Binance Coin Price Analysis – Build the utility and they will come

Binance has masterfully engineered the BNB token to become an all-encompassing aspect in every facet of the ever-growing Binance ecosystem.

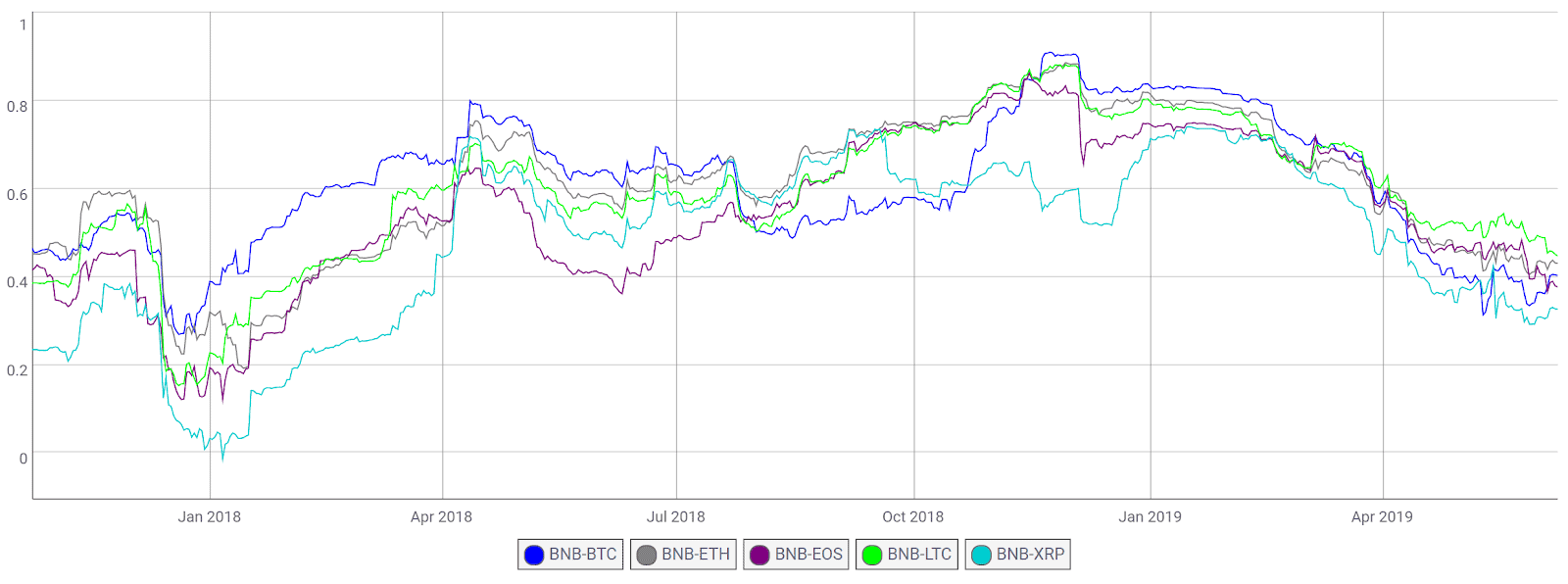

Binance Coin (BNB) provides access to various aspects of Binance on the Binance exchange. Initially an ERC-20 token, migration to the Binance Chain (BEP2) took place in late April 2019. The market cap currently stands at US$4.26 billion with more than US$250 million in trade volume in the past 24 hours. The crypto asset is ranked 7th on the Brave New Coin market cap table, below EOS (EOS). Since December 2018, BNB has risen 650% and is strongly decoupled from the other top cryptocurrencies at this time.

Source: coinmetrics.io

Binance opened in July 2017, with founder and CEO Changpeng Zhao at the helm. Zhao had previously worked at blockchain.info from December 2013 until May 2014, and OKCoin as CTO from June 2014 until February 2015.

The BNB token ICO occurred from July 1st, 2017 to July 21st, 2017, where 100 million BNB tokens were sold, raising US$15 million with a token price of US$0.15. Notable investors and advisors included Matthew Roszak, Roger Ver, Chandler Guo, Zhao Dong, and Da Hongfei.

BNB has a capped supply of 200 million tokens, with 50% sold during the ICO, 40% going to the founding team, and 10% going to angel investors. The team funds have a vesting schedule, where 20% of the 16 million tokens were initially released and a further 20% will be released annually for the subsequent 4 years after the ICO.

According to the whitepaper, the funds are allocated for the following; 35% is for building the Binance platform and perform upgrades to the system, including team recruiting, training, and development; 50% will be used for Binance branding and marketing, including continuous promotion and education of Binance and blockchain innovations in industry mediums; and 15% is kept in reserve as an emergency fund.

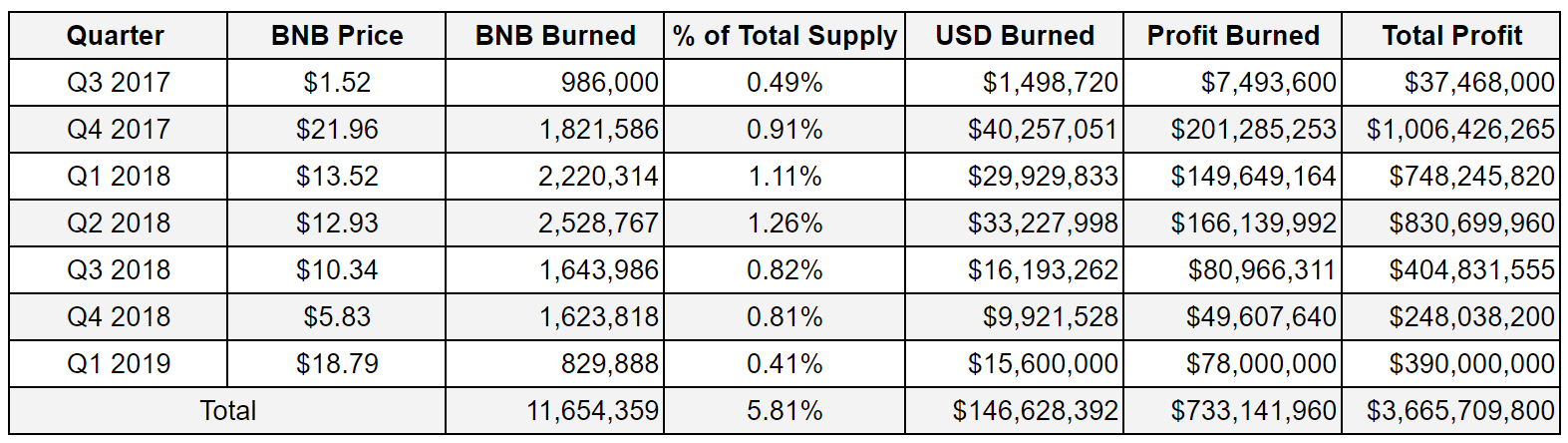

A unique aspect of the BNB token management are burning events which take place every quarter. Tokens are acquired for burning purposes through exchange fees, OTC markets, or sold on the market and bought back later for the burn. However, Zhao has not explicitly stated how this process is completed.

The tokens burns are paid for with 20% of the total exchange profits from the quarter. The current total token supply is 189,175,490 BNB. The current circulating supply is 140,345,602 BNB, accounting for all seven token burns thus far. The burning events will continue until 100 million BNB, or 50% of the total supply, are destroyed.

Source: https://www.binance.vision/blockchain/what-is-a-coin-burn

The use cases for BNB ensure users remain in the closed garden ecosystem of Binance, including; Binance.com, the Binance DEX, Binance Launchpad, BEP2, and later this year, margin trading. Binance was originally founded in China, but moved to Japan in late 2017 and had offices in Taiwan by March 2018. Shortly thereafter, Binance announced a move to Malta to open a fiat-to-crypto exchange. In January 2019, the company launched Binance Jersey with fiat-to-crypto trading of the Euro (EUR) and British Pound (GBP). Binance.com remains one of the few mainstream exchanges to enable trading on most alt coin pairs without geo restricting US users.

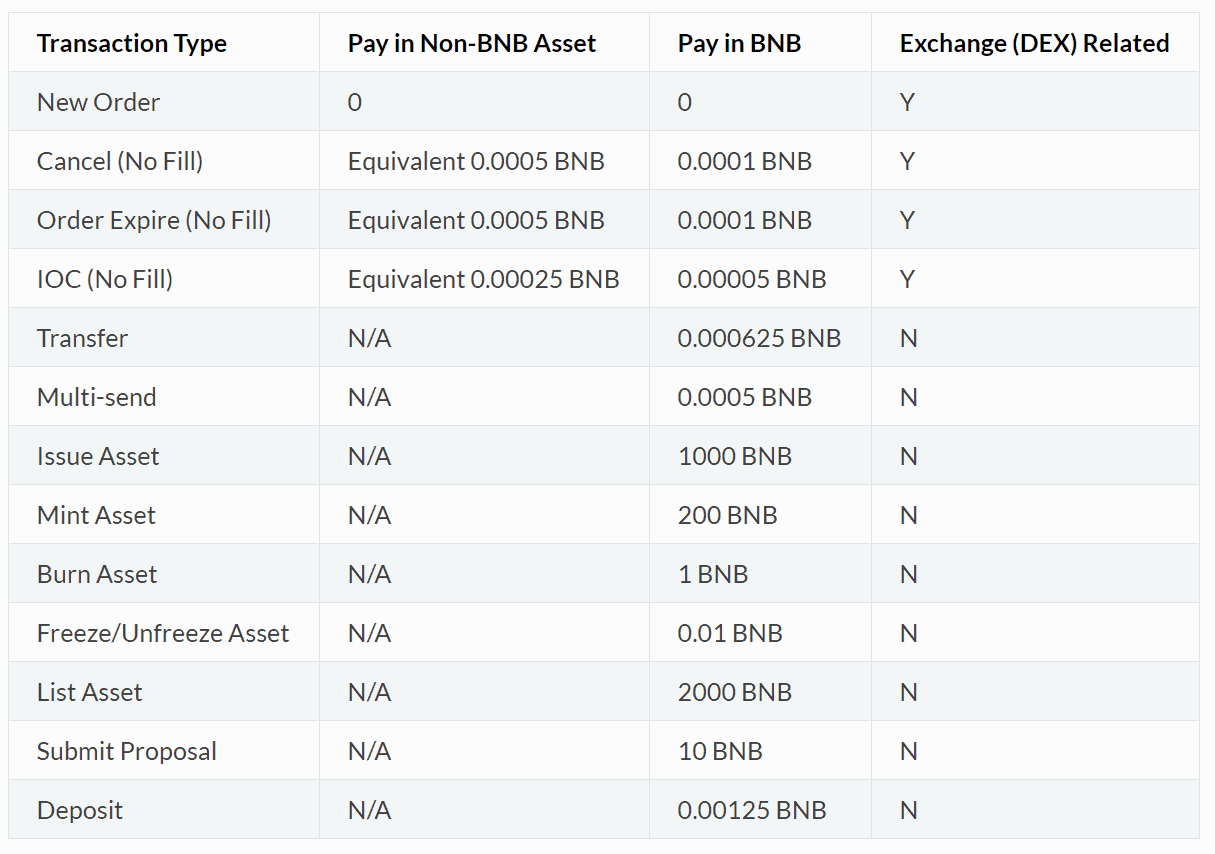

Projects migrating to the BNB chain, or ICO projects listing on the BNB chain, must also purchase BNB tokens, currently equivalent to approximately US$90,000-US$100,000 (see table below). These fees can be changed through a governance mechanism on BEP2. In October 2018, Binance announced that any exchange listing fees on Binance.com would be sent to a charity address, which has raised over 580 BTC, or nearly US$4.5 million. It is unclear whether DEX listing fees are currently sent to this fund or not.

Source: https://docs.binance.org/trading-spec.html#current-fees-table-on-mainnet

Binance.com lists nearly 100 BNB base pairs, and the Binance DEX, which launched in late April, lists pairs solely denominated in BNB. Fees for both exchanges can be paid with both BNB and non-BNB assets, with fees paid in BNB currently attracting a 25% discount. Additionally, on Binance.com, there is a tiered trading fee discount program for accounts holding a significant BNB balance.

Source: https://www.binance.com/en/support/articles/360007480472-Binance-Launches-New-Tiered-Trading-Fee-Discount-Program-and-Adjusts-BNB-Discount-Rate

The launch of the Binance DEX followed a two-month testnet period, during which nearly 8.5 million transactions were made across a simulated trading competition, coding competition, and bug bounty program, where new updates and enhancements were implemented. By July 1st, the Binance DEX will also geo restrict users in 29 countries, including the US.

The BEP2 mainnet went live on April 23rd and is focused on token issuance and trading. All transaction fees are denominated in BNB. The chain uses the Tendermint Byzantine Fault Tolerance (BFT) consensus mechanism and does not have smart contract capabilities.

According to the BEP2 explainer, “the initial validators are selected from trusted members of the Binance community, and will eventually expand to more members as the Binance blockchain and ecosystem matures, this responsibility will be distributed,” with more validators to be introduced over time. Light Simple Payment Verification (SPV) nodes can also use the network without verification or taking part in consensus.

As of the beginning of this month, 24 projects have migrated to or were listed on BEP2, including; Mithril, Harmony, Blockmason, Red Pulse, GIFTO, Aeron, Crypto BonusMiles, MyWish, BOLT, CanYa, BLOC Platform, TrustED, Pledgecamp, GTEX, Ankr, Hut34, Raven Protocol, GIVLY, Chiliz, Fantom, SPEND, NOW, BETX, and Honest Mining.

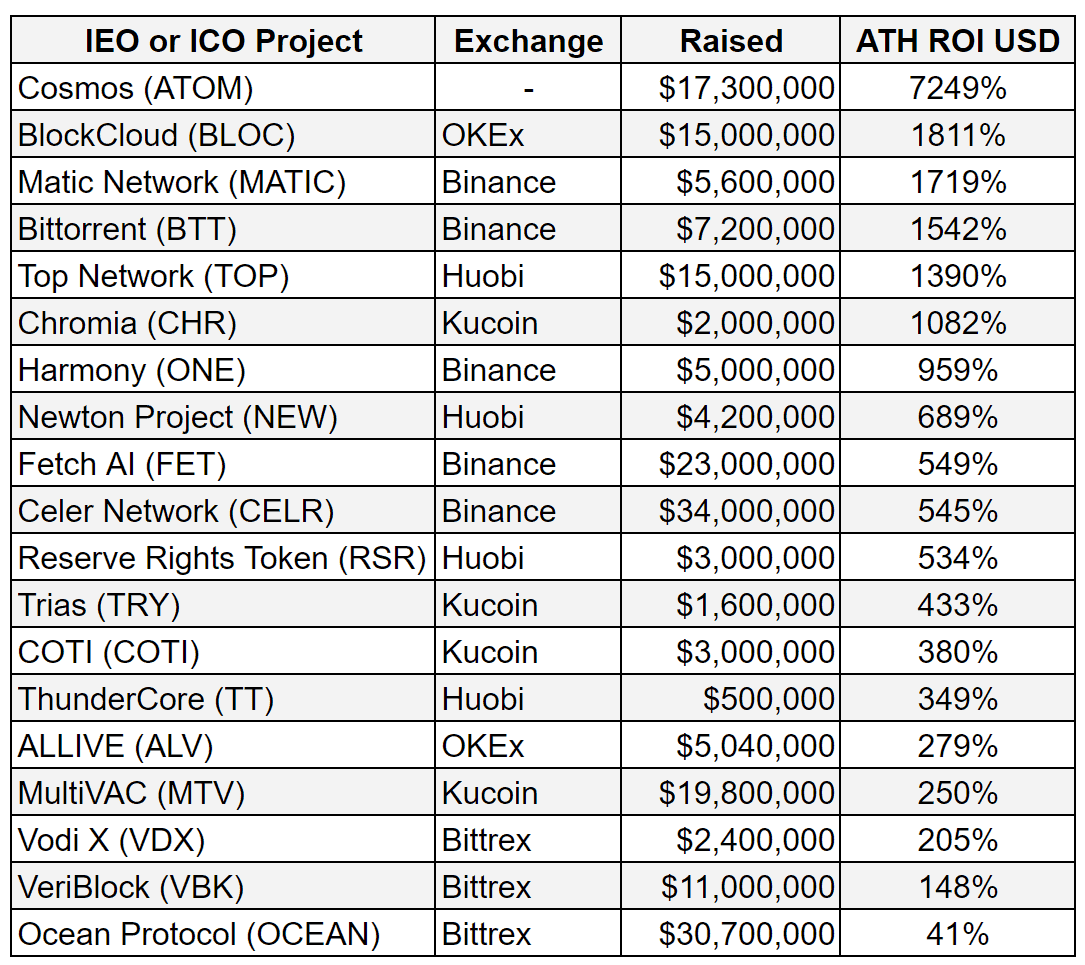

The Binance IEO platform, “Launchpad,” completed the ecosystems first IEO in late April and uses a system of lottery tickets for participation in the IEOs. Each lottery ticket is obtained by holding at least 100 BNB over a 20-day period preceding the lottery, with a maximum of five lottery tickets per account.

Thus far, recent Binance IEOs have outperformed and out raised most projects on other platforms. Binance IEOs have raised nearly US$75 million, raising the highest on average, at nearly US$15 million. Cosmos (ATOM) has had the benefit of several major exchange listings, including; Huobi, Binance, OKEx, Poloniex, Kraken, Bittrex, and Bitfinex.

Sources: @CryptoDiffer and @ICO_Analytics

Binance also has a Secure Asset Fund for Users (SAFU) where 10% of all trading fees are stored, starting from July 2018. The SAFU acts as additional disaster insurance. On May 8th, Binance reported a theft of 7,074 BTC worth over US$40 million at the time. Zhao later reported that the BTC was withdrawn from Binance’s hot wallets, which contained only 2% of the exchange’s total BTC holdings. Binance’s other wallets are unaffected. All funds lost in the hack were replaced with Binance emergency funds.

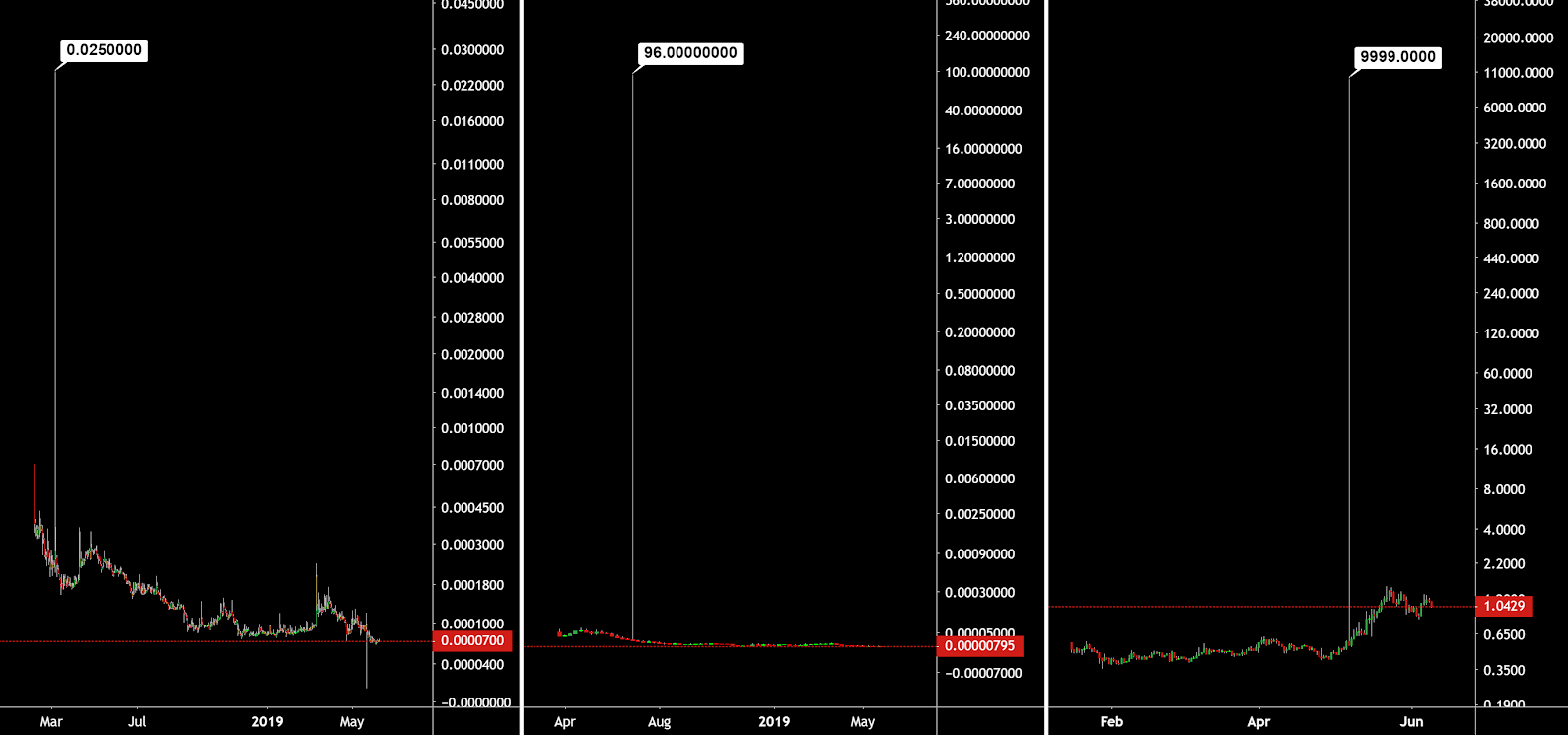

The exchange was shuttered for several days while key system infrastructure was reset and rebuilt to mitigate future attacks, including significant changes to the API, 2FA, and withdrawal validation areas, which were areas exploited by hackers during this incident. The attack was similar to the Viacoin and Syscoin market abnormalities which occurred in March and July 2018, when the VIA/BTC pair briefly reached 0.025 BTC and the SYS/BTC pair briefly reach 96 BTC.

There are three levels of API permissions on Binance; read, trade, and withdrawal. For Viacoin and Syscoin, APIs were likely accessed through weakly secured third-party platforms using these API keys for trading purposes. In the most recent attack, a much larger list of API keys was accessed by an attacker, which included API keys allowing withdrawals. The LINK/PAX pair was also exploited in the same fashion as the VIA/BTC and SYS/BTC pairs had been previously and subsequently reached nearly US$10,000.

On-chain statistics for the BNB token are sparse, likely because most of the transactional volume occurs on the Binance exchange itself. Nevertheless, transaction counts and daily active addresses have been steadily increasing since the beginning of the year, matching the increase in price. Both metrics have also increased since the BNB migration to BEP2 and the launch of the Binance DEX.

Source: coinmetrics.io

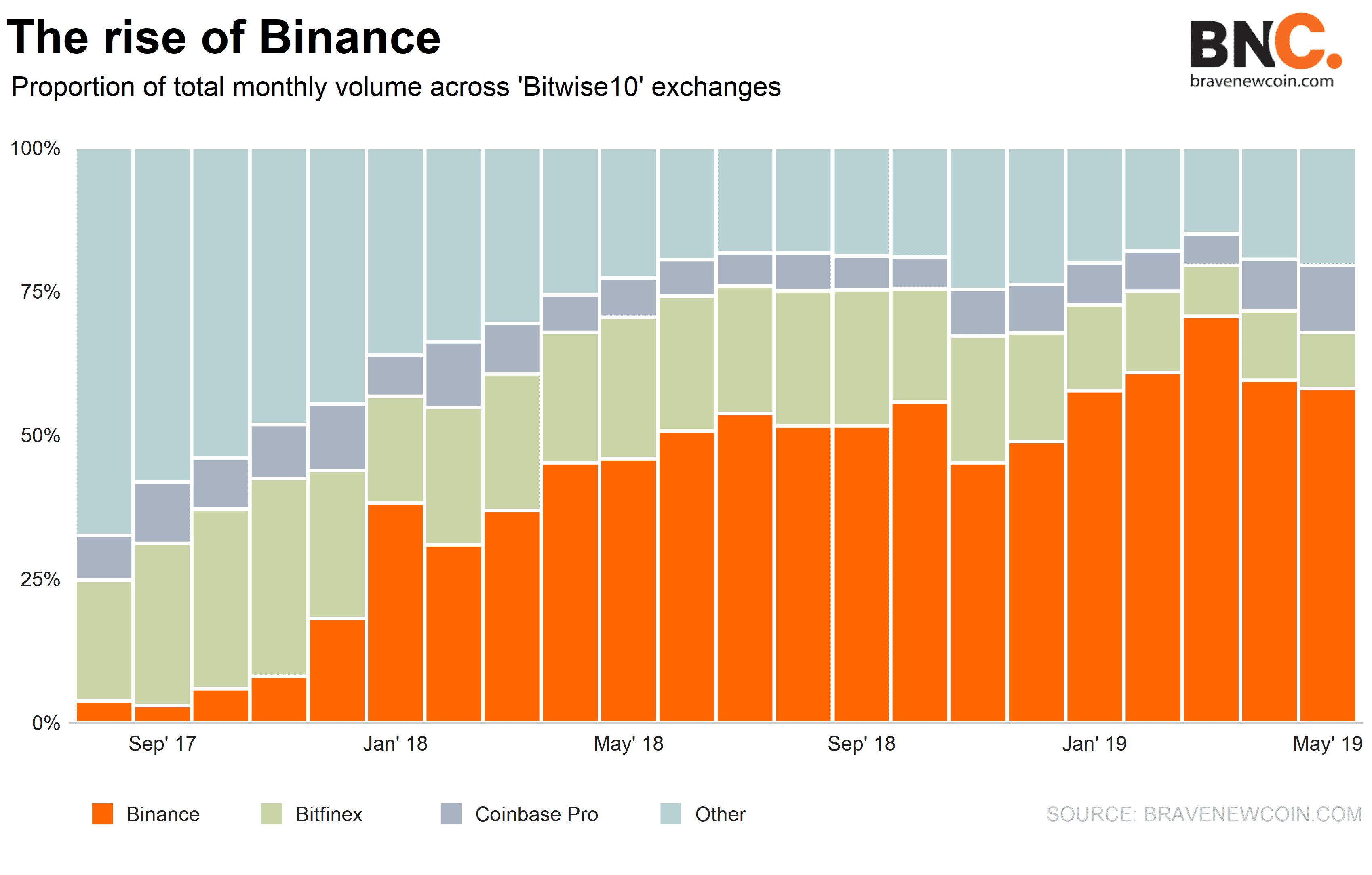

A key driver is the BNB token successes is the Binance global footprint and sustained success to trade volume. The company has grown to employ between 500-600 employees across the globe. Since early 2018, the Binance exchange has consistently held the largest portion of the trading market. This has also likely put a bullseye on Binance from a regulatory perspective and may attract the attention of law enforcement officials, specifically in the US. Of the top 10 exchanges by real trading volume, Binance does not have money-service-business distinction or a New York BitLicense.

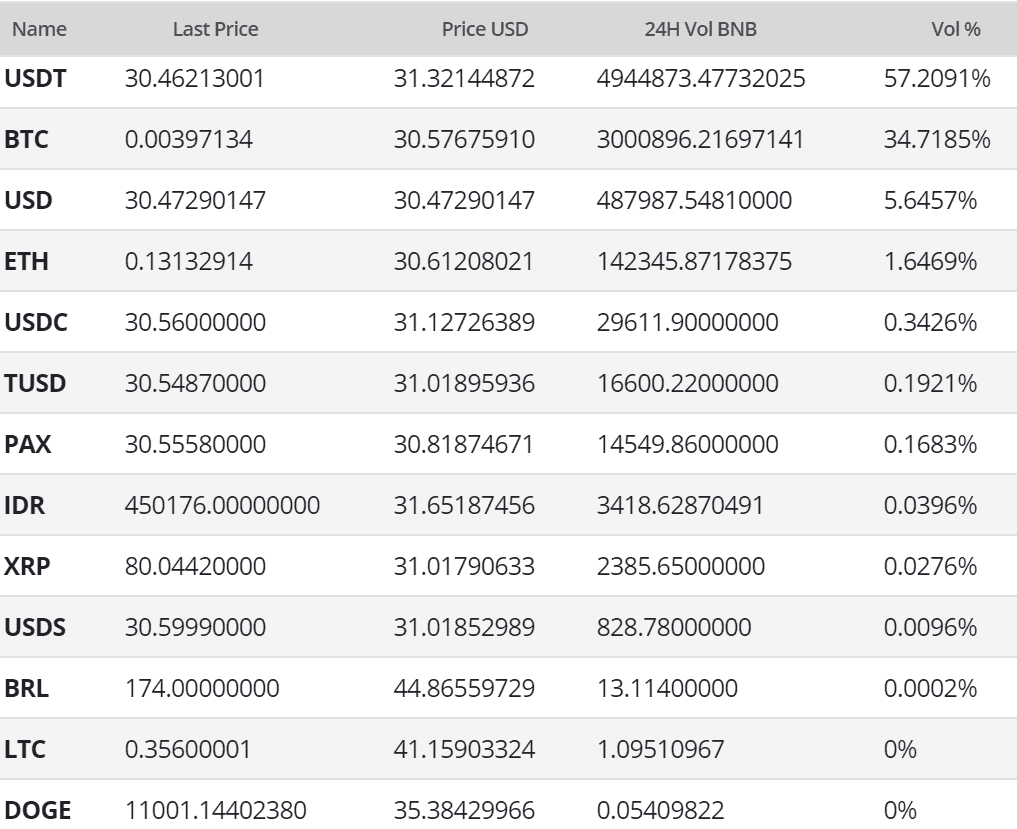

In the markets, BNB exchange traded volume over the past 24 hours has predominantly been led by the Tether (USDT), Bitcoin (BTC), and U.S. Dollar (USD) pairs. Almost all of this volume comes from the Binance exchange itself. As many other exchanges begin to release their own exchange coins, such as Bitfinex’s LEO, it is unlikely BNB will ever be listed on competing exchanges. In some cases, Binance would also likely require the exchange to hold the BNB token in order to facilitate trading.

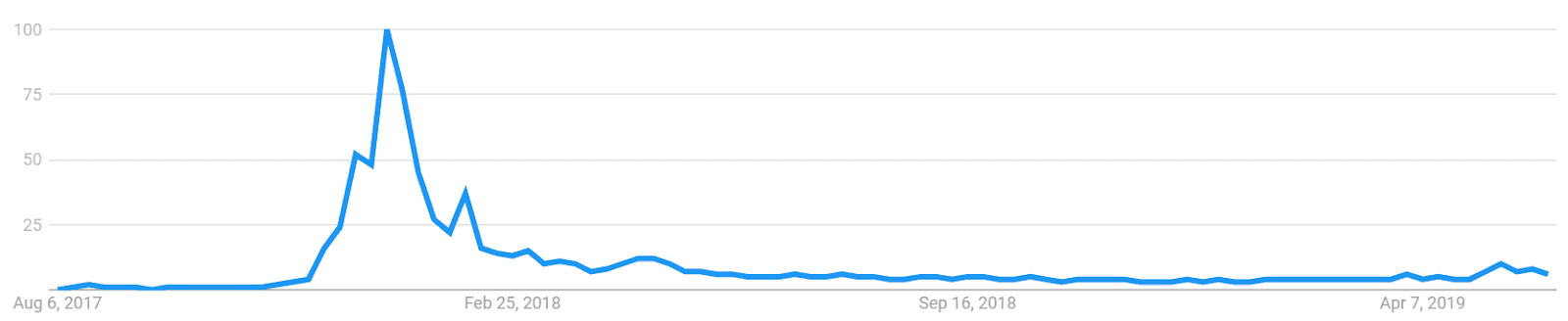

Google Trends data for the terms “Binance Coin” (top) and “Binance” (bottom) has made a new yearly high over the past few weeks, but overall, interest remains down significantly from late 2017 and early 2018. Currently, BNB is the only coin pushing record highs while at the same time showing very little interest on Google Trends, when compared to December 2017 and January 2018. This strongly suggests the next rapid influx of new market participants could push the crypto asset much higher.

Searches for both terms fell drastically throughout 2018 whereas a slow rise in searches in late 2017 and early 2018 corresponded with a market wide price highs, likely signaling interest from new market participants at that time. A 2015 study found a strong correlation between the Google Trends data and BTC price, while a May 2017 study concluded that when the U.S. Google "Bitcoin" searches increased dramatically, BTC price dropped.

Binance.com has also gained significant traffic over the past 90 days, according to search engine analysis by Alexa. The site is ranked 841st globally and 564th in the US. Coinmarketcap.com is the only other cryptocurrency-related website which currently ranks higher in these search statistics, being ranked 412th globally and 312th in the US.

Source: https://www.alexa.com/siteinfo/binance.com

Technical analysis

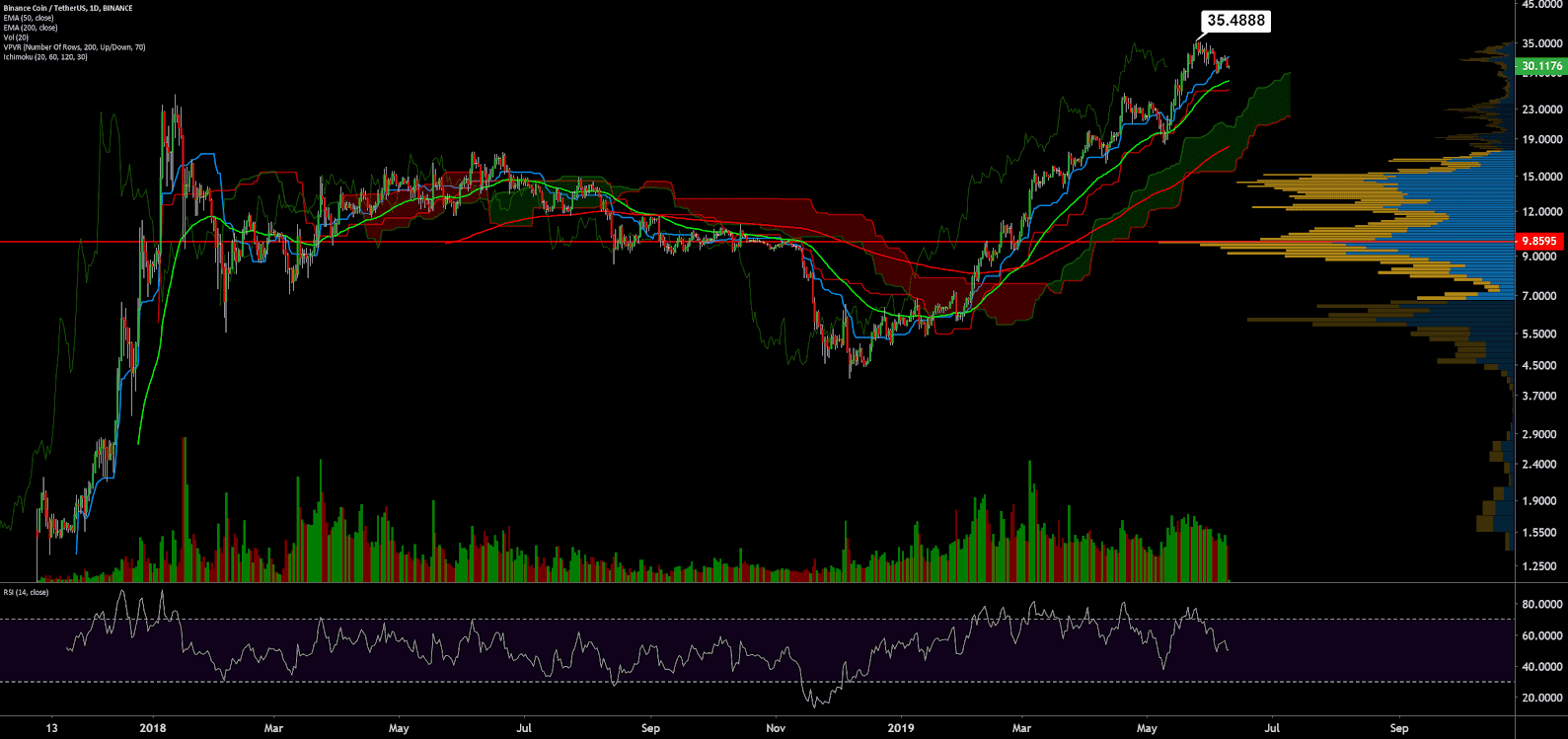

BNB has recently set record highs in both the USD and BTC markets, albeit for a coin less than two years old. Trend continuation or reversal while the asset’s price is consolidating near these highs can be determined using exponential moving averages (EMAs), divergences, Ichimoku Cloud, and chart patterns. Further background information on the technical analysis discussed below can be found here.

On the daily chart, the BNB/USD pair has been in a strong bull trend since the beginning of the year. The 50-day EMA and 200-day EMAs have been bullishly crossed since the end of February. Both EMAs, at US$27.35 and US$18.16, should now act as support. A 50% retracement, from the current high, at US$35.50, to the December low, at US$4.12, sits at US$19.67, and will also act as support. Substantial volume support sits at and below the previous range high of US$15 in June 2018.

Although both volume and RSI has shown signs of bearish divergence in recent weeks, price has not pulled back with significant bearish momentum. The most significant retracement occurred in the setting of a Binance hack, and the asset recovered completely over the course of the following week.

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

The cloud metrics with doubled settings (20/60/120/30) for more accurate signals are all bullish; price is above the Cloud, the Cloud is bullish, the TK cross is bullish, and the Lagging Span is above Cloud and above price. Buyers will likely re-enter the market near the Kijun support, currently at US$26.31. The bull trend will remain intact as long as price remains above the Cloud.

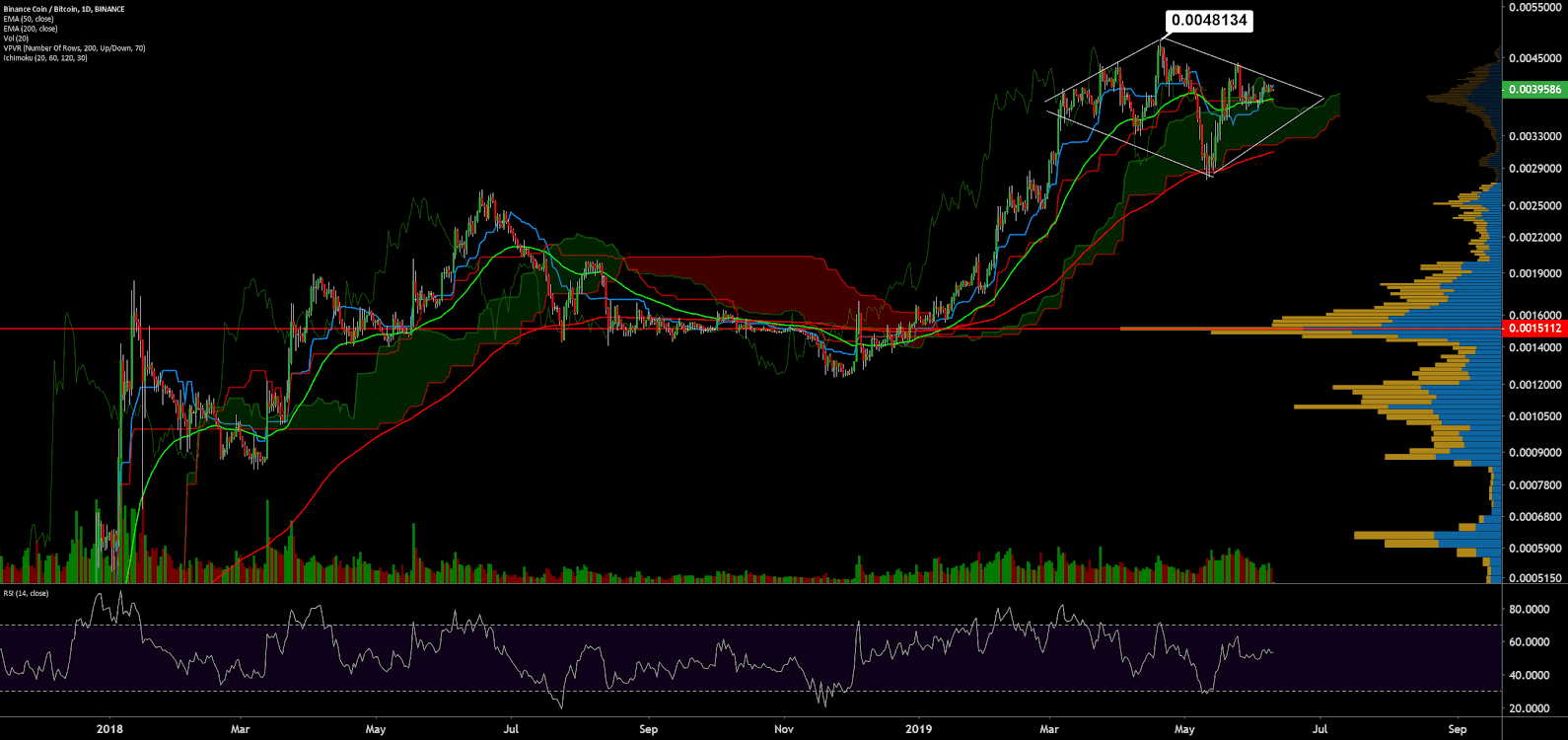

On the daily chart, for the BNB/BTC pair, price has also been in a strong but potentially weakening bull trend since January. The 50-day EMA and 200-day EMAs have been bullishly crossed since mid-January. Both EMAs, at 38,000 sats and 31,000 sats, should now act as support. A 50% retracement, from the current high, at 48,134 sats, to the Novemer low, at 12,371 sats, sits at 30,000 sats, and will also act as support. A large volume node of support sits at the previous range high of 25,000 sats in June 2018. The largest zone of support sits at the 15,000 sats level.

The most significant recent pullback occurred in the setting of a bearish RSI divergence and the announcement of the Binance hack. Price has now formed a diamond top chart pattern, signaling a bearish bias and the potential for reversal. This pattern includes a diamond shape created with higher highs and lower lows, touching each trend line more than once. Resolution of the pattern should take place before mid-July.

Cloud metrics with doubled settings (20/60/120/30) for more accurate signals, are mostly bullish; price is above the Cloud, the Cloud is bullish, the TK cross is newly bullish, and the Lagging Span is above Cloud but on par with price. The bull trend will remain intact as long as price remains above the Cloud. The most conservative long entry will take place once the Lagging Span has moved above price, which would signify a failed reversal attempt of the diamond top.

Conclusion

Binance has masterfully engineered the BNB token to become an all-encompassing aspect in every facet of the ever-growing Binance ecosystem. Because of this, the token has indeed gained a high degree of utility, which may also be seen by some as gatekeeping through the IEO lottery system, DEX listing fees, BEP2 transaction fees, and BEP2 token migrations. These fees can also be seen as analogous to membership fees on the trading floors of traditional legacy markets. Users are also incentivized to spend BNB to pay for trading fees, which are discounted by 25%, or hold BNB for a maker/taker discount. This coupon will be reduced to 12.5% later this year, 6.75% the year after, and ended completely on Binance’s 5th anniversary.

Buying and holding the BNB token is effectively going long on the success of the Binance exchange itself, which has yielded immense profits over the past 23 months of existence. A legal question remains as to where the blurred lines of security and utility could dampen token success in the future, if the token gains regulatory scrutiny.

As for the token burn, thus far, there has been an unenforceable implied contract with users, which has been met as expected. There is no reason to believe this will not continue, but the migration of BNB to the BEP2 chain now means Binance is the centralized authority of these token transactions, at least for the time being. From a public relations perspective, Binance has no reason to ever reverse transactions, but they do now likely have the ability to do so.

Technicals for both BNB pairs suggests an intact and strong bullish trend, although the BNB/BTC pair will have a decision on continuation vs reversal over the next few weeks. Even a Binance hack, one of if not the worst events that can manifest for an exchange, could barely drop the price for either pair. There continues to be a one-sided market of strong buying pressure from Binance exchange users, employees taking a salary in BNB, and tokens onboarding to Binance and the Binance chain. With margin trading coming later this year, there will likely be an additional incentive to hold the BNB token.

Don’t miss out – Find out more today