XTZ Price Analysis: Time to walk the talk

XTZ, the native token of the controversial Tezos blockchain, has entered a new phase on its road to redemption, recently launching its mainnet. Whether its experimental form of blockchain governance and transaction consensus actually works in practice, will now become more apparent — early signs appear to be mixed.

The Tezos (XTZ) story is one the crypto spaces most enduring cautionary tales punctuated by instances of false promises, mishandled investor funds and internal power struggles. Underlying these issues however, is an idiosyncratic blockchain proposal that provides novel alternatives to classic problems like network governance and user engagement.

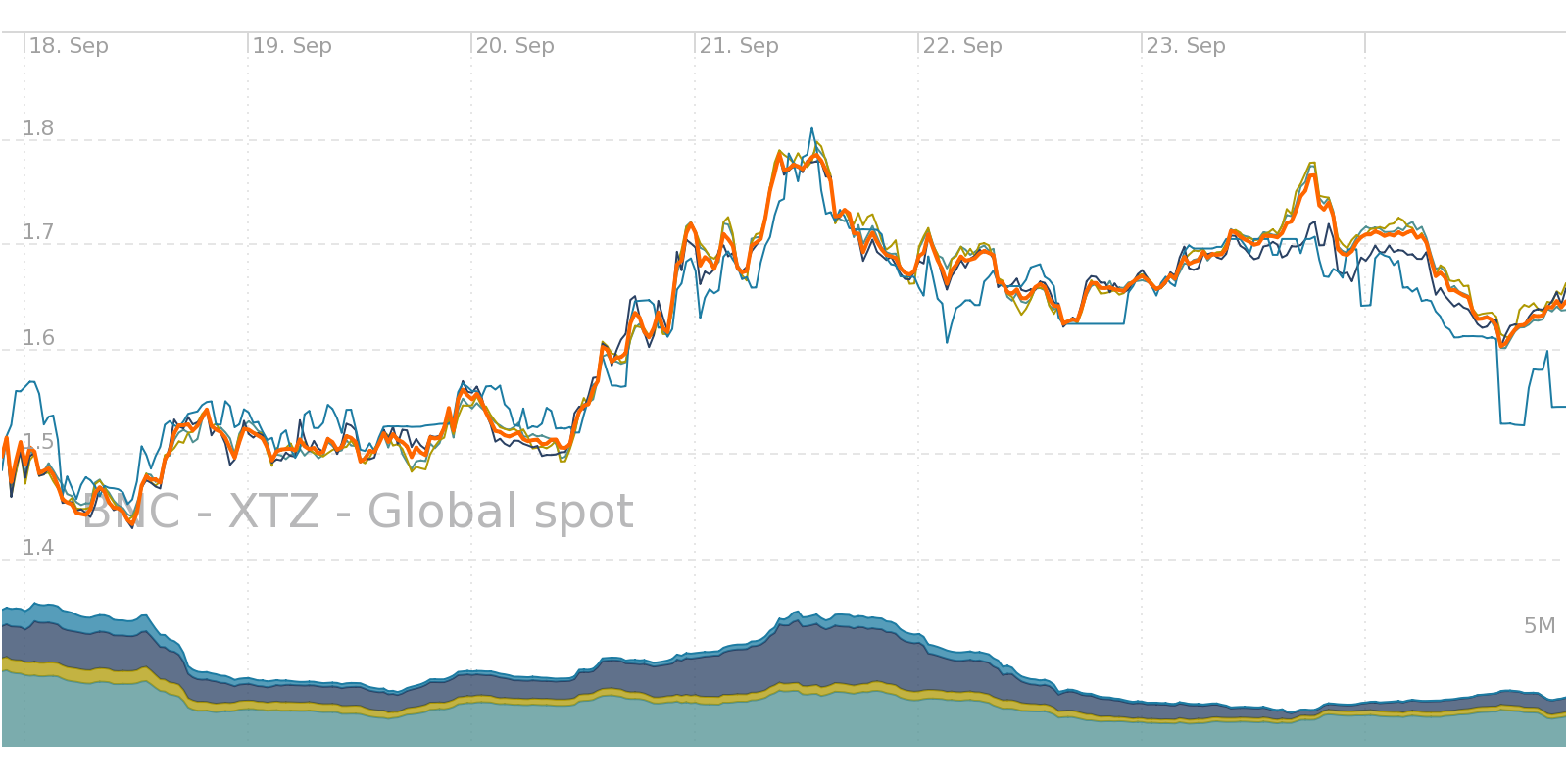

Tezos recently launched its main network, with some fanfare from key influencers within the crypto developer space. The launch coincided with a bullish run for XTZ with the price up ~10% since the 18th of September.

XTZ mainnet launch kicks off a strong week- Orange line represents an index price of XTZ’s most popular pairs, the density charts below indicate volume, with colours representing the respective pairs.

Exchanges and Trading Pairs

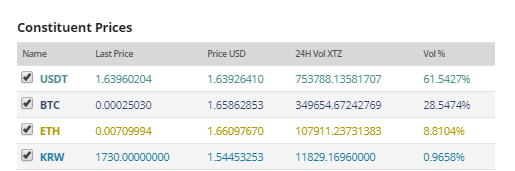

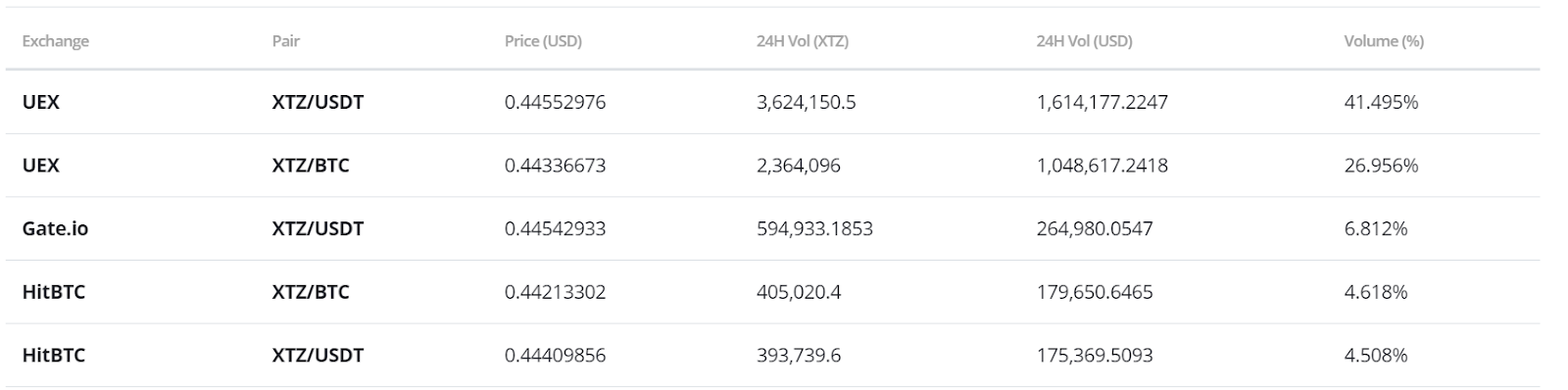

Crypto-to-crypto pairs dominate the XTZ marketplace with the USDT/XTZ, BTC/XTZ, ETH/XTZ pairs making up over 99% of trading volume and worth close to $2 million daily. There are fiat on-ramps available for XTZ with Coinone offering a KRW/XTZ pair, and Gatecoin offering EUR/XTZ and USD/XTZ pairs, however, these markets appear relatively inactive/illiquid meaning there may be some price slippage when trading them.

The HitBTC and Gate.io exchanges dominate the external trading marketplace for XTZ,making up over 95% of daily trading. Interestingly,XTZ on Gate.io appears to be significantly cheaper than HitBTC for exactly the same pairs, potentially offering an opportunity for a spread trade. But traders be warned, Gate.io offers a relatively expensive 0.2% trading fee and also charges for withdrawing funds from the exchange.

The Tezos experiment

The Tezos blockchain has the unique value proposition of being the first self-amending blockchain. Tezos is being programmed using the Ocaml language, and at a basic level appears very similar to the Ethereum network.

They both offer Turing complete smart contract languages which allow for programmable loops. Ethereum prevents infinite loops using the gas system; while Tezo limits the number of steps a compuation can use, however, smart contracts within Tezos can call other smart contracts within the ecosystem, meaning this limit can be extended. XTZ, like ETH, is used for powering computations.

Where Tezos differentiates itself, is given that it is programmed in a functional language, its protocol can be changed directly by stakeholders.

Changes are verified within the protocol itself, as opposed to the informal governance style used by major networks like Ethereum and Bitcoin.

In these old skool networks, key developers direct & discuss network updates and protocol changes using specific online platforms like Reddit and Github, making it challenging for the everyday network participant to become involved and influence network governance.

What the Tezos blockchain offers in theory, is decentralized governance via an immutable blockchain that directly bakes protocol decision making and updating into the network’s core program, circumventing elements of bureaucracy and internal politics.

However, this style of solution is challenging to deliver, and Tezos has complex consensus economics that helps to facilitate onchain governance.

Network topology

There can be a maximum of 10 billion XTZ in existence, 608 million were distributed and circulated when the Genesis block was issued in June 2018 with the remaining XTZ being released to governance participants at an inflation rate expected to be around 5%.

This is a another unique characteristic of the Tezos model, staking your tokens to become a delegate, or delegating your tokens to a delegate, means your XTZ holdings grow with inflation at a ~5% rate, otherwise they become diluted.

Not staking doesn’t mean losing your tokens, or missing out on profits because of external market driven price movements, but it does mean losing out on these passive returns. This means an incentive is created for all holders to participate in network decision making.

‘Participation’ comes in a number of different forms on the Tezos network. Delegates are Tezos accounts assigned the responsibility of managing a node and handling protocol amendments, software updates & patches.

They pay a bond as security, and need to own at least 10,000 XTZ to become a delegate or baker (making Tezos a PoS network). They also charge network users for their services as network amenders and block producers.

If a user cannot afford the bond, or are not technically inclined, they can delegate their XTZ to a delegation service, a network operation in itself, and still receive the inflation benefit. The users retain the right to their tokens during delegation, and value is added to a delegates pool.

Protocol amendments are adopted over election cycles every 131,072 blocks, or approximately every three months. If 80% of the delegate quorum votes to approve the proposal, it is implemented into the code of the network.

Delegates need to become bakers first, bakers are the network’s block producers, and are randomly assigned to the Tezos network to mine on it and verify transactions. A group of 32 randomly selected nodes become endorsers, and vote on the validity of blocks. Bakers provide a bond, like delegates, which is lost if they attempt any malicious activity (i.e.publishing empty blocks).

Block rewards are dependent on inflation rate, which relies on the number of tokens staked, while Endorsers receive 2 XTZ per block they endorse.

The Tezos blockchain model has a number of interesting implications. Because governance decisions have real monetary stakes (because of the bond and the minimum required investment), network developers have to carefully consider the implications of their decisions given their accountability thanks to blockchain transparency, and the fiduciary responsibility they owe to users who delegate their tokens to them.

The average XTZ holder is not likely to actively participate in network governance but will assign this right to a delegation service. Questions arise as to whether they know, or care, about the network amendments their chosen delegate is working towards, or are simply delegating out of a desire to receive inflation rewards.

Blockchain software is also complicated. Do delegates have a responsibility to educate delegators on the nature of decisions being made using their stakes, given the responsibility and financial rewards they are entitled to, and if so, how should this responsibility be enforced?

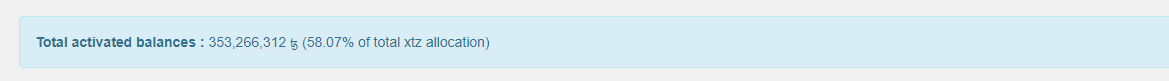

This in mind, currently 353,350,212 XTZ, or ~58% of the total in circulation, has been activated by public users for delegation. While this is significant growth from the estimated ~200 million tokens staked in July 27th, this still means that either; close to 40% of holders don’t understand that their tokens will be diluted if not staked, or that these XTZ holders are unwilling to assign proxy voting right responsibility to a delegate from the approved list provided by Tezos.

Another surprising metric is that apparently active user addresses has fallen, from the 32,000 accounts operating during the Genesis block, to ~26,000.

A drop of close to 20%, implying that possibly, a number of early investors/buyers may have quickly lost faith in Tezos due to the botched ICO fund management and related dramas.

However, given that activated tokens have risen over the same period, the remaining holders on the Tezos chain are likely more invested in its future.

Governance considerations

As Tezos enters its main network era, how delegates, bakers, activators, and users deal with initial network governance discussions will be interesting to see.

It is unlikely that Tezos will deliver on the idea of becoming a utopian decentralized democratic digital economy. The large volume of unstaked tokens and proxy voting system created by high network participation costs, indicate that the majority of single users don’t care, or are unable to participate in network governance because of cost and information obstacles.

Many have already compared Tezos’s political economy as designed to generate a cartel style, banana republic, with a small group of bakers and delegates controlling network governance and block rewards, making decisions on behalf of less powerful users.

Despite these issues, Tezos offers, and encourages, far more engagement from users than a number of blockchain investment alternatives, and the protocol amendments allow the network to update and adapt if the current model creates power imbalances within the network

Onchain observations

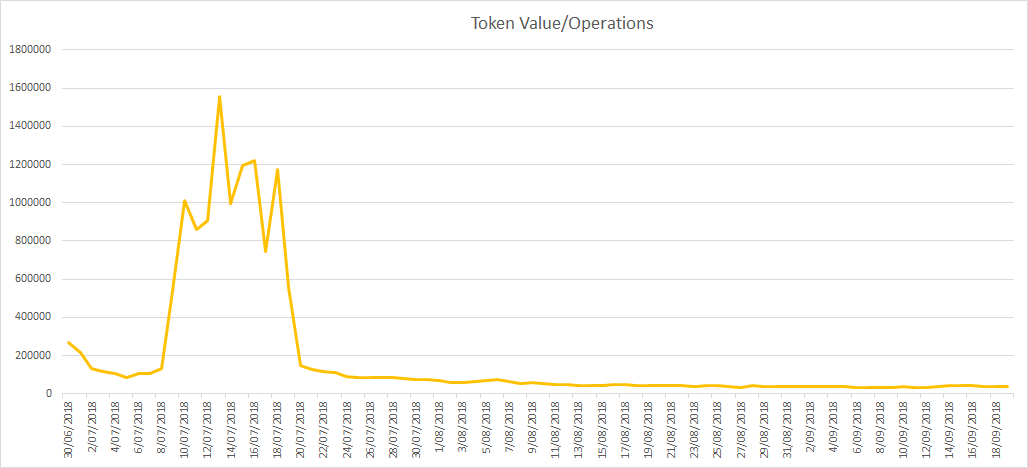

The NVT signal, Network value(market cap)/On-chain transactions, developed by blockchain researchers Dmitry Kalichkin and Willy Woo, operates in a similar way to the price-equity ratio in traditional finance, and essentially gives a raw signal to indicate if a digital asset is over or undervalued, based on ochain activity.

A high NVT indicates that a token’s market value, is not indicative of fundamental network performance & activity, but is more likely based on other unobservable factors such as wider market conditions, speculative assessment and marketing.

The majority of available Onchain transaction data is based on the alphanet and betanet stages of the Tezos blockchain, meaning transactions for these periods were restricted, additionally Tezos is available on very few third party exchanges — meaning options to access XTZ are limited. For this reason operations per days (compilation of individual activations, endorsements, transactions, collected from tzscan.io) has been used as a proxy to better reflect the current state of the network.

Another consideration is that XTZ likely has some ‘ideological’ value, not reflected by onchain activity, baked into its price, because of the unique, onchain approach it takes to blockchain governance. This may mean that it will always have a comparatively high token value versus its onchain activity/performance proxy.

The pattern for XTZ’s market value vs onchain operations can be considered a positive sign. The falling ratio, indicated by the dipping orange line in figure 1, evidences that XTZ’s value has become more reflective of its on chain operations over time.

This is likely associated with a growing rate of operations since the release of Tezos’s alphanet, betanet and mainnet. It is indicative that the asset is maturing and that its value is not based primarily on speculation and has a fundamental network to back it up, on which users are publishing blocks, achieving consensus and activating their token for network governance.

Figure 1: Token Value/Operations per day on the Tezos network, this ratio has fallen significantly over the last few months

Operations growing against token value this significantly is a positive sign that XTZ is maturing as an asset, and is beginning to deliver on its whitepaper promises.

Technical analysis

Long Term Trends

Since trading initiated back in 2017, the price of Tezos has been volatile, topping out at ~$11, and now trading near $1.33. On the 30 minute chart, the strong bear trend continues to exist with a negative linear price trend, including a Pearson R coefficient between time and price of 0.57.

Also, further bearish confirmation can be found via the volume flow indicator (VFI), which has consistently remained beneath 0, despite a few brief attempts to break above 0 (black circle). The VFI interpretation is: a value above 0 is bullish and below 0 is bearish, with divergences between price and oscillator being high probability signals.

However, there are a few points of positive. First, XTZ’s current price level is beneath the long term mean, which will revert towards that level over time (mean reversion). Second, historical volatility is nearing a low range, i.e. 10 and below (black box). These two indicators may indicate a temporary price reprieve for XTZ back towards $1.40 to $1.60 is likely; before succumbing to the overall bearish trend once again.

Ichimoku Clouds with Relative Strength Index (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 30 minute time frame with singled settings (10/30/60/30) for quicker signals is bearish; price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and touching price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

XTZ is currently sitting at ~$1.33 and attempting a Kumo breakout. The RSI has recently dipped downward and currently sits at 43. If price can enter the Cloud with momentum, it has an increased probability (medium) of completing a Kumo breakout given RSI is not near overbought territory of 70, price currently beneath long term mean (mean reversion), and historical volatility near low levels of 10. The support levels for price are $1.25, $1, and $0.75, while price targets for a successful Kumo breakout (breaking above $1.36) are $1.40, $1.46, and $1.50.

The status of the current Cloud metrics on the 30 minute time frame with doubled settings (20/60/120/30) for more accurate signals is bearish; price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and touching price.

As mentioned, XTZ is currently sitting at ~$1.33 and attempting a Kumo breakout, which has a medium probability of success. In the event of a successful Kumo breakout, price will need to breach $1.38 with price targets of $1.40, $1.47, and $1.52.

Conclusions

Tezos has had a bumpy road from ICO raise to main network launch. Besides the internal financial and political issues that have plagued the project, there are questions surrounding the nature of decentralized governance Tezos employs. With a proxy voting system and high participation costs, Tezos is not a utopian democracy, so how much value it will add to the market remains to be seen.

However, with the ability to implement protocol amendments fluidly, and a fully functioning, growing blockchain now underlying the XTZ token, the asset retains its uniqueness and potential to disrupt within the blockchain space.

As Tezos begins to host Dapps and projects on top of its blockchain, the number and volume of transactions and operations on the network should grow. However, the bearishness surrounding Ethereum, and Dapp and ICO ecosystems in general, may affect Tezos’s ability to grow onchain activity in the near future.

The long term technicals for XTZ are firmly bearish and shown few signs of abating. However, short term technicals indicate that a near-term price reprieve is likely, with price targets between $1.40 to $1.60 on the table. However, both, the prudent short term trader (10/30/60/30) and longer term trader (20/60/120/30), on the 30 minute chart, will await a positive TK cross and Kumo breakout above $1.36 and $1.38, respectively, before entering a long position.

Both trader’s support levels are $1.25, $1, and $0.75. Additionally, the (10/30/60/30) trader’s price targets are $1.40, $1.46, and $1.50, and the (20/60/120/30) price targets are $1.40, $1.47, and $1.52.

Don’t miss out – Find out more today