Basic Attention Token Price Analysis – Brave usage growing despite falling token prices

Driven by a recent listing on Coinbase, BAT has enjoyed a period of strong fundamental performance - growing both its user numbers and transaction volume. Price, however, has not reflected this growing momentum and technicals suggest the token may currently be oversold.

Basic Attention Token (BAT) has dropped almost 60% since the announcement of a confirmed Coinbase listing which came in early-October. The crypto asset is also down 86% from the record high established in January 2018. The market cap currently stands at US$171.38 million with US$3.82 million in trading volume over the past 24 hours.

Brendan Eich, founder and CEO of BAT, is also the creator of Javascript and co-founder of Mozilla and Firefox. The Brave web browser aims to enable micropayments for publishers and content creators, providing an alternative to ad-based revenue streams, through the use of the BAT token. Direct payment to publishers like this also removes the need for ad networks, fraud arbitration, and privacy violations.

Currently, Google and Facebook largely dominate the online advertising industry. Together, the two companies collect over 73% of all online digital ad revenue, and have accounted for 99% of all growth in U.S. online ad budgets from 2015 to 2016. Moreover, ads have not only significantly increased page load times, but more and more users have also opted toward using ad blockers, which has lead to decreasing revenue for the majority of online publications.

The traditional revenue cycle has also given rise to publisher-specific subscription models which create a diminished user experience across the web broadly, as users need to manage these subscriptions individually on a site-by-site basis. The Brave/BAT combo on the other hand, creates a seamless payment experience which occurs invisibly in the background while surfing the web.

Creators and publishers do not need to use Brave to collect BAT payments, but can complete the verification process on Uphold, a payment processor, where audience contributions are kept in escrow. On Uphold, BAT can also be automatically converted to fiat currencies and transferred to the creator’s bank account. Brave users can take advantage of a program for opt-in ads, as well as direct payment support for YouTube and Twitch streaming.

In October 2018, Eich reported 4.6 million active users on the Brave browser, including 28,700 publishers listed to collect BAT funds from Brave users. Brave for Android has over 10 million downloads on the Android operating system. In comparison, as of November 2016, Google’s Chrome browser reported two billion installs. However, in repeated head-to-head testing, Brave had the quickest load times amongst competitors Chrome and Firefox.

Brave also offers private Tor browsing on the desktop and DuckDuckGo for private mobile tabs, as well as integrating the Ethereum (ETH) browser wallet MetaMask. Brave is continually upgraded to improve performance on all platforms and the browser is also the default web browser for the newly released HTC Exodus1 blockchain phone.

The Brave platform underwent three rounds of funding; a seed round in November 2015 raising US$2.5 million, a seed round in August 2016 raising US$4.5 million, and an ICO in May 2017 raising US$35 million in 30 seconds with 130 participants. Notable investors include Digital Currency Group and Pantera Capital. Each of the one billion ERC20 tokens available for the crowdsale was sold at a price of US$0.03. The BAT team also holds 500 million tokens and according to the team, the total supply of BAT will never exceed 1.5 billion tokens.

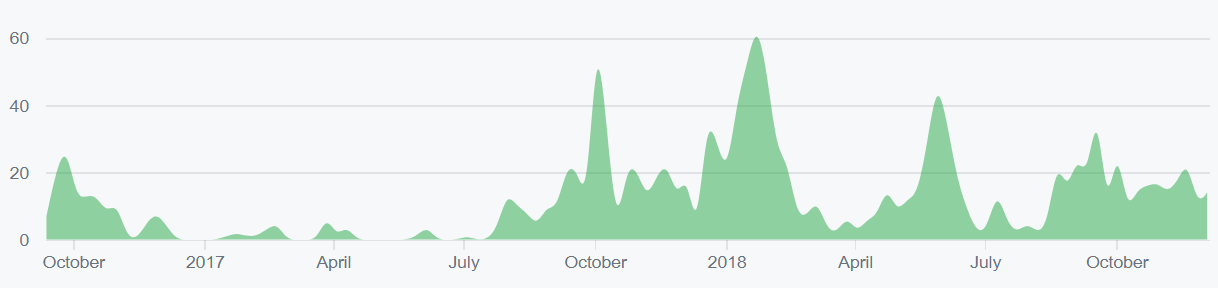

On the network side, transactions per day of the BAT token (line, chart below) spiked dramatically through October and early November, likely due to speculative demand and/or transactions from the Coinbase listing. Transactions per day have decreased substantially since the listing. The average transaction value (fill, chart below) has oscillated over the course of the year and is sitting at a midway point between yearly highs and yearly lows.

Source: coinmetrics.io

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) is currently sitting at an all-time low. A clear downtrend in NVT suggests the coin is undervalued based on its economic activity and utility, which should be seen as a bullish price indicator. However, the Coinbase listing and subsequent flurry of BAT token activity has likely skewed this data significantly. Although historic data is minimal, a low NVT should also be an indicator of an undervalued asset.

Daily active addresses (fill, chart below) increased dramatically throughout October and early November but have declined by half since reaching for previous all-time highs. Again, this rise in active addresses corresponds with the Coinbase listing in mid-October. Active and unique addresses are important to consider when determining the fundamental value of the network using Metcalfe’s law.

Source: coinmetrics.io

Turning to developer activity, 23 developers have contributed a cumulative 1,100 commits to the BAT repos in the past year. Most coins use the developer community of GitHub where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest. Most of the BAT related commits have occurred in the publishers repo (shown below).

Source: https://github.com/brave-intl/publishers/graphs/contributors

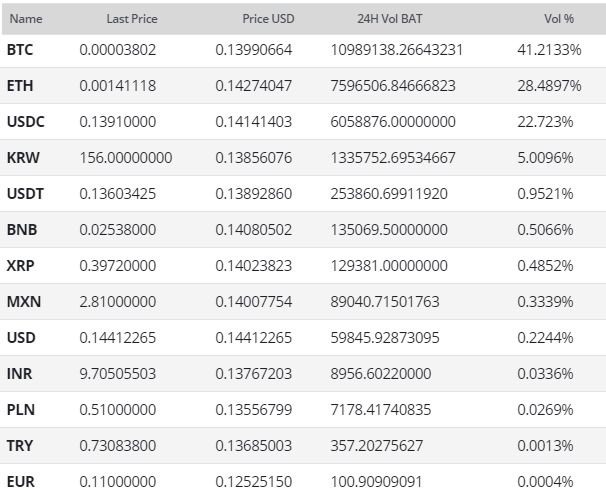

BAT exchange-traded volume in the past 24 hours has predominantly been led by the Bitcoin (BTC), Ethereum (ETH), and USDC pairs, with direct fiat pairs representing minimal volume overall. The majority of trading has been conducted on Coinbase, Binance, and Bittrex. BAT was first listed on Bittrex in June 2017, followed by a Binance listing in November 2017, a Bitfinex listing in January 2018, a Poloniex listing in August 2018, and most recently, a Coinbase listing on November 2nd.

Google Trends data for the term "Basic Attention Token" spiked in early November, corresponding with the Coinbase listing. Searches also spiked near the ICO date in May and June 2017, as well as in late 2017 when all crypto-related searches increased broadly. Spikes in Google searches often correlate with spikes in market prices. A 2015 study found a strong correlation between the Google Trends data and Bitcoin price, while a May 2017 study concluded that when the U.S. Google "Bitcoin" searches increased dramatically, Bitcoin price dropped.

Technical Analysis

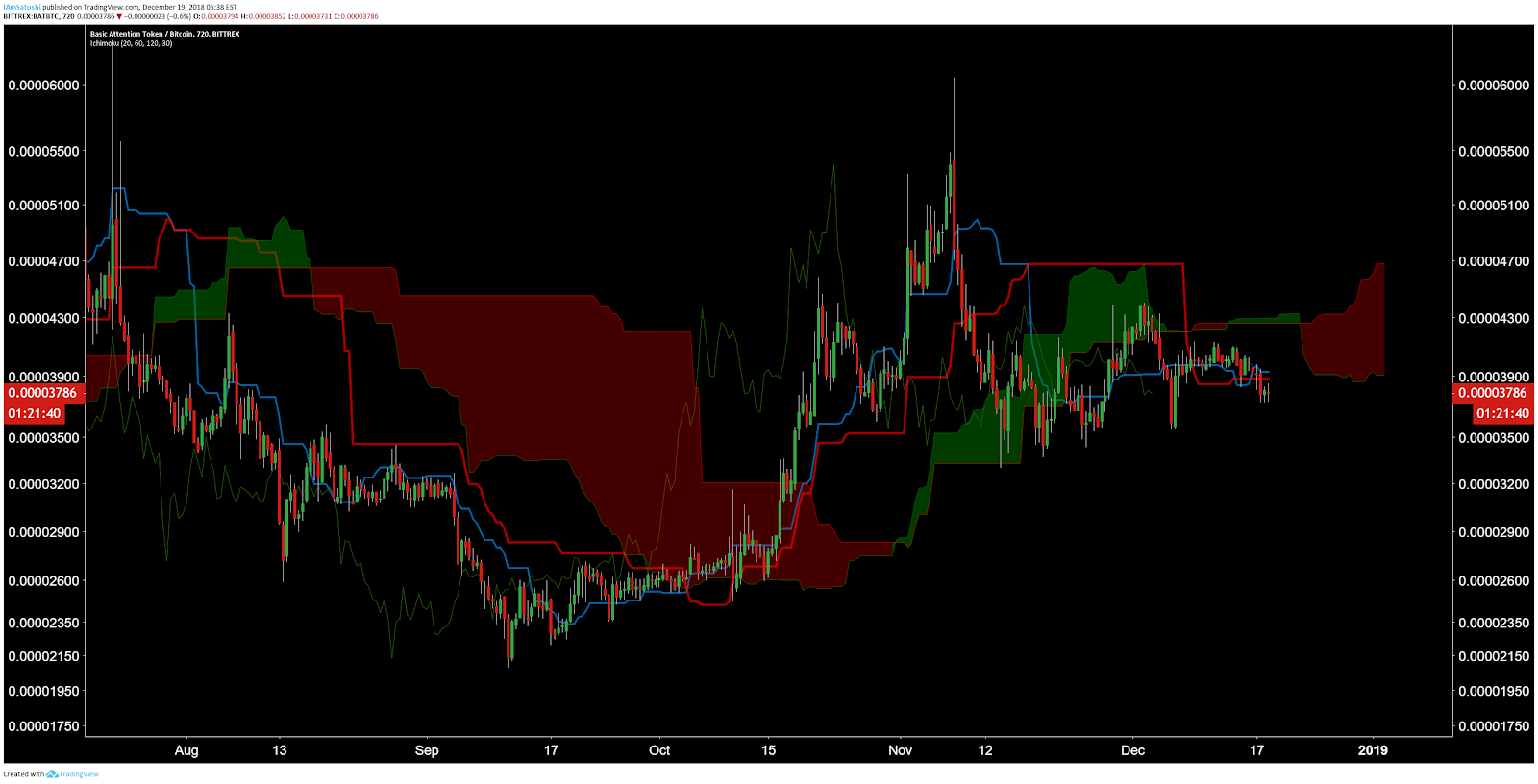

The fiat markets for BAT are fairly new and lack price data, therefore charting the BAT/BTC pair is the most prudent. BAT has essentially ranged from 1200-5500 sats over the past year. If BAT breaks this range and a trend emerges, volume, exponential moving averages (EMAs), and Ichimoku Cloud can help determine optimal entry points. Further background information on the technical analysis discussed below can be found here.

On the daily chart, the 50/200EMAs have been bullishly crossed since early November. Previous crosses this year have had very little sustained effect on price due to the largely trendless nature of price action. The volume profile of the visible range (VPVR) shows that, unsurprisingly, most of the volume has occurred at both extremes of the range. If multiple candle closes occur above the 5000 sat level with a spike in daily volume, price will likely continue much higher. There are not active bullish or bearish divergences.

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

The status of the current Cloud metrics on the twelve-hour time frame with doubled settings (20/60/120/30) are bearish; price is below Cloud, Cloud is bearish, TK cross is slightly bullish, and Lagging Span is below Cloud and below price. A traditional long entry will not trigger until price is above the Cloud with a bullish TK cross, which has not been the case since October.

On the BAT/USD pair, the daily Cloud is bearish but showing oversold conditions with a bullish RSI divergence. As price moves further and further from the Kijun (red line), a mean reversion back to the Kijun becomes more and more likely. If price does not make lower lows, a TK C-Clamp will continue to form, suggesting mean reversion to the Kijun to the US$0.26 level. The flat Kumo at US$0.26 will also act as a magnet for price. There is also historic volume confluence at that level (red horizontal line) which should act as resistance.

Conclusion

Fundamentals suggest that use of the BAT token has increased dramatically over the past few months, likely due to the Coinbase listing. Whether or not BAT use will continue to increase is likely dependent on Brave browser usage, which continues to increase month over month. With recent and ongoing revelations regarding privacy and user data, Brave is fighting the good fight with brand alignment, not only with cryptocurrency users but the public at large. The supply of the circulating one billion BAT tokens are likely to continually provide downward pressure on price until active Brave users, active addresses, and daily transaction amounts increase dramatically.

Technicals for the BAT/BTC pair suggest continued ranging between 2200-5500 sats until price breaks the range highs or range lows. Technicals for the BAT/USD pair suggest a buying opportunity due to oversold conditions ripe for mean reversion towards US$0.26. Overall, both pairs are currently holding within a bearish trend. The true test for the potential speculative power of BAT on Coinbase will come when crypto enters a broad bullish market.

Don’t miss out – Find out more today