Crypto market Forecast: 1st July

Bitcoin continues to grow in market dominance, trading green over the last week as other large cap assets faltered. Mainstream support for BTC also grew, with the popular 'Cash' app adding deposit support for Bitcoin - and the futures platform LedgerX gaining CFTC approval for physically settled Bitcoin futures.

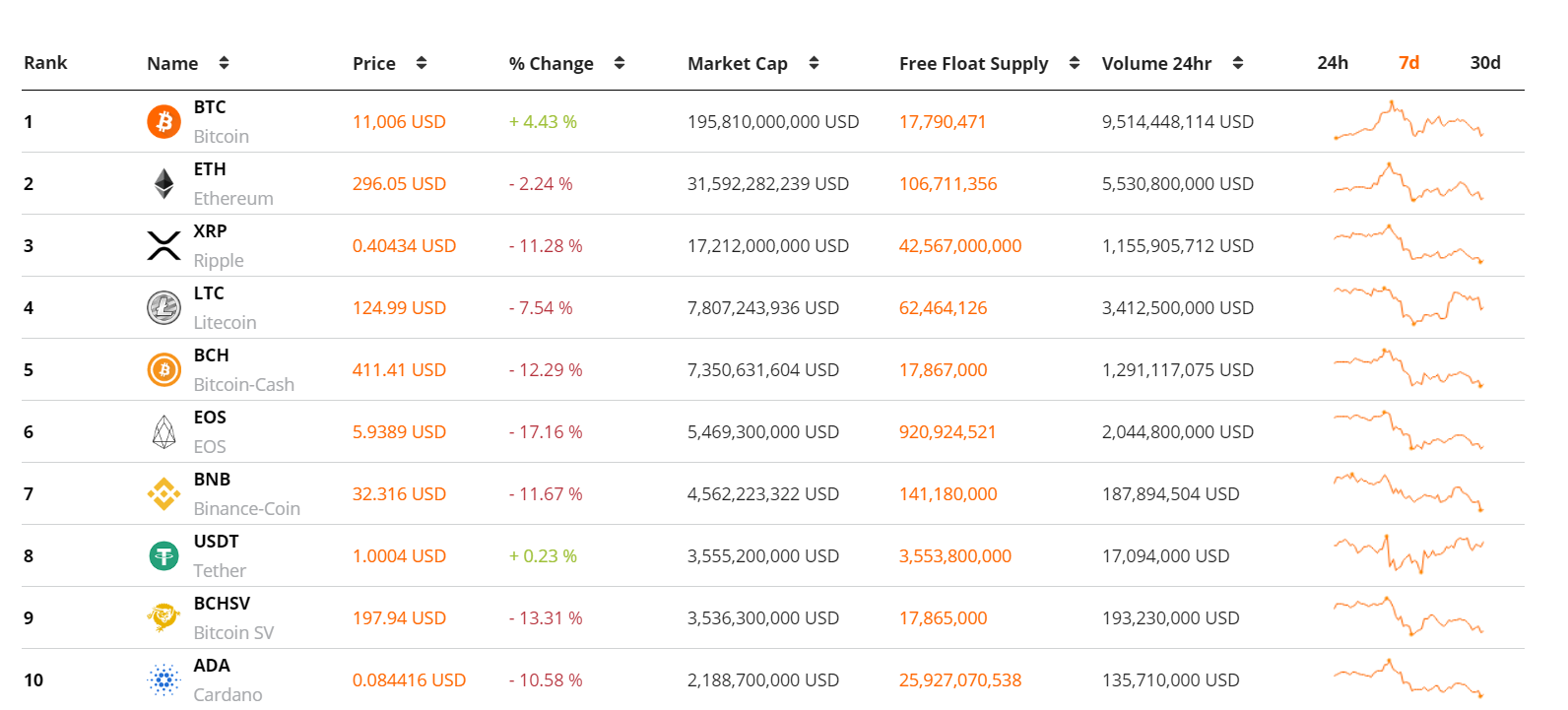

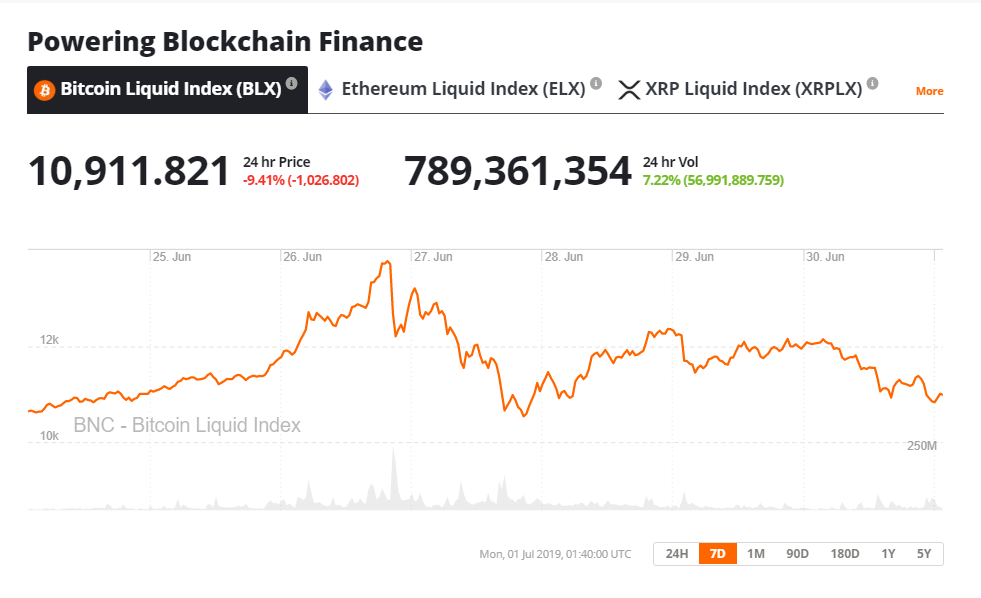

It was a volatile, up-and-down week for digital assets. The week started strongly with Bitcoin soaring to an impressive USD 13,768 on Wednesday, an 18-month high. After the big move up, the market corrected strongly, erasing most of the gains by the end of the week. The Bitcoin price is currently trading at around ~11,300. Despite the extreme price action, the BTC markets ended the week up 4%, a steady, moderate gain. However, the large-cap altcoin markets suffered heavily during the pullbacks. ETH ended the week down ~3% while XRP is down ~15%.

The overall crypto market cap fell by ~2% to USD 320.45 billion. The Bitcoin dominance of the total crypto market cap rose to ~62.4%, the highest it has been since January 2018. Bitcoin’s dominance is increasing as Bitcoin’s recent growth continues to far outstrip the gains across most altcoin markets.

A factor in the late week market sell-off may have been the temporary crash of major crypto trading platform Coinbase. Neither the platform’s website or API was working for a 51 minute period on June 26th. The outage coincided with a USD +1,000 drop that appeared to halt the market’s strong bullish momentum. This drop then preceded further sell-offs as the week progressed. Reports from October 2018 suggest that Coinbase has 25 million users and is growing at an average of 25,000 users per day. This shows the important position that Coinbase occupies in the retail crypto trading space. The temporary shutdown may have contributed to the widespread anxiety in the Bitcoin market as the price fell, however, steep corrections are not uncommon after extreme increases in the Bitcoin price.

On the fundamental side, the Bitcoin network had some useful updates related to third-party products, and these will help extend the reach of the ecosystem. The Cash app, currently the number 1 Finance app on the Apple iOS store, enabled Bitcoin deposits for users last week. With an average of two million new downloads a month, the reach and popularity of the Cash app is growing. It is now a key ecosystem player and plays a big role in introducing the mainstream to Bitcoin.

On the 25th of June, the Commodity Futures Trading Commission (CFTC) cleared Bitcoin derivatives provider LedgerX to offer physically settled Bitcoin futures. The announcement means that New York-based LedgerX will eventually list bitcoin futures contracts and offer its products to both retail traders and institutional clients.

Meanwhile, the ErisX Bitcoin futures product will be physically settled in BTC, not cash, as is the case with the current regulated Bitcoin futures product offered by the CME. This means traders receive actual Bitcoin at the end of their contracts following initial payment with dollars. New Bitcoin is purchased by LedgerX with each new speculative contract agreement made. This implies that the LedgerX should create a new wave of buying pressure for BTC once it is launched at a yet unspecified date.

Upcoming events in crypto

3rd to 4th July- Asian Blockchain summit

One of Asia’s biggest crypto conferences takes place in Taiwan this week and features an influential list of speakers including Binance CEO Changpeng Zhao, and The Tangle in Taipei, a debate between Bitmex CEO Arthur Hayes and one of Bitcoin’s most famous skeptics, Nouriel Roubini. Soundbites, announcements and price predictions are likely to emerge from the event which had 4,000 attendees in 2018.

2nd July- Komodo platform AMA

The Komodo platform, a growing cryptocurrency network, hosts a community AMA (‘ask me anything’) this week. Questions will cover an upcoming public rebrand of the network and the new Antara multi-chain smart contract platform. Positive sentiment from the AMA has the potential to affect short-term buy/sell action of the blockchain’s underlying token KMD. The token was one of the week’s best altcoin performers rising ~3%.

While BTC was able to sustain some bullish momentum and end the week trading green, large-cap assets bled heavily with many suffering double-digit losses. Just outside of the top 10, the week’s biggest altcoin winner was Chainlink(LINK) which rose an impressive 93% on the back of an announcement that it would begin trading on mega crypto exchange Coinbase. The Coinbase effect may be back.

Following a strong start to the week, the Bitcoin markets began fading on Wednesday with the price dropping back to the USD11,000 level. Over the last 24 hours, there has been a sharp drop in the number of short positions active on Bitcoin derivatives platform Bitmex. This suggests that some bearish traders may be considering flipping long or staying inactive in the near term. The hashrate of the network has hit an all-time high of 69 exohash per second, a doubling since the 2018 lows, as miner interest network surges.

Don’t miss out – Find out more today