Bitcoin beyond 2020: Can proof-of-work sustain life after block rewards?

A Bank of International Settlements report concludes that bitcoin's liquidity is "set to fall dramatically" due to decreasing mining rewards and low retail use if it doesn't migrate to another consensus model such as proof-of-stake. Rootstock (RSK) is a Lightning-like sidechain that builds a bitcoin-pegged coin and smart contract utility on top of the bitcoin security layer to create a high-throughput currency that keeps bitcoin relevant as a medium of exchange and keeps network mining profitable.

The BIS report titled ‘Beyond the Doomsday Economics of proof-of-work in cryptocurrencies‘ sets out what it describes as two fundamental limitations in the economics of payment finality in bitcoin and PoW.

The first is that payments to miners must always be a high ratio to transaction volumes to secure the network. Because of the monetary advantage an attacker would have over miners if successful – collecting block rewards, tx fees and the double-spend transactions – there must be a high pay-off either in transaction times or costs.

"Double-spending is very profitable. In fact, attackers stand to gain a much higher bitcoin income than does an honest miner."

__ Bank of International Settlements__

The second limitation is that without block mining rewards the network cannot generate sufficient transaction fees to compensate miners to secure the network, which it attributes to the collective economic behavior of participants to set their individual transaction fees as low as possible.

"Either, the system works below capacity and users’ incentives to set transaction fees are very low, or the system becomes congested."

Bank of International Settlements

Proof-of-work will lead to bitcoin ‘liquidity crisis’

After the next bitcoin mining reward halving in 2020, there is some fear with BTC transaction fees so low that the diminished returns to miners will disincentivize mining and put many out of business if price doesn’t adjust upwards after it. As miners leave the network security is compromised as hashrate declines, leaving it susceptible to 51% attacks, and the perceived value in bitcoin could diminish with it.

The dichotomy for BTC as mining rewards are halved is that either transaction fees will have to increase to compensate for the loss to miners, in which case bitcoin’s use as a method of payment (Lightning Network aside) will be redundant and at best be used only for large transfers of value, or there will have to be an alternative use for the currency.

While acknowledging the Lightning Network as an effort to improve bitcoin’s usefulness and relevance as a payment currency it thinks ultimately it will migrate from the costly and slow PoW consensus for payment finality as the current system cannot generate transaction fees in line with the goal of guaranteeing payment security.

"Simple calculations suggest that once block rewards are zero, it could take months before a Bitcoin payment is final, unless new technologies are deployed to speed up payment finality." Bank of International Settlements

A Bitcoin 51% attack is coming within range

The BIS surmises with the cost of mining equipment coming down, unprofitable miners going offline and their surplus of cheap hash power available for rent, a 51% attack is more within range of bitcoin than it has ever been before.

Source: Bank of International Settlements

The hash power needed to secure the network is a derivative of transaction demand from network users so hashrate fluctuates in tandem with transaction demand as indicated by block size – the closer the block size to its 1MB limit the more transaction demand there is.

Miners see all pending transactions and choose those maximizing their fee income, thus generating an average transaction cost. But as long as blocks still have free space, the marginal cost to the miner to include a transaction is 0, and the miners include any transaction with a non-zero fee.

The "tragedy of the common chain"

At the heart of the low transaction fees/miner the report posits is a "free-rider dilemma" in that the proof of work required to secure every transaction in a block is premised on the fees attached to each transaction in a block being sufficient to incentivize miners. Overall it is in users’ (payees) interests to set a generous fee for miners to include their transaction in the next block and reduce confirmation time, but transaction fees are set privately so the individual tendency is to set transaction fees low and free-ride off others higher transaction fees in the block.

However, when newly added blocks are already at the maximum size permitted by the protocol, 1MB, the system congests and many transactions go into a queue. There is a positive relationship between transaction times and fees and transaction fees only increase when there is excess demand from users, ie when the blocks are hitting their 1MB capacity.

In order to prevent "liquidity from ebbing away", the paper suggests Bitcoin and other cryptocurrencies would need to depart from using proof-of-work – unsustainable without block rewards and towards proof-of-stake, or delegated proof-of-stake.

Rootstock – scaling bitcoin the Ethereum way

Pre-empting the halving and the hundreds of millions of mining hardware that will become obsolete as miners can’t make breakeven, several projects from the Lightning Network and Liquid sidechains to Segwit are trying to add more functionality to bitcoin.

Another sidechain project less talked about is Rootstock (RSK) which had its ICO late 2018 and is taking a different approach by scaling bitcoin in a direction similar to Ethereum by enabling smart contracts and proof-of-stake consensus. RSK isn’t mined as such but co-mined along with bitcoin in ‘merged mining’ – a task that allows miners to mine simultaneously other cryptocurrencies at no additional cost.

Rootstock uses an account-based ledger, like Ethereum, instead of the UTXO model in bitcoin.

Ethereum is also scheduled for a halving of block rewards but was postponed along with the Constantinople upgrade. The primary purpose of the reduction in Ethereum is to move miners away from Proof-of-work mining and towards proof of stake. This will be a gradual process, but the intent is to make mining financially uneconomical by simultaneously ramping up the difficulty in the Ethash PoW algorithm.

Keeping bitcoin mining profitable

As we’ve seen from the fallout of other 51% attacks, most recently Ethereum Classic, a perceived downgrade in the security of bitcoin (or any cryptocurrency) would be negative for its price. RSK aims to bring this added value to bitcoin miners by bringing functionality with smart contracts and scalability to its blockchain.

The global price of Rootstock’s bitcoin-pegged token RSK on Brave New Coin.

The Rootstock coin is mined with every bitcoin and pegged in price and exists on the RSK blockchain as a ‘smart bitcoin’. The network consensus protocols work as bitcoin miners vote with hash power (1 vote), and RSK vote with proof-of-stake (1 vote) but the security protocol is the same as bitcoin, the SHA-256 mining algorithm, and the result is more transaction throughput (initially 300 transactions per second), near instant confirmations and smart contract utility, all with the security of bitcoin’s network.

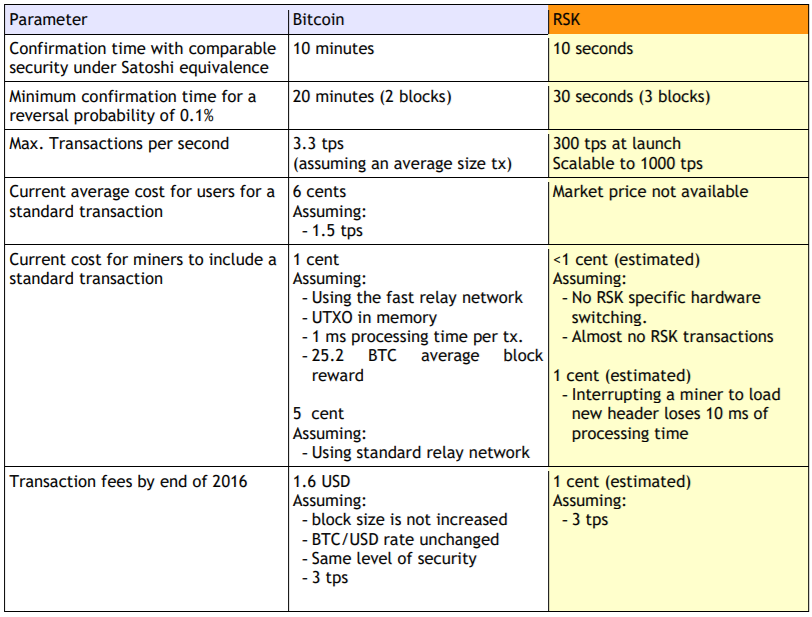

Table shows the speed and cost advantages of RSK transactions over bitcoin transactions. Source: Rootstock

The concept is to incentivize miners keep mining after the halving and stop a decline in hash rate by adding extra utility and scalability to bitcoin as a currency, which adds to its value and mining profitability.

The reason for the approx 10 minute block times in bitcoin is to guarantee security as it gives a chance for transactions to be broadcast and verified by as many peers on the network as possible. This creates a high degree of decentralization but slow transaction throughput. In the Nakamoto whitepaper, it is posited that higher waiting times adds exponentially to network security as forging new blocks also requires proof of work and higher wait times become more costly.

The miners broadcast transactions while the non-mining nodes hold the hashes to the blocks which are gradually filled with transactions from miners. RSK on the other hand uses different consensus protocols to bitcoin, DECOR+ and FastBlock5, to bitcoin which it claims can bring block verifying rates down to 10 seconds without creating incentives for centralized mining.

Conclusion

Like the first pioneers of any industry the prospect of bitcoin being usurped as the ‘gold standard’ for cryptocurrencies beyond 2020 is a high probability considering its market value relies on an equilibrium model in which the cost of updating the blockchain is equal to the reward.

One way to alleviate the cost/rewards of updating and securing the ledger is to partly insitutionalize or coordinate its governance rather than it being completely decentralized. This could provided insurance against double-spending attacks as there could be guaranteed reversal to avoid a hard-fork like that which happened to Ethereum after the DAO attack.

Adding smart contract functionality and moving to another consensus protocol like PoS or DPoS sounds practical for scaling but would possibly move bitcoin away from being a store of value and put it in competition with EOS or Ethereum. Or, the endeavors of Rootstock might prove that it’s possible to have both.

One advantage bitcoin has over previous pioneers such as auto or aerospace is that code is malleable.

Subscribe to BNC’s newsletters for insights and forecasts direct to your inbox

Don’t miss out – Find out more today