Chris Skinner

More from this author

Will Sweden be the first cashless country?

As Sweden was the first European country to use cash for payments back in 1661 it’s unsurprising that it’s the first European country that wants to be cashless. This is why, for several years, I’ve been watching the regular speeches by Lars Nyberg, Deputy Governor of the Sweden’s central bank, the Riksbank, talking about eradicating the use of cash in Sweden. **February 2003** Cash is still the king. Given the rapid increase in the use of cards in Sweden, particularly in the late 1990’s, cash should have been expected to fall in importance. This, however, does not seem to have happened. The use of cash, measured as the ratio of the value of currency in circulation (M0) and GDP, fell during the first half of the decade, but have been fairly constant since then, lately even increasing somewhat.

Survival of the most adaptable

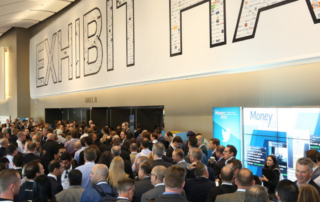

Wrapping up thoughts on #Money2020, the Vegas show is by far the biggest of this monster event organising company. I’m guessing there were around 15,000 folks there this year, and everything but everything was being covered: AI, machine learning, mobile wallets, core banking, distributed ledger, blockchain, cryptocurrencies and just about every other aspect of making and taking payments. Usually the keynotes on the plenary stage don’t impress me much, as they’re just product pitches, but a few did stand out this year. I was particularly impressed by the content of Oliver Jenkyn’s presentation. Oliver is EVP & Group Executive, North America for Visa and I usually hate Visa’s content. But Oliver began by talking about a messaging conversation he had with his ten-year-old daughter that finished with her asking:

A global currency is coming, whether you like it or not

Continuing yesterday’s discussions about a big bank’s conference, I was intrigued at how often the subject of cryptocurrencies and bitcoin came up. But there again, it’s a topical thing at the moment with the price of bitcoins surging past the $4,000 mark and Goldman Sachs going against JP Morgan, and saying that they might even trade in it. The conversation at this particular large bank’s meeting went along the lines of bitcoin being a broken model, it’s a bubble and you should definitely not invest in it. The reason for not investing is based upon two major factors.

Why bankers only see horses and technologists are creating cars

I was at a large bank’s wealth management conference recently, where the CEO was being quizzed about various areas including a lot about technology and FinTech. He made several statements that I noted with interest: “Roboadvisory services improves our speed-to-market and human productivity, but does not replace humans. In particular, I can see that artificial intelligence (AI) and machine learning makes it far easier for us to comply with and implement regulations and deal with regulatory change in the back office.”

The imperative for self-sovereign identification

I’m making a presentation on cybersecurity this week at our Nordic Finance Innovation meetings. This meant preparing a few new slides from scratch as I don’t have a set deck for cybercrime, and sat and started ideas just as the news dropped about the Equifax breach. You’ll all know about this by now, but over 143 million Equifax accounts were hacked during June-July 2017, including customers’ social security numbers, name, address, date of birth, driving licence and other sensitive info. In other words, all the information you need to open new accounts and access existing accounts.

InsurTech’s big ticket items: machine learning on the blockchain

I don’t usually tell people that I’m a qualified expert in insurance as it’s not relevant, but I’m mentioning it today as I just presented at a private insurance event. There are lots of interesting nuances in insurance. You and I probably think it’s just that once a year renewal of our auto policy, or maybe the regular premiums we pay for life and pensions. That’s an important part of it and is a challenge as people don’t buy insurance, it has to be sold. Think about it. You don’t wake up and think “oh, I might die today! Better get some life insurance”, but you learn through advisory sales that this is what you need to do. Then there’s a whole other raft of insurance where the real money is made: commercial insurance. Insuring ships, aircraft, offices and employees is where the big-ticket policies arrive. These are more complicated, as the risks have to be calculated in more depth. Under assess the risk and the insurance company loses; over assess and a competitor might steal the business. Equally, the corporate relationship becomes important in this space, as that’s where the strength of understanding the client comes from.

FinTech and the world of investment banking

Some people talk about FinTech disruption and how payments and banking is being attacked and unbundled by start-ups, but we often look at banking too simplistically. Global banks and investment banks are far more complex creatures than their high street counterparts, which is why we’ve seen far less disruption in corporate, commercial and wholesale banking that we are seeing in retail, but don’t be complacent or closed here. There are things happening in the more complex areas too. For example, there’s a new clearing bank that is just an API; there’s a global trading social network, that is far more effective and fun than day trading on your own; there’s a clearing and settlement engine being built, supporting billions of transactions through blockchain technologies; there’s a whole range of crowdfunding ventures that are allowing start-ups to get started far faster and easier than ever before; equally there are reams of new firms offering SME financing support, allowing small businesses to flourish and prosper; and there’s a lot more. In fact, the landscape of change in this more specialised market of markets is massive, but often overlooked.

What was hot at Money2020 Europe

Last week was Money 2020 Europe week. This year a gathering of 6,000 odd people – and I mean **ODD**– assembled in Copenhagen to talk all things FinTech and stuff. That’s 50 percent up on last year’s first outing and, due to the numbers and a few brown envelopes from the Dutch, the whole shindig moves to Amsterdam next year.

Turkey to be cashless by 2023

I spend a lot of time talking with my friends in Turkey, particularly since the big change in climate after the protests last year. Nevertheless, from a financial markets point of view, it’s a fascinating place. One of the first to be contactless and, more recently, one of the first to offer social retail banking.

The crazy world of crypto currencies and ICOs

I’m boarding a flight yesterday and murfing (mobile surfing). Flicking between Facebook apps, twitter, bank account, BBC news and more. Suddenly I spot a new ICO – Initial Coin Offering – for a new bank.