Bitcoin investors need to know these 5 facts about Bitcoin corrections

Bitcoin is in a bull market. But that doesn’t mean that price won’t pull back to lower levels. And sharply. Technical analyst Rekt Capital explains why corrections are a natural, healthy component of a bull market cycle.

Bitcoin bull markets are exciting. There is no better feeling for Bitcoiners than waking up to the prospect of new all-time highs. However, it’s important to understand that even in a bull market, the price never goes up in a straight line. In fact, price corrections are a natural, healthy, and necessary component of a bull market cycle.

Yes, we’re experiencing a correction right now. It may well go deeper and last for days, or even weeks. Once the correction is complete, that is when Bitcoin’s price can shoot back up and rally to new highs.

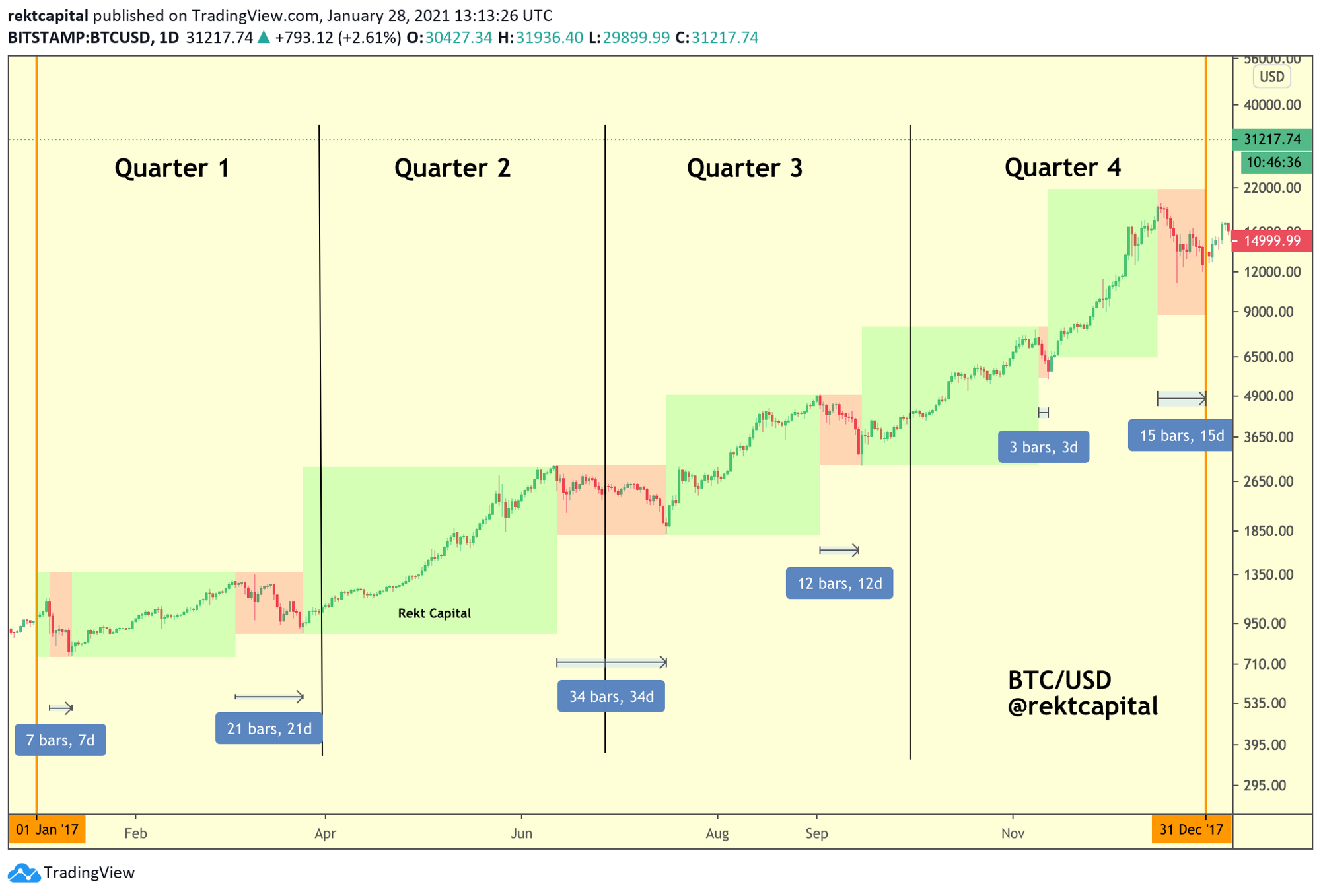

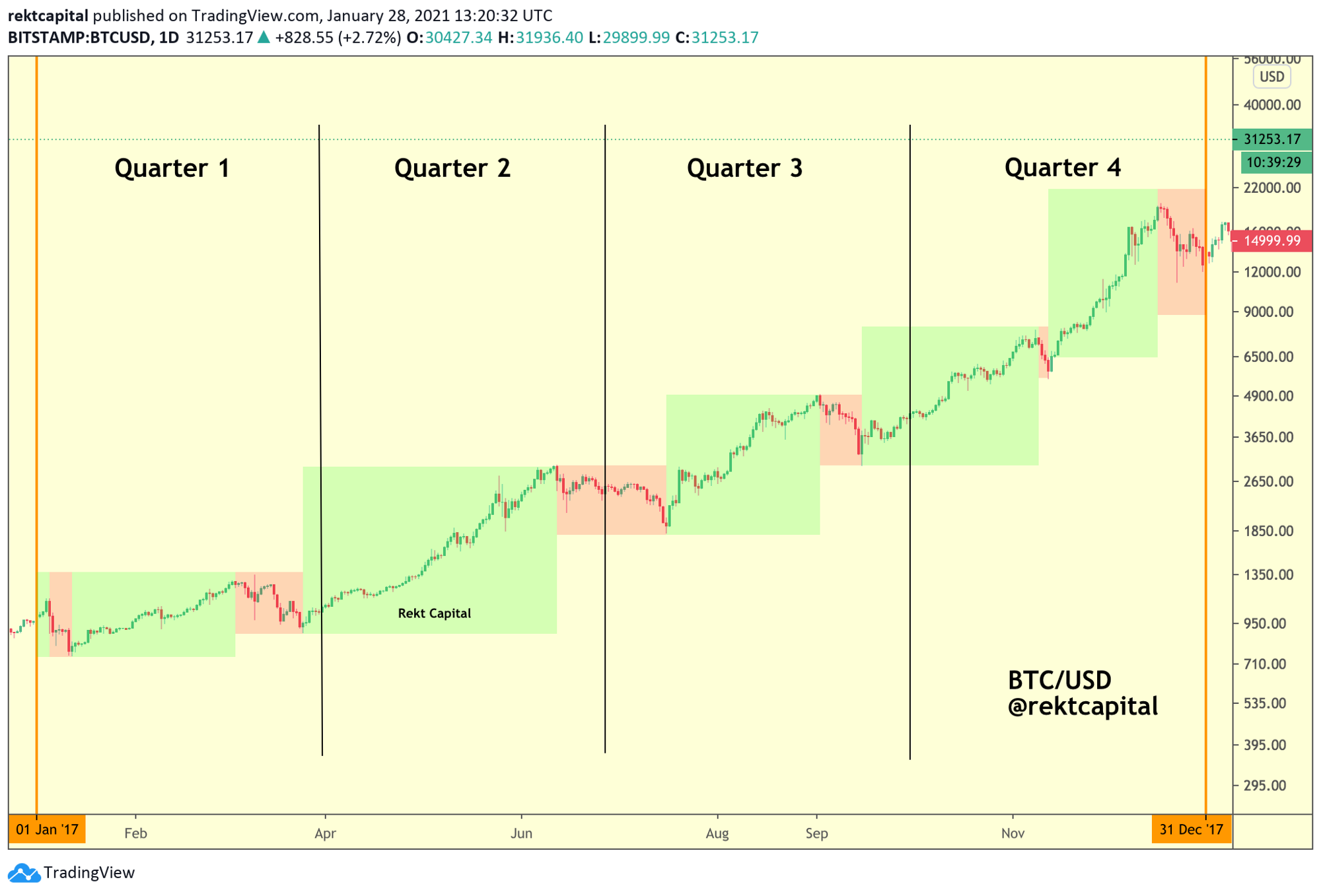

In this article, I will divide the 2017 Bitcoin bull market into quarters to illustrate several key insights about Bitcoin corrections and the uptrends these tend to precede.

Here are five facts about Bitcoin corrections:

1. Uptrends are longer than corrections

Throughout its 2017 bull market, Bitcoin spent most of its time in an uptrend (green) compared to time spent in a correction (red).

In fact, throughout the 2017 bull market, Bitcoin spent a total of 267 days in an uptrend and only 98 days in a downtrend.

That means Bitcoin spent a staggering 73% of the entire year in an uptrend!

The average time BTC spent in an uptrend in 2017 was around 50 days.

2. Corrections are normal

In 2017, Bitcoin experienced five major corrections.

While the shortest retrace took only three days, the longest correction lasted just over a month.

In fact, the average time Bitcoin spent in a retrace was about 16 days.

In 2017 overall, Bitcoin only spent 98 days in a corrective period, which is only 27% of the year.

But not only are the corrections shorter than the uptrends, the corrections also get shorter as the bull market progresses.

Corrections arguably become briefer later in the year as the buy-side pressure begins to reach euphoric proportions.

3. Every quarter sees at least one strong Bitcoin correction

In 2017, Bitcoin would retrace at least once per quarter.

However, it was actually more common for Bitcoin to experience two corrections during a quarter (e.g. Q1, Q3, Q4)

The only quarter that saw only one strong Bitcoin correction in 2017 was Q2. Not only are corrections a common occurrence in Bitcoin bull markets, but they tend to take place cyclically.

4. Corrections tend to occur at the end of a Quarter

While some Bitcoin corrections began at the beginning of a quarter (e.g. Q1 & Q3), Bitcoin corrected near the end of every quarter in 2017.

The only time when BTC retraced mid-quarter was in Q4, though it was very brief.

5. Corrections tend to be -30% to -40% deep

In the 2017 bull market, Bitcoin experienced 5 major pullbacks. These pullbacks ranged between -29% to -40%.

The average bull market correction was about -35%.

That said, no matter how deep these retraces were, each of them preceded new all-time highs for Bitcoin’s price.

Closing thoughts

At the moment, Bitcoin is experiencing its second major pullback in this 2021 bull market.

The first retrace in January was around -31% deep. This second pullback is around 20% already. This is very normal by the standards of Bitcoin’s price history.

And while it would be healthy for Bitcoin to retrace even deeper, history suggests this correction will eventually precede further exponential upside.

If you liked this analysis, you’ll find value in the Rekt Capital newsletter where I feature more extensive, in-depth analysis.

Don’t miss out – Find out more today