Welcome to the Merge – What happens Next?

The Ethereum Merge has happened. The network’s shift from Proof-of-Work consensus to Proof-of-Stake is more than just cosmetic. The transition to Proof of Stake is the most significant blockchain network upgrade this industry has seen to date.

The Facts

Ethereum (ETH) is a decentralized blockchain technology that functions as a peer-to-peer network that executes and verifies application code, called smart contracts. Ethereum was launched in 2015 and builds on the original blockchain innovations first introduced by Bitcoin.

Both Bitcoin and Ethereum allow users to exchange value without payment providers or banks. Ethereum, however, differs because it allows application developers to build decentralized applications. It is able to do this because it supports more complex, programmable transactions than Bitcoin.

The Ethereum foundation states that the Merge will be ‘the most significant upgrade in the history of Ethereum.’ The Merge will witness the joining together or ‘merging’ of the execution layer, Ethereum as we know it today, with a consensus layer called the Beacon chain. The Beacon chain uses a Proof-of-Stake (PoS) consensus model that will replace the current Proof-of-Work (PoW) model that the mainnet currently uses. The switch to PoS will replace energy-intensive mining, and instead secure the network with staked ETH.

The Merge upgrade officially kicked off on September 6th with the Bellatrix upgrade. As Ethereum founder Vitalik Buterin explained on Twitter “The Merge is still expected to happen around Sep 13-15. What’s happening today is the Bellatrix hard fork, which prepares the chain for the Merge. Still important though – make sure to update your clients!”

It is important to note that the Beacon chain was shipped separately from the Ethereum mainnet chain and the Merge. It has been running independently and parallel to other assets within the Ethereum ecosystem. The Merge is when it will integrate with other assets within the ecosystem.

The Bellatrix upgrade prepared the existing Ethereum PoS Beacon chain to Merge with the Ethereum mainnet layer. The Ethereum mainnet layer is the Ethereum that the crypto ecosystem is familiar with and has been using since 2016. When the Merge is completed in mid-September, the Beacon chain will become the official consensus layer when interacting with Ethereum and the current mainnet will become purely an execution layer.

The Bellatrix upgrade occurred at Epoch 144896 on 6th September at 11:35 UTC. Terminal Total Difficulty (TTD) represents the cumulative difficulty of all Ethereum blocks mined. TTD value triggering the Merge has been set at 58,750,000,000,000,000,000,000. This is expected to occur between the 13th-16th September. The way the transition is planned, the difficulty level of the current Ethereum PoW mainnet will increase to a point where mining new blocks will no longer be possible.

The countdown to the Merge can be tracked here.

The Hype

Leading up to the Merge, ETH has rallied strongly. On Saturday, June 18th, 2022 at 12:00 UTC, the Ethereum Liquid Index (ELX) ETH price was US$968.15. This marked a local bottom. While the ELX is aggregated on some exchanges the ETH price fell as low as US$880. It then pushed as high as ~US$2000 on August 14th, a jump of around 110% in two months. Since mid-August, the price of Ether has slipped to around ~US$1600.

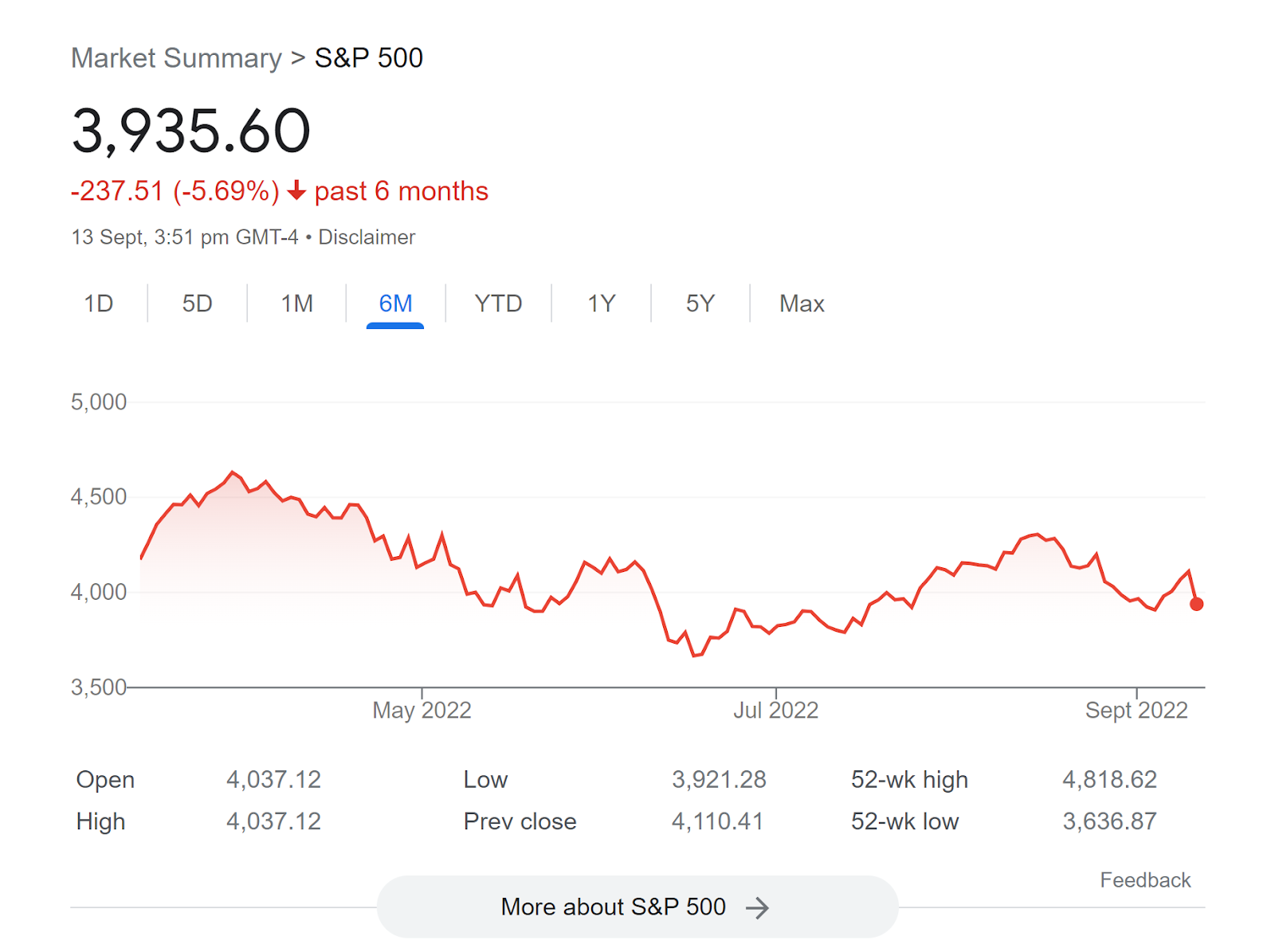

It should be noted that in a wider context, the ETH price rise was not as idiosyncratic as many ETH bulls assumed. Over the same period, the price of BTC rose by ~29%, and the prices of Binance Smart Chain token (BNB), and Solana (SOL), also both rose by ~51%. Additionally, the S&P500 rose by ~15% as did the Nasdaq Composite. Notable is the similar price appreciation each of these assets followed.

ELX 6-month price trend. Source: Bravenewcoin.com

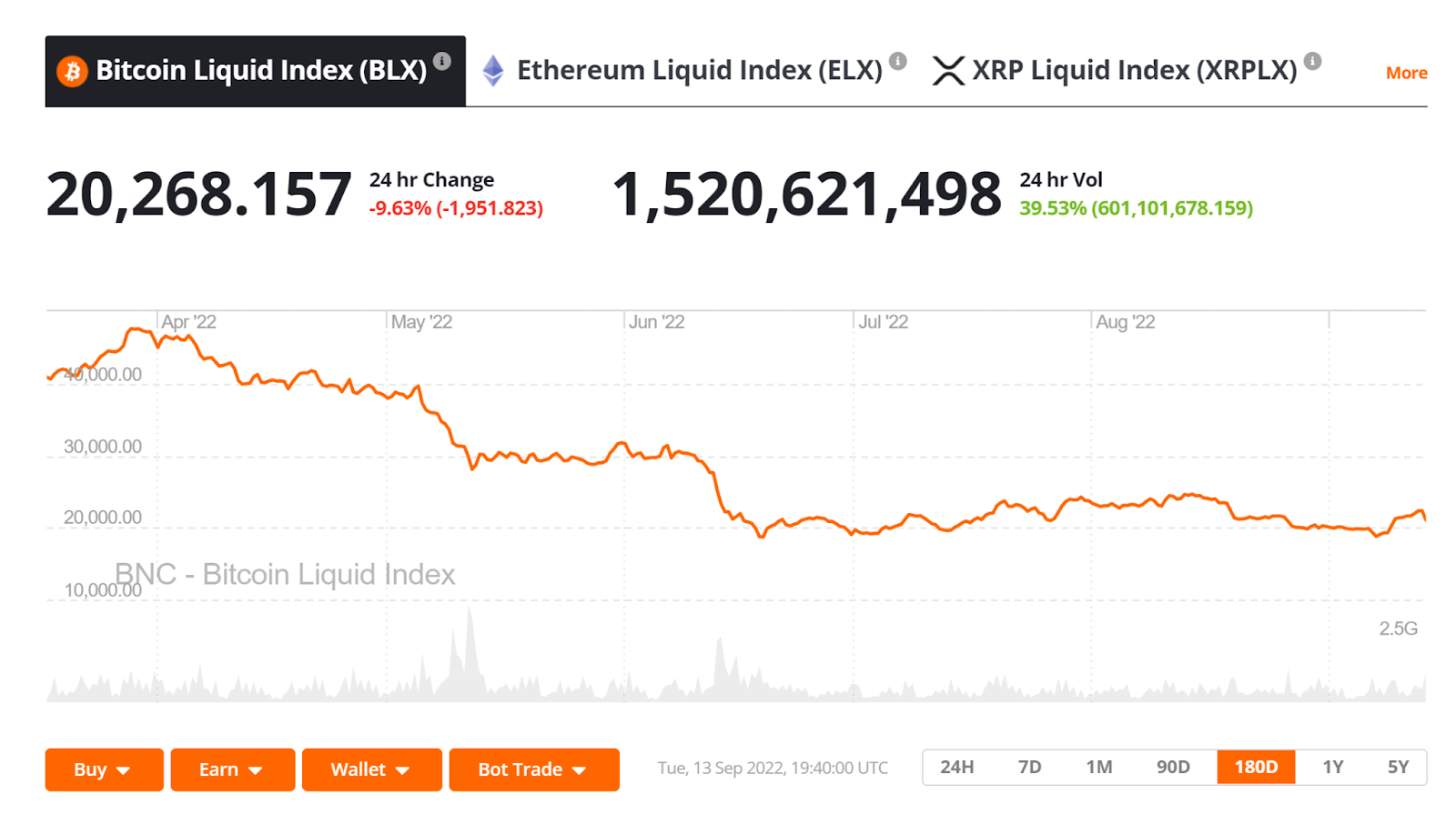

BLX 6-month price trend. Source: Brave New Coin

S&P 500 6-month price trend. Source: Google Data

A number of perceived risk assets had further corrections following a strong period of selling and price drops in Q2. This included equities and crypto assets. The wider crypto market was able to recover from the mass liquidation events of Terra, Celsius, and Three Arrows Capital. Ethereum’s strong last two-month price period was not purely driven by the Merge.

Triple Tailwinds: What has ETH bulls so bullish

The Merge is creating bullish tailwinds for Ethereum and there are likely three key factors behind that surge.

The Triple Halving – The bitcoin halving is pivotal in crypto markets because of the strong positive effect it has on the price of BTC. It occurs approximately every 4 years and cuts the supply rate of new Bitcoin in half. The halving reduces the rate of inflation and like clockwork, creates upward price pressure for Bitcoin.

Source: Tradingview user- BitcoinBearSlayer

Ethereum is set to undergo a similar halving type of effect with the transition to Proof-of-Stake (PoS). The Merge is set to cut the emission rate of Ethereum by 90%. PoS makes securing the network much cheaper than with Proof-of-Work, and because of this, PoS validators are paid far less than PoW miners. Calculations from some analysts suggest that the inflation rate cut to Ethereum will be the equivalent of “three Bitcoin halvings”.

Bitcoin bulls generally tout the halving as a powerful bullish tailwind and often focus on investing around this four year cycle. If Ethereum bulls are right then the PoS transition will be 12 years of halving cycles in one single event. Some analysts have suggested that Ethereum will become the ‘first profitable blockchain ever’ post halving.

The issuance rate changes for Ethereum can be tracked here.

Illiquidity – With PoS, transaction fees from the B block are collected and then distributed as staking rewards to validators and delegators. The original proposer gets an additional reward for their service. Delegators are average ETH holders who assign their stake to a validator, who participates in staking on their behalf for a fee and offers a small share of their validator rewards.

A large amount of ETH is already locked into DeFi protocols like Uniswap, Compound, and Aave for lending and market-making rewards. The launch of new native ETH staking rewards for participating in the Beacon chain will see even more ETH locked up – and it will therefore become more illiquid.

Currently, Lido Finance offers depositors ~3.5% for delegated staking services. Noted Ethereum researcher Justin Drake predicts, based on modeling, that ETH staking rewards will shoot up following the Merge. His expectations are that yields for ETH staking will rise to as much as ~25%, with his lowest expectation being that yield will be ~9%. The transaction load of the beacon chain is set to increase significantly.

Native yield means not having to trust a 3rd party protocol like Aave or Compound. Yield is a passive income and generates yield independent of market conditions. This may make ETH more appealing in trendless markets than other large-cap crypto assets like Bitcoin (BTC).

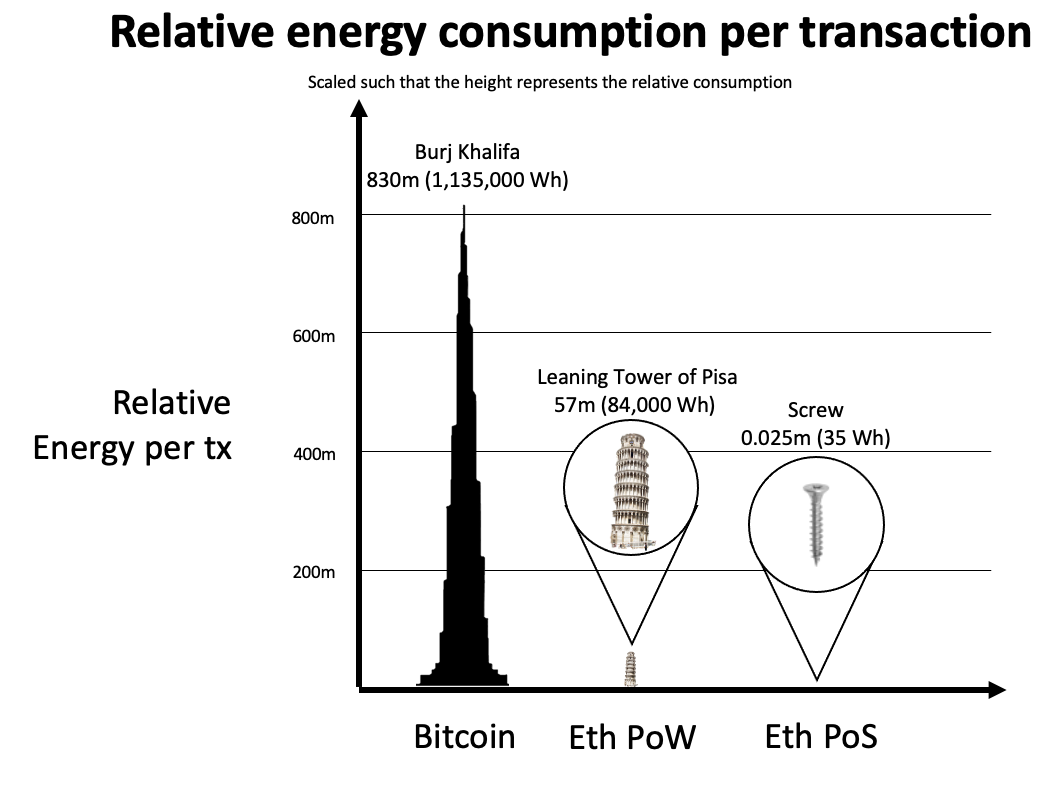

Ethereum becomes environmentally friendly – The Ethereum foundation says that after the Merge Ethereum’s energy usage will decrease by ~99.95%. The Ethereum network is a decentralized, secure payment network for users seeking to send and receive money and relies on its peer-to-peer nature for its operations and cryptography. Securing the information and value stored on the network in a truly decentralized manner using PoW, it turns out, took a great deal of processing power – particularly as Ethereum grew. PoS is set to significantly lower the energy consumption and processing power required to secure the network, while at the same time maintaining decentralization.

Both PoS and PoW require the parties involved in securing the network to have ‘skin-in-the-game’.

In PoW, if a miner proposes an invalid block, the miner wastes time, energy, and money (investment in hardware). In PoS the protocol can destroy a validator’s stake or ban them from participating in the protocol. With one model, participants risk wasting hardware and processing power. With the other, participants risk losing staked native coins.

In PoW, miners stake and compete with energy and hardware. Ethereum has grown to become a large powerful network that requires powerful machines with ASIC and GPU chips to efficiently mine. It may have initially been minable with just a personal PC but this is not the case anymore. With PoS, validators should always be able to perform their roles with an unassuming laptop.

Source: The Ethereum foundation

From an investor’s perspective, this is a major narrative win for the Ethereum investment proposition.

The environmental impact of Proof-of-Work blockchains is often a barrier for large investors. Corporations and entities like pension funds often have ESG mandates that conflict with a Bitcoin investment and turns them away from allocating capital towards crypto.

PoS, while less decentralized, likely passes the ESG test with a better score than PoW and may mean large investors will select Ethereum over Bitcoin.

Bullish factors stack together

On top of these major changes to the Ethereum blockchain, because of Ethereum’s existing free burn model introduced as part of the London Hardfork and EIP-1559, the supply impact of the Merge is set to be even more exaggerated. The drop in daily emission rates and the supply shock will be even more pronounced.

If ETH is being burned with every transaction because of EIP-1559, a chunk of ETH is illiquid because it is locked up in high yield native staking. There will be a triple halving effect because PoS validator rewards are much lower than PoW miner rewards. It appears somewhat inevitable that the price of ETH will rise as a result of the supply shock. This is assuming that the network functions smoothly post-Merge following the transition to Proof-of-Stake.

It is a misconception that the switch to Proof-of-Stake will immediately make transactions faster and cheaper. ETH will have a supply shock and the network will consume less energy but there is no guarantee that the user experience of Ethereum will improve post-Merge.

What is more likely to improve, is the UX of Ethereum due to the burgeoning layer-2 ecosystem that is being built to make Ether faster and cheaper at scale. The AUM and transaction loads of the big-4 Ethereum layer 2’s- Optimism, Arbitrum, ZkSync and Starknet will help with this.

Layer-2 refers to any secondary framework or protocol built on top of an existing blockchain that adds features that generally improve the scaling capabilities of the base chain. One of the key advantages of layer-2 solutions is that they don’t require any structural changes to the base layer chain.

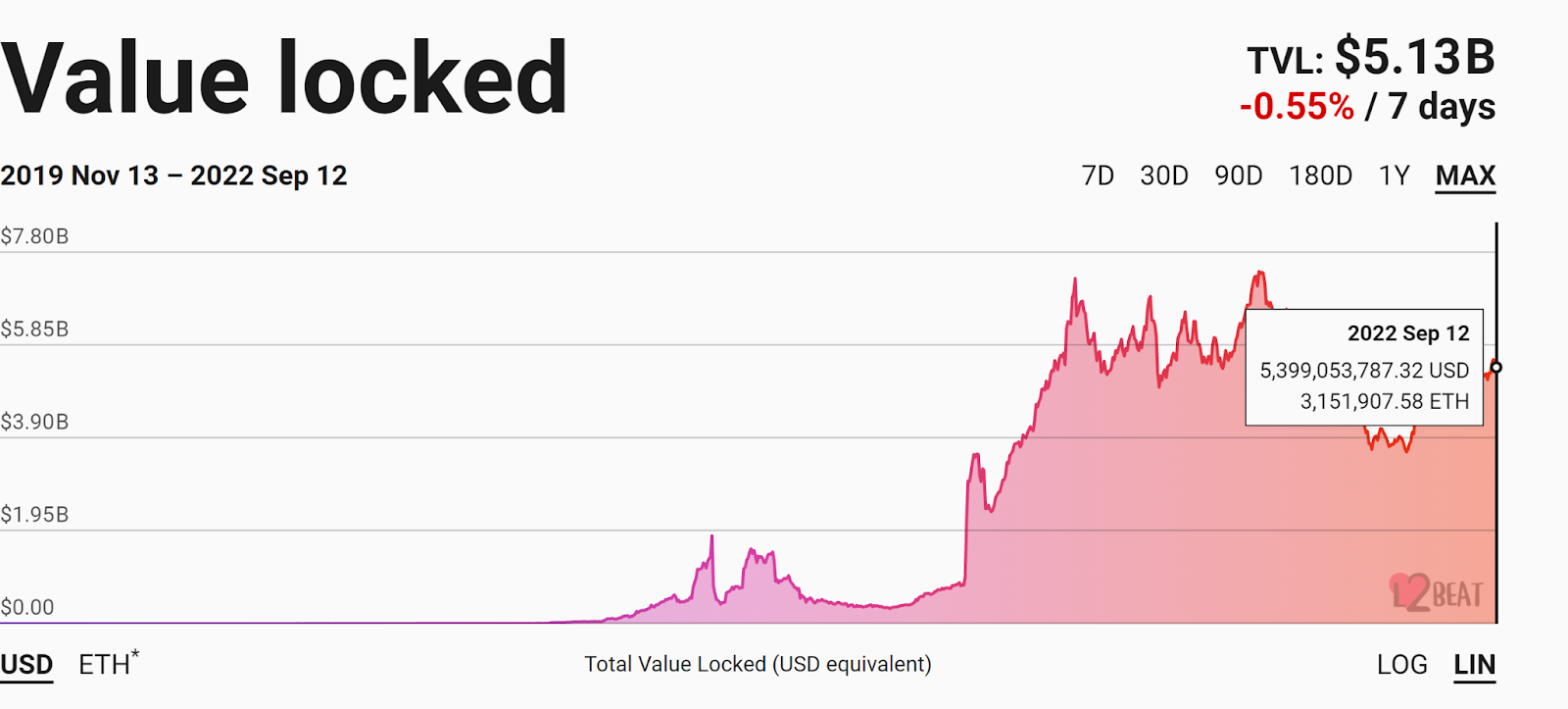

Source:L2beat.com

The total value locked into these protocols currently sits at ~US$5.1 billion. This is without any native token incentives. This growth in AUM has been organic.

None of the four layer protocols mentioned have native tokens, but they will in the future. When these tokens are launched, and there are more incentives to use the L2s, there will likely be more AUM and transaction volume.

The Beacon Chain is incomplete: Vitalik outlines improvements required

It’s clear the public is excited about the potential price impact of the Merge, and alongwith that there is a perception that Merged Ethereum will be the height of best practise and crypto consensus perfection. Behind the scenes, though, Ethereum developers are carefully studying the architecture of the new Ethereum – and finding it lacking, or at least falling short of perfection.

In a speech in early September, for example, Vitalik Buterin himself discussed at great length some of the potential flaws with the current Beacon chain model and how they may be exploited.

He says Miner Extract Value (MEV) re-orgs, while difficult to conduct with the Beacon chain’s current Casper Proof-of-Stake model, are still possible. Buterin explains that an MEV reorg attack “is basically an attack where the miner or the proposer, instead of creating a block that builds on top of the previous block, they build a block that competes with the previous block.”

He notes that with Tendermint style Proof-of-Stake consensus, which is used by the Cosmos ecosystem, it is essentially impossible to Reorg because of its single slot finality system. He suggests to “take the Ethereum Beacon chain and try to get some of these benefits by making it more Tendermint-like.” Buterin says there are also steps that the Beacon chain can take to negate the possibility of miners colluding to attack the network.

In addition, there is a fundamental issue with Ethereum’s PoS model. Ethereum’s consensus model is really a combination of two different consensus protocols: a "finality gadget" (called Casper FFG) that finalizes blocks after 6.4-minute-long epochs, and a "fork-choice rule" (called “latest message driven greedy heaviest observed subtree”, “LMD GHOST” for short) that governs the chain within each epoch. Buterin is not a fan of this dual PoS consensus model.

“Instead of trying to combine together LMD ghost and FFG, and having these two very different mechanisms and trying to get them to talk to each other and agree with each other, how about we use ideas that are already well known to work, which is basically just single-slot SW finalizing consensus, right? There are plenty of papers talking about it. There are plenty of implementations of it. It’s something that everyone uses, it’s a very well-established and robust concept.”

As well as Buterin, Web3.0 investment firm Paradigm suggests that Ethereum should explore an alternative PoS consensus architecture.

Buterin says another goal for the Beacon chain will be to “increase the efficiency and decrease the cost of running validator nodes.” He says that the cost of running a node could end up being extremely high if left unchecked.

Throughout his speech, Buterin suggests potential fixes for the issues with the current version of the Beacon chain he lays out. This includes the aforementioned switch to a Tendermint style PoS.

Towards the end of his speech Vitalik suggests that Ethereum devs have always known the Merge wasn’t to be the end of the road. “Making some modifications and fine-tuning and refining the Beacon chain consensus has been something that was part of the plan since the beginning,” he says.

It seems that while this week’s Merge will be a seminal event for Ethereum, its own creator acknowledges that more work will be needed to optimize the network’s bold new consensus model.

This week’s transition of Ethereum to Proof of Stake will be the most significant blockchain network upgrade this industry has seen, and probably will see for some time to come. After the Merge takes place, the conversation around Proof of Work vs Proof of Stake will only increase, especially as crypto networks increasingly integrate themselves into everyday life. However, it will likely take years for these arguments to play out in the real world.

Don’t miss out – Find out more today