Toward more equitable token sale structures

At an accelerating pace, blockchain projects have been raising money to impressive levels by offering their digital assets to a global market of token sale investors. Earlier this year, DFINITY sold $3.9M worth of pre-seed assets in just 24 hours. A few days later, Melonport’s “contribution period” sold out over $2.9M worth of MLN tokens in just under 3 minutes. In 2017, many more companies and projects are gearing up to raise capital through this new methodology of decentralized crowdfunding.

At an accelerating pace, blockchain projects have been raising money to impressive levels by offering their digital assets to a global market of token sale investors. Earlier this year, DFINITY sold $3.9M worth of pre-seed assets in just 24 hours. A few days later, Melonport’s “contribution period” sold out over $2.9M worth of MLN tokens in just under 3 minutes. In 2017, many more companies and projects are gearing up to raise capital through this new methodology of decentralized crowdfunding.

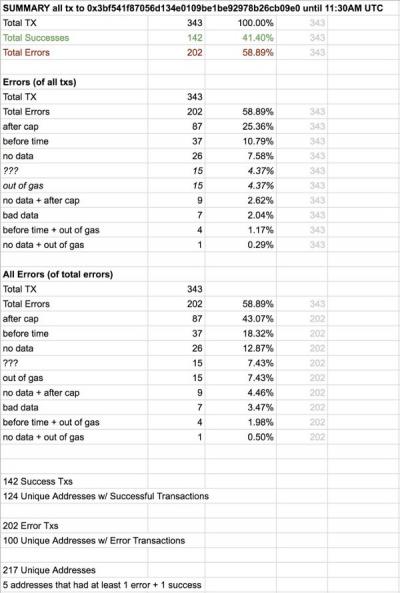

Courtesy of Taylor Van Orden/MyEtherWallet.com

However, the structure of token sales has direct impact on the experience of investors, the distribution of stakeholders, and the resulting valuations of projects. The first-come first-serve frenzy of Melonport’s crowdfunding has resulted in a distribution to less than 150 Ethereum addresses with an average buy-in of over $15,000 — both numbers being extremes in recent crowdsale statistics. WeTrust, a community lending platform which aims at underbanked markets, would also benefit from distributing tokens equitably among participants whose individual buy-in power is relatively small.

What are the current trends in token sale structures and how can we improve equitable access?

Trends in allocation structure

The valuation of digital platform assets is more quantitative than traditional technology startup valuations because the digital assets usually have an unambiguous market price. The market capitalization provides a reference to valuation by multiplying the total asset supply with that price.

At token sale time, critical structural decisions revolve around the following questions: (1) What is the ratio between the supply offered at sale time and the supply preallocated to the product team? (2) How do teams create a token distribution that is most advantageous for their project?

Historically, large “premines” — that is, large preallocations of the supply under control of the team — resulted in lopsided incentives and have left a bitter aftertaste with sale participants. The team’s ability to flood the market has been viewed by investors as a threat to price action. Looking at the economics and history of LBRY’s asset, we see a combination of relatively high inflation and outsized team preallocation translate into downward price pressure. And although CEO Jeremy Kauffman doesn’t mind, there are clear lessons to be extracted regarding what might be termed “investor experience” — namely, that preventable crash prone cryptoeconomics are best avoided. (Another such lesson could be argued in the case of Steem’s initial highly inflationary economics, but without the premine.)

Consequently, as a percentage of total supply, team preallocations have been trending down. Unlike many a currency project before it, Ethereum reserved around 12%. In November, Arcade City set their preallocation at 16%. Most teams in recent history have landed somewhere in the 10–20% range. While lower rates of preallocation align incentives and assuage investors, what are the consequences of these minority preallocations?

Team allocation models

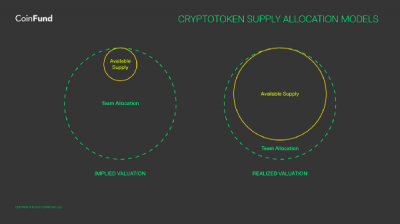

There are two mathematically but not psychologically equivalent ways to arrive at a project’s market cap.

In a “realized valuation” model, the team allocation is a minority of the supply, and the valuation of the project is actually backed by real funds at risk. In this case, the majority of the project is owned by investors, which supports correct incentives and creates a community of stakeholders highly incentivized to support, promote, and beta test the product.

The downside of this approach is that it has little precedent in the “real world” of startup equity. In particular, unless the team makes specific accommodations at the inception of the project, it is difficult or impossible to do multiple funding rounds in the future — an ability traditional companies actively make use of in order to back growth. In certain industries, such as ridesharing, the ability to sustain tactical financings in concert with growth might be key success criteria.

In the “implied valuation” model, the team strives to sell as little equity as possible while the market helps to valuate it. Startups tend to sell 15–25% of their equity in traditional seed rounds, and by analogy, token sales of this type strive to preserve a higher level of ownership for the team.

(1) The “implied valuation” model is more analogous to traditional startup equity, and enables multi-round financing, but large preallocations tend to scare cryptoinvestors. (2) The “realized valuation” model is more prevalent, but leaves little for the team’s future financing and speculative business model.

In this model, the market capitalization of the asset is not realized, but implied, by the smaller available supply (or, “float”) offered at sale. Not only does this model enable multiple funding rounds, it seems to encourage smaller, more reasonable sales which better control for investor risk — all without discouraging future growth.

The downside is that large preallocations may need to be secured in smart contracts or DAOs to ensure good behavior of a public project. This is an imperative that complicates capital custody and is often disadvantageous for very agile projects. Teams might find it more difficult to convince their DAO investors that development delays are routine costs of doing business, or that the project should pivot into a different roadmap. That said, the underlying technology to do this is becoming more accessible: see, for example, the VestedToken contract from the Zeppelin team, or various DAO funding platforms, such as EtherCamp.

Token sale caps

If you are a founder running a responsible token sale, chances are your sale should be capped. Not only do caps encourage better investor relations by limiting risk and discouraging wasteful and dangerous over-funding, they force founders to think in terms of multiple raises, controlled growth, frugality, and success criteria at different stages of the project. This is healthy.

Serenity Now. Five million dollars will probably be enough.

Unless founders can show that their business model scales with capital out of the box and millions of mainstream users are ready to buy their product, their sale should be capped and the cap should reflect reasonable, planned capital expenditures and realistic expectations. (One important exception are non-profit organizations, where the company may be able to quickly and responsibly deploy as much capital as can be collected.)

Yet, capped sales for in-demand projects have eroded some of the value proposition of global access to digital asset investments and encouraged more and more “ICO arbitrage” business models — an irony for a technology space which promises to dissolve agency problems and middlemen. As a broad guideline, inclusivity and the network effects it brings, should benefit all projects and thus should be a major consideration for all token sales.

Caps create sub-optimal stakeholder distribution

The core issue with hard caps is that they tend to create undesirable “stakeholder distribution” — the general measure of the size of your investor pool and their average individual risk. For open source and open community projects, founders will benefit from a wider distribution of ownership with lower average stake versus one which is more centralized and high stake. As I wrote previously, wider community-owned token distributions create stronger network effects which grow faster and are highly desirable for projects with challenging adoption problems (that is to say, all of blockchain).

Hard caps prevent these desirable distributions, however.

In the majority of token sales to date, high-stake buyers can purchase the supply faster than low-stake buyers. Hard caps on popular projects create first-come first-serve competitions where “minnows” are racing “whales” before they eat up the supply and lock them out of the sale. Because most sales do not require identity verification, even a per-transaction cap does not prevent whales from using Sybil strategies to take the entire supply, if they so desired.

As larger brokers have become fond of swiping supplies just to redistribute them at a premium the following day, does this behavior herald the end of the open crowdsale days? Not if we establish good practices for equitable participation. The following basic ideas are meant to start a conversation about how this may be implemented.

A thoughput-limited capped sale

One simple solution is for the token sale to instrument a reasonable per-transaction cap coupled with a maximum contribution that will be honored per block (or every n blocks). In this way, an “attacker” who wishes to swipe the supply finds that stake can be accumulated only as fast as everyone else; their ability to create multiple addresses or transactions doesn’t confer an edge in accumulation.

As a simple example, suppose your team would like to cap the sale at $6M and raise for 30 days (and the block time is 20 seconds). Set a maximum buy-in transaction cap of $2,000 and a contribution of $10,000 every 216 block window: transactions can be lower, but anything higher will be refunded. This means that the sale can raise at most $200,000 per day for 30 days and no single individual can buy more than $10,000 worth of stake every 72 minutes; now large buyers will have to compete on network latency, which is not well-defined and hard to control.

There is a tradeoff here in terms of convenience for buyers, but considering that most sales in recent memory had median buy-ins in the $2,000–5,000 range, this covers the vast majority of buyers with just a few transactions. Still, this method creates high friction for large buyers which should be taken into consideration.

A capped sale with a guaranteed participation

A simple mathematical scheme can go a long way to guarantee stake to every single participantwithin a capped token sale structure.

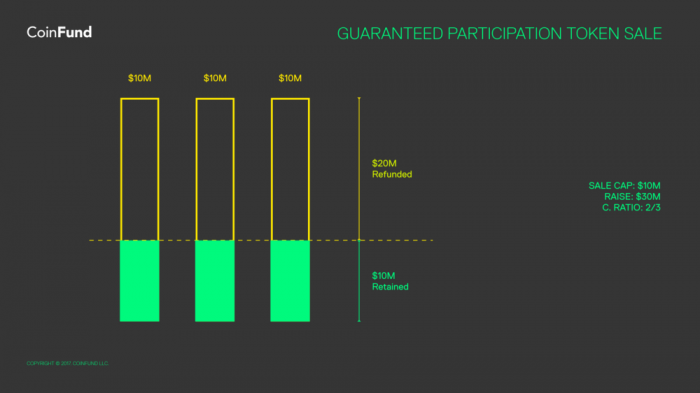

The tradeoff is that everyone who proffers a sale buy-in transaction is guaranteed stake, but is not guaranteed absolute size: if the sale goes over the cap, everyone is refunded some portion of their buy-in amount to accommodate everyone else.

The key metric for this scheme is the capitalization ratio, which we use to determine the refund. We define it as:

The capitalization ratio, a simple measure of the sale raise in relation to the sale cap.

If you execute a sale with a $10M cap and raise $9M, your capitalization ratio is negative: you didn’t hit your cap, and you would have needed to raise another 1–10/9 = -11.11% more than you did in order to hit it. Similarly, if you intend to raise $10M, but you end up raising $30M, your capitalization ratio is 1–10/30 = 66.66%, meaning that 2/3 of your raise is beyond what you intended with your cap.

In our proposed structure, we allow anyone to send as much money to the sale as they wish. When the sale is completed, the capitalization ratio is calculated. If the raise exceeds the cap, each participant is refunded the excess. In this scheme, everyone is guaranteed a place in the sale, no one participant can steal the entire supply, and the cap is fully respected.

Finally, there are a number of optimizations that can make this structure even more robust, including giving priority to smaller transactions, per-wallet entry fees or bonds to discourage multi-wallet attacks, and even burning or locking excess capital to prevent over-commitments.

Edit: Similar ideas have already been implementedas Solidity contracts.

A simple example

Suppose there are three token sale participants: Whale, Trout, and Minnow, and that the token sale has a cap of $10M. Whale tries to buy the whole supply, and he sends $10M. Trout tries to buy most the supply and sends $9M. Minnow sends $1M.

Based on the inbound capital, the total collected is $20M and the relative stake is 50%, 45%, and 5% for Whale, Trout, and Minnow, respectively.

The raise is over the cap, and the capitalization ratio is 1–10/20 = 50%. We refund $5M, $4.5M, and $500K to the participants, respectively. Now we have raised a total of $10M, and the stake of each participant is preserved.

The following diagram illustrates a scenario where three Whales attempt to take the entire supply of a $10M sale. The raise is $30M, and each Whale is then refunded 1–10/30=2/3 of their contribution ($6.66M).

Three whales try to take the entire supply of a $10M token sale, but are refunded 2/3 of their transaction value.

Token sale distributions through auctions

Recently, Gnosis has described a modified Dutch auction mechanism which supports a hard cap. Participants bid Ether at a rolling GNO token exchange rate which decreases over time. The auction ends when either the sale cap is reached, or the fixed supply of GNO tokens is exhausted. The exchange rate of the block at which the sale terminates becomes the auction price for all participants.

While it remains to be seen exactly what the aggregate investor behavior looks like for such a model, it certainly makes it more challenging for high-stake users to swipe supply.

Innovations like modified Dutch auctions are important to watch in the decentralized crowdsale space. We as a community can, and should, write many a post on individual auction models, and many such models may be compatible with capped sales.

In summary

Token sale structures can drive the sentiment around your product, can determine the rate of growth of your community, and can help your team develop a productive and amicable relationship with your global investor base. Or not.

If you are in the process of putting together a sale, consider how your structure will impact the “investor experience” and consider giving equitable participation opportunities to your supporters.

If you are wondering about how much of the supply to allocate for team endowment, consider how long-term financing will play with minority reserves.

Not all projects require equitable token distributions, but looking ahead to a more decentralized global economy using blockchains, effective sale structures are worthy topics for consideration in designing your crowdfunding.

Special thanks for feedback from Aleksandr Bulkin, @eeks, Follow The Chain, Alex Felix, Charlie Morris, and others.

Jake Brukham is co-founder of CoinFund, a blockchain research company and private investment vehicle focused on the blockchain space.

Don’t miss out – Find out more today