Yearn Finance Price Analysis – New services released as DeFi yields cool

Yearn Finance has quickly expanded its services over the past 120 days, just as DeFi yields have begun to cool across the board. With many copycat protocols quickly being spun up in recent days, the project will likely maintain a first-mover advantage in the months to come.

Yearn.Finance (YFI) is a decentralized finance (DeFi) platform with a native governance token used for voting rights and staking rewards to holders. The network is underpinned by the Yearn protocol, a yield optimizer which aims to maximize yields for a user’s crypto holdings by automatically switching funds across a range of lending protocols.

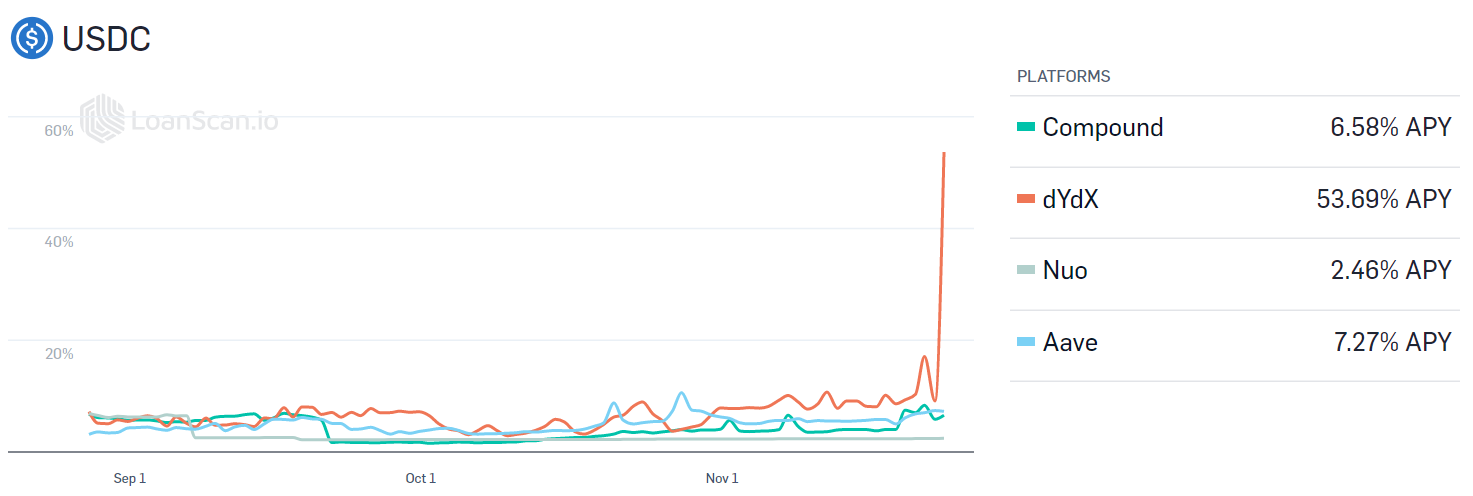

Developer Andre Cronje built the protocol in early 2020 after looking for a way to automate the process of finding the highest possible yields on his stablecoin holdings. Stablecoins like DAI (DAI), Tether (USDT), USD-Coin (USDC) can be deposited in return for yields on a number of platforms like Compound, Aave, Fulcrum, or dYdX, with each offering unique APY’s.

Source: LoanScan

Source: LoanScan

Source: LoanScan

The protocol works by creating pools for each individual asset. When a user deposits stablecoins into one of these pools, they receive yTokens which are yield-bearing equivalents of the deposited coin. If for example, a user deposits DAI into the protocol it will issue back yDAI.

Assets are automatically shifted between lending platforms in the DeFi ecosystem, like Compound and Aave, where interest rates for deposited assets change dynamically. Every time a new user deposits assets into a pool on Yearn, the protocol checks whether there are opportunities for higher yield and rebalances the entire pool if necessary. At any time, a user can burn yTokens and withdraw the initial deposits and accrued interest in the form of the original deposit asset.

The protocol has evolved to offer more complex solutions that can efficiently maximize yields on user deposits. The yCRV liquidity pool built by Yearn on the Curve finance platform contains the following yTokens: yDAI, yUSDC, yUSDT, yTUSD and pays back a yCRV token that represents the index. Users can deposit any of the four native stablecoins into the pool and earn interest back from yield-bearing yCRV tokens. Depositors also earn trading fees from Curve for providing liquidity to other users of the platform.

The Yearn.Finance solution also aggregates rewards from yield farming programs, allowing users to earn native tokens like COMP, by offering liquidity provision services to other platforms. To capture this new value, Yearn launched yVaults as part of Yean.finance V2 launch in late July. Vaults are pools of funds that have an associated strategy designed to maximize returns on DeFi asset pools. Beyond just moving assets between lending platforms, vaults perform multiple operations to maximize returns on deposits – like farming native coins and selling them for profits, providing liquidity to earn a share of platform fees, and using pooled funds as collateral to borrow stablecoins. Each vault follows a strategy decided by the Yearn community.

Alongside the core yield aggregator services, Yearn.Finance has also built, and is building, a range of complementary DeFi products for its ecosystem, including:

- Yswap, an automated market-maker (AMM) that allows users to deposit single-sided liquidity – an alternative to the 50/50 deposit model offered by platforms like Uniswap, designed to reduce impermanent loss.

- yTrade, a leveraged stablecoin exchange which enables users to borrow stablecoins with other stablecoins up to 1000x leverage. Traders earn by betting on whether a particular stablecoin will move away from it’s one dollar peg.

- yInsure, a prototype for tokenized decentralized insurance that allows users to make claims and earn a share of community insurance payments by staking stablecoins.

The total value of assets locked (TVL) in YFI is currently US$436 million, down from the August all-time high of nearly US$1 billion. A falling TVL with rising Bitcoin (BTC) and Ethereum (ETH) prices suggests waning market sentiment in YFI yield strategies.

Source: defipulse

The Yearn.Finance governance token, YFI, was first issued as a reward for liquidity providers (LPs) using the Yearn.Finance protocol. When Cronje first launched the token he stated, “in further efforts to give up this control (mostly because we are lazy and don’t want to do it), we have released YFI, a completely valueless 0 supply token. We re-iterate, it has 0 financial value.” Despite Cronje’s disclaimer that the tokens were worthless, users rushed to pour money into the incentivized liquidity pools assigned for earning YFI.

A 9-day long YFI token distribution started with 10,000 tokens allocated to the liquidity providers of the yCRV pool. The LPs had to stake their yCRV LP tokens to receive YFI rewards. Shortly after yCRV distributions, two more pools to earn tokens on the Balancer asset management platform were added, each offering 10,000 tokens to liquidity providers, ending up with a total of 30,000 YFI tokens.

The YFI price is currently US$25,000 and has been wildly volatile over the past few months, which is partially related to the lack of available tokens and partially related to the fever of listings on various exchanges. YFI reached an all-time high of US$42,000 on September 13th. The 30,000 YFI tokens in circulation have now been capped after an on-chain vote favored the permanent cap. While YFI can no longer be earned through liquidity minting, the asset is now tradeable on major centralized exchanges including Binance and Coinbase as well as decentralized platforms like Uniswap.

YFI holders can stake their tokens to a Yearn.Finance governance contract and earn a share of ecosystem rewards which are derived from;

- Yearn.Finance interest

- COMP from compound

- CRV from curve.fi

- curve.fi/y trading fees

- ytrade.finance leverage fees and liquidation bonuses

- yswap.exchange underlying system fees

- yliquidate.finance liquidation bonuses

- system dust (unassigned interest or fees)

These fees are collected on a daily/weekly basis and YFI holders can claim their share of rewards by burning their YFI tokens. Cronje explained, “as the system AUM and usage grow, so do the fees, and respectively the rewards pool.”

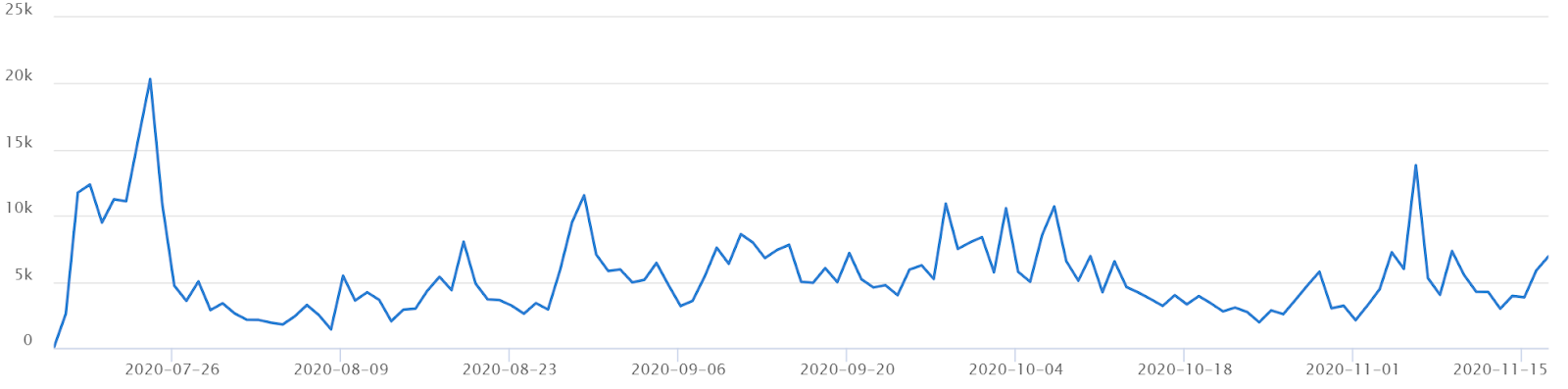

The YFI rich list shows relatively few addresses holding a majority of the available coins with Binance, Huobi, and OKEx holding nearly 25% of the supply. On-chain stats revealing declining transactions per day (top) and declining average transaction values (bottom) over the past few weeks.

Source: Xangle

Source: Xangle – transactions per day

Source: Xangle – average transaction values

On the development side, nearly 50 developers have contributed hundreds of commits across 37 GitHub repos over the past several months. Most coins use the developer community of Github where files are saved in folders called “repositories,” or “repos,” and changes to these files are recorded with “commits,” which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

YIP-55, a formalization process to standardize the Yearn Improvement Proposal (YIP) introduction, voting, and implementation, which governs the YFI protocol, was recently voted on and approved. This YIP will be used to define and formalize the process in order for proposals to be valid and binding, and reduce any confusion in the YIP introduction and voting process.

Source: GitHub – iearn-finance/iearn-finance

Source: GitHub – iearn-finance/ygov-finance

Source: GitHub – iearn-finance/yearn-protocol

Source: GitHub – iearn-finance/YIPS

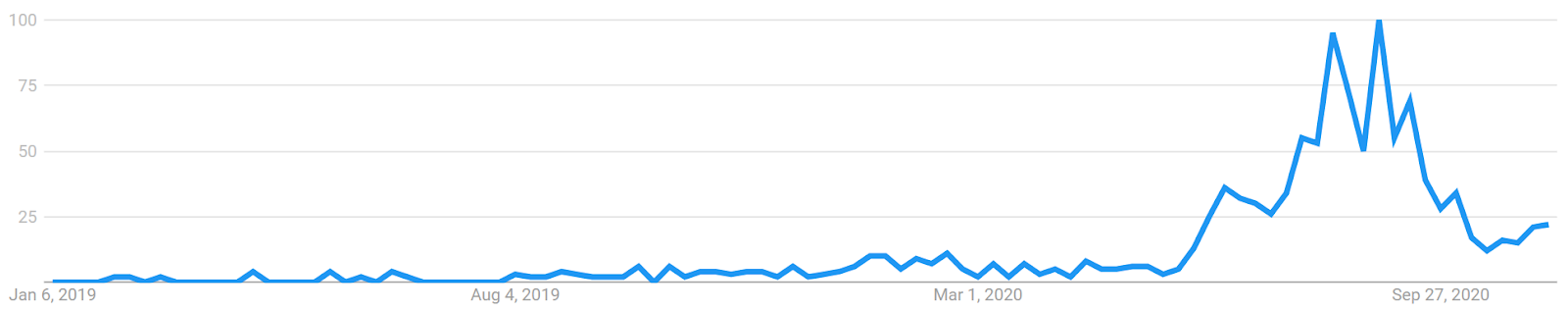

Worldwide Google Trends data for the terms “Defi Crypto” and “Yield Farming” increased massively earlier this year but have declined substantially in recent weeks. A 2015 study found a strong correlation between the Google Trends data and BTC price, while a May 2017 study concluded that when the U.S. Google “Bitcoin” searches increased dramatically, BTC price dropped.

Source: Google Trends – “Defi Crypto”

Source: Google Trends – “Yield Farming”

## Technical Analysis

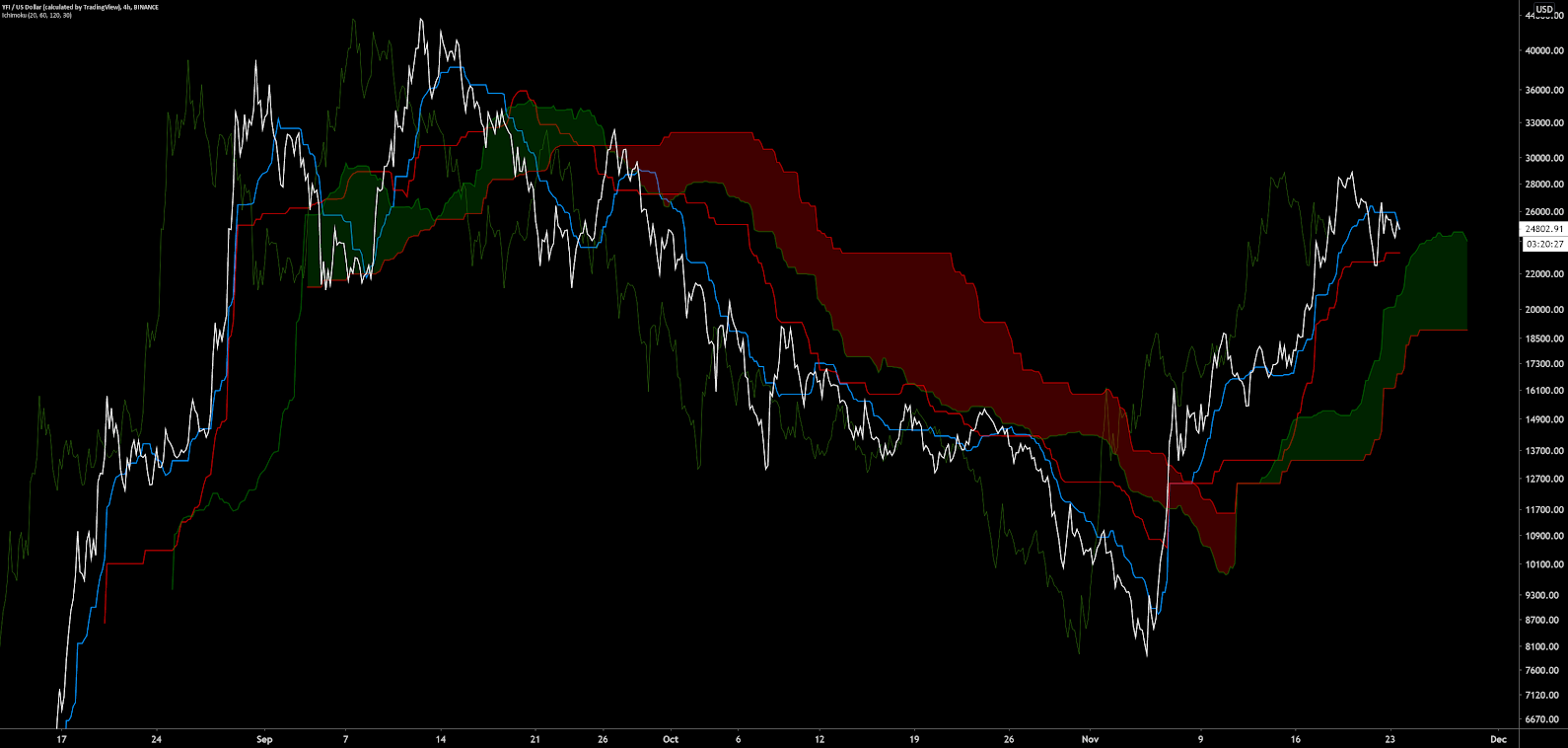

As a potential bearish trend resumes, roadmaps for future market movements can be found on high timeframes using Exponential Moving Averages, Volume Profile Visible Range, Pivot Points, Ichimoku Cloud, and divergences. Further background information on the technical analysis discussed below can be found here.

YFI has a limited trading history and needs to be analyzed on lower timeframes, as opposed to the daily chart. On the four-hour timeframe, the 50-period Exponential Moving Average (EMA) and 200-period EMA crossed bullish on November 13th, which has resulted in a 75% increase thus far.

The current spot price also sits above a high volume area at US$22,000 according to Volume Profile Visible Range (VPVR) and a monthly support pivot. If this horizontal support fails, the next significant support sits at US$13,000 to US$16,000 based on monthly pivots and VPVR.

The spot price has also formed a series of bearish chart patterns since the all-time high was established; including a head and shoulders and descending triangle. Both patterns have reached projected targets with price now experiencing a definitive trend reversal without the appearance of further bearish consolidation patterns. There are currently no bullish or bearish divergences on volume or RSI. With RSI at 50, momentum is neutral.

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the four-hour timeframe, with doubled settings (20/60/120/30) for more accurate signals, are bearish; the spot price is above the Cloud, the Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and above the current spot price. The trend will remain bullish so long as the spot price remains above the Cloud, currently at US$23,000.

Conclusion

The Yearn.Finance platform stormed into the DeFi community’s box of tools earlier this year, furthering and improving upon yield farming through automation and efficiency. The YFI token also saw dramatic early success, despite founder Andre Cronje stating the token should have no value whatsoever.

YFI has quickly expanded its services over the past 120 days, just as DeFi yields have begun to cool across the board. With many copycat protocols quickly being spun up in recent days, YFI will likely maintain a first-mover advantage in the months to come.

Technicals for the YFI token are neutral to bullish, after a significant rejection of the sub US$20,000 lows. Trend metrics show price above the 33-day EMA and four-hour Cloud. If the spot price dips into the Cloud, a bullish Kumo breakout and bullish TK cross will need to occur for an additional long entry signal in the future. Otherwise, strong support stands at US$13,000 to US$16,000 based on monthly pivots and VPVR.

Don’t miss out – Find out more today