BNC Research Forecast- March 10th— Crypto Events you should have your eye on

The BNC Research Forecast is a fortnightly report covering upcoming key events across the crypto space with the potential to move the markets.

Benchmarks

Bitcoin (BTC) is down 5.4% in the last 7 days and is up ~9.7% in the last 14 days

Ethereum (ETH) is down 8.4% in the last 7 days and is up ~3.1% in the last 14 days

Exchange listings

Coinbase

– March 9th

Listings for Aergo (AERGO), Ethernity Chain (ERN), Status Network Token (SNT)

In the last 7 days- AERGO is up ~18.9%, ERN is down ~0.3%, SNT is up ~6.9%

-March 18th

Listings for Aioz Network (AIOZ), Golem (GLM), Highstreet (HIGH) & Synapse (SYN)

In the last 7 days- AIOZ is up ~28.2%, GLM is up ~5.0%, HIGH is down 9.4%, SYN is down ~17.0%

FTX

-March 10th

Listings for IndiGG (INDI)

The INDI token is a brand new token launched by an initial exchange offering on FTX. IndiGG is the India Sub-DAO of YGG (Yield Guild Games) and is built in partnership with Polygon Studios -the gaming arm of Polygon. Backed by one of the biggest exchanges in crypto, the biggest Play-to-earn DAO, and one of the largest blockchain layer 2 solutions in the space, it seems likely that the INDI IEO will be oversubscribed.

It would not be surprising for the price of INDI to rise well above its US$0.1 initial IEO price this week.

__-March 9th __

Listings for Wrapped Flow (WFLOW)

FLOW is down ~6.6% in the last 7 days

Binance

- STEPN (GMT) token sale on Binance Launchpad went live with immediate listing after the sale was completed

STEPN is a unique take on the Play-to-earn utility token model where users earn a token for running, offsetting carbon, and burning calories. STEPN calls their model Move-to-earn. While this may seem a little gimmicky, the project has big-name backers like Sequoia, Solana ventures, Alameda, and 6th Man ventures. A question is how easy will it be to game a system like Move-to-earn?

Governance forum review

Summary

Two weeks ago investment firm Arca posted a governance proposal with an aim to bring “much-needed” utility to the Anchor protocol’s native token ANC.

According to Jeff Dorman, the interconnected Anchor, Terra, and UST applications are some of the fastest-growing protocols in crypto.

Despite this, ANC, Anchor’s native token, has underperformed the rest of the market. According to Dorman, ANC lacks utility, and users are incentivized to use LUNA rather than ANC when dealing with Anchor.

Dorman points out that ANC’s TVL has increased by US$11.3 billion since launch. Despite this, the price of ANC has dropped by 16%. In the meantime the price of LUNA is up by 233%.

Anchor has acknowledged that the current tokenomics of ANC have some problems. Numerous proposals have been made to evolve these, and the discussion on how to achieve this is ongoing. Something big is likely happening for the ANC token soon. Either through Arca’s proposal or some other stakeholder’s proposal.

According to Dorman, because of the underperformance of the ANC token and the way rewards work, Anchor needs capital injections to keep the protocol secure. An example of this is a recent US$450 million injection into the project by Terraform labs.

These capital injections are needed to maintain the high 20% interest rate on UST deposits. The current scheme on Anchor does not require depositors to have any “skin in the game” in the form of ANC tokens. They do not have to buy into the protocol.

Arca suggests that large depositors with balances over US$100,000 have to own 10% of their deposits in ANC, in order to gain the full 20% reward. If they don’t do this then they don’t earn the full yield.

According to Dorman, at the current UST level, this program would create significant demand for ANC.

The Arca proposal was followed by other proposals such as a combined proposal made by Polychain and Arca. The proposal is for Yields to be paid to Anchor depositors to be paid-out 85% in UST, and 15% in ANC. It is also suggested that the ANC used to pay depositors is market bought using UST.

Polychain and Arca also suggest a vote escrowing model similar to the one used by Curve. Arca and Polychain suggest that if ANC is deposited it is then converted into Vote Escrowed ANC. The proposal then suggests that the absolute yield level for depositors is determined by the amount ve-ANC and how long it has been locked in for. Those willing to lock in for longer earn more interest rate rewards and more voting rights.

The final part of the proposal is an ANC rebate boost for borrowers, proportional to the borrower’s amount of ANC.

Both tokenomics proposals have received significant viewership across the Anchor governance platform and in general, the view appears to be that the ZNC tokenomics needs to change and more value needs to be redirected into the Anchor platform’s native token.

Tokenomics can make or break the value of a popular Defi Platform’s native token. Curve for example has found a way to create utility and value for its native token in a way that platform’s such as Compound and Balancer have not. Balancer has even released a governance proposal that proposes a switch to Curve style tokenomics model.

If the ANC tokenomics are adjusted so that value locked into the platform reflects the price of the token, expect ANC to be an alpha performer in 2022.

ANC is up 12.1% in the last 2 weeks

Upcoming hardforks

Theta v3.3 hard fork is set for block height 14526120 which is expected to occur on March 14. This upgrade lowers the Validator Node staking threshold from 2 million to 200,000 THETA, allowing more community users to run Validator Nodes with to further decentralize the Theta protocol.

After the version 3.1 upgrade of the Theta in July, the price of the project’s native token rose by ~38.1%.

The price of THETA has dropped ~6.2% in the last week.

Is there a potential for price reversal of the THETA token with the hard fork just around the corner?

Other notable events in the cryptocurrency space

-

President Biden’s cryptocurrency executive order has received the stamp of approval from a number of key industry players. The order has directed federal agencies to take a unified approach to regulate crypto and has asked them to work together to support crypto innovation and aid in maintaining the US’s position as technological leadership in this ‘rapidly growing space’. He also did ask the agencies to address the risks of crypto such as consumer protections and national security implications.

The order, which was first announced in October, has been the source of much speculation. There were concerns that the executives would call for major regulations for the crypto space. Biden’s neutral tone through the letter, which opens positively, has been met with great relief by the industry. Prices across the sector have risen following the reveal of the contents of the executive letter.

-

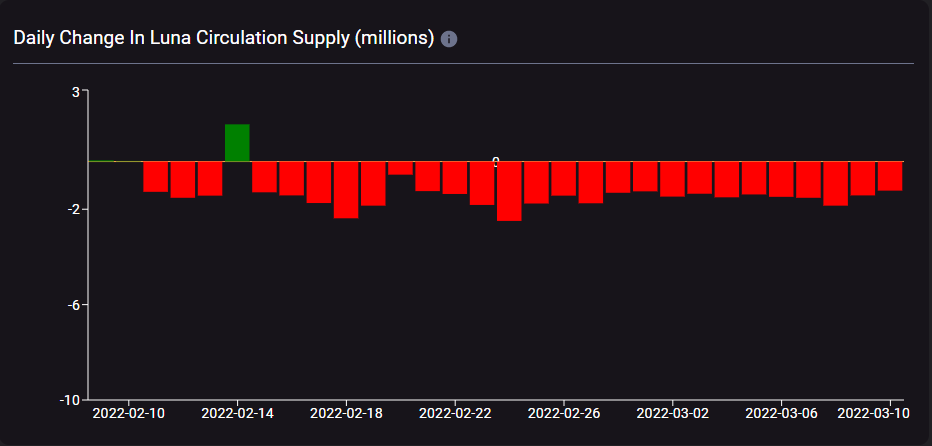

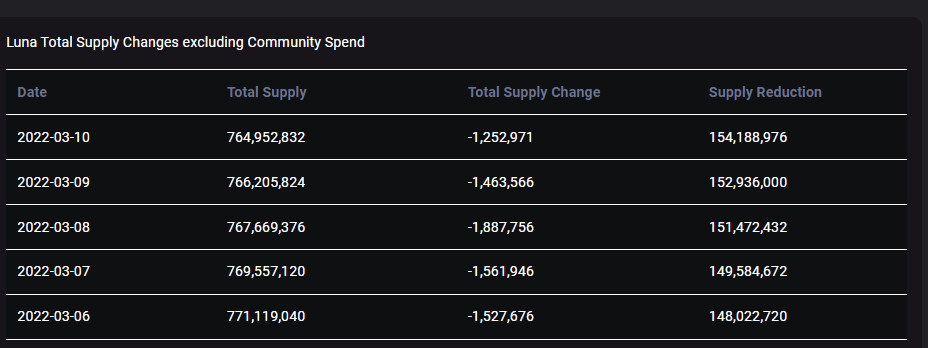

LUNA has been on a siloed bull run and has continued rising aggressively while other assets around it have traded in the chop. The price of LUNA is up ~66% in the last two weeks and has established new all time highs and crossed above the US$100 price in the last few days. LUNA is most likely rising because demand for UST, the Terra ecosystem’s native token, is surging rapidly.

If the price of UST is above US$1 because of excess demand, then the supply of UST needs to expand to dilute the price. Terra lets arbitrageurs turn in LUNA for UST worth US$1, even though the price of UST is more than US$1. Terra then burns the LUNA handed in by the arbitrageurs and the supply of LUNA drops. The buying pressure for UST pulls it back towards the peg.

Presently millions of LUNA is being burnt everyday to ensure that the UST peg is maintained. This supply shock is putting price pressure on LUNA and organically forcing the price upwards. It is also likely that speculators are piling into LUNA noting its alpha performance.

Another boost for LUNA was an announcement by the non-profit, the Luna Foundation Guard (LFG), that it had raised US$1 billion to create a protective layer for UST, the Terra ecosystem’s native USD stablecoin, which is also protected by LUNA holders. The new fund will add to the long-term stability and security of the Terra ecosystem.

Source: https://terra.smartstake.io/

Source: https://terra.smartstake.io/

Don’t miss out – Find out more today