Terra Failure Triggers Crypto Price Crash

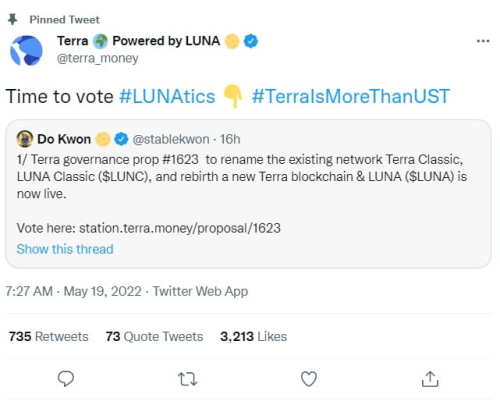

Terra founder Do Kwon has announced community voting has started on a rescue proposal for the Terra ecosystem

The original Terra blockchain was halted on the 12th of May. Following the spectacular devaluation of the Terra blockchain’s LUNA token, validators opted to officially cease network operations. The blockchain network was suspended initiallly at a block height of 7,603,700 then restarted. The second halt came at block height 7,607,789. The halt came after a series of extraordinary events that resulted in an unprecedented drop in the LUNA price and the price of the TerraUSD (UST) stablecoin.

Terraform Labs halted its blockchain because with the LUNA price essentially at zero, the project was uniquely vulnerable to a governance attack. The price drop "substantially decreased [the] cost of attack" they said at the time.

According to Twitter user @Route2FI, the disorder began on Sunday the 8th of May because of a UST sell-off on the decentralized exchange Curve. This led to rumors across markets and social media that led to further UST withdrawals on Anchor. The jitteriness continued and there was a large scale run from UST.

The UST peg against the US dollar then fell away completely hitting a low of US$0.30 on the 11th of May and it has continued to fall from there. Terra’s Luna Foundation Guard sold off US$1.5 billion of bitcoin reserves and announced that it would loan US$750 million worth of bitcoin to trading firms to defend the peg and provide liquidity on exchanges.

UST and Luna were key projects that won big during the crypto bull market and the DeFi 2.0 season. The failure of both projects affected the short-term sentiment surrounding DeFi infrastructure components like algorithmic stablecoins. Tokens that serve a similar purpose to LUNA (in that they also support stablecoins) have also been impacted. For example, the Frax price (FXS) is down 75% since the start of May and the Spell Token (SPELL) is down ~67% in the same period.

The systematic chaos caused by UST could have been expected. Terraform Labs has been expanding the presence of UST to chains outside of Terra in recent months. A non-profit, the Luna Foundation Guard (LFG), has been buying assets other than LUNA to build a protective layer for UST.

LFG had purchased a large amount of Bitcoin that could be dipped into if UST ever lost its peg. In interviews, Terraform Labs founder Do Kwon explained that BTC was chosen because it was a neutral, liquid asset that was held by users across various DeFi chains. An enormous amount of BTC was bought by the LFG, well over US$3 billion worth, and it made LFG one of the largest bitcoin holders on the planet holding a reported 80,394BTC.

There were concerns raised over the LFG strategy, as in a scenario where UST lost its peg, LFG would have to dump a large amount of BTC on the market to protect it, in turn crashing the bitcoin price. As events have shown, Terra’s strategy of trying to anchor UST to the entire crypto market was ultimately a flawed one.

External-Sell-offs in risk markets driven by recession fears

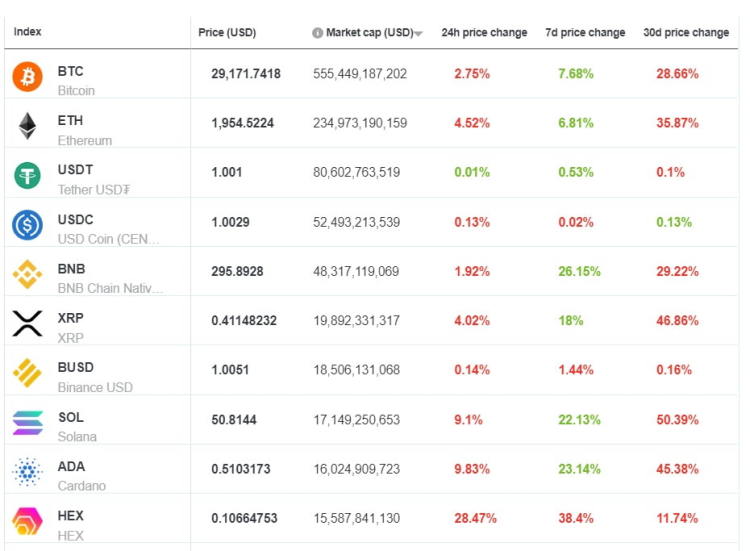

The latest moves follow digital asset markets plummeting downwards during the week with Bitcoin (BTC) dropping as low as $26,700 on May 12th. Prominent altcoins such as SOL, AVAX, SHIB and XRP have also all fallen by around 50% in the last month. Internal and external factors beyond Terra’s problems have contributed to the selling pressure.

Parallel to the downswing in the crypto market, stocks are also selling off heavily as macro investors across the board have opted to reduce their exposure to risk assets.

The S&P500 hit a new low for 2022 in the last day and is down ~18% year to date, while the Nasdaq composite is down ~28% in the same period. Big-ticket tech stocks like Tesla and Nvidia are down ~41% and ~44% this year, while Meta is down 44%, Alphabet is down 23%, and Amazon has dropped 37% since January 1st.

The correlation between Bitcoin and equity market indices has hit new highs in recent weeks. The 30-day Pearson correlation coefficient between the BTC price and the Nasdaq composite currently sits at 0.96, while for the S&P 500 it sits at 0.94. This implies that the price of Bitcoin and the US stock market index are almost moving in sync with each other.

Source: The Block data, CryptoCompare

Market momentum for speculative assets like equities has fallen away amid concerns that global inflation will continue to surge and economic growth will slow. Inflation in the US hit a four-decade high of 8.5% in March 2022.

The US Federal Reserve raised interest rates by 0.5% in response and most forecasts predict more aggressive rate hikes are likely as the US economy tangles with historically high inflation.

The central bank rate hikes will constrain capital and investment capability. This may slow down inflation but it will come at the cost of economic growth. The economy is being put under further strain because of the extended Russia/Ukraine conflict and China’s strict ongoing Covid-19 lockdowns and their impact on global supply chains.

The challenges faced by the US economy are mirrored in the EU, UK, New Zealand, Australia, and other OECD economies. Inflation has surged in these countries after extended periods of expansionary monetary policies and low interest rates led to the money supply ballooning.

These economies now face the possibility of stagflation, a situation where the inflation rate is high but economic growth is slow. Policymakers face a difficult challenge, sharp interest rate rises will reduce inflation but will negatively affect already stagnant growth and unemployment. Trying to gradually raise interest without affecting economic growth may be too conservative and could lead to inflation surging even higher.

Investors appear to have lost confidence in the Central Banks’ ability to dig economies out of a stagflation and recession hole. They are pulling money away from risk markets and into safe, stable investments. Most investors expect markets will remain volatile and skewed towards the downside.

Do Kwon Annouces Rescue Plan

Amid all the chaos Terra founder Do Kwon has announced in a Twitter post, that voting has commenced on a Terra ecosystem revival plan.

If the Terra community votes in favor, the proposal will entail;

-

Creating a new Terra chain without the algorithmic stablecoin (so no UST). The previously failed chain to be renamed Terra Classic (token Luna Classic – LUNC), and the new chain to be called Terra (token Luna – LUNA).

-

Luna will be airdropped across Luna Classic stakers, Luna Classic holders, residual UST holders, and essential app developers of Terra Classic.

-

TFL’s wallet (terra1dp0taj85ruc299rkdvzp4z5pfg6z6swaed74e6) will be removed in the whitelist for the airdrop, making Terra a fully community owned chain.

-

Allocation of a large portion of the token distribution to 1) providing emergency runway for existing Terra dapp developers 2) aligning the interest of devs with the long term success of the ecosystem.

-

Network security to be incentivized with token inflation. Target staking rewards of 7% p.a.

Voting on the plan will continue until the 25th of May. To date 87% of votes cast are in favor of accepting the proposal.

At the time of writing LUNA was trading at US$0.00017, whereas a month ago it was US$116 – an all-time high. UST is priced at US$0.094. CEO Do Kwon has been summoned to a South Korean parliamentary hearing following the crash of LUNA and UST.

Meanwhile Polygon CEO, Ryan Wyatt tweeted that Polygon was working with several Terra projects to assist them in migrating to Polygon. Fantom (FTM), VeChain and Binance CEO, CZ have also offered support to the Terra community.

Don’t miss out – Find out more today