Could Brock Pierce really restart Mt Gox?

Crypto entrepreneur Brock Pierce has floated an out-of-left-field plan to fire up MtGox — the Japan-based crypto exchange that set the standard for massive bitcoin hacks — but is it his to play with?

At the Japan Blockchain Conference in Yokohama three weeks ago, crypto entrepreneur Brock Pierce spoke of his ambition to recover the missing MtGox bitcoin, and ultimately take the battered brand name of what was once the world’s biggest bitcoin exchange, and resurrect it as an exemplar non-custodial platform that would help end the problem of hacks forever. With "Gox Rising", Pierce plans to finance an independent foundation that would recover the lost assets, distribute them to the 24,000 former clients, and bring the exchange back from bankruptcy.

Brock Pierce launches Gox Rising in Yokohama

And how does he plan to achieve this? With a Security Token Offering (STO): "I believe that we can create a Gox coin to give creditors that potential recovery now," says Pierce, "in a format that is tradable – most likely a security token. […] So for those creditors that don’t want to wait any longer, they can sell at a discount, those that want to wait can, and those that want to speculate can do so."

Who owns MtGox?

Since the speech was made, the discussion around Pierce’s plans has spilled over to Twitter, where more details have emerged suggesting that Mt. Gox might not actually be his exchange to play with.

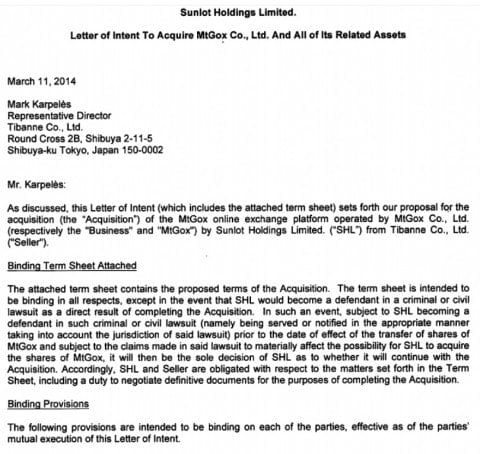

On March 11th 2014, soon after MtGox had filed for bankruptcy protection in both Japan and the U.S., a Letter of Intent was signed by Pierce and former MtGox CEO Mark Karpelès that proposed a framework for the potential transfer of the exchange from Tibanne (Karpelès’ company) to Sunlot Holdings (Pierce’s company).

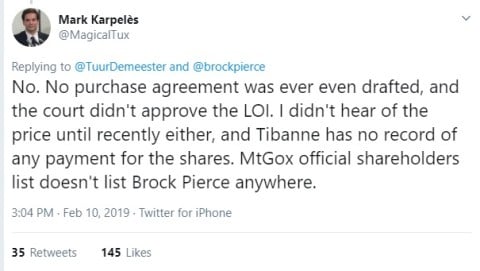

Although the letter included "binding terms", according to Karpelès it was was not followed up with a payment for the 88 percent of MtGox shares in his possession. So when he was later asked to confirm the transaction on Twitter, Karpelès rejected any assertion that a sale had been made.

Karpelès is adamant MtGox was a ‘no sale’

Kim Nilsson, the software developer who led the initial investigation into the MtGox hack, outlines in a blog post the complications that ensued after the letter had been signed — with Karpelès sending Pierce a further request to confirm the Letter of Intent as rescinded so that the civil rehabilitation process might progress through the Japanese courts. Says Nilsson: "since MtGox was already under civil rehabilitation at the time, MtGox could not be entered into any binding agreements without the permission of the court, and especially not sold. Sunlot negotiated to acquire MtGox without going through the court first, rendering the entire attempt invalid."

As for the other 12 percent of MtGox shares, these are still thought to be owned by the exchange’s founder Jed McCaleb, who hasn’t stepped forward to verify the sale — a transaction that, according to Karpelès, wouldn’t have been able to happen anyway because the shareholder agreement required any share transfers to be approved by all the shareholders.

Was a deal done?

For additional context, the legal status of a ‘letter of intent’ is also worth mentioning. If the issue was to progress to court, any dispute would likely have to be resolved in a Japanese court. In jurisdictions like the United States and England, a letter of intent is considered non-binding, unless its signatories make it abundantly clear that they wish to be contractually bound.

As mentioned above, if genuine, the letter of intent in this case makes numerous mentions of its terms being binding and has been signed by both Karpeles and Pierce — so on its face, it appears to be a binding agreement. Further strengthening that argument is that under Japanese law, letters of intent are binding by default, unless the parties specifically state the terms are non-binding.

Letter of Intent clearly states its terms are binding

Whether or not this deal actually happened should not be difficult to prove, however, as the letter of intent states that any purchase would be subject to the signing of a definitive agreement — and that the agreement would have to be approved by the Tokyo District Court. The date for final settlement was set for April the 9th 2014 — so if the deal did proceed, documents from the Tokyo District Court from that time should settle the argument, as any such sale would have had to be have been approved by the Court, not just pursuant to the letter of intent, but also because MtGox had already been in receivership for months.

Rewriting the end of the MtGox story

In his Yokohama speech, Pierce emphasized the need to "rewrite the story of MtGox" to help prevent it from blighting the reputation of bitcoin. Given the difficulty of revitalising a brand that has now become synonymous with hacking, some are suggesting his plans are not motivated by the desire to prove bitcoin naysayers wrong, but by economic benefit.

If he was to gain ownership, Pierce would potentially make himself the rightful beneficiary of the "hundreds of millions of surplus assets" that Japanese authorities might have once paid out to MtGox shareholders. Or, as an innovative STO model, the exchange could be a profitable fundraiser. Pierce was previously one of the first to use Security Tokens raising funds for his venture capital firm.

Legally, a return of MtGox is theoretically do-able. The company is only in what is termed in Japan as ‘civil rehabilitation’ and with the permission of the court, its management team may continue to do deals and raise additional financing, so as outlandish as a MtGox relaunch sounds, it is hypothetically possible.

Regardless of outcome of the current twitter squabbles between Karpelès and Pierce, both agree that the biggest roadblock to any happy ending for MtGox is the ongoing lawsuit with CoinLab, which is described by Karpelès as "the real evil in this MtGox bankruptcy", and widely thought to be preventing the successful continuation of the civil rehabilitation process.

Creditors then, remain in the same limbo they have now suffered for several years and as the

submission deadline for Exchange-Related Rehabilitation Claims has recently been extended again to March 15, 2019, their situation seems unlikely to be ending soon.

Don’t miss out – Find out more today