which simply allows for betting on Bitcoin price movements.

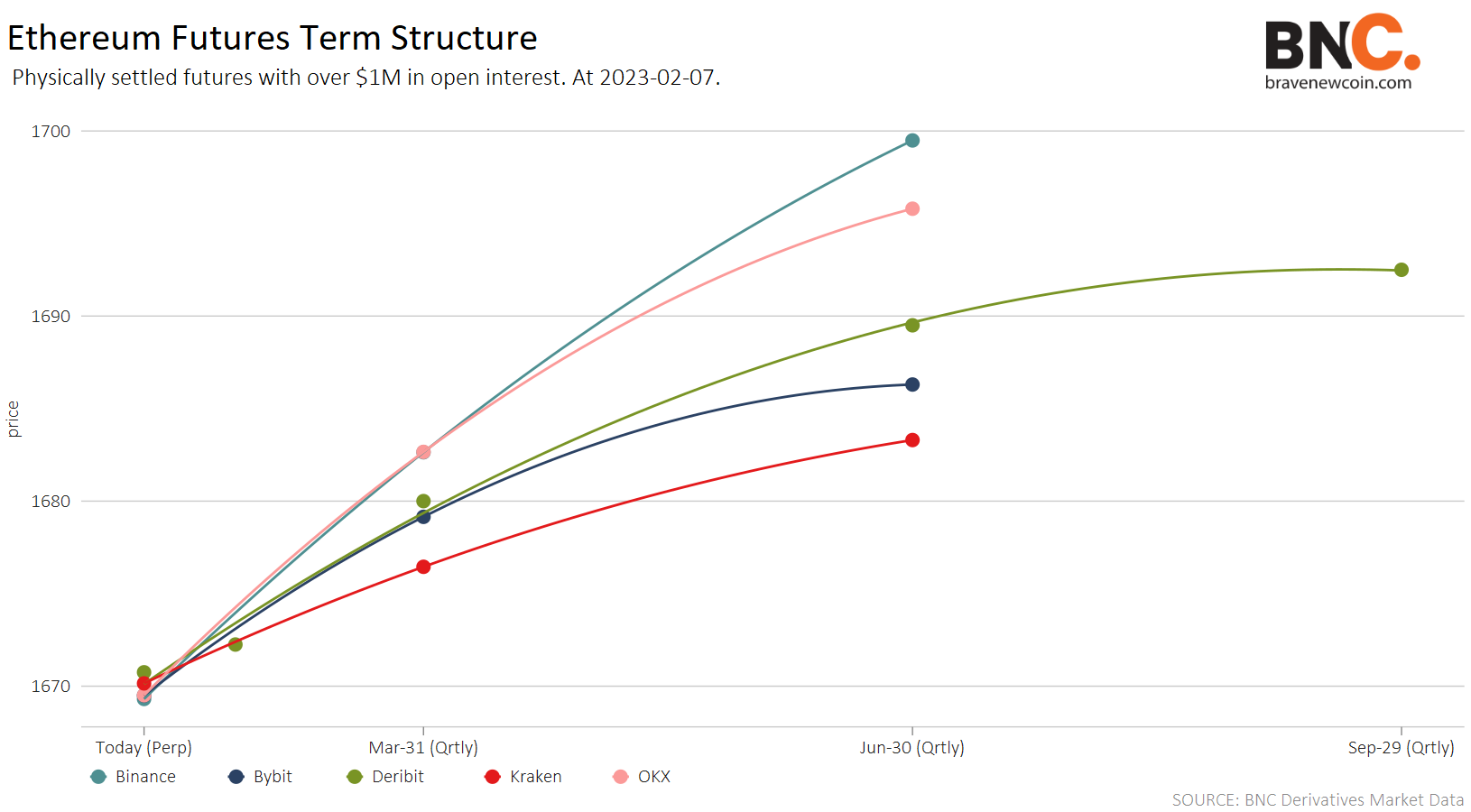

Source: Brave New Coin Derivatives market data

Ethereum (ETH) like Bitcoin, is in a state of Contango. This is likely for similar reasons to Bitcoin — optimism for the future price of the asset and a rising cost of carry probably because traders are concerned about buying crypto spot following the collapse of FTX.

The Contango Arbitrage Trade

In both Contango and Backwardation, there is an opportunity to make a cash and carry arbitrage trade. Backwardation is the opposite of Contango. This is when the current price of an underlying asset is higher than prices trading in the futures market.

Buy Bitcoin on the spot market (long position) and sell Bitcoin at a predetermined date (short position). This is a market-neutral strategy, whether the price of Bitcoin moves up or down, the crypto arbitrage trader makes money.

If for example an arb trader observes the Contango and decides to participate in the cash & carry trade, he/she will purchase BTC spot at 23,500 and sell futures expiring in October 2023 for 24,200 on Deribit.

- If the price of BTC falls off, the short future pays out

- If the price of BTC rises then the spot position becomes profitable

The bigger the gap between the spot and the futures price, the higher the profit for traders. Bitcoin volatility and the immature Bitcoin futures market can that this premium is often large.

A current approximate Risk-Free Rate of return for Bitcoin futures is ~4.6%. The risk-free rate of return is an indication of the potential yield of Futures trading strategy.

This is based on this traditional formula for calculating the price of the future.

Where the Futures price is the price of the BTC-Future on December 29th = US$24,160

The Spot price is the current BLX price = US$23,485.87

x is the number of days to expiry, for the December 29th futures contract is 226

A risk-free rate of return of around 5% is considered high, and in currency markets we only observe rates like this for geopolitically volatile currencies like the Turkish Lira. The cash-and-carry returns for the Bitcoin futures, which involve manipulating more market inefficiencies than the baseline in order to maximize the arbitrage trade, is reportedly between 25-50%.

Stéphane Ouellette, the chief executive and co-founder of Canadian hedge fund and broker FRNT, told the Financial Times, “The gap is large and does not look like shrinking any time soon.” It has provided his fund with a return of 30% per year.

Key Takeaways

- Bitcoin markets are in a state of Contango— the futures price of a commodity is higher than the spot price.

- This suggests that the market is underlying bullish.

- The Contango may be driven by positive expectations of the future price of BTC and also a higher cost of carry connected to greater custodian risks. The greater counterparty risk is likely tied to the collapse of FTX.

- The BITO Bitcoin Futures ETF trades at a premium to the spot, likely because investors don’t want to use exchanges to buy bitcoin directly.

- Contango and the high volatility of BTC mean that there is an excellent opportunity to generate arbitrage profits through cash and carry trades.

Don’t miss out – Find out more today