Crypto and COVID resilience – is there a correlation?

Is there an increased willingness to adopt crypto in countries that have a less restrictive approach to COVID? We look at the shifting geo-politics of rising crypto adoption in a post-pandemic world.

The COVID-19 pandemic has changed the world. The relationships between citizens, the state, and the market economy have become strained and divisive at times. During the pandemic, the state has consolidated power and policy in both the corporate and social realms all around the world.

The role of the state has increased drastically with governments taking steps to grant themselves new powers – ostensibly to protect their citizens. This increase in power has at times come with the sacrifice of core civil liberties. In many countries, the public perception of the state has shifted because of frustrations surrounding the rationale behind why freedoms have been taken away.

There has been an increase in social fragmentation due to differing opinions on how policies such as lockdowns, vaccine mandates, vaccine passports, and travel restrictions should be considered. Across the world, citizens have protested en-mass against state encroachment on their freedoms, while others have submitted willingly hoping that the pandemic will pass with each new measure introduced.

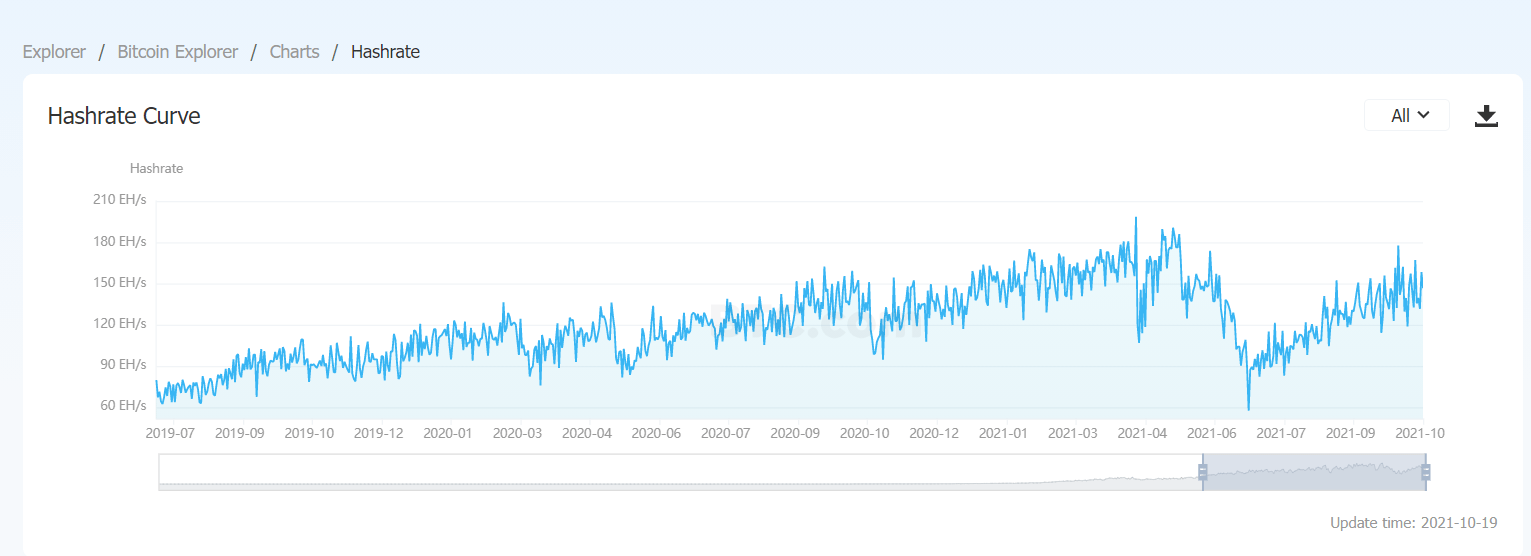

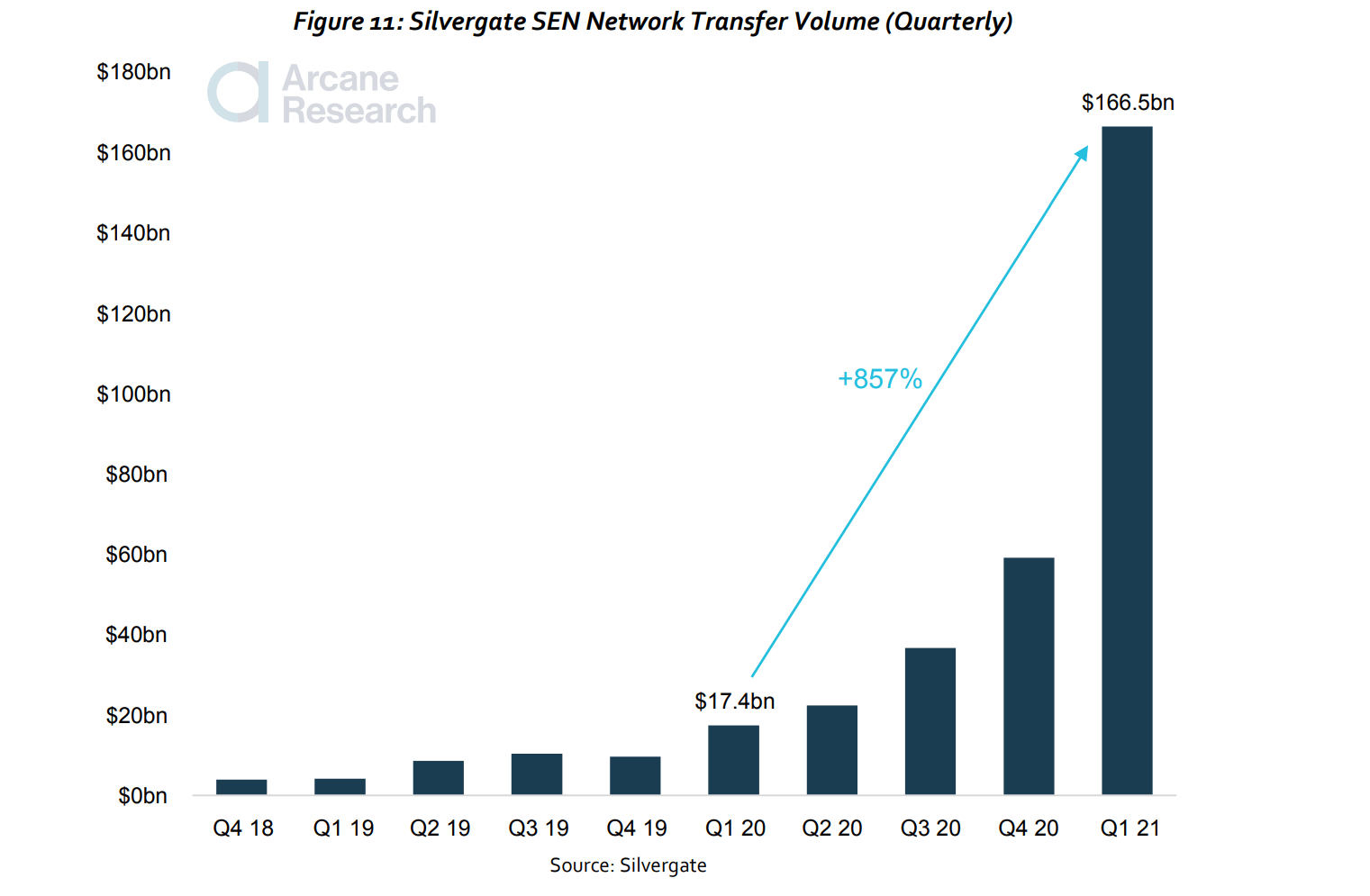

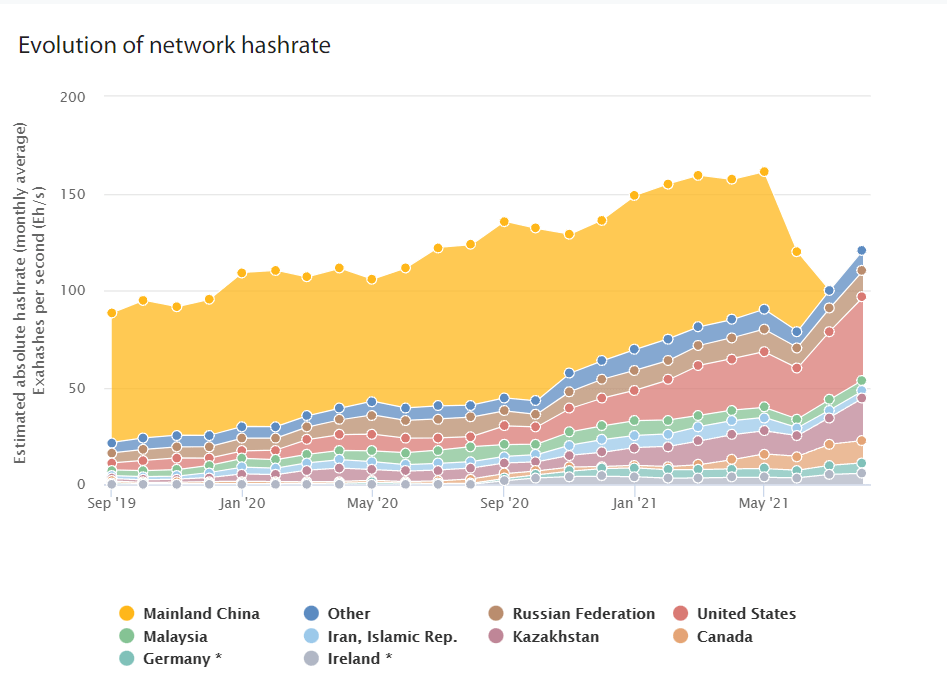

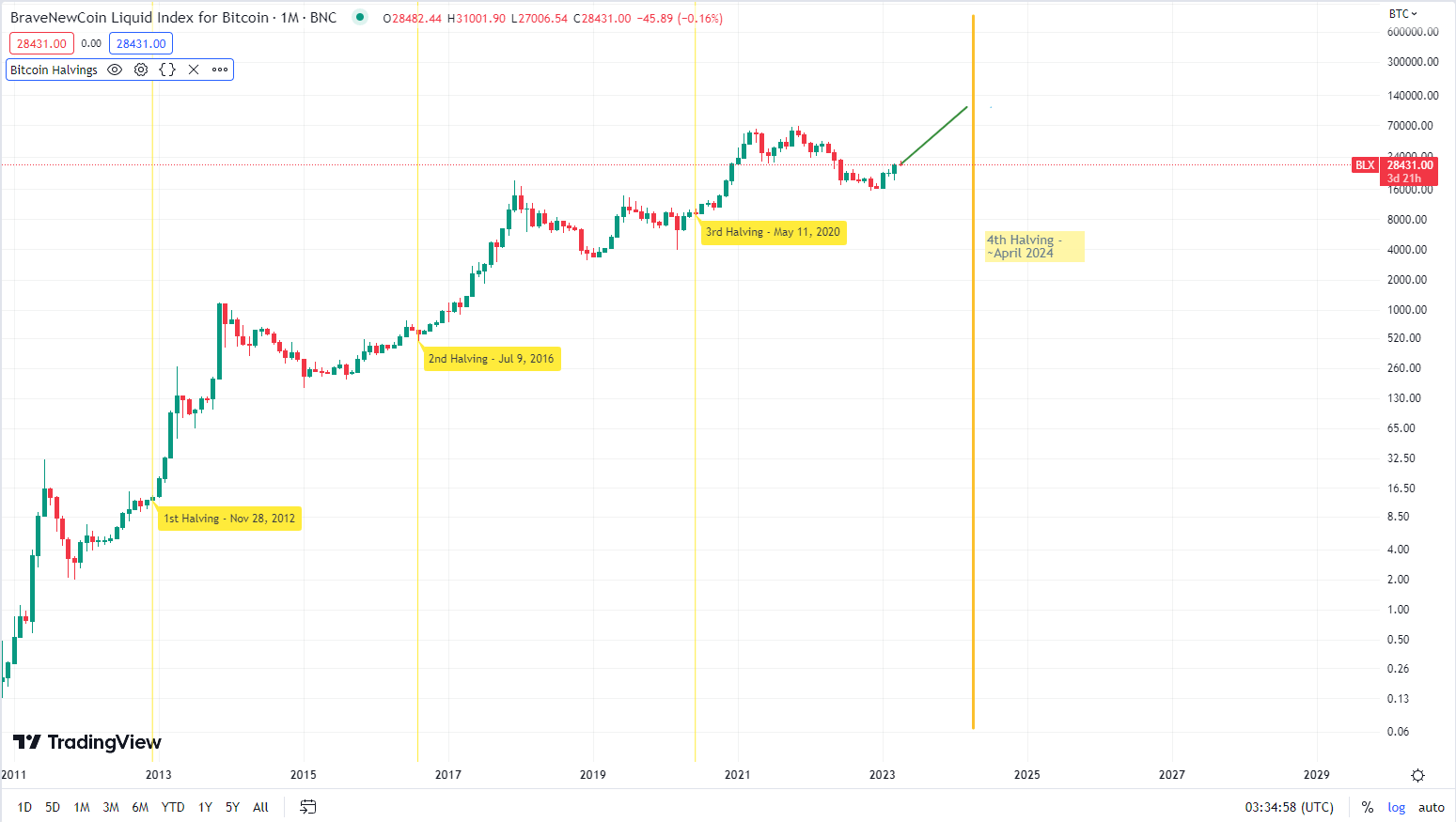

While much of the physical and financial economy has suffered in the pandemic era, the blockchain industry has benefited from a crypto bull market.

The total market capitalization of all crypto assets is currently around US$2.9 trillion. At the start of COVID-19’s spread, early January 2020, this number stood at US$286.5 billion. These figures suggest that the cryptocurrency space has grown by ~914% during the Covid era.

There are a number of reasons why cryptocurrencies benefited during a mandate crippled global supply chain.

Cryptocurrencies can be traded from anywhere in the world, at any time. Their digital, permissionless nature also makes them more difficult to regulate or control than other financial assets. This means that when governments restricted trading activities or banking operations because of a lockdown or mandate (some countries cutting off basic banking services for non-compliance of mandates), crypto could continue to operate without interruption.

Additionally, decentralized cryptocurrencies can act as highly liquid hedges against political risk. Investors concerned that governments were going to increase the flow of fiat currency turned to crypto as a sector that was unlikely to have productivity be affected by government lockdowns. They became attractive as hedges against inflation, the potential collapse of GDP, and the earnings of companies in the market economy.

Globally, inflation is hitting new 30 year highs. Central banks have turned on their money printers and are supporting economies with newly created fiat. Governments are using the levers that central banks pull to artificially create more money to spend on infrastructure to support mandate-affected economies. These policies are debasing the intrinsic value of currencies globally through inflation.

Debasement is an easier way to fund government spending than increasing taxes but it is shortsighted because of the inflation it creates. Globally, investors are investing their cash holdings knowing that it is losing value quickly. Equities and crypto have both soared in this environment. Additionally, traditional safe havens like Treasury Bonds and gold are both underperforming these asset classes, further boosting their appeal.

COVID-19 and Crypto Prices

It appears that the surging crypto asset class and the COVID-19 mandates are linked. Numerous academic studies explore the relationship.

For crypto investors, finding a location in the world where they can maximize the immense market opportunity is desirable. Governments that offer their citizens and visitors greater agency are likely to be the most desirable destinations for crypto economy participants.

Some of the countries that have the highest COVID resilience scores have emerged as some of the fastest new adopters of cryptocurrency. Results from countries like Chile, Denmark and Finland stand out.

This article looks at some of the best options globally for crypto citizens both from a perspective of crypto growth and the ability to resiliently handle the pandemic.

COVID resilience

COVID Resilience for the purposes of this article is assessed on Bloomberg’s monthly COVID resilience ranking snapshot. From Bloomberg:

“The Covid Resilience Ranking is a monthly snapshot of where the virus is being handled the most effectively with the least social and economic upheaval. Compiled using 12 data indicators that span virus containment, quality of healthcare, vaccination coverage, overall mortality, and progress toward restarting travel, the Ranking captures which of the world’s biggest 53 economies are responding best—and worst—to the same once-in-a-generation threat.”

The precarious nature of the relationship between the state and its citizens is reflected by Bloomberg’s COVID resilience ranking. A useful example of this is New Zealand. The country has shifted up and down the resilience ranking table as it responded to the pandemic. The country was either top 3 or number 1 on the Bloomberg Resilience index for most of 2020 and 2021, however, it presently sits in the 32nd position. An obvious correlation between COVID mandates (loss of freedoms or the fear of political instability) and crypto adoption is observed.

Source: Bloomberg

New Zealand was a bastion of hope for the rest of the world during much of the pandemic. The country enjoyed a near-zero COVID presence with a populace of citizens that trusted and complied with the government.

The New Zealand government told its populace it had a COVID strategy of transparent communication from the start. The country used a four-level alert system that was meant to give citizens a clear picture of how and why the authorities would act as a COVID outbreak evolved.

The government used short, sharp strict lockdowns (the highest levels of the alert system) to contain outbreaks. Pre-pandemic, New Zealand had a high level of government trust and social compliance. This meant citizens were willing to give up freedoms for a short period if it meant containing the virus.

However, when the most recent delta outbreak occurred, the lockdown strategy was not able to contain COVID’s more transmissible delta variant. The four-level alert system changed. More levels were added in between levels in the four-level alert system, and a secondary traffic light vaccine-based system was introduced that would run in parallel to the level system. The strategy of simple, effective communication broke down.

Frustration mounted and compliance with an extended lockdown began to drop. The public began to question why lockdowns were so severe when the country had one of the lowest levels of monthly cases and fatalities amongst any developed country in the world.

Concerns around public health infrastructure and an unvaccinated population have meant the government has been unwilling to open the country up domestically or to foreign arrivals leading to widespread frustration amongst citizens. Recent polling data shows the popularity of the governing Labour Party is sliding.

The top 15 countries in the world by Bloomberg Resilience Score — Reopening Progress

The top 15 countries in the world by Bloomberg Resilience Score — COVID Status

The top 15 countries in the world by Bloomberg Resilience Score — Quality of life

Top countries for Crypto holders during the pandemic

U.A.E -Ticks all the boxes

A country that has been a hub for expats for many years, the United Arab Emirates (UAE) has handled the COVID19 pandemic as well as any country in the world. This is both in terms of containing the pandemic and ensuring its citizens maintain civil freedoms.

UAE currently has one of the lowest 1-month COVID cases per 10,000 in the world, at just 45. It also scores very well for fatality rate, total deaths per million people, and positive test rates. The country has one of the highest vaccination rates of any of the 53 countries on the list with 97.3% of its population covered by vaccines.

The country has not observed a sharp pick up in cases of the delta variant of COVID in the second half of 2021 – unlike many other countries.

As of November 2021, the pandemic is not affecting the freedoms of UAE residents as much as those other countries. In October, infection levels reached the lowest levels in a year. The U.A.E ranks well for Bloomberg’s measures for lockdown severity (high freedom) and community mobility.

Dubai, the largest city in the UAE, is currently hosting Expo 2020, a world expo where achievements of countries from all over the world are displayed publicly. 25 million people are expected to visit the expo over the course of the 182 days the expo will take place (October 1st, 2021 to March 1st, 2022). Visitors do not need to be vaccinated to attend Expo 2020 Dubai, but will need to show a negative PCR test on arrival.

The answer to the question of how open the country is, is a nuanced one. It is quite clear, however, that crypto is legal in the country. Presently, there is no express prohibition against crypto assets in the UAE. It is, however, regulated by some agencies within the federal government and the two financial free-zones which currently exist in the country — the Dubai International Financial Centre (“DIFC”) and the Abu Dhabi Global Market (“ADGM”).

The Central Bank of the UAE (CBUAE) made statements in December 2020 clarifying that presently, it does not recognize (or acknowledge) crypto-assets or virtual assets as legal money in the UAE, and assesses that it may only be utilized as high-risk investment assets.

CBUAE’s regulations are designed to facilitate FinTech firms and other non-bank payment service providers’ “easier access to the UAE market while safeguarding customer’s funds, ensuring proper business conduct and supporting the development of payment products and services.”

The UAE is separated by federal and regional laws and some regions of the country appear to be pushing to make themselves crypto and blockchain hubs. In September, the United Arab Emirates’ Securities and Commodities Authority and the Dubai World Trade Centre Authority (DWTCA) agreed on a framework that allows the DWTCA to approve and license financial activities relating to crypto-assets.

The U.A.E does not enforce any personal income taxes so there are taxes on capital gains from crypto.

The U.A.E temporarily became the center of the crypto social media universe last month. The World Blockchain Summit in Dubai hosted several exhibition boxing matches between top cryptocurrency influencers hosted by noted British boxer Amir Khan.

Nordic Europe – High Social Freedom but nervous about crypto

European countries like Sweden, Finland, Denmark, and Norway are all well positioned on the COVID resilience rankings. The world has watched as the continent has opened up and removed COVID-driven lockdown restrictions despite the delta variant of COVID19 emerging.

Two months ago Denmark lifted all remaining domestic coronavirus restrictions as the government declared Covid-19 was no longer "an illness which is a critical threat to society."

Thanks to a successful vaccine rollout, the country is pushing for a return to pre-pandemic life. Citizens are able to visit nightclubs and restaurants without showing a Covid vaccination passport, use public transport without having to wear a mask, and meet in large numbers without restrictions.

Norway adopted a similar policy on September 25th. The nation’s government announced to its citizens that they could "live as normal" following 561 days of lockdown restrictions designed to contain the virus.

These open policies may be subject to change, however, as Europe shifts into the winter season. As the cold weather drives people inside, most countries in the continent are also dealing with spikes in case rates thanks to the more infectious delta variant.

On the COVID resilience rankings, Nordic countries score well for Lockdown Severity, population covered by vaccination, and Travel Routes. The COVID status for these countries is also some of the strongest compared to others on the COVID resilience list. They are some of the best-performing countries in terms of case rates, deaths from COVID, and positive COVID test results.

Beyond this, the Nordic states also score well in terms of public health infrastructure, and the Human Development Index (based on life expectancy, access to education, and income per capita).

These countries are showing a commitment to offering their citizens social freedom – but what of their attitudes to cryptocurrency? A fair appraisal is that the Nordic region is not as open-minded towards crypto-assets as neighboring countries in Europe such as Switzerland and Lichtenstein. There are signs, however, that crypto is popular in the region and that the industry has backing.

The state of cryptocurrency regulation across the Nordic countries is similar. There are no comprehensive regulatory frameworks for the most part in these countries. In Sweden, Finland, Denmark and Norway, top central banking officials have warned citizens about the risks associated with investing in digital assets. This has not stopped citizens in these countries from developing an interest in crypto.

According to a recent report by Australian blockchain education startup Coinformant, Finland and Denmark have experienced surges in crypto interest over the last year.

Finland, it says, has had by far the biggest increase in the number of online articles being published about crypto of any country in the world. Coininformant says the number of crypto articles published in the country has jumped over 725% in the last year from 136 to 1,123 articles.

The growth in the level of crypto engagement in Denmark was the 2nd highest of any country recorded by Cryptoinformant, with an increase of 1,317%. The number of engagements is based on engagements with articles posted online in each country that references the terms ‘cryptocurrency’, ‘crypto’, ‘Bitcoin’ and ‘Ethereum’ according to BuzzSumo.

Norway is perhaps the most interesting country from the group because of its digital-first approach to payments. Norway is the world’s most cashless country, according to its Central Bank, which says that just 4% of the payments in the country are made with cash, and the majority are made with contactless cards or digital wallets. For a digital-first economy like Norway, cryptocurrency seems like the perfect fit.

Cryptocurrency trading is not prohibited in Norway. However, providers engaged in exchange services between virtual currencies, fiat currencies and custodian wallet providers must register with the FSA and are subject to AML reporting requirements.

In August 2021, the FSA ordered the world’s largest crypto exchange, Binance, to stop offering its services in the Norwegian market unless it registered with the FSA. Accordingly, Binance is unwilling to submit to these requests to terminate its Norwegian operations and services.

One of Norway’s most prominent businessmen, Kjell Inge Rokke, is a noted Bitcoin supporter.

Rokke has a roughly $5 billion fortune built out of Norway’s offshore fishing industry. He has publicly revealed that he believes that Bitcoin will be “on the right side of history.” His industrial investment company, Aker ASA, says it is open to the idea of accepting payment in the cryptocurrency.

Chile – A hidden gem

South American nation Chile has surged up Bloomberg’s COVID resilience ranking tables and is now in the 8th position. Chile’s turnaround from being near the bottom half of the tables a few months ago reflects a general improvement in overall conditions across South America during the pandemic’s delta period.

The region was one of the worst-hit by COVID and was crippled by the spread of the virus. In Chile now, however, millions of people have received booster shots, domestic restrictions have been relaxed and borders have been opened up to all vaccinated foreign tourists with a five-day quarantine.

Chile scores well on Bloomberg’s COVID resilience ranking for lower Lockdown Severity and High Flight Capacity. The country has 166 cases per 100,000 people and the total deaths per 1 million people are 1,971. The country also scores well for Community Mobility.

It is a growing economy and has one of the highest expected GDP growth rates of any country on Bloomberg’s COVID resilience index. Perhaps surprisingly, despite being a developing country, it also scores reasonably well on the Human Development index.

The country announced that as of November 1, 2021, the previously announced five-day isolation will no longer be required for fully vaccinated travelers who receive a negative result for a PCR test taken in Chile. The country is officially open for tourism.

In terms of its attitude towards crypto, like much of the rest of South America, Chile appears to be open to the asset class. There is currently no statutory or regulatory regime in Chile that governs the use of cryptocurrencies. The Central Bank of Chile has advised that crypto assets are neither legal tender money nor foreign currency.

These statements have not dissuaded the Chilean population from cryptocurrency investment. Cryptoinformant reports that Chile, over the last year, had an increase in crypto-related Google searches of 707.1% and comes in second place in the firm’s crypto interest growth ranking table. The country also scores well for total crypto engagement, a ~639% increase, and the number of crypto articles written, a ~282% increase. The report estimates that there are over 500,000 crypto holders in Chile.

Data from LocalBitcoins shows just how much peer-to-peer Bitcoin trading boomed during the pandemic. In the week of the 9th of January 2021, it soared to hit a peak of ~US$800 million in daily trading volume. The reason so many people were turning to Bitcoin in the country was a depreciating Chilean peso.

Source: Coindance

Conclusion

The countries mentioned in this article are just a short list of states that are COVID resilient and show signs of becoming cryptocurrency hotspots in the future. Countries that grappled with the worst of the virus and are now emerging from it, are some of the fastest crypto adopters in the world.

South Korea and Switzerland are also examples of states that have an openness to crypto and are showing signs of reigning in the worst effects of the virus.

The pandemic has changed the relationship between citizens and the state. COVID-19 has accelerated the existing global shift towards citizens demanding greater agency for themselves. In financial terms, cryptocurrency enables this personal empowerment and the resulting correlation between crypto’s market cap and adoption and government restrictions and loose monetary policy is clear to see.

Don’t miss out – Find out more today