A new stable coin offers 133 million reasons for an algorithmic central bank

Last week, a consortium of high profile investors piled $133 million dollars into Basis (previously basecoin), a stable coin startup and ICO project. This news is impressive because of the amount of money raised, caliber of investors, and their protocol leveraging an algorithmic token issuance process to ensure price stability.

The objective of the Basis project is to create a token that has a reasonably stable value and which would be used to facilitate exchange between users. Price stability for the token would follow a series of processes which are controlled by an algorithm. Basically, the method revolves around controlling the amount of tokens in circulation, based on set instructions that are determined by the price of the token or peg. Thus, just as the central banks would expand or contract the money supply based on inflation or deflation rates, the Basis protocol is expected to do same, but on a decentralized algorithmic platform. Hence, the reason why it is referred to as an “algorithmic central bank.” The protocol’s initial target customers would be citizens from developing nations with historically poor fiscal and monetary policy track records, plus cryptocurrency holders looking for a reprieve from the volatility.

Should we get rid of humans from monetary policy?

The Basis protocol seemingly asks an interesting question. Should we remove humans from monetary policy decisions? After all, it is becoming indisputably obvious that computer algorithms are better than humans, when it comes to implementing the best decisions. This dynamic has played out in chess, go, stock trading, and driverless cars, to name a few. Furthermore, economic participants understand that the global economy goes “off the rails” periodically, which one could attribute to human error.

For example, the Federal Reserve maintained a low interest policy after the DotCom crash and 9/11 attacks, which provided fuel to the Subprime Housing Bubble, which in turn lead to the Global Financial Crisis in 2008.

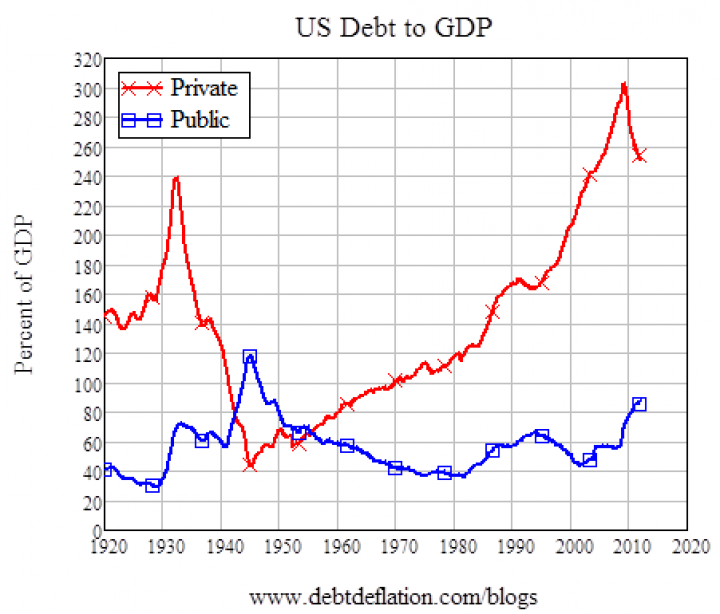

Everything is “20/20” in hindsight, so we are not drawing any irrefutable causal relationship between the aforementioned economic links, but rather illustrating a correlation that we know was governed and probably exacerbated by human error and emotion. For this reason, algorithmic monetary systems may actually prevent economic crises from occurring. Economist Steve Keen has demonstrated ad nauseam that excessive private debt growth is the key ingredient to debt-deflationary depressions, which we know can be initiated by human error such as a persistently low interest rate policy. To further illustrate, two examples below articulate the strong correlation between private debt and economic growth.

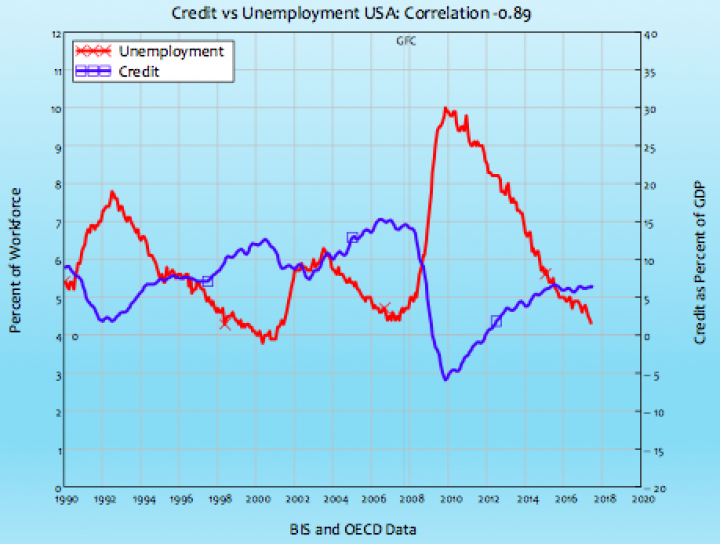

The first chart shows the high correlation between credit growth and unemployment in the U.S. since 1990.

The second chart shows private debt as percentage of GDP peaking before the Financial Crisis of 2008, which even eclipsed the private debt to GDP peak before the Great Depression.

Now, imagine an algorithmic monetary system that automatically adjusts the monetary base or interest rates to levels that better match aggregate demand in the macroeconomy, thus promoting financial stability and economic growth.

Conclusion

I believe that the world’s “majority,” who live in unstable currency regimes will be the engine that determines the success or failure of stable coin projects like Basis and whether “algorithmic monetary policy” grows in popularity around the world. Undoubtedly, powerful monetary regimes like the $USD (FED), €EUR (ECB), £GBP (BOE), and ¥JPY (BOJ) will attempt to stave off these notions, so we won’t pretend to make any predictions. But, I think given the track record of human policy-makers, we should at least explore and conduct further due diligence on the topic.

DOWNLOAD FREE REPORT

STABLECOINS: Mitigating Capital Risks in Crypto

With many new entrants, the stablecoin market is currently in an exploratory phase, with no single stability mechanism available that satisfies all the requirements of potential stakeholders. Download this groundbreaking Techemy Capital report now to access compelling new insights into this critical sector and its likely long term evolution.

Don’t miss out – Find out more today