Why Blockchain will revolutionize the banking industry

The banking industry, with all of the potential that blockchain technology offers for change, iteration, and development has been slow in its uptake of the new tech. That said, there’s no questioning whether blockchain technology will disrupt and revolutionize the banking industry. Leaders feel it coming. Some are ready. Most aren’t. But why and how is blockchain going to change banking over the next decade?

Blockchain technology was invented back in 2008. But it’s just now taking the internet, technology, and even banking by storm. Already, 24% of people around the globe are familiar with blockchain technology. That number is 41% if you only count people in North America. In 2015, 13 different blockchain companies secured $365 million in funding. And by 2016, they had raised well over one billion dollars to drive their operations.

However, that speed of development doesn’t always benefit the companies trying to keep up. The banking industry, for instance — with all of the potential that blockchain technology offers for change, iteration, and development — is particularly susceptible to getting overwhelmed.

And that’s probably why 70% of financial service leaders say that the speed of technological change concerns them. There’s no questioning whether blockchain technology will disrupt and revolutionize the banking industry. Leaders feel it coming. Some are ready. Most aren’t. But why and how is blockchain going to change banking over the next decade? To answer that question, let’s first discuss how blockchain technology works.

How does blockchain work, and how does that apply to banking?

To understand how blockchain will revolutionize the banking and finance industry, you first need to understand how it works. For the sake of simplicity, you can think of blockchain as a mathematical model for processing, securing, and finalizing transactions. Naturally, banks process tons of transactions each day. Which is exactly why it will likely be one of the industries to change the most from this up-and-coming technology.

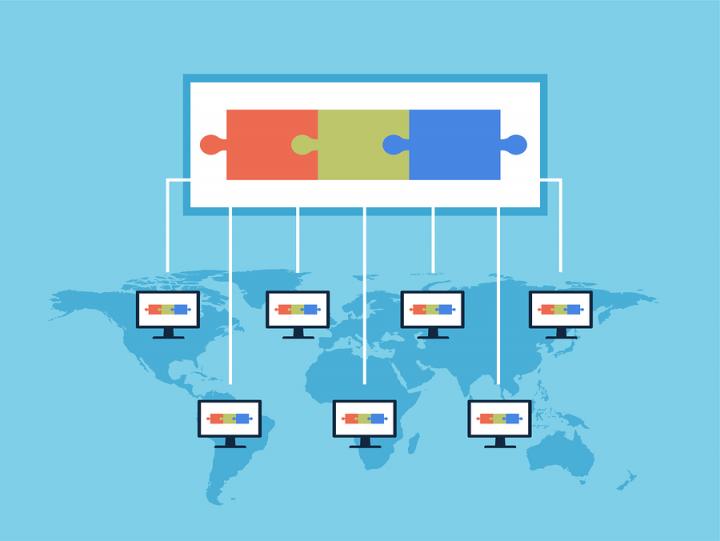

The blockchain process is really quite simple. First, someone requests to make a transaction — usually using cryptocurrency. Once they do, computers, or “nodes,” jump to work processing the transaction. When the nodes are finished, blockchain verifies the transaction, gives it a unique address, completes it, and places it as a new block within the strand of existing blocks.

Thus the name “blockchain.”Now that you understand how blockchain technology works, you need an answer to the more important question: Is it really going to impact the banking industry all that much? Or is this just another invention that will come and go, nearly as fleeting as the wind?

Well, Harvard Business Review claims that blockchain will do to banks what the internet did to media. And, as of 2016, 60% of financial organizations plan on using blockchain for international money transfers, 23% for security clearing and settlement, and 20% for Know Your Customer (KYC) regulations and anti-money laundering services.

In the end, there are two primary reasons that blockchain technology is going to revolutionize the banking industry in the next decade.

- It’s far less expensive.

- Transactions are significantly faster.

After its inception, the telephone took 76 years to captivate just half of the U.S. population. The smartphone took about ten years. The internet, after Tim-Berners Lee published the first website on August 6th, 1991, found its footing almost immediately. For Blockchain, it just seems to be a matter of time until the same thing happens. And for naysayers, take a moment to consider what Jim Keyes — the once CEO of Blockbuster — said about Netflix in 2008. “Neither RedBox nor Netflix are even on the radar screen in terms of competition. It’s more Wal-Mart and Apple.”

You know the rest of that story. Of course, we’re not talking about movies on demand. We’re talking about blockchain technology and the banking industry. But it’s worth at least listening to the arguments of how the blockchain technology is going to revolutionize the banking industry before making assumptions. After all, no one wants to end up like Blockbuster.

Blockchain is far less expensive

If banks can spend less money, they will. As with any business, the ROI of the banking industry is a major concern. Especially in recent days. One writer points out that three different forces are pushing on banks, simultaneously raising their costs and lowering their efficiency.

They are:

- An uncertain regulatory environment (which changes every 12 minutes).

- Historically low interest rates.

- Digital disruption.

In fact, as he further mentions, those three forces might cost financial companies around the globe $300 billion by 2021. But it isn’t just a changing environment that costs the banking industry a massive amount of cash. It’s also their dinosaur-like processes for international payments and keeping up with KYC regulations.

Each year, businesses send about $150 to $300 trillion for payment across national borders. Fees for those transactions average around 10%, and the money transfer takes about two to five business days. That’s a lot of paying fees and waiting for money transfers. Similarly discouraging, financial institutions currently spend between $60 million and $500 million just to keep up with KYC regulations.

Of course, those are only a few examples of the time and money challenges that the banking industry faces. But, is blockchain any better? For banks, it might be. For instance, blockchain technology would potentially remove any overhead costs for customer identification. Here’s how a report by PWC puts it:

“Blockchain systems could be far cheaper than existing platforms because they remove an entire layer of overhead dedicated to confirming authenticity. In a distributed ledger system, confirmation is effectively performed by everyone on the network, simultaneously. This so-called ‘consensus’ process reduces the need for existing intermediaries who touch the transaction and extract a toll in the process. In financial services, that includes those who move money, adjudicate contracts, tax transactions, store information and so on.”

And perhaps nowhere is customer identification more critical, expensive, or detrimental if done wrong than in the banking world. After all, if someone breaches your bank information, they have access to your hard-earned cash. So the bank had better do a darn good job of protecting your money.

Strictly discussing blockchain in regards to KYC regulations, an Accenture representative said, "We think identity could be big. We can easily see how you could move [Blockchain] to the massive area of ‘know your client’ and anti-money laundering, where the costs are huge for banks and the costs of messing it up are also huge."

Identity fraud already cost victims over $16 billion in 2017. So it’s not difficult to believe another report that claims blockchain technology could save banks $20 billion every single year in infrastructure costs alone. For most banks, then, the decision is an easy one. Which is why bank spending on blockchain technology is expected to surge to $400 million by 2019. For now, though, banks have their allegiances. It is, of course, far easier to trust a system you’ve worked with for the past twenty years than it is a newcomer piece of technology.

Said another way, banks will need to learn to trust blockchain technology before they start using it and saving millions of dollars annually. That might take some time. But who knows? A decade is plenty of time to build trust — especially when there’s money involved.

Transactions are significantly faster

Imagine that you are shipping oil from Singapore to Malaysia. How long do you think the oil would take to travel from point A to point B? The answer is a single day. Unfortunately, the story is far different if you ask how long the paperwork will take? The answer to that question is about a week. So you can ship in a day, but it takes a week to finish the paperwork. This ‘what if’ scenario neatly illustrates why trade finance is one of the many facets of banking that blockchain technology is ready to disrupt. And with those kinds of wait times, it needs disruption.

“Trade finance is an obvious area for blockchain technology. It is so old it’s done with fax machines and you need a physical stamp on a piece of paper."

— — Charley Cooper, Managing Director, R3

In the words of R3’s Charley Cooper, “Trade finance is an obvious area for blockchain technology. It is so old it’s done with fax machines and you need a physical stamp on a piece of paper." Even for personal banking, wait times on deposits are often wildly frustrating. And since there’s more money on the line in trade finance, that wait is time even more costly.

Blockchain, on the other hand? Well, to test the proof of concept on how fast you can make a cross-country payment using the technology, SAP, ATB Financial, and Ripple collaborated to send the first ever international blockchain payment from Alberta, Canada to ReiseBank in Germany. Here’s the result according to Digitalist Magazine.

“The CAD 1000 (€667 EUR) blockchain payment, which would typically have taken from two to six business days to process was completed in about 20 seconds. The proof of concept has since been enhanced, and we are able to complete the transactions in just 10 seconds.”

So, not only does blockchain technology have the potential to save banks millions of dollars, but it can also drastically speed up the transaction process overseas and locally. For those reasons, 40 massive banks around the world are currently investing huge assets into blockchain. Bank of America is seeking blockchain patents. And Goldman Sachs, JPMorgan Chase, Citibank, and Bank of New York Mellon all created their own cryptocurrency. Those banks are investing for a good reason. Blockchain doesn’t just offer savings. It offers faster transactions. Which means happier customers, lower overhead, and more efficient processes.

Blockchain Transactions – Less expensive and much much faster

Conclusion

It took 76 years for the telephone to captivate consumers, and it took the smartphone ten years. How long until blockchain technology captivates the banking industry? Well, your guess is as good as anyone’s. But you’ll more than likely see banks begin creating their own cryptocurrencies and using blockchain technology for transactions within the next ten years.

If for no other reason than the fact that it will save them money and time. After all, those are the two most convincing reasons to make any change. And the banks that don’t follow suit? Of course, no one can claim to the know the future, but they should probably study up on the fall of Blockbuster before totally opting out of blockchain integration.

Don’t miss out – Find out more today