Coins to watch in 2022: Crypto.com’s CRO token

CRO is the native token of the fast growing Crypto.com platform. So what is the token’s utility, and does it have the potential to outperform the market again this year?

Crypto.com is a payment and cryptocurrency platform that empowers users to buy, sell, and pay with crypto. Its offering encompasses a digital asset exchange, a point of sale VISA card, payment services, borrowing and lending solutions, and a smart contract platform blockchain.

CRO coin is Crypto.com’s native token and CRO holders receive perks when using these products and services. They pay discounted trading fees when using the exchange, they earn more when they lend, and CRO holding Crypto.com cardholders have additional benefits such as higher CRO cashback.

CRO is also the settlement asset on the Crypto.org chain, a blockchain running under the Crypto.com brand, in a similar vein to the Binance Smart Chain and Binance. CRO also supports Crypto.com’s recently released EVM compatible Cronos chain.

CRO has recently rebranded. The coin was formerly called the “Crypto.com Coin” but it is now known as “Cronos” – although it will retain the same ticker. According to the company, the change reflects the “decentralized nature of the CRO and recognizes the explosive growth of the Cronos ecosystem.”

In 2021 the CRO coin price increased a staggering ~1060% with from $.05 to $.58. It has a market capitalization of around $12 billion and is the 22nd largest asset in crypto.

October and November 2021 were especially good months from CRO. Between the beginning of October and the end of November, CRO was up ~346%, easily outperforming the rest of the large-cap crypto market. Over the same period, Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), were up ~33%, ~48%, and ~49% respectively. The CRO coin price surge was driven by the launch of a US$100M mega-ad campaign featuring Matt Damon and on the back of news that the Staples Centre, an iconic downtown Los Angeles arena, will be re-named the Crypto.com arena (this occured on Christmas day 2021.

The CRO price is down ~20% so far in Q1 2022. Investors across all markets have turned risk-off because of factors like profit-taking after the extended 2021 bull run, rising global inflation, and the continuing war in Europe.

Crypto.com Company history

Crypto.com was founded in Hong Kong in 2016 by its current CEO Kris Marszalek under the name Monaco. At the time it was more of a pure payment gateway VISA card-based solution and had the slogan “Spend anywhere, without fees.”

In the first half of 2017, the company launched its own token, MCO, funded via an ICO. The ICO took place from May 18 to June 18, 2017. The company managed to raise ~USD 26.7 million through publicly selling 12,135,542 MCO tokens, about a third of the total supply.

In July 2018 the company announced it would be re-branding to Crypto.com and began shipping its signature Visa debit cards. In the same year, the company announced the launch of the Crypto.com platform blockchain that would be supported by the soon-to-be-launched CRO token.

In 2019 Crypto.com began to launch more services. This included crypto-to-crypto exchange services with the aiming of being a more broad one-stop shop for crypto users that would target the profitable “crypto trader” demographic. In the same year, the company began offering centralized crypto borrowing and lending services in a similar vein to Celsius and BlockFi. These services were called Crypto Earn and Crypto Credit. In 2019, Crypto.com cards begin shipping to the United States.

In 2020, the company launched its non-custodial DeFi wallet and new non-custodial swap capabilities and decided to phase out the MCO token completely and get users to swap it for the CRO token. This meant that all the previous MCO utility would be transferred to CRO and the Crypto.com Visa card became available across more regions globally.

In 2021, Crypto.com launched its Non-Fungible-Token (NFT) marketplace, which is designed to challenge the incumbent leader in the space, OpenSea. The NFT marketplace has a dedicated space on the Crypto.com website. It was the chosen platform for major brands like Snoop Dogg, Mr.Brainwash, Aston Martin, and Serie A.

CRO for Crypto.com cards and payments

To unlock higher tiers of Crypto.com Visa cards, large amounts of CRO need to be staked. The higher card tiers offer benefits like airport lounge access, more CRO cashback, free Amazon Prime as well as Expedia and Airbnb discounts.

The Crypto.com Visa Card is a prepaid card. It functions similarly to bank account-based debit cards but instead of being linked to a bank account, the prepaid cards need to be topped up through a Crypto.com-based portal. The card can be topped up using bank account transfers, other credit/debit cards, or cryptocurrency.

Search interest

Source: Google Trends

The Google Trends data above compares search interest for the term ‘crypto.com’ with search interest for two other crypto projects with similar market caps (Chainlink and Litecoin). The chart shows that while at the start of 2021 the Crypto.com brand was flying under the radar, post-October the project really entered the consciousness of crypto enthusiasts. The rise in search interest has been correlated with the rise in price of CRO.

Search interest for Crypto.com has been particularly high in Italy, Singapore, Hong Kong, Bulgaria, and Bulgaria.

Crypto.com Usage

On February 24th 2021, the company announced that it had crossed the 10 million user mark. The milestone came just four months after it crossed the five million mark and is an indication of the tremendous momentum the company and the cryptocurrency industry enjoyed in late 2020 and early 2021. Crypto.com’s founder and CEO Kris Marszalek said in a blog post announcing the new benchmark that the company had experienced “10x revenue growth in 2020.”

Based on data from SimilarWeb, on the Google Play store, the Crypto.com mobile app is currently the 10th most popular free financial app in the United States. This rank puts it above powerhouse apps/brands in the space like Coinbase, Experian, FTX, Western Union, and Robinhood. In Singapore, it is the 23rd most popular free financial app. It is the most popular mobile crypto app in Singapore, it is the 2nd most popular mobile crypto app in the US after the Cash App.

On the iPhone, the Crypto.com app is slightly less popular in the United States and is the 14th most popular mobile app on the Apple App store. In Singapore, it is the 16th most popular free finance app and the most popular crypto application on the platform.

SimilarWeb reports that the Crypto.com website had 12.1 million visits in February – which reflects dropping interest in cryptocurrencies overall given the falling price of Bitcoin. Crypto.com’s traffic peaked in November 2021 at 21.5 million and it has declined steadily since. Nonetheless, Crypto.com’s February total is still up on the 10.3 million visitors the site attracted in October 2021 – prior to the start of its major marketing campaign.

SimilarWeb currently lists Crypto.com as the 3,820th most visited website in the world and the 3,083rd most visited in the United States. It is ranked as the 44th most visited finance website in the world.

Unlike on the mobile application charts, there are many more crypto-associated platforms that rank above Crypto.com on the website ranking charts. This includes sites like Coinmarketcap.com, Coingecko.com, Coinbase.com, and Opensea.io.

Crypto.com’s popularity on both mobile app stores and websites has fallen off in recent months and this is likely due to the bearish price action across crypto markets so far in 2022.

What is the Crypto.org Chain?

One of the original purposes of CRO coin was to be the native token of the Crypto.org chain. Crypto.org is Crypto.com’s public blockchain protocol. It is designed with a focus on enabling transactions between customers and merchants. The chain is designed specifically for the use of mobile payments. It powers the mobile wallet’s payment solution, trading, and DeFi solutions.

The Crypto.org chain’s primary goal is to support Crypto.org Pay, the company’s mobile payment solution. Initially, it only supports payment through CRO.

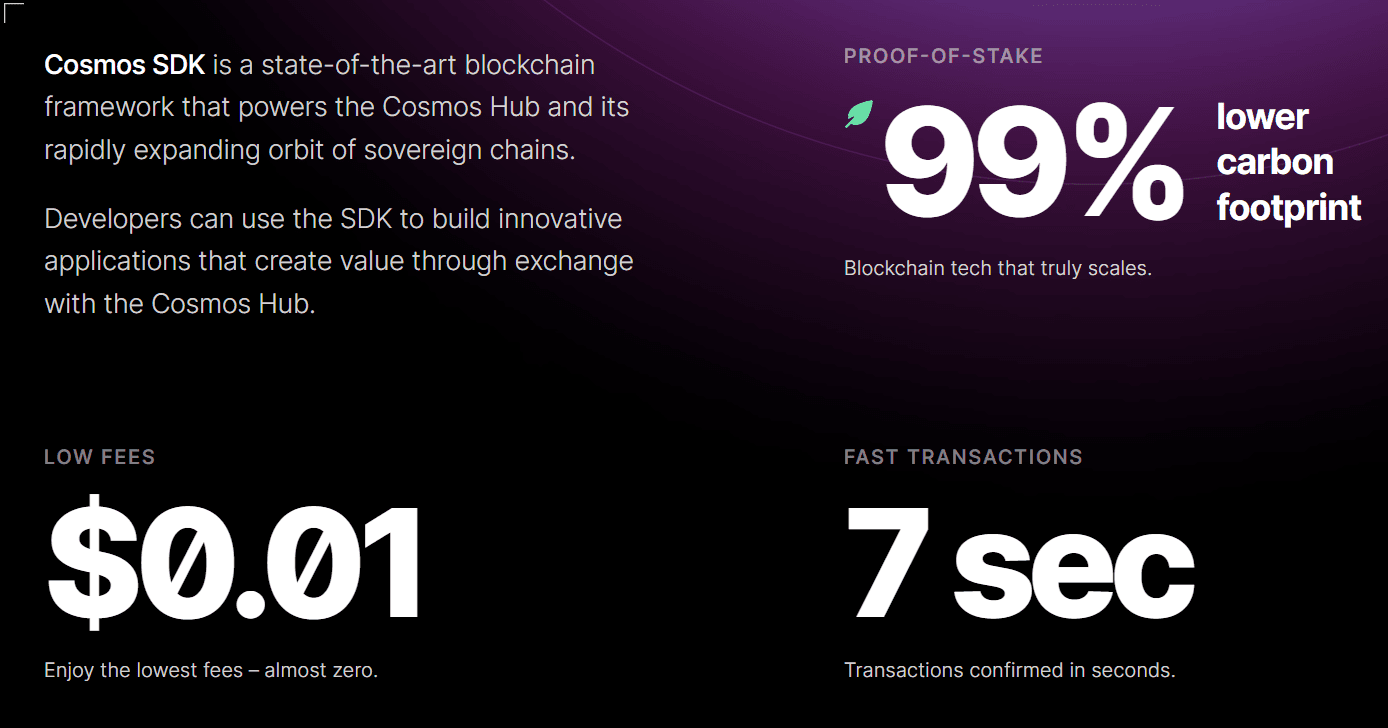

The platform utilizes the Cosmos SDK and Tendermint Core’s Byzantine Fault Tolerance (BFT) consensus mechanism, which is also used by other popular platform blockchains like the Binance Smart Chain and Terra.

Cosmos SDK can be understood as software that crypto startups can license for building their own blockchain ecosystems. It allows teams to significantly speed up development times and focus on economics and products, while the blockchain architecture is outsourced. Cosmos SDK and Tendermint allow for fast and cheap transactions but sacrifice decentralization.

Source: Cosmos

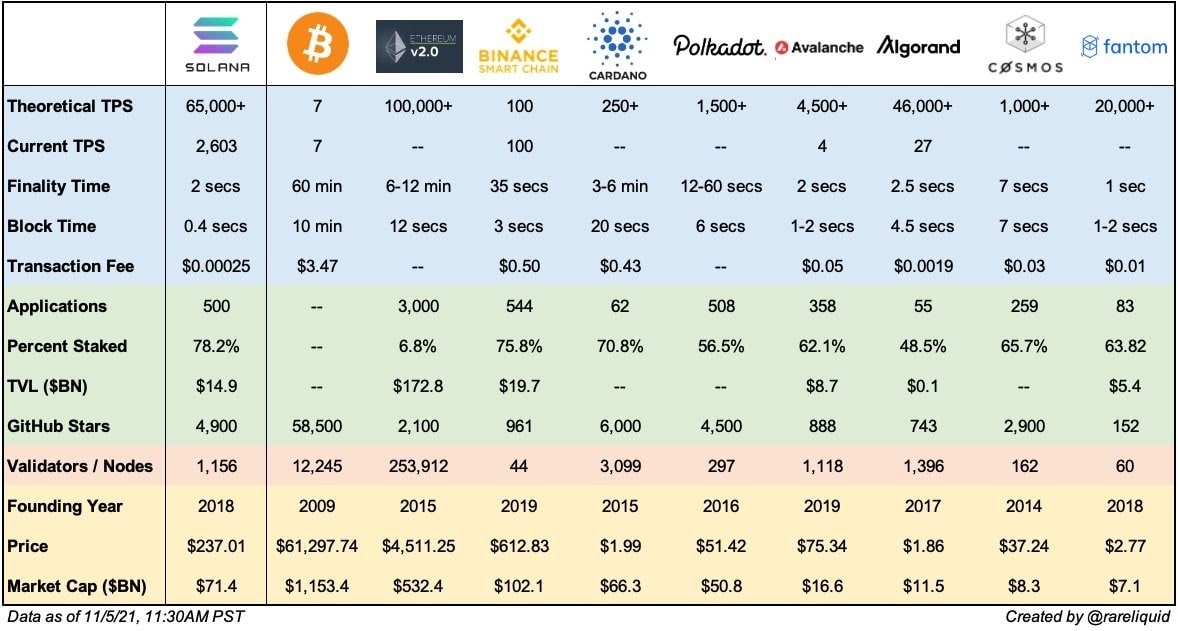

How Cosmos SDK-based blockchains compare to other blockchain architectures. Source: Twitter user @rareliquid

This consensus model is Proof-of-Stake based. Participants in the Crypto.org chain can participate in the network directly by being a validator, or they can delegate their CRO to a validator who will stake on their behalf.

Validators charge delegators a percentage of rewards earned in exchange for performing the work of validation, the distribution of rewards occurs on-chain. There is no minimum delegation but there is a 28-day unbonding period during which delegators do not earn rewards. Delegators can change their validator without having to unstake.

There are two types of nodes that make up the Crypto.org network. Validator nodes are responsible for validating transactions and committing new blocks to the chain, while full nodes retrieve data from the blockchain and drop it off at the validator node client. Running a validator node requires running a cluster of computers, which requires running both types of nodes and investing in infrastructure to support the cluster.

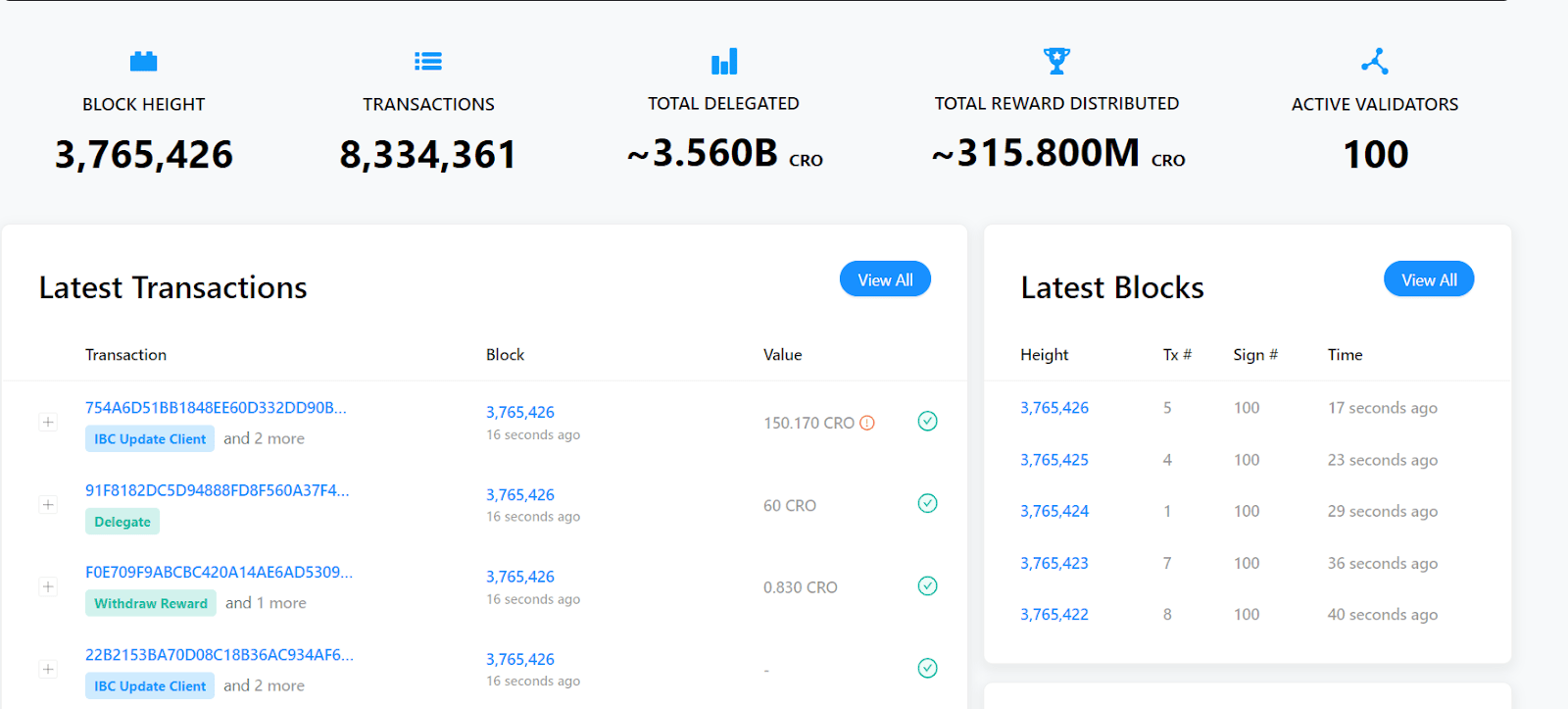

Source: crypto.org/explorer Snapshot of the crypto.org chain

There is always an active set of 100 validator nodes, that is assigned by ranking nodes with the highest total stake. This includes the self-bonded stake and delegation.

There are two types of rewards on the Crypto.org chain. Block rewards are earned for conducting the work of validating transactions and committing new blocks to the blockchain. There is also a transaction fee bonus for validators that include a high level of pre-commits from other validators in the blocks they produce. This is to encourage better communication amongst nodes.

CRO coin holders can participate in Crypto.org’s on-chain governance, with staked CRO serving as the voting mechanism.

Cronos, the new Crypto.com EVM chain, explodes in popularity

Cronos, an EVM chain that will run in parallel to Crypto.com’s existing Crypto.org blockchain, launched on November 8th. It aims to massively scale Crypto.com’s DeFi ecosystem by giving developers the ability to instantly port DApps from Ethereum and EVM-compatible chains. Cronos also uses Cosmos SDK as the Crypto.org chain does.

Crypto.com exchange users can now enjoy faster, cheaper, and safer transfers for CRO, ETH, WBTC, USDC, USDT, and DAI via Cronos. Cronos’s ability to support EVM is due to Ethermint – the proof-of-stake blockchain architecture built on the Cosmos SDK that is EVM (Ethereum Virtual Machine) compatible.

Source: DeFiLlama. Cronos Total Value Locked.

There is already US$2.34 billion in assets locked into the Cronos chain despite the platform only launching in November 2021. Cronos has rapidly risen to become the 10th largest DeFi platform in the space according to DeFiLlama.

This TVL is dominated by VVS Finance, which accounts for ~67.2% of the assets locked. As of February 6th, there are at least 120 Dapps built on Cronos and 3,500 different CRC-20 tokens minted since November 2021. CRC-20 is the Cronos custom token creation framework that mirrors the ERC-20 framework used by Ethereum.

VVS Finance is designed to be a DeFi platform for users to swap tokens and earn high yields through liquidity incentives.

Its ability to support Ethereum-styled applications through Ethermint and interoperability capabilities through Inter Blockchain Communications (IBC) is helping push Cronos into a position of relevance.

To support the further development of projects on Cronos, developers can apply for funding from a Cronos development fund called particleb. The fund has US$100 within.

The Cronos Roadmap for 2022 includes Protocol & Database optimizations, Transaction fees, Tooling & infrastructure add-ons, an expansion of Cronos’s gaming Dapp ecosystem, an expansion of the number of validators, and new Connectivity & interoperability additions. Cronos has set a goal to become a top-5 public blockchain by TVL by the end of the year.

Branding

Megastar Matt Damon is now the face of Crypto.com. Damon is starring in a US$100 million campaign for the company that is designed to attract new users globally and push the Crypto.com brand further into the mainstream.

Crypto.com’s Matt Damon advert has contributed to a CRO coin price surge

The ad campaign was produced by director David Fincher’s production company RESET and directed by cinematographer Wally Pfister. Pfister is best known for his work with acclaimed director Christopher Nolan. He was the director of photography for the Dark Knight Trilogy, Inception, and The Prestige.

The ad campaign that began airing in the United States on Thursday, October 26th was titled “Fortune Favors the Brave.” The ad had a prime time spot during the NFL “Thursday Night Football” program which averaged 14.1 million viewers a week in 2020. It will eventually be shown in 20 countries.

The 60 second ad features Damon walking with brave figures from history such as Edmund Hillary and the Wright brothers. Damon explains that these figures would “embrace the moment and commit,” spurred by a belief that “fortune favors the brave”. The ad closes with a shot of Mars.

“I’ve never done an endorsement like this,” Damon said in an interview. “We’re hoping this is the beginning of a great long-term collaboration.”

The Fortune Favors The Brave campaign is set to expand further with more celebrities including Ronda Rousey, basketball star Carmelo Anthony, snowboarder Lindsey Jacobellis, rapper CL, and astronaut Scott Kelly.

“This is a defining moment for the company and for the industry,” said Chief Executive Officer Kris Marszalek.

Crypto.com also had an ad featured during the 2022 Superbowl. SuperBowl commercials have become a cultural phenomenon in themselves alongside the football and non-sports fans tune into the game just to see the ads. Most feature big stars and high-quality cinematography and it is a chance for brands to put themselves out to one of the biggest television audiences in the world.

Crypo.com’s Superbowl ad was titled “The Moment of Truth” and featured basketball superstar LeBron James. The ad is focused on making life-changing decisions. The ad opens with a teenage James asking aloud if he’s ready to go pro and join the NBA. An older James interrupts him and says “I can’t tell you everything, but, if you want to make history, you’ve got to call your own shots.”

The ad implies that a similar mindset to the one suggested by the older James is needed when considering crypto investment decisions. Calling his own shots clearly worked out for James and Crypto.com is clearly hoping that prospective users follow his lead.

On September 22nd, Crypto.com announced that it had signed an eight-figure deal with National Basketball Association (NBA) franchise the Philadelphia 76ers. The deal will involve the team having a Crypto.com jersey patch and visibility in the 76ers Wells Fargo arena home stadium. The deal is an indication of the investment the company is willing to make to reach mainstream audiences and attract new fans.

Crypto.com has spent close to US$500 million on sponsorship deals in the last year. In September 2021, the company began a partnership with French soccer giant Paris Saint-Germain. This was preceded by partnerships with the National Hockey League team, the Montreal Canadians, the UFC, the Aston Martin Formula One team, Fox Sports’ college football midday coverage, and a deal with e-sports team F4natic.

Crypto.com CMO Steven Kalifowitz discussed the culture-focused approach to branding Crypto.com with Forbes.com. “Crypto is not just another shoe,” he said. “It’s not a commodity thing or a suitcase or something. Getting into crypto is very much a cultural thing.”

The deals also include plans to develop NFTs and programs to include Crypto.com-based payments to the team’s audiences.

The price of Crypto surged on November 16th after a blockbuster announcement that the Los Angeles’s Staples Centre is set to be renamed the Crypto.com arena. The arena is the home of iconic franchises in basketball and Ice Hockey, such as the Lakers, the Clippers, the Kings, and the Sparks. Sources familiar with the deal say it is worth US$700 million and is one of the biggest endorsement deals in sports history.

The arena’s new logo made its debut on December the 25th when the Lakers hosted the Brooklyn Nets. The logo will be fully integrated by June 2022.

On November 24th, actress, comedian, and screenwriter Mindy Kaling brought up the subject of the name change with Access Hollywood while discussing taking her father to a Lakers game.

“It does make me think that I need to understand crypto,” Kaling said during the interview. “If this is going to be where the Lakers now live, I have to understand what crypto is.”

Discussing the Kaling Access Hollywood interview, Kalifowitz said it had an immediate impact on the visibility of Crypto.com. “Did people go and download the app? Did people go and read more about it? Yeah, of course.”

A botched token swap

Crypto.com’s recent history hasn’t been entirely without missteps, though. One of the biggest suppressants of the CRO token price was the fallout of the MCO token swap and transition to a CRO token-only ecosystem.

On August 3rd, 2020, Crypto.com announced that there would be an ecosystem-wide MCO to CRO token swap. This meant that MCO token, the original Crypto.com utility token, would no longer have any function going forward.

The swap would be conducted based on a formula that used the 30 day-volume weighted average price of MCO and the 30 day-volume weighted average prices of CRO. At the time, this amounted to 1 MCO equaling 27.64 CRO. There was also an option to claim an early swap bonus of 20% CRO available to users willing to stake the new CRO in the Crypto.com exchange for 180 days. Anyone doing this would receive 33.17 CRO for each MCO.

Reading between the lines it becomes more clear why the MCO holding community was so frustrated with the swap mechanics. In the year leading up to the token swap, the value of CRO had been rising rapidly against that of MCO. CRO at the time was only attached to the Crypto.com exchange while MCO was required to access the Crypto.com Visa debit card program.

According to the community, a key factor in the rise of CRO during the lead up to the swap was the focused promotion of the Crypto.com exchange. At the time the community believed this was a seasonal campaign to promote the release of a new product and that there would eventually be a rebalance in marketing and the MCO token and the crypto card program would receive more attention.

A number of Crypto.com users saw the flat MCO price trend as an opportunity to buy it on the cheap and access more premium Crypto.com cards that required higher holdings of MCO. When the switch to CRO only happened it meant that they were priced out of the cards because they now required CRO. CRO had been gaining in value against MCO and the swap calculation appeared to punish users who had been accumulating larger holdings of MCOs.

Long-term holders and ICO buyers of MCO were also left frustrated. The swap favoured holders of the newly created CRO over MCO holders. The early MCO buyers had backed the project since its infancy and provided the funds to help it grow into a large company. They had bought into MCO because of the utility it was described as having in its whitepaper. Crypto.com had appeared to arbitrarily flip the script and decide on a completely new tokenomics, structure, and design.

To make matters worse, Crypto.com held almost all the CRO tokens in existence at the time of the swap and had previously stated that CRO and MCO were going to exist in the ecosystem as separate tokens with separate utilities. It is not surprising that many in the Crypto.com community were angry and accused the management of Crypto.com of insider trading. Community sentiment surrounding Crypto.com dropped following the token swap and it appears many users decided to exit the ecosystem.

Why did Crypto.com undertake such a painful token swap? Firstly, having just one token to cover the ecosystem greatly simplifies operations for Crypto.com and its users. Having just the CRO token to cover the exchange, the card, the borrowing and lending platform, and the blockchain means not worrying about the price of two different tokens or having to swap between different tokens to access different services.

There was also a regulatory reason behind the shift away from MCO. MCO was the token that Crypto.com used for its ICO, this could mean that the company could have potentially faced the ire of regulators like the SEC for conducting an unregistered securities offering. ICO issuers such as Boon, Coinspark, and FLiK were charged with securities fraud well after their ICOs were completed. Removing its original ICO token from existence may have been an unconventional strategy to protect itself from potential SEC action.

It should also be noted that the token swap was a one-time event. Now that it has been completed Crypto.com can focus on growing its base of users that aren’t jaded by how they were shortchanged by the shift away from MCO.

Other challenges

The top post in the Crypto.com subreddit for the last year is titled “Open letter to Crypto.com”. The post has 1.8k upvotes and a number of awards by other users. The post initially compliments the company “You guys have developed several partnerships, you have reduced the amount needed to buy coins, and new coins have been added.” The poster, u/nemli12, initially writes.

u/nemli12, however, goes on to discuss the problems that customers have had accessing their accounts. These problems correlate with periods of high demand. The user bemoans the poor user experience of the platform, stating “we cannot access our accounts when we need to.”

The user asks for a “boring app” that works as opposed to one with numerous features. This sentiment is echoed by users in the comments section. The top comment states “They sure spend a ton of money on marketing and customer acquisition. Perhaps use some of that to develop an app that’s stable, scalable, and give us the ability to do limit orders.”

Conclusion

Crypto.com has built a one-stop shop for retail crypto users. It offers everything a crypto native or newcomer might need or want. Spot and derivatives trading, centralized and decentralized financing services, NFTs, point of sale solutions and staking rewards. The company is a behemoth that is one of the most touted and used platforms in crypto.

Its token, however, for some time underperformed in comparison to the rest of the crypto market. This is somewhat surprising given the visibility and popularity of the project. Taking a deeper look under the hood at the CRO token and the Crypto.com project it appears that a botched transition away from the MCO token left a sour taste in the mouth of early backers of the project. The usability of Crypto.com products also raises questions, the platform continues to be unpredictable and is prone to crashing during periods of high traffic – although in fairness this is a problem that affects many other exchanges including Kraken and Coinbase.

In 2021 the tide began to turn, however, with the company choosing an aggressive brand and culture-based marketing strategy. The new campaign featuring one of the world’s biggest actors, Matt Damon, had an immediate impact. Crypto.com is putting its name front and centre at some of the world’s biggest basketball, motorsports, MMA, and American football events. It is embedding its brand in the culture of the demographics that crossover into crypto. Its debut as the new primary sponsor of LA’s biggest sporting arena is set to have a barnstorming impact on visibility of Crypto.com and the CRO token in 2022.

There are also new features consistently added to Crypto.com ecosystems like the recently EVM compatible Cronos chain and an NFT marketplace, further buffering the value of CRO.

It seems inevitable that Crypto.com will grow and gain more users. As long as it can deal with its accessibility issues the value of the CRO is likely to continue growing with it.

Don’t miss out – Find out more today