Bitcoin vs. Stocks, Bonds, Gold, Silver, and Oil

Bitcoin is the best-performing asset of the last ten years. For early investors, this means an ROI of 100,000 percent in ten years. How has Bitcoin performed against other asset classes such as stocks, bonds, precious metals, and oil more recently?

Despite its sometimes extreme volatility, the Bitcoin price has increased steadily since its inception – from less than one cent in early 2009 to an all-time high of over $69,000 in November 2021. Bitcoin trades at around the $41,000 mark today.

In this article, we will analyze and compare the absolute returns of Bitcoin versus stocks, bonds, gold, silver, and oil over the last one, three, and five years.

Bitcoin versus traditional assets

For the analysis, we chose stocks, bonds, gold, silver, and oil. Stocks and bonds are generally key components in institutional investment portfolios while gold and silver have characteristics similar to Bitcoin. Oil was added due to its low correlation with stocks and bonds.

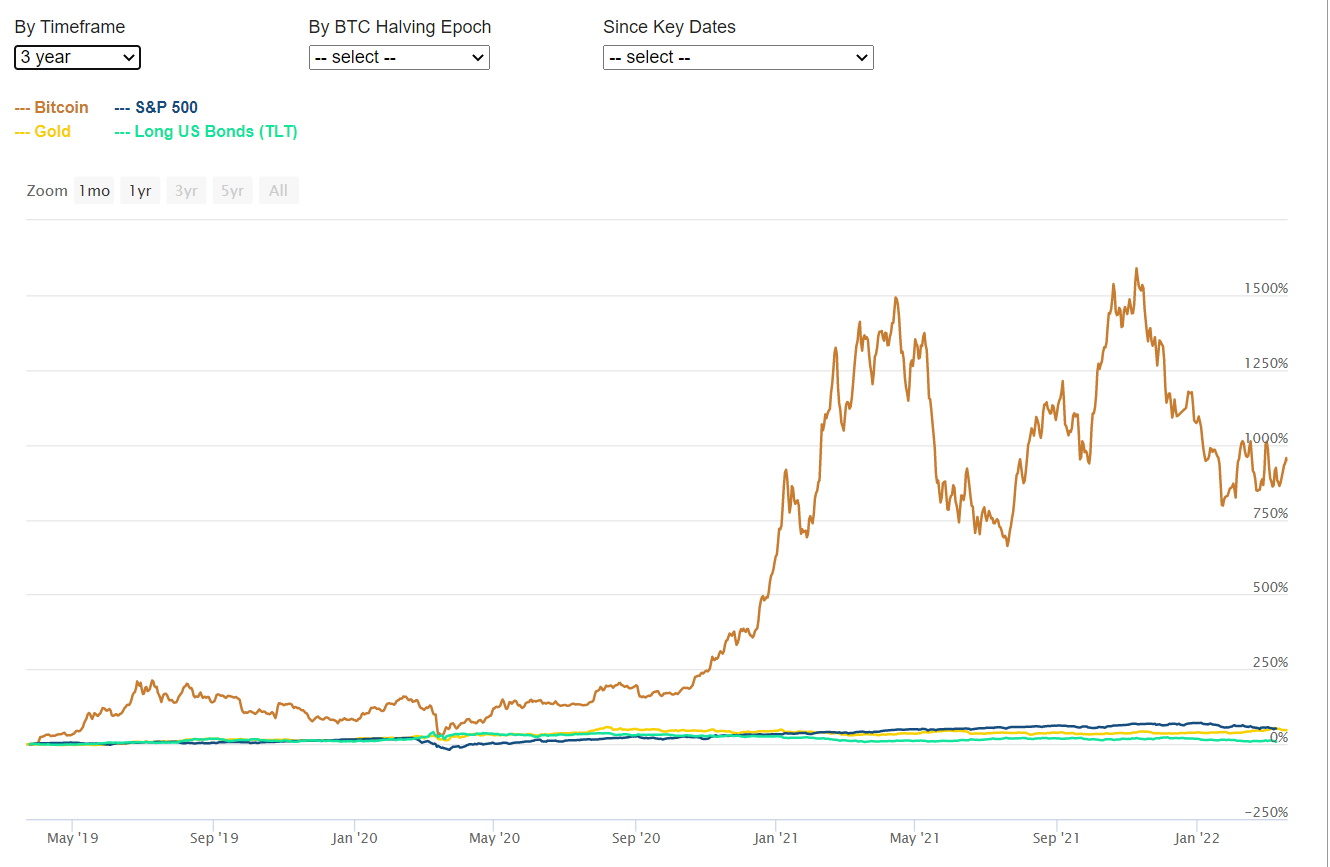

The table below shows that Bitcoin has outperformed every major asset in all three chosen investment periods on an absolute returns basis.

| Asset | 1-Year Return | 3-Year Return | 5-Year Return |

| Bitcoin | -22.64% | 926.24% | 3210.34% |

| Stocks (S&P 500 w/ Dividends Reinvested) | 8.60% | 57.10% | 93.35% |

| Bonds (AAA-Rated Corporate Bonds) | 1.80% | 26.00% | 46.45% |

| Gold (Spot Price) | 12.56% | 49.16% | 55.62% |

| Silver (Spot Price) | 1.66% | 66.64% | 52.37% |

| Oil (WTI Crude) | 80.27% | 104.39% | -131.73% |

| Ethereum | 73.71% | 1985.25% | 5787.51% |

While our analysis covers absolute and not risk-adjusted returns (and, thus, does not include volatility), the numbers show that returns-hungry investors with ample risk appetite could benefit significantly from adding Bitcoin to their portfolios, if the digital asset continues to generate similar returns in the future. There is no guarantee of this.

Bitcoin’s price gains dwarf those other noted safe havens, Source: Casebitcoin.com

Bitwise and others makes a case for Bitcoin in every portfolio

The argument presented above suggests that due to its high returns potential, Bitcoin should be included in every well-diversified investment portfolio. However, due to the high risk compared to traditional assets, most experts agree that Bitcoin should only make up a small percentage of a portfolio.

However, it is important to note that the case for Bitcoin as part of a portfolio holding goes beyond the potential for high returns. Bitcoin also stands out as an excellent diversifier as it is uncorrelated to traditional assets such as stocks and bonds.

Digital asset investment firm Bitwise highlighted the case for Bitcoin in a report titled ‘The Case for Crypto In An Institutional Portfolio.’ In the report, Matt Hougan, Global Head of Research at Bitwise, and his team analyzed the impact that small allocations to Bitcoin would have had on a 60 percent equity/40 percent bond portfolio between January 1, 2014, and March 31, 2018.

“Allocating to Bitcoin would have significantly increased the portfolio’s risk-adjusted returns, assuming the portfolio was systematically rebalanced over time,“ the report concluded.

Specifically, Bitwise found that an allocation of one percent, five percent, and ten percent to Bitcoin would have generated returns of 31.09 percent, 50.89 percent, and 78.38 percent versus the Bitcoin-free portfolio, which would have only made 26.53 percent total return.

Legendary investor Paul Tudor Jones, in a monthly letter for his fund BVI, also makes the case for including Bitcoin in investment portfolios. He backs it for factors including the “coming digitization of currency everywhere, accelerated by COVID-19.” He acknowledges the growth of Bitcoin in comparison to other traditional stores of value like financial assets, cash, and gold. Tudor Jones says that even if the market cap of Bitcoin grows marginally in comparison to some of these other safe havens that it is competing with, the asset’s price gains may be astronomical.

"At the end of the day, the best profit-maximizing strategy is to own the fastest horse. Just own the best performer and not get wed to an intellectual side that might leave you weeping in the performance dust because you thought you were smarter than the market. If I am forced to forecast, my bet is it will be Bitcoin."

The “Radical Protection Portfolio”

Digital asset investor and outspoken Bitcoin advocate, Anthony Pompliano, also believes that Bitcoin should be in every investment portfolio.

In a tweet on May 20, he wrote: “Bitcoin is a non-correlated, asymmetric return asset. By putting it in your portfolio, you can reduce the risk profile, increase Sharpe ratio, and produce a material amount of impact on overall portfolio with a single-digit allocation. Essentially, it improves your portfolio.”

In a new blog post titled ‘The Radical Protection Portfolio’ Pompliano makes the argument for a portfolio composed for 95 percent cash and 5 percent Bitcoin in light of the low projected returns for stocks and bonds and sluggish economic growth projections.

“The risk/reward trade-off of 95% cash and 5% Bitcoin is incredible. First, the risk profile is quite clear – an investor could lose up to 5% of their portfolio in the worst-case scenario. A 5% loss would be a smaller drawdown than the S&P 500 had last year (-6.24%). Second, the upside for Bitcoin is quite asymmetric. The asset will either be worth much more than it is today or it will be worthless. This type of binary outcome, combined with the non-correlated nature of the asset, gives investors a great hedge against economic chaos,” he wrote.

Similar portfolios with 99 percent cash and one percent Bitcoin or 98 percent cash and two percent Bitcoin would have done well in the past, generating around 10 and 20 percent annualized returns, Pompliano argues.

Pompliano’s proposed ‘Radical Protection Portfolio’ would have a downside risk of 5 percent versus a potential upside of 20 percent plus. While it may seem odd to hold a 95 percent cash position, this portfolio has the potential to outperform most stock and bond portfolios given the low projected returns for these two asset classes in the coming years.

The barrier to investing in Bitcoin and digital assets has been further reduced because of the issuance of financial products like regulated derivatives, ETFs, and investment fund shares. In light of the high returns potential of Bitcoin and other cryptographic assets, it’s likely that it will become increasingly difficult for portfolio managers to ignore digital assets. Clients will want to see high returns regardless of how stocks and bonds are performing, and Bitcoin might be the best solution.

Don’t miss out – Find out more today