Coinbase acquires the prime brokerage platform Tagomi

Coinbase is one of the worlds largest crypto exchange companies, and recently acquired a crypto prime brokerage platform, Tagomi. The acquisition will bolster Coinbase’s offerings for advanced traders and sophisticated crypto investors.

Tagomi was founded in early 2018 by; Greg Tusar, the former global head of electronic trading at Goldman Sachs GSBD; Jennifer Campbell, a former venture capitalist at Union Square Ventures (USV); and Marc Bhargava, who did prior stints at McKinsey and Airbnb.

The companies core product is a prime brokerage platform designed to cater to crypto traders who make large transactions, valued between US$250K and US$2M. In traditional finance, the term prime brokerage refers to a bundle of specialized services offered by investment banks and securities dealers to hedge fund clients.

According to Campbell, Tagomi is “agency-only,” which means that the firm offers consulting services for its clients, and determines “how best to execute a trade or fund strategy.” The company links to a range of large exchanges, including the likes of Coinbase and Binance US, with the goal of routing an order to the exchange offering the best price.

In close to three years, Tagomi has raised US$28M in venture capital funding from leading investors including Peter Thiel’s Founders Fund, Coinbase co-founder Fred Ershams Paradigm, Digital Currency Group, Pantera Capital, Dragonfly Capital Partners, Collaborative Fund and others.

Matt Huang led the second venture round of Tagomi which raised US$12M, stating that he viewed Tagomi’s offering as “the next step in the evolution of how digital assets trade.” Huang founded Paradigm, a US$400M crypto-focused fund, alongside Coinbase co-founder Fred Ersham, after leaving Sequoia Capital.

Coinbase was founded in 2012 by Fred Ersham and Brain Armstrong, who is the current CEO. The crypto firm has gone on to raise just under US$550M from a slew of investors over a range of funding rounds. Investors include the likes of Y Combinator, USV, Andreessen Horowitz, NYSE, MUFG, Initialized Capital, Polychain, Digital Currency Group, and Tiger Global Management.

Coinbase has been acquiring smaller crypto startups as a method of bringing onboard their tech or talent. The most recent acquisition, prior to Tagomi, was Xapo for US$55M. The acquisition was touted as concluding a “tremendous period of growth and innovation for Coinbase Custody,” according to a blog post made by Coinbase.

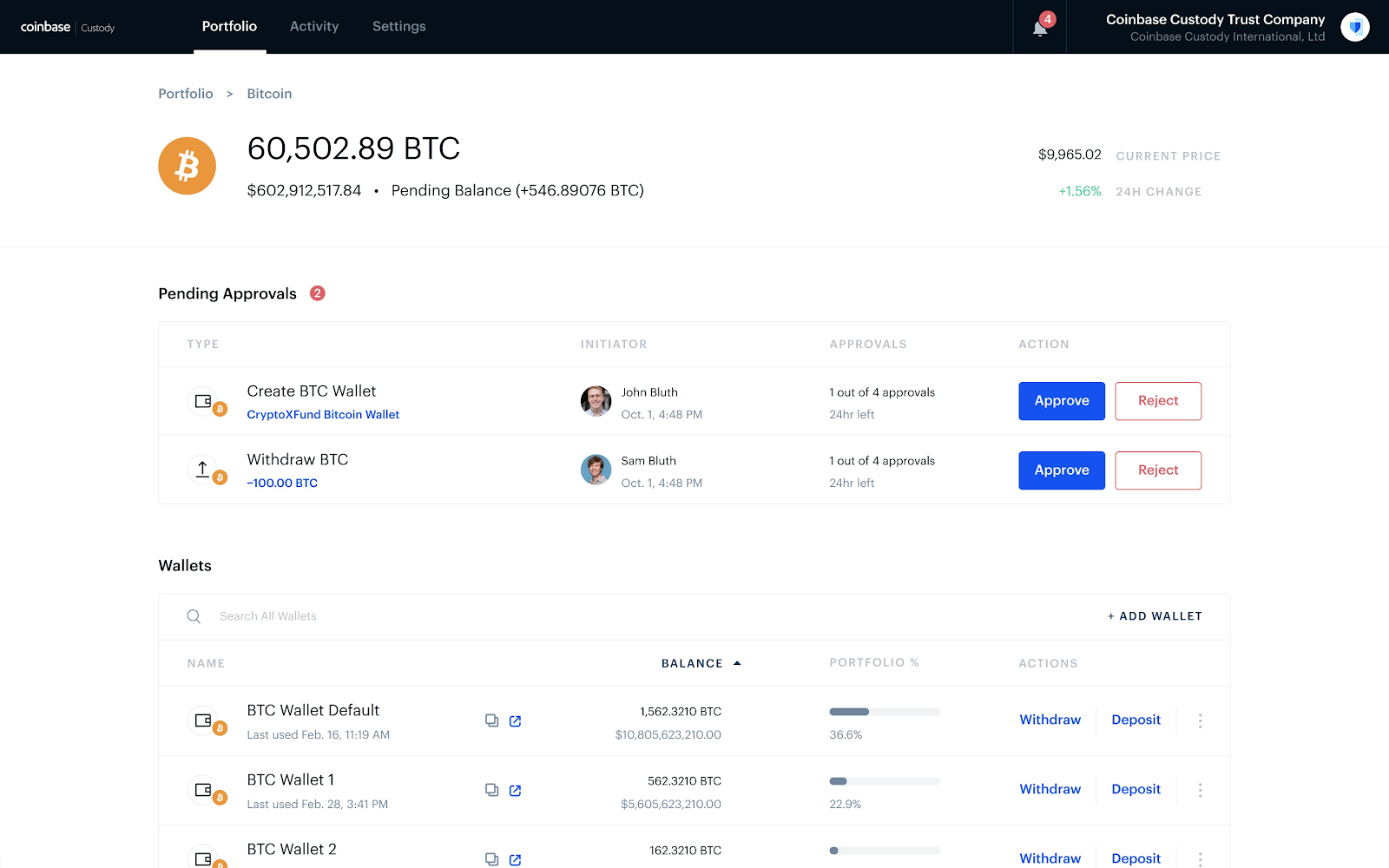

Since launching Coinbase Prime in mid-2018 and Coinbase Custody in 2017, the firm has doubled down on its focus on catering to institutional participants in the crypto space. Coinbase Prime offers features such as algorithmic trading, as well as API and third-party platform support.

There is a clear demand for the features Coinbase has started to offer institutional investors. Since launching Coinbase Custody, the business has grown to over US$8B in Assets Under Custody, from more than 120 clients in 14 different countries. It is also the only crypto custodian to attain both its SOC1 and SOC2 compliance reports.

In late April, Coinbase hired Brett Tejpaul as the new Head of Institutional Coverage. Tejpaul previously spent 17 years in various global leadership positions in both the US and the UK.

Tejpaul will be focused on the continued “institutionalization of crypto.” This includes continuing to expand the company’s institutional client base, expanding the coverage team, introducing new features and services that institutional investors expect, and continuing to educate the institutional community about crypto as an asset class and its role within a diversified portfolio.

Coinbase isn’t the only crypto firm focussing on the growing interest of institutional participants. On Wednesday, a leading custody provider, BitGo, announced that they are launching BitGo Prime, a platform aiming to bridge crypto lending, custody, and trading for institutions.

Earlier in May, Genesis Global Trading announced that they acquired Vo1t, a UK based institutional-grade custodian. In a blog post referencing the acquisition, Micheal Moro, the CEO of Genesis Trading, stated that the reason they acquired Vo1t is “because it is the latest step in our journey: to build the preeminent prime brokerage in the digital currency ecosystem — a one-stop-shop for trading, lending, and securing digital assets for financial institutions.”

Don’t miss out – Find out more today