Crypto Market Forecast: 11th November

It was a mixed week in the crypto markets. Market benchmark BTC was down slightly, but altcoins such as XLM and XTZ enjoyed healthy gains. The ever-evolving Chinese government blockchain policy was a major story this week. New reports suggest that the country's miners are safe from regulators for the time being.

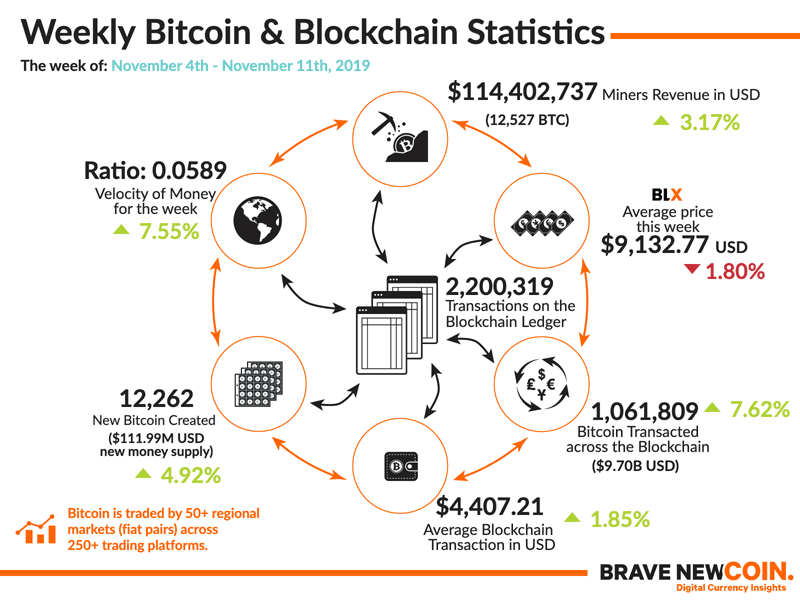

It was a mixed trading week in the crypto markets. Marginal losses in the Bitcoin markets were offset by strong double-digit gains in a number of altcoin markets. The market leader BTC fell ~2% over the last 7 days, while the number two and three crypto assets on Brave New Coin’s market cap table, ETH and XRP, rose ~4% and fell ~4%, respectively. The overall crypto market cap held steady falling just 0.04% by the end of the week.

One of the largest movers of the week was XLM. The native token of the Stellar network rose a significant 14% following news that the Stellar Development Fund had decided to burn 55 Billion XLM tokens, over half the token’s total supply at the time.

These tokens had been set aside for payment to developer grant and investment programs, however, burning them deletes them permanently. Because remaining XLM tokens are now more scarce, they have risen in value but it remains to be seen whether this forward price momentum will continue. Stellar has burnt much of its development budget and will likely lose some long term value.

The China-Blockchain Q4 news cycle continues to churn – last week it emerged that China will not ban Bitcoin mining. Six months ago, the country’s government-controlled economic planning agency placed ‘Bitcoin Mining’ on a list of industries not to be encouraged. This led some analysts to suggest that the government might even ban the industry.

A new catalog released last week by the economic planning agency has removed cryptocurrency mining from a list of industries viewed unfavorably by the state. While China’s relationship with crypto is opaque from a Western viewpoint, it implies that Chinese miners can continue operations in the short term at least. This may be a bullish flag for Bitcoin as over 60% of the network’s hashrate is generated in China.

Many crypto projects appear to be looking East towards China as the region that will drive the next cycle of blockchain adoption and investment demand. In an interview with Forbes on the 9th of November, Consensys (an Ethereum network development group) founder Joseph Lubin said that he hopes operators of China’s new Central Bank Digital Currency will allow for interoperability with public, permissionless blockchains such as Ethereum. Lubin suggested that Ethereum’s existing knowledge base around tokenization and blockchain infrastructure could be beneficial to the new Chinese government blockchain if collaboration is allowed.

This week in crypto events

Consensus Invest NYC: 11th-12th November

Some of the leading voices in Blockchain and legacy finance meet in New York early this week to discuss blockchain investment trends and macroeconomics. Speakers include Raoul Pal, the CEO and co-founder of the Real Vision group, Travis Kling, the founder and CIO of Ikagai capital management, and Meltem Demirors, CSO of Coinshares.

Blockshow Singapore: 14th-15th November

Following Consensus: Invest another major crypto conference will be held in major Asian blockchain hub Singapore. Blockshow also includes an impressive list of speakers including Changpeng Zhao, the CEO of Binance, Samson Mow, the CEO of Blockstream, and Thomas Lee, the managing partner at Fundstrat. Major discussions on the conference panels include blockchain scalability and the state of Web 3.0 projects.

While Bitcoin and XRP ended the week marginally red, several assets on Brave New Coin’s market cap table performed strongly last week. Litecoin (LTC), EOS, and Stellar (XLM) all enjoyed healthy gains against BTC. EOS grew despite reports from major exchange Coinbase that the EOS network is over congested following the EIDOS token airdrop. The congestion has created issues around token transfers on the network.

It looked unlikely at the start of the week, however, the BTC/USD market finished the week above $9000 following a sharp price pick up on Sunday. There is generally less trading volumes on crypto trading markets over weekends, which means that these days are prone to short, sharp price moves that can often not be trusted as bullish or bearish flags.

Don’t miss out – Find out more today