FinTech and the world of investment banking

Some people talk about FinTech disruption and how payments and banking is being attacked and unbundled by start-ups, but we often look at banking too simplistically. Global banks and investment banks are far more complex creatures than their high street counterparts, which is why we’ve seen far less disruption in corporate, commercial and wholesale banking that we are seeing in retail, but don’t be complacent or closed here. There are things happening in the more complex areas too.

For example, there’s a new clearing bank that is just an API; there’s a global trading social network, that is far more effective and fun than day trading on your own; there’s a clearing and settlement engine being built, supporting billions of transactions through blockchain technologies; there’s a whole range of crowdfunding ventures that are allowing start-ups to get started far faster and easier than ever before; equally there are reams of new firms offering SME financing support, allowing small businesses to flourish and prosper; and there’s a lot more. In fact, the landscape of change in this more specialised market of markets is massive, but often overlooked.

Some people talk about FinTech disruption and how payments and banking is being attacked and unbundled by start-ups, but we often look at banking too simplistically. Global banks and investment banks are far more complex creatures than their high street counterparts, which is why we’ve seen far less disruption in corporate, commercial and wholesale banking that we are seeing in retail, but don’t be complacent or closed here. There are things happening in the more complex areas too.

For example, there’s a new clearing bank that is just an API; there’s a global trading social network, that is far more effective and fun than day trading on your own; there’s a clearing and settlement engine being built, supporting billions of transactions through blockchain technologies; there’s a whole range of crowdfunding ventures that are allowing start-ups to get started far faster and easier than ever before; equally there are reams of new firms offering SME financing support, allowing small businesses to flourish and prosper; and there’s a lot more. In fact, the landscape of change in this more specialised market of markets is massive, but often overlooked.

I popped over to Google to try and find a chart of how investment markets are being changed by FinTech, and there was nothing. I went to the CB Insights 2016 review of FinTech and found they identified this marketspace, but didn’t drill down into it.

While fintech covers a diverse array of companies, business models, and technologies, companies generally fall into several key verticals, including:

Lending tech: Lending companies on the list include primarily peer-to-peer lending platforms as well as underwriter and lending platforms using machine learning technologies and algorithms to assess creditworthiness.

Payments/billing tech: Payments and billing tech companies span from solutions to facilitate payments processing to payment card developers to subscription billing software tools.

Personal finance/wealth management: Tech companies that help individuals manage their personal bills, accounts and/or credit, as well as manage their personal assets and investments.

Money transfer/remittance: Money transfer companies include primarily peer-to-peer platforms to transfer money between individuals across countries.

Blockchain/bitcoin: Companies here span key software or technology firms in the distributed ledger space, ranging from bitcoin wallets to security providers to sidechains.

Institutional/capital markets tech: Companies either providing tools to financial institutions such as banks, hedge funds, mutual funds, or other institutional investors. These range from alternative trading systems to financial modelling and analysis software.

Equity crowdfunding: Platforms that allow a collection of individuals to provide monetary contributions for projects or companies provisioned in the form of equity.

Eventually, I found an update from CB Insights this month that gave me what I wanted: the whole capital markets landscape of FinTech:

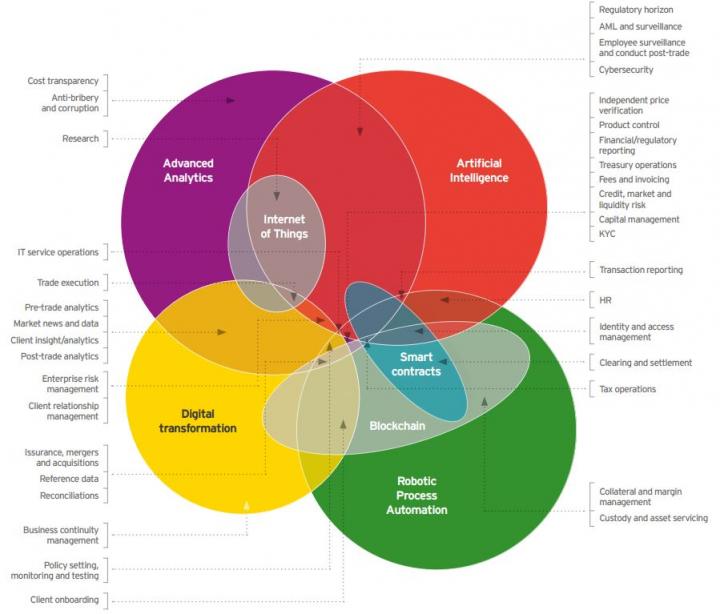

You can read their analysis of this market and the new start-up players over here. I then stumbled across another report produced by Ernst & Young and Innovate Finance that delves into the capital markets landscape in depth. Probably the key chart in that report is this one (page 33):

As can be seen, there is a raft of new technologies that are rearchitecting the landscape of capital markets and 100s of start-ups leveraging these new technologies to both assist and attack the inefficiencies in the investment banking world.

Meantime, rather than ignoring these changes, the biggest banks are investing in them. Since 2012, the ten largest US banks by assets participated in 72 rounds of investment totalling $3.6 billion in 56 FinTech companies whilst, in Europe, Banco Santander leads with the most number of unique investments to FinTech startups. The firm has made 13 investments to 12 unique fintech startups. The largest investment was a $135 million in Q3 2015 to small business lender Kabbage, that also included participation from ING among other investors.

Chris Skinner is Chair of the European networking forum: the Financial Services Club. He is best known as an independent commentator on Fintech through his blog, and as author of the best selling book Digital Bank and its new sequel ValueWeb.

Don’t miss out – Find out more today