What Is an Institutional Crypto Exchange?

From the backrooms of tech enthusiasts to the powerhouses of Wall Street, cryptocurrency trading has taken the world by storm. This article explores the nuances of the retail versus institutional dynamic inherent in the cryptocurrency trading arena.

“Trading in cryptocurrencies has grown rapidly over the last decade, primarily dominated by retail Investors,” write authors Kogan, Makarov, Niessnar, and Schoar in a working paper for the National Bureau of Economic Research. They write that this pattern is unlike what is observed in traditional markets.

A retail trader is an individual trader who trades with money from personal wealth, rather than on behalf of an institution, like a bank. Institutional traders engage in trading for accounts they manage for an institution, which may include a pension fund, a family office or hedge fund.

There are a number of factors that explain why retail investors have embraced crypto with such vigor. Price growth, volatility and dreams of wealth are foremost among these factors.

Crypto asset prices move like roller coasters- evidenced by rapid oversized gains and deep, painful periods of price depression. Smaller retail traders have less to lose than large institutions and are therefore more willing to accept the volatile nature of crypto and its risks. These risks in crypto have historically been more ‘worth it’ for this demographic versus the more risk averse institutional traders.

Digital Assets in their early years were often considered to be investments for fun. Unreliable ventures that the technologically savvy would hold on to buffer portfolios.

The main way to invest in cryptocurrencies is through direct investments via online exchanges and storage in wallets. There is a requirement for self-custody and the need to manage wallets. This doesn’t fit well with the portfolio operations of large institutional trading firms. Unless they have a specified crypto arm, or have a deep understanding of crypto custody requirements they have often simply avoided the hassle.

Digital assets have only been around since 2010, and in the early years of the space, data reporting was patchy at best. Price data for Bitcoin is limited and crypto price datasets cannot be expected to have the same level of complexity and robustness as price datasets for traditional finance assets. It is easier to conduct robust forecasting for asset classes such as equities and gold. This lack of data means that crypto price movements seem random. While institutions may have historically been put off by the randomness, retail investors were willing to embrace it.

Enter the Institutions

“The Bitcoin Trading Ecosystem and the Emerging Institutional Infrastructure” report from LMAX Digital Digital and Arcane Research examines the Bitcoin trading ecosystem and includes findings from the latest institutional survey conducted by LMAX Digital. Over 200 institutional market participants were surveyed about their crypto trading needs and infrastructure gaps around things such as regulated custody providers and insurance.

In the report, it is stated that “2021 has been marked by speedy institutional adoption, from corporates to hedge funds to major investment banks revising their crypto initiatives. Most of the biggest names on Wall Street have now announced plans to offer their client’s access to cryptocurrencies.”

This trend has accelerated significantly in the last two years. There has been a recent boom in institutional interest around crypto following the approval by the SEC of 11 Bitcoin Spot ETFs from a range of providers from the traditional investing world, such as Blackrock, Fidelity, and Ark.

Institutions want to get involved with Bitcoin, either directly or through an ETF. The future is now.

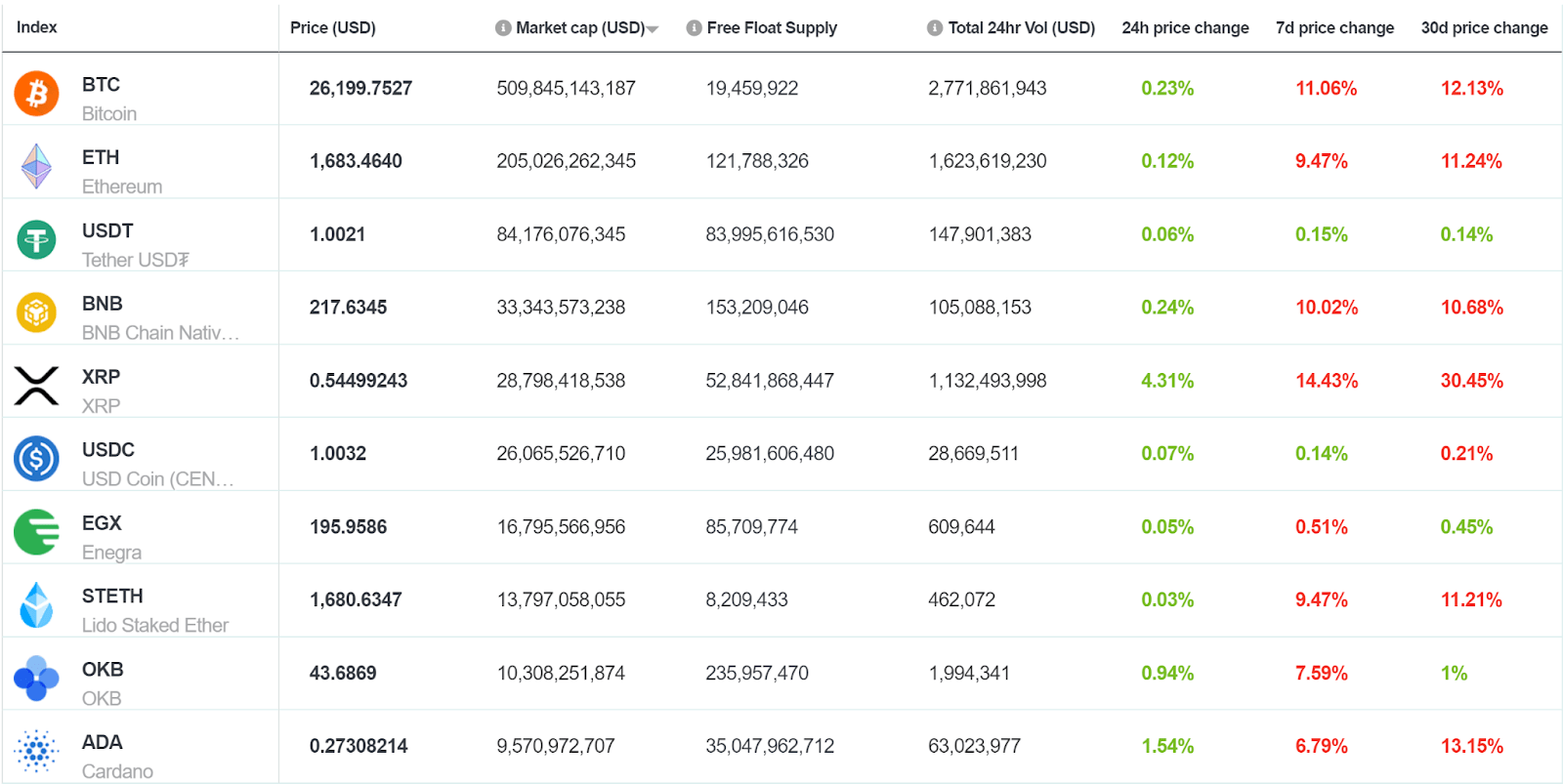

Recent data collected by the market data team at Brave New Coin shows that daily volumes for specific pairs on institutional-only exchanges exceed those observed on large international exchanges. The large international exchanges included in this study all offer their services to retail and institutional customers, and many have been around long before the latent institutional interest in crypto became clear.

For the data study, BNC compares volumes from LMAX Digital with volumes from exchanges that are a part of the BNC Liquid Index program.

The BNC Liquid Index (LX) series is a family of single-asset price indices representing the fair value of crypto assets, used for settlement and reference pricing. Indices are derived from transaction data, sourced from the world’s most trusted and liquid trading platforms. The BNC Governance Committee reviews the platforms included in the LX series based on a number of quantitative and qualitative factors.

The Exchanges

LMAX Digital

LMAX Digital is a leading institutional spot cryptocurrency exchange, run by the LMAX Group, which also operates several leading FCA-regulated trading venues for FX, metals, and indices. LMAX Digital is regulated by the Gibraltar Financial Services Commission (GFSC) as a DLT provider for execution and custody services.

LMAX Digital differentiates itself by only serving institutional customers. Institutional market participants are generally not individual traders and may include banks, funds, asset managers, proprietary trading arms, HFTs, brokers, and corporates. They tend to have characteristics such as higher trade amounts and a greater willingness to accept KYC/AML procedures.

Coinbase

Coinbase is a digital asset exchange. It is available for use in over 100 countries and as of 2022 it had a reported 103 million verified users, and 9 million users transacting each month. Coinbase targets both beginner and advanced users. The platform has a wide range of assets and pairs available. Not just assets like BTC and ETH, but also much more obscure assets like LDO and EGLD. The exchange includes over 1000 assets for trading.

Coinbase is amongst the top 3 exchanges in the world. Documentaries have been made about the founder of Coinbase and it is the only publicly tradable cryptocurrency exchange in the USA. While it continues to spar with the SEC and users often complain about its customer service, it is top of the exchange totem pole.

Bitfinex

Bitfinex is a large cryptocurrency exchange that is perhaps most notable for its unique product offerings and financial innovations. Alongside basic spot trading, the exchange offers margin trading, derivatives and more. It also has a unique ‘debt token’ called LEO and was heavily involved in the creation of the popular stablecoin US-Dollar Tether (USDT).

Bitfinex, however, is perhaps most well known for its controversies. It has on numerous occasions had battles with US regulators including the Commodity Futures Trading Commission and New York Attorney General’s Office over allegations of financial misconduct and misleading investors. It has also had ties to offshore jurisdictions and banking institutions with ties to the criminal underworld. The exchange has shown resilience, settling and reconfiguring operations to appease investors.

It remains popular with numerous users globally. The exchange has been around since 2012 and has a base of loyal users. It also is noted for its competitive fees.

Kraken

Kraken is even older than Bitfinex and was established in 2011. This San Francisco based exchange offers trading of over 200 digital assets and also includes unique fiat options like the Canadian Dollar and Japanese Yen. Like Bitfinex, Kraken also offers digital asset derivative contract trading.

In 2014, alongside Coinbase it was selected by the Bloomberg Terminal as a provider of cryptocurrency market data. This established it as a leader in the nascent days of the digital asset exchange space. Like Bitfinex and Coinbase it has had its own sparring sessions with US financial regulators. Notably in 2019, the Office of Foreign Assets Control (OFAC) investigated Kraken for breaking international sanctions by allowing users in Iran to use the exchange. The exchange eventually settled and paid a hefty fine as a result.

Bitstamp

Bitstamp, like Kraken, was found in 2011, making it one of the oldest major exchanges in the world. It is also the first nationally licensed Bitcoin exchange in the world. Bitstamp only has 83 digital assets available for trading on its exchange meaning it has less coverage than some of the exchanges mentioned above.

Bitstamp was founded and is registered in Slovenia. The exchange has over 5 million customers worldwide as of April 2023. It also has offices in the US, the UK, Luxembourg and Singapore. Like Coinbase it has separate products for advanced and beginner traders. The combination of a long, clean history, competitive trading fees and a strong user interface has helped Bitstamp maintain its position of relevance in the Bitcoin trading market.

Gemini

Gemini is an American exchange that allows trading for 60 digital assets. It was launched in 2014 and is known for its outspoken founders, the Winklevoss twins who gained pop culture notoriety after they were portrayed in the film The Social Network.

Gemini is noted for popularizing daily Bitcoin and Ether auctions. Like many other exchanges it has a separate suite of products for beginner and advanced traders. Gemini also offers catered services for more active traders, has a clearing house for OTC transactions and like Coinbase, has a separate service purely for digital asset custody called Gemini Custody.

Overview: LMAX Digital competes with the big boys

Source: Brave New Coin market data

Comparisons between LMAX Digital and the LX constituent exchanges begin from July 2022 and end in July 2023 due to data limitations. For some charts, weekly volumes are used and this allows for dates further back but some granularity and precision is lost.

The chart above indicates total volumes on the LMAX Digital exchange for the BTC/USD, ETH/USD and XRP/USD pairs. There is a notable drop off in volumes between peaks observed in 2022 and troughs in the summer of 2023. Top daily volumes for the Bitcoin/USD pair hovers close to US$300 million, for Ethereum/USD they are close to US$200 million, while for XRP/USD they are closer to US$30 million.

Source: Brave New Coin market data

Visually, the most notable difference between daily volumes across the same pairs on Bitfinex is the inconsistency. The drop off in volumes on Bitfinex appears to be much more extreme than on LMAX Digital. While peak daily volumes on LMAX Digital are much lower than on Bitfinex — ~US$800 million compared to ~US$300 million.

This may also speak to the nature of the two exchanges. LMAX Digital is an exchange that caters only to institutional traders. Compared to retail traders, Institutional traders are likely to be less emotional and prone to being reactive to market price movements. They are more likely to stick to strategy and trade consistently. For this reason, it appears likely that LMAX Digital volumes will always be more consistent than volumes on retail exchanges.

Source: Brave New Coin market data

The chart above compares the daily volumes of LMAX Digital with select BLX and ELX constituents.

The charts indicate that volumes on LMAX Digital, have in the last year, kept pace with some of the largest and oldest crypto exchanges in the world. Daily volumes on LMAX Digital for the BTC/USD pair consistently hover around US$50 million. The average daily BTC/USD volumes for both Kraken and Bitfinex both tend to be higher than this but they are not as consistent.

Source: Brave New Coin market data

Note: due to the limitations on the LMAX Digitak API, depth is uncertain and is likely higher than what is reported on the table above.

Data analysts at BNC have also developed methodologies to compare these exchanges using non-volume based metrics. This includes metrics that summarize Depth and Trust. The chart above summarizes these results.

For the BTC/USD pair, LMAX Digital is the fourth highest rated exchange based on volume, depth and trust. For the ETH/USD pair it is rated third, and for XRP/USD it is fourth. It is not the most robust exchange for any of the pairs, however, it is consistently middle of the pack, suggesting it does belong amongst the elite cryptocurrency exchanges in the world.

Source: Brave New Coin market data

Source: Brave New Coin market data

The two charts above indicate total weekly exchange volumes across the exchanges observed for this study. Clearly Coinbase is an outlier. It has much higher volumes than any other exchange being measured making it difficult to compare the other exchanges visually.

The chart below excludes Coinbase and as such we are able to achieve a more clear visual comparison between compared exchanges. There are few notable observations that can be made. Across the board, volumes have dropped significantly between 2022-2023. This is likely down to the collapse of FTX and the loss in confidence this created.

LMAX Digital is a middle of the pack exchange, frequently outperforming Gemini and Bitstamp but underperforming in comparison to Kraken and Bitfinex. There are also periods when volumes rise on other exchanges but fall off on LMAX Digital. Notably in two short periods around June and July 2022. This may be down to LMAX Digital traders choosing to be inactive during periods where traders on others are more frequently buying and selling. We are more likely to observe this pattern with selling and ‘weak hands’ exiting positions early.

Pair Data

(For the next section, weekly volumes are used)

Source: Brave New Coin market data

For Bitcoin volumes, LMAX Digital again remains middle of the pack and has a high level of consistency compared to retail exchanges.

Source: Brave New Coin market data

For Ethereum volumes, LMAX Digital again remains middle of the pack and has a high level of consistency compared to retail exchanges. Volumes are more volatile and inconsistent compared to BTC. It is also notable that starting from 2023, the volumes of ETH/USD on LMAX Digital began to exceed the volumes on Bitfinex and has been in close competition with Kraken as the top exchange amongst the 5 observed. This may be an indication that institutional traders have a growing interest in ETH and Web 3.0.

Source: Brave New Coin market data

With XRP volumes there is a clear outlier, Bitstamp. Across the four exchanges observed, users on Bitstamp, throughout the observed period, are consistent traders of XRP. For the other exchanges observed the same cannot be said. LMAX Digital again is middle of the pack. With XRP, LMAX Digital does not have the same consistency as observed with the ETH and BTC pairs.

Conclusion

Since its inception the digital asset space has been dominated by retail investors. Driven by characteristics such as a willingness to accept volatility and technological unknowns, retail defined the market, setting it apart from traditional financial sectors. In recent years, however, institutional interest in crypto has accelerated. Time, understanding, and the right players making the right moves has warmed institutional traders to crypto. They now seem willing to accept digital assets, despite the perceived flaws built into the asset class.

Exchanges such as LMAX Digital, Coinbase, Bitfinex, Kraken, Bitstamp, and Gemini have emerged as pivotal players in the market, each with unique characteristics, offerings, and challenges. The comparisons between their trading volumes, consistency, and performance reveal a complex and dynamic ecosystem that continues to mature and expand. LMAX Digital, an institutional exchange, has evidenced an ability over the last year to compete volume wise with the largest, most well-established digital asset exchanges in the world.

As institutional interest grows and exchanges evolve to meet new demands, the future of cryptocurrency trading appears poised for further complexity and opportunity. While 2023 has been a tepid year for digital asset volumes, signs that the ecosystem is maturing and attracting larger more complex players is extremely encouraging.

Don’t miss out – Find out more today