Analysing the current state of Cryptographic Asset Sectors: Payments, Platform and Application tokens

2018 has been a challenging year across digital asset markets. The total market crypto has diminished by a sizable ~85% and sentiment surrounding aspects of the ecosystem like ICO raising, is at all time low. However, the narrative surrounding crypto this year has not been all doom and gloom with a number of individual blockchain sectors introducing innovations that have led to short term fundamental performance improvements, and reasons to invest in the industry long term.

Brave New Coin’s General Taxonomy defines Payment Cryptographic Assets as general form of money with the potential to capture global M1 and M2 money supply. That is, monies that are very liquid such as coins and notes in circulation and other money equivalents that are easily convertible into cash (M1), in addition to short-term bank deposits and 24-hour money market funds (which fall under M2).

Platform Cryptographic Assets are distributed protocols that integrate high-level programming capabilities and are not limited to peer-to-peer electronic transfer of value. While their main economic activity is not capturing global M1 and M2 money supply, their breadth and depth in the ecosystem makes these assets an attractive store of value.

Application Tokens are defined by the General Taxonomy as tokens that are native to decentralized applications and have a cryptographic asset associated with their use or monetization, without locking value in its parent protocol.

The BNC taxonomy provides to a framework to diversify Cryptographic Asset investment and analysis. These individual digital asset categories are becoming increasingly unique and mature in fundamentals and long term value distinction. While the price of BTC and alt markets remains highly correlated, each category has varied distinctly in technological development and sentiment.

Examples of Payment Cryptographic Assets– BTC, LTC, ZEC, XRP, XMR

Examples of Platform Cryptographic assets– ETH, ADA, ETC, IOTA

Examples Application Tokens– BNB, OMG, MAID, BAT

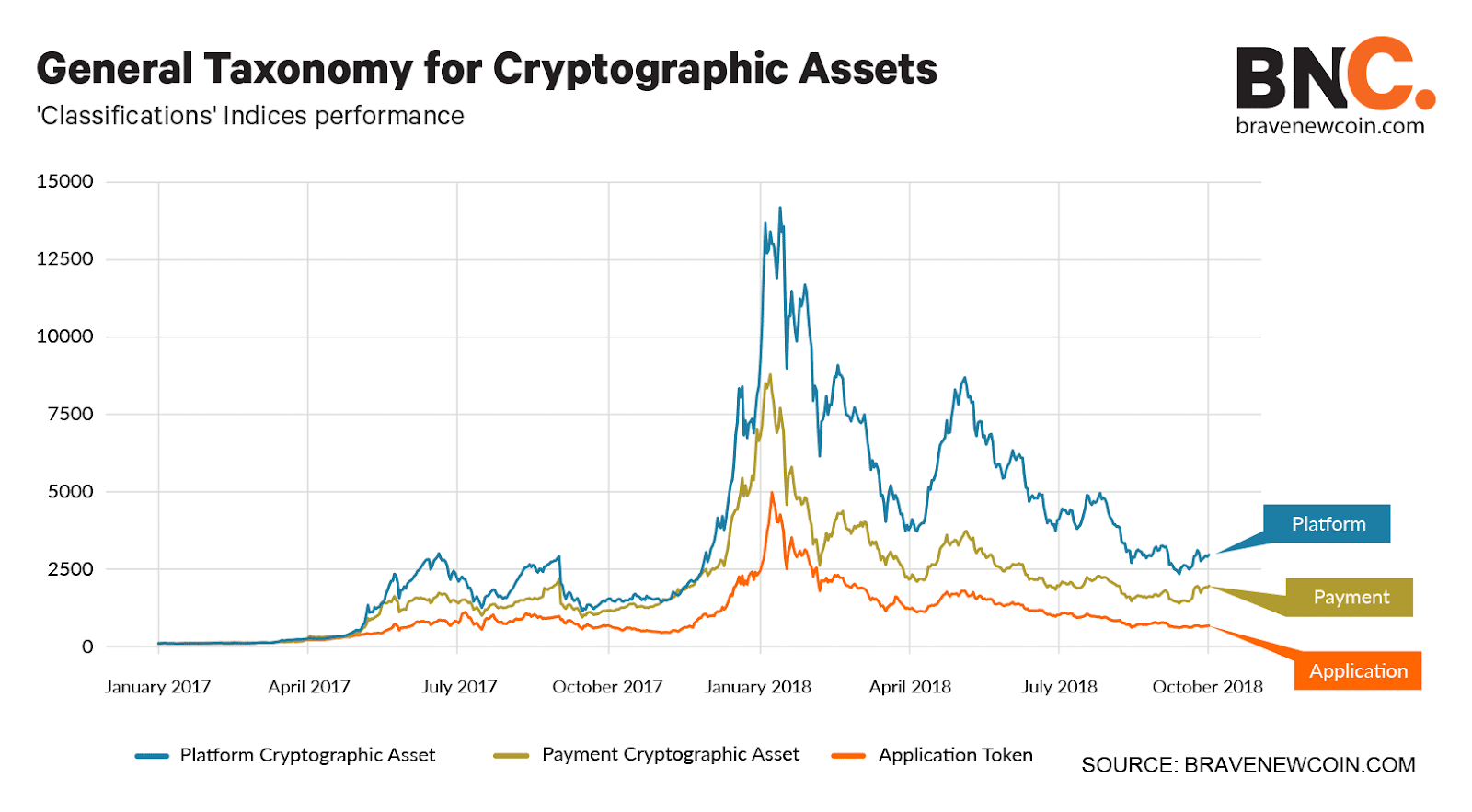

All tokens in the respective weighted markets begin the measuring period (January 2017) with a points score of 0. The baskets are weighted and assigned normalized score based on volume/price/number of tokens to allow for straightforward comparison of between the three baskets.

For Payment Cryptographic Assets, and the underlying networks that they sit on top of, 2018 has been the tale of two narratives. The prices of large cap tokens like BTC, BCH and LTC, have lagged and contracted through most of the year, but fundamentally, a number of technical innovations have emerged that have allowed this subclassification of digital assets to re-establish itself as a potential challenger to M1 and M2 money.

In late 2017 during the height of the bull market when transaction demand for payment networks surged scalability challenges created heavily congested networks and led to the emergence of extended, expensive transactions on networks like Bitcoin.

This led to a number of suggestions from market analysts that the fundamental nature of blockchains and the most commonly used proof-of-work consensus, prevented the underlying tokens built on top of them, from operating as peer-to-peer payment alternatives to legacy fiat based options.

However innovations deployed in 2018 such a s block malleability protocol Segwit used by the Bitcoin network, as well as the widespread popularity of side chain innovations like the lightning protocol, have allowed larger PoW networks to cross to push past network bottlenecks this year, coming out the other side looking like more stable, scalable blockchains.

The falling value of tokens has likely played a part in the reduced transaction fees. With less demand for crypto transactions today then at the tailend of last year, there has been less strain on payment blockchains

The price of BTC was ~$19,000 on 15/12/2017 it currently trades at ~$3,722, an 81% fall in price. The concurrent fall in transaction fees over the same period has been ~99%. It is likely that code updates have played some part in the networks improved fundamental performance.

SInce the 1st of July, despite price some volatility of BTC, with the price of the Asset fluctuations between highs of ~$8,385 and lows of ~$3170, the average transaction fee on the Bitcoin network has not exceeded $1 since the beginning of July.

These improved fundamentals, and subsequent strides in transaction stability, may play into Payment Cryptographic Assets near term prospects as fiat alternatives within volatile developing economies such as Venezuela and Turkey.

Cryptocurrency payment processor Bitpay, has shown evidence of a strong fiscal performance in 2018 despite declining crypto prices. A major factor for this success has been demand for crypto payment solutions in the Asia Pacific region, where unstable domestic financial sectors, clunky cross border payment velocity and negative perceptions of local governments, have led to hoards of curious clients investigating the potential usefulness of Payment Cryptographic Assets as cash style solutions.

In Western/OECD economies with stable financial networks, Tokens within the Payment subclassification may only work as ‘store of value’ gold-style investments, but their adoption as payment alternatives in unstable, weak financial infrastructure, developing economies, is showing encouraging signs.

Platform Cryptographic assets

Similar to Payment Cryptographic Assets, price performance of Platform counterparts has suffered in 2018. However, they have not appear not to have enjoyed the same fundamental improvements, with sentiment surrounding the utility of these blockchains appearing to be at an all time low.

In 2017, this subclassification emerged in popularity with underlying network such as Ethereum utilizing programming related smart contract capabilities, to facilitate 2 primary use cases, Dapps and ICOs, As such lead by Ethereum, became the parent chains of a number of blockchain based projects.

Dapp ecosystems on networks like Ethereum and NEO, allowed developers to access potential users of their apps without having to deal with potentially oppressive, powerful third parties like the App store, or the Google Play store. Coding on these new decentralized platforms had challenges but the traction that Dapps like CryptoKitties, appeared to gaining, pointed to a bright future.

Dapp usage on Ethereum has regressed significantly from all time user highs at the end of last year and early this year. Popular collectible game CryptoKitties is down 98% from all time active user highs, other major Dapp projects like VR world project,Decentraland and data science competition platform,Numerai are down 52% and 97% respectively. Respectively they support 319, 78 and 11 daily active users currently.

The ICO funding markets have also faced challenges, that have added to the diminishing short term utility of Platform Cryptographic assets as tokens that facilitate fundraising for technology ventures. In March 2018, ~80 ICOs raised ~$7 billion, 6 months later ~30 ICOs have raised ~$64 million. By any assessment this is a significant drop off.

Ongoing Regulatory crackdowns and concerns surrounding future ring-fencing have heavily affected investor perceptions towards ICO projects.

Network congestion on hosting networks like Ethereum has also often made using Dapps a laborious process. With decentralized networks generally slower and clunkier than their centralized counterparts, causing users to opt out from using them altogether.

A potential silver lining may be the slow but apparent trialling of smart contracts for enterprise use. Major French Airline AXA, have implemented an Ethereum smart contract based refunding protocol called Fizzy which circumvents the long human-intensive process of refunding passengers for extended delays to flights.

With Fizzy, if your flight is delayed by more than 2 hours, and you have your details loaded into the AXA app, you automatically get notified of payment compensation options automatically, once a choice is made you immediately receive the payment back to your bank account.

A key benefit of a smart contract driven automation service like this, is that the code is all open source and transaction activity can be viewed in real time. This created significant transparency that AXA’s customers are likely to appreciate. If Fizzy is used at scale across more AXA routes, then this will translate into more activity on the Ethereum which is likely to feedback into added value

However, logistical challenges have meant that the product has only been launched for flights out of France and Italy, additionally all payments are processed off chain, with only event and oracle data is transacted over the blockchain.

New Platform blockchain competitors that have emerged this year led by EOS have shown impressive volume and active address growth primarily led by increased usage of transaction cost free gambling apps. UI/UX at this stage for these Dapps are crude and rudimentary but the ability of the network to create new transaction activity a few months after launch may point to a bright future for the network

Application tokens have been the unruly children compounding the challenges faced by the struggling platform cryptographic assets networks that have hosted them.

As defined in the BNC taxonomy, Application tokens are the native tokens of decentralized applications. They surged in popularity in 2017 during the crypto bull market, and as referenced earlier, with Dapp usage falling severely in recent times, the price and sentiment of application tokens has also diminished.

Application tokens as well as having the highest number of tokens amongst the subclassifications, are also the most diverse in terms of their products and value propositions. The Basic Attention Token (BAT) as the name suggest, rewards user of the Brave web browser for viewing ads and allocating ‘attention. BAT is also used by ad publishers to ensure their content is viewed by specific segments.

The MaidSafe (MAID) coin, is awarded to users of the SAFE network who provide unused computer storage for the network, which in turn allocates this for solutions like Website hosting.

An emerging form of application tokens are exchange tokens such as the Binance coin (BNB) and the Huobi Token (HT). These tokens are generally used to access discount privileges on the native platforms that they are hosted on top of and generally have some form of dividend scheme where profits from the exchange are fed back to holders.

This style of token has gained relative popularity in the bear market due to the theoretical positive correlation between these tokens price and crypto trading volume.

In a situation where there is BTC or ETH is sold on the open market, if an exchange based token like BNB is used for the trading fees, then that token should retain value compared to the dumped asset, giving it a strong hedge appeal and additional portfolio option.

BNB token is up ~358% 1 year vs BTC, showing the comparative strength and usefulness of this style of Application token in the bear market. This figure also evidences the divergent performance of tokens within this subclassification, BAT is down ~50% vs Bitcoin in the last year, while MAID is down ~75%.

Don’t miss out – Find out more today