Augur Price Analysis: Playing the long game

The Augur platform enjoyed a strong start to the year with its native REP token up more than 100% over one six day period in mid-January, driven by excitement surrounding new tools designed to improve user experience. Two months on and momentum has cooled, while liquidity and adoption remain as long term challenges. Short term technicals lean bullish, however, and Augur’s future potential is promising.

Augur (REP) is the Ethereum blockchain’s leading decentralized prediction platform that is designed to forecast and communicate the outcome of real world events based on a majority consensus principle. Traders participate in peer-to-peer prediction markets built around these real world events and Augur’s intricate reward and dispute model is designed to create a system where market odds naturally align with true, real world sentiment.

The Augur network’s native token, REP, has fallen by ~1% in the last month and is currently trading at ~USD 14. Medium term momentum for the project has been created by the release of a series of ease-of-access tools in recent months such as Veil, which act as applications on top of Augur. Since January 1st, the price of REP has risen by 80%

However, REP is nonetheless down ~85% from its all time high achieved on 9th January 2018 and currently occupies the 42nd position on the Brave New Coin market cap table.

A live example of an Augur market

In the graphic above, the odds are set at 24% chance of the event occurring with a significant amount of money being staked (~315 ETH worth ~USD 43,000). The 24% number intuitively seems to be a fair baseline for odds in this market given present real world conditions. With BTC currently having a market cap about 5 times that of ETH it is unlikely that its market cap will be overtaken by the end of 2019. Rational odds like this suggest that the Augur platform is functioning as designed. Odds in this market should change as external market conditions change.

The Augur platform functions with a smart contract which matches opposite orders. Users who want to make opposing bets on the outcome of specific betting markets are connected and interact with each other.

Markets can either be binary (Yes/No or one/or the other markets), categorical (multiple different fixed outcomes), or scalar (variable with opportunities to short or long).

Created markets on Augur: The vast majority fall into simple yes/no categories. These tend to be the most popular for wagers because they make order creating/filling and profit calculations simpler. Source: http://crystalball.be/stats/ (March 25th)

For example, if someone wanted to buy an outcome such as ‘Yes, Liverpool win against Tottenham on March 31, 2019‘ at odds set at ~62% with a USD50 stake, there must be a counterparty willing to match this bet in reverse, so willing to stake USD50 at 38% odds that, no Liverpool will not beat Tottenham.

If a user buys an outcome that ends up being true (based on oracle reporting) in their favour, they will profit based on their stake. If the selected outcome ends up being false then the user loses their stake.

As all markets are open before the oracle finally reports on an outcome, users can cash out their stakes; hedging risk, minimizing losses and more quickly accessing profits if they are no longer interested in participating in the market.

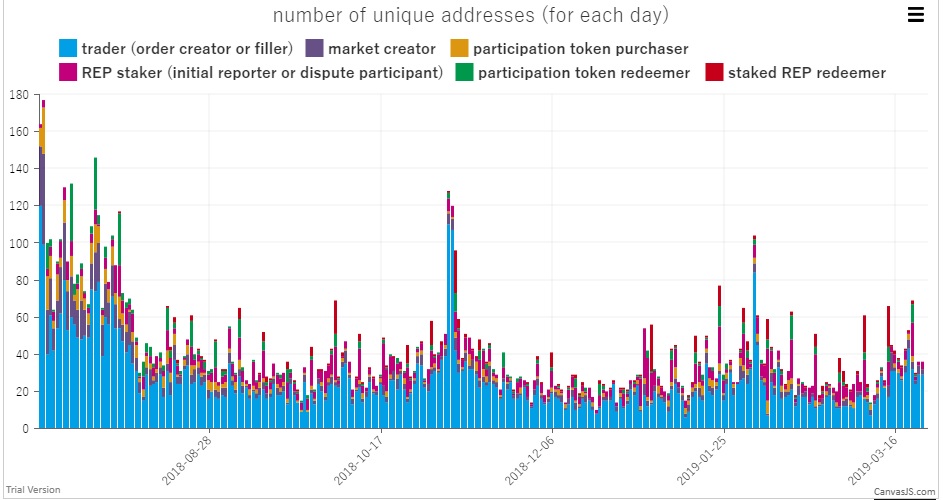

All wagers/trades on Augur are made with ETH. As such the majority of unique addresses on the Augur platform are trading accounts (order creators or fillers) and most of the economic activity on the platform is carried out with ETH and not its native token REP.

Source: http://crystalball.be/stats/ (March 25th)

The REP token represents ‘reputation’. Users/Oracles are rewarded REP if they report an event and it matches up to the agreed consensus of other reporters. They must ‘work’ (report events, participate in dispute resolution) to keep their REP stakes and inactive REP accounts are punished. This is an incentive based system, if an oracle misreports an event—an objective output—then the rest of the market makes note (seamlessly through a smart contract) of this bad reporter and they are punished by losing REP. If a REP holder doesn’t participate in a fork (when the network has a very large dispute over an outcome), they lose 5% of their REP.

Value of the REP token is derived based on quality and quantity of activity on the Augur platform which defines the demand for Oracle services.

For gamblers, the Augur platform offers a number of advantages over traditional betting market services offered by large centralized entities like Betfair or PaddyPower.

-

There is freedom for users to create any market they want, and as such let other users determine if it is a feasible betting opportunity.

-

Blockchain based smart contract settlement has the potential to substantially reduce the cost and time to settle multiple bets across numerous marketplaces.

-

The permissionless nature of Augur (funds and transactions are secured and confirmed based on the Ethereum global account) lets users in any region participate in previously unavailable secure marketplaces. I.e. An ETH holder in Asia can make speculative bets on US stocks cheaply, with minimized friction, in a way not possible before marketplaces like Augur existed.

For oracles, Augur event reporting provides an opportunity to participate in an n-sided marketplace. This means that any user can provide their homogenous service to any other user and the ecosystem can continue to support more workers if demand for their services grows from the other side of the marketplace. Because of these characteristics, Augur has often been referred to as the ‘Uber of crypto’ ( a service where any driver can meet any passenger’s service requirements).

Source: http://crystalball.be/stats/ (March 25th)

Augur, despite some structural advantages versus traditional betting markets and a unique, open ‘work’ structure that is scalable, has yet to achieve mainstream penetration for its solution. Five betting markets have handled over 50% of the open interest within Augur, all of them relate to crypto asset prices with four of them specific to the price of ETH.

A likely barrier to growth of the Augur platform is the chicken and egg problem which occurs whenever the value proposition to two separate groups is dependent on penetration in the other. With Augur the number of order creators drives the number of order fillers (market makers) and without order fillers available, traders are not willing to create orders. This therefore means that oracles on Augur are left without much ‘work’ to do, or with ‘work’ that is very low stakes.

If both sides of the Augur chicken and egg problem meet their respective ends of the bargain, a network effect and natural liquidity is created. Network effects comes with the promise of exponential growth. At this stage of its solutions timeline, however, Augur is yet to find a viable method to bootstrap liquidity.

Of the ~385 open markets active on Augur, Predictions.Global (Augur’s leading network intelligence platform) assess that only 53 meet their minimum liquidity standards .

Data also indicates that the ratio between daily orders filled (a trader can cancel any order created if it is not automatically filled by being matched fully) vs daily orders canceled is generally very close and on a number of days there are more orders canceled than filled. for example on the 24th of March, 36 orders were filled and 57 were canceled evidencing that currently there are still major challenges around providing liquidity for order creators. Canceling an order incurs a transaction fee which is likely a very, small amount of ETH. This also disincentives micro trades because transaction fees can exceed profits. This may be a factor in Augur’s small user base.

Source: http://crystalball.be/stats/ (March 25th)

Augur has had historical issues creating an organic pool of liquidity and growing out its user base, and presently it appears as though these issues remain despite several products released in the last year designed to improve the Augur User experience (UX).

A major obstacle in Augur accessing new users is the platform’s poor user experience. Non-technical traders face challenges understanding buy & sell outcomes and calculating profits. Additionally, dispute resolution within Augur can be long winded which affects how long it takes to receive payouts.

This excellent thread details how challenging it can be to write to precise markets on Augur with clear outcomes. A recent example of a market with a vague outcome is the ‘will GRIN/USD be listed on CoinMarketCap by March 16, 2019?’ built on Veil. The market was unclear because GRIN/USD can mean either GRIN denominated in USD (Veil’s intent) or the literal GRIN/USD trading pair. Veil halted trading on the market and later resolved it as YES. It is currently being disputed on Augur. The dispute process holds up potential profits, or cancels out potential profits and clogs the UX funnel.

Some users/market creators like @realPoyoPoyo are clear about their attempts to game the Augur system and by; creating a market with a deliberately subtle mistake, betting on the outcomes that will not win, stake REP on the market being invalid. The gamers know the staked funds will be distributed equally, so gamers that bet on the wrong outcome will profit. Augur operators and creators have acknowledged noted this strategy and Joey Krug has outlined structures in V2 Augur that will disincentivize this profit strategy.

For many, these factors combine to make participating in Augur seem like more hassle than it’s worth, exasperating the ability of the blockchain startup to address its liquidity challenges and create organic participation.

In the near future, though, these technical barriers to access may be eased. In the last few months some infrastructure projects connected to the Augur platform have emerged that have made it easier to interact with.

- Predictions.global allows for the sorting of Augur markets into a number of different categories and provides excellent granular information

- The newly released crystalball.be collects a number of relevant Augur performance metrics and charts live data trends

- Veil is an Augur derivative market that makes trade execution more straightforward and is built using 0x

- The Augur Insider calculates volatility for Augur markets

- Augur dispute crowdsourcer lets users check the outcome states of different markets

Veil for example, which has features like instant settlement that pays out users as soon as the market expires, and has a leaderboard which features users performance across the platform creating an objective way for user’s to assess their ability to predict real world events. These solutions that expand the Augur value proposition and UX, but at this stage appear to have not gained much traction.

There are currently just eight markets live on Veil, and the leaderboard for last week’s trading activity shows just how thin participation on the platform presently is, with most top traders averaging as few as 2-to-3 trades a week.

https://app.veil.co/leaderboard (March 25th)

Veil despite being more intuitive and easier to use than the native Augur platform still faces the same chicken-and-egg problem and users generally face a Veil marketplace where they are limited by the amount they can trade and the prices being offered.

Around the lead up to the release of Veil on January 15th the price of REP pumped strongly, rising ~127% between January 14th and January 20th and from ~USD8.27 to ~USD18.80. Since this mid-January lift off, price has corrected and ranged between USD 12-USD 15 for the last two months, currently sitting at close to ~USD14.

For Augur to build outwards, and the intrinsic value of the REP token to grow in the medium to long term, there will have to be a viable solution to current liquidity challenges. Some challenges like unclear market outcomes may naturally correct as more users experiment with building markets and the community discusses best practice for writing out prediction scenarios.

Some Augur and REP backers have proposed that because it is still a young and experimental platform, slow growth and adoption should be expected. They maintain a perspective that Augur will naturally develop a larger user base over time and the current multi-million dollar market cap is a reflection of enthusiasm for the solution’s horizons and an ultimately efficient Augur product. "When product usage is growing despite a mediocre UX, it is typically a good idea to start paying attention if you’re an entrepreneur or investor," says 1confirmation founder Nick Tomaino. It is still quite early, but feels like @augurproject is on to something.".

Augur is a platform at the forefront of a new sector of blockchain based products focused on complex oracle reporting and using untested incentive models, even Augur backers concede that tangible market penetration and adoption may take a few years because of its radical nature.

This suggests that drivers of price activity in the short to medium term are likely to revolve around network updates and product releases which may drive network participation in the future. This implies that any periods of sharp upward price momentum around update release dates will likely come with eventual corrections because liquidity, and therefore tangible fundamental value, remain a challenge.

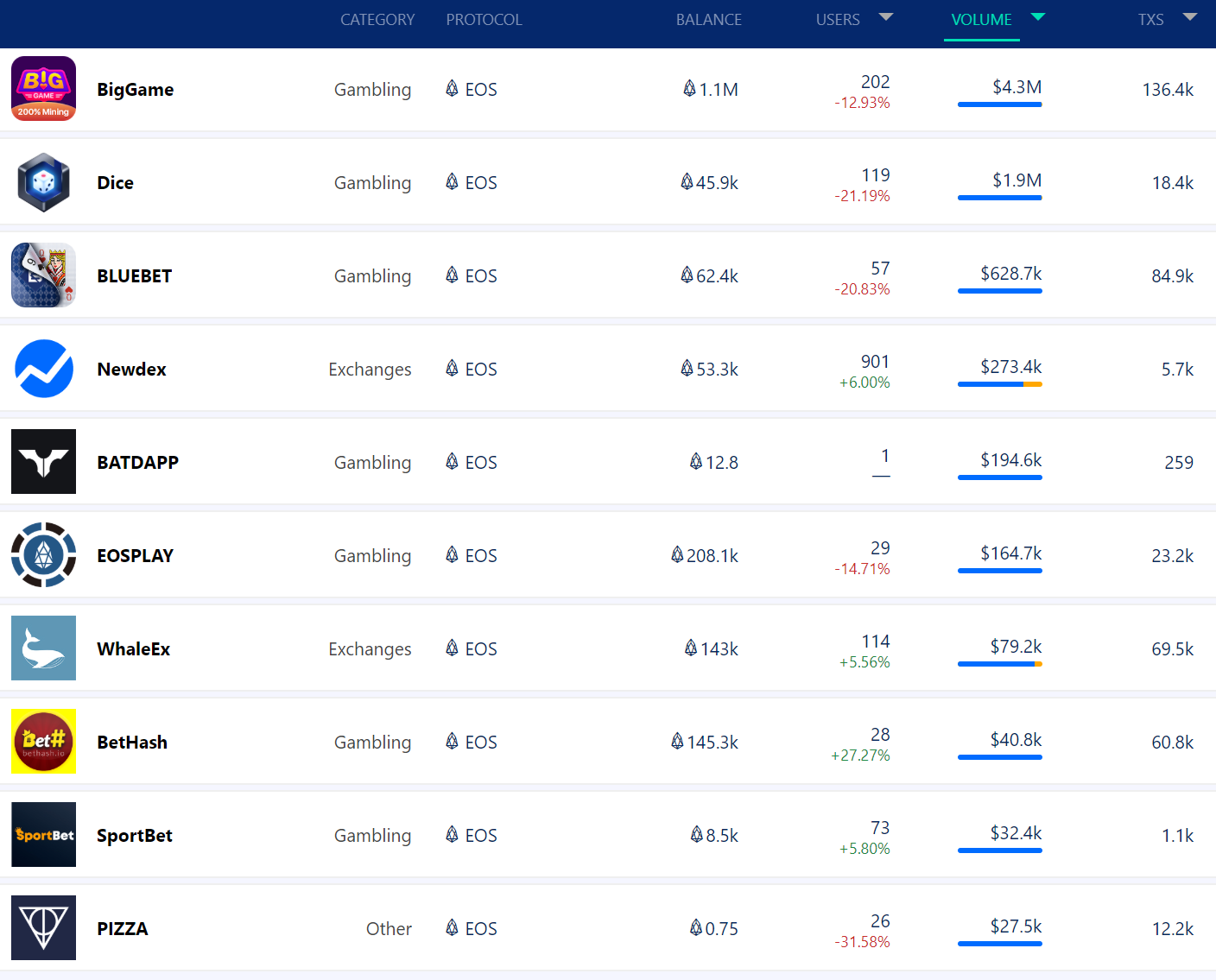

Network activity

NVT signal

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin. Crypto markets are prone to bubbles of speculative purchasing, not backed up by underlying network performance and activity.

The NVT signal provides some insight into at what stage of this price cycle a token may be.

A high NVT signal is indicative of a network that is going through one of these bubble periods, and may move towards a position of becoming overbought/overvalued, because of the market’s speculative assessments running out of steam.

Data sources: Brave New Coin, Coinmetrics.io

The NVT signal of REP has tested lower highs/overbought inflection points over the last year. This is a bullish long-medium term flag that suggest that onchain volume of REP is steadily growing against token value. This pattern suggests that price discovery of the REP asset may be improving, and the ‘steady growth despite mediocre UX’ bullish long term narrative suggested by Nick Tomaino, may be valid.

In the short term, NVT signal has fallen quickly since early March and at the same time price has experienced single digit growth. This is a bullish signal that any new price momentum will be backed by network activity and fundamentals.

A potential factor in the rise in on-chain activity is a recent emergence in the popularity of sports and specifically Football/Soccer betting. Two of the top five most liquid markets currently on Augur are binary markets that involve the results of football games (Premier league and European championship qualifier) and curiousgiraffe.io reports that currently the top search tags on Augur include Soccer, Premier, League, UEFA and Qualifiers – suggesting organic interest in specific markets.

Source:www.curiousgiraffe.io/augur/

These markets also settle quickly and are not long term like some price prediction and election markets, meaning oracles are rewarded quicker and they create a more immediate flow of economic value through the network. With the Premier League and Champions league seasons ending soon, REP onchain volume against token value may continue to grow in the next few weeks to months.

PMR Signal

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin, and by comparing it to price, can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to implement versus onchain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

This makes it a relatively transparent metric as compared to onchain volume. However, there may be a question of the granularity of the data, and who controls these addresses. Note that these measurements are based on REP accounts, and not Augur accounts. Most Augur users transact primarily in ETH, REP is a utility token and has unique value as a payout to network oracles.

Data sources: Brave New Coin, Coinmetrics.io

The value of the REP has historically been high, ranging between 6-9 natural log points since the launch of the token. This means that token value/market cap far exceeds the number of active addresses and any potential network effects within the REP token ecosystem are minimal. As such it appears as though the relationship between price and PMR is not a useful indicator and is purely by driven by token value and not active addresses.

The Augur platform will likely have to address the liquidity challenges it currently faces to increase the demand for oracle services to a point where a network effect is created and active addresses begins having a tangible effect on REP prices.

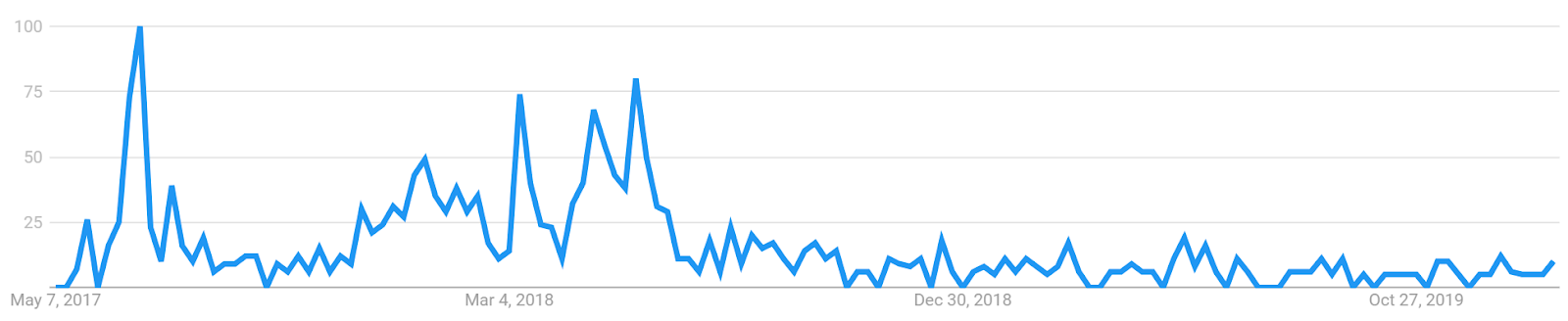

Social metrics

The main Augur/REP subreddit is r/Augur which currently has 9,813 subscribers and is ranked as the 9140th most popular community on reddit. It averages 2 posts per day and averages 0.000013 comments per subscriber, suggesting a largely inactive follower base.

Most popular posts are based on the release of the Augur mainnet on Ethereum eight months ago, the first markets successfully resolving on Augur and REP’s listing on Binance. Top keywords include ‘Liquidity’, ‘Markets’ and ‘Predictions’

Source: Subredditstats.com

The number of subscribers to the subreddit has grown quickly since 2015 but appears to have plateaued around late 2018

Source: Subredditstats.com

The number of comments per day on the subreddit jumped up sharply around the release of Veil and the coinciding price jump, before falling away once market sentiment corrected.

Turning to Twitter, the primary and verified Twitter account for the Augur community is the @Augurproject account. It currently has ~123,576 followers and is ranked as the 58,857th most popular account on Twitter.

Source: Socialblade.com

Following sharp growth in the number of followers per month in early 2018, follower growth has only grown marginally. Over the last six months growth in followers has hovered around a few 100 per month.

Post activity appears to have picked up around the 2nd half of 2018 and the Twitter account generally retweets notable community discussions and updates quite frequently.

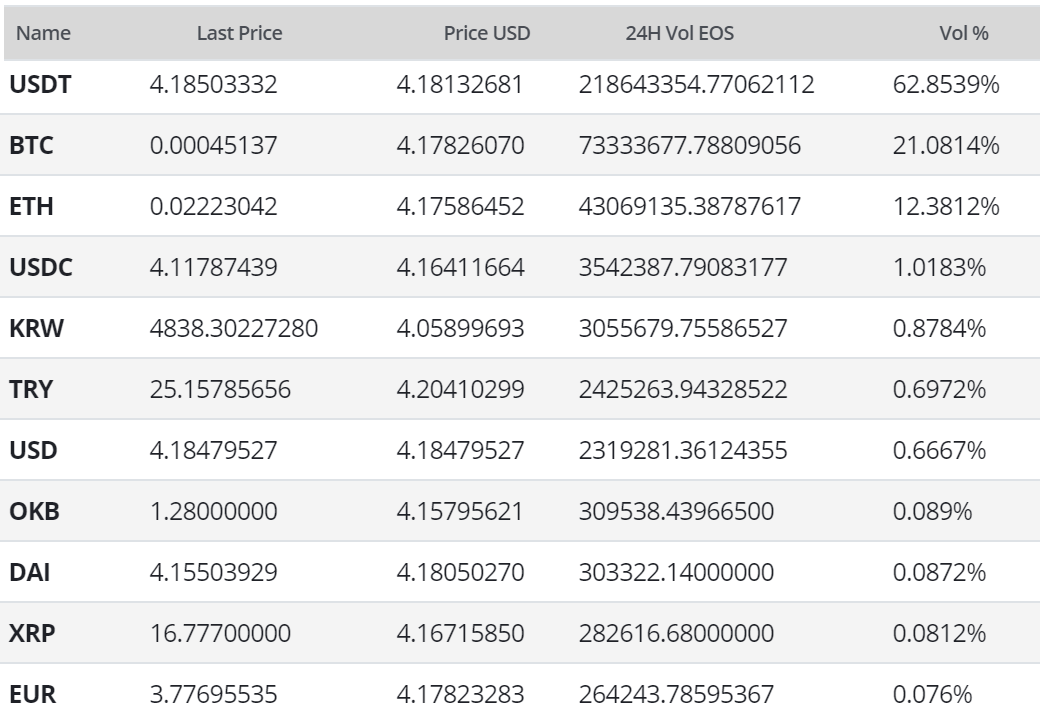

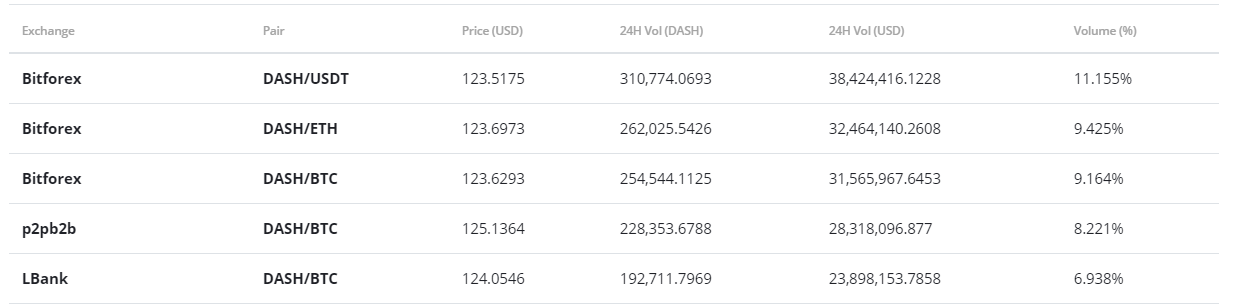

Exchanges and trading pairs

The most popular trading option for REP is BTC, handling just 45% of daily trading volume. The second most popular market is the REP/BTC pair and together the top two pairs make up over 85% of daily trading volume for REP. Fiat transactions with REP are available in the Korean won which is overall the 4th most popular trading market, Euro and US dollar trading on-ramps are also available. The USD value of daily volume of the entire BNB market is ~ USD 3.3 million.

The most popular exchange by pair for trading REP is Cayman Islands based LAtoken, REP options are also available on mega exchange Binance. REP is also tradeable on visible and trusted exchanges such as Kraken, Poloniex and Bitfinex.

Technical analysis

Moving Averages and Price Momentum

On the 1D chart, REP has followed a negative linear price trend with a Pearson’s R correlation between time and price of ~0.82, which has resulted in a death cross since August 2018. However, since December 2018, REP has shown demonstrable strength with price currently sitting near $13.75; ~139% return over that period. Also, Fibonacci retracement has mapped price’s patterns quite well during this phase with the 0.382 level currently acting as resistance, while the 0.5 level is providing support.

Additionally, on the 4 hour chart, REP’s golden cross is edging closer to reversing with only the 200 period EMA providing support currently. If the reversal ensues, the 0.5 Fibonacci level of $12.72 is the next line of price support.

On the 1D chart, the volume flow indicator (VFI) and SAR both provide a positive short-term outlook despite the current decline in price. The VFI remains above 0 and continues to trend higher, while SAR maintains an uptrend at the moment.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals is mixed; price is above the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is above the Cloud and touching price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Despite the recent price decline, the Kumo breakout remains intact with a likely re-test of Cloud support between $13.10 – $13.40 in the near term. RSI is currently in the middle of the range, which provides little indication of potential buying or selling exhaustion. However, if Cloud support holds, future price targets are $15.31 and $16.20.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is mixed; price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and touching price.

Analysis of the slower settings yields almost identical results to the faster ones with only Cloud support levels changing slightly to between $12.90 to $13.40.

Conclusion

Augur is an exciting platform at the forefront of creating use cases for decentralized oracle reporting and prediction markets. The native REP token has built fundamental value since a mainnet launch in 2018, with a first wave of fully decentralized markets created and resolved through its complex smart contract system.

However, attracting liquidity is still a challenge for the platform, making the standard user’s experience frustrating on the vast majority of Augur prediction markets. While infrastructure is being built to make the UX more seamless, the platform can still feel crude and unclear to users, with orders generally difficult to fill and outcomes often vague.

This means Augur’s true future value and addressable market is difficult to assess. Fundamental growth of the platform is clear, however, and if one of the UX solutions does hit, then growth of Augur and REP could be rapid.

The technicals for REP are cautiously bullish in the near term with support and resistance both consolidating within a tight band, which will determine the next leg for price; either up or down. Both short term trader (10/30/60/30) and longer term traders (20/60/120/30), on the 1D chart, will wait to see if Cloud support salvages the current Kumo breakout. If so, both trader’s price targets are $15.31 and $16.20, with support levels of $13.00 and $12.72.

Don’t miss out – Find out more today