Crypto market Forecast: 24th June

Bitcoin prices continue to soar with the cryptocurrency reaching a yearly high of USD$11,400 last week. Trading volumes on derivatives markets are at all-time highs as bullish sentiment remains strong despite fears of a pullback. The second largest blockchain network, Ethereum, also enjoyed strong gains in the last week due to strong market momentum and improving on-chain activity.

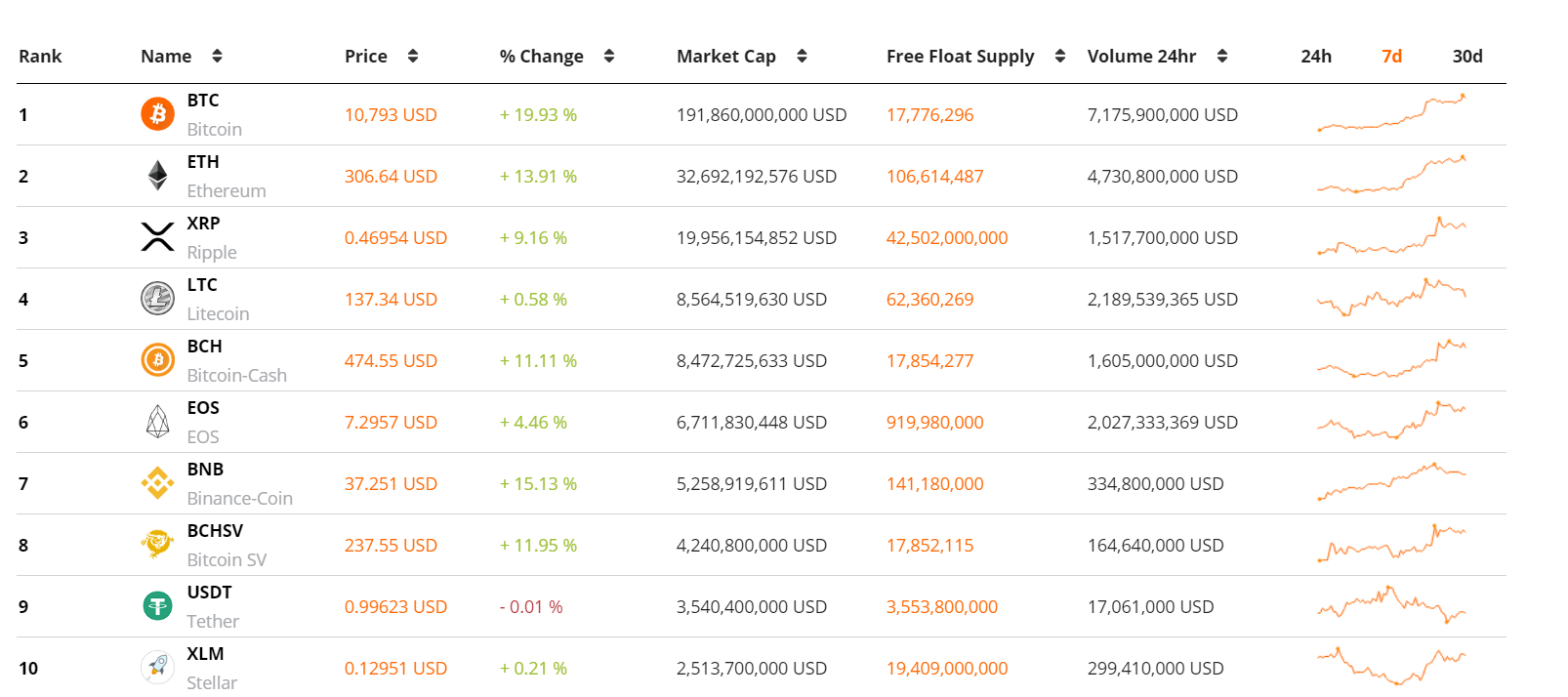

A bumper week for crypto traders ended with Bitcoin prices up 24%, ETH prices up 17%, and XRP prices up 13%. Bullish momentum remained strong with gains continuing through the weekend despite market apprehension and anticipation of a pullback after double-digit gains early in the week. Between Friday and Saturday, BTC prices jumped from USD $10,000 to $11,000 in under an hour.

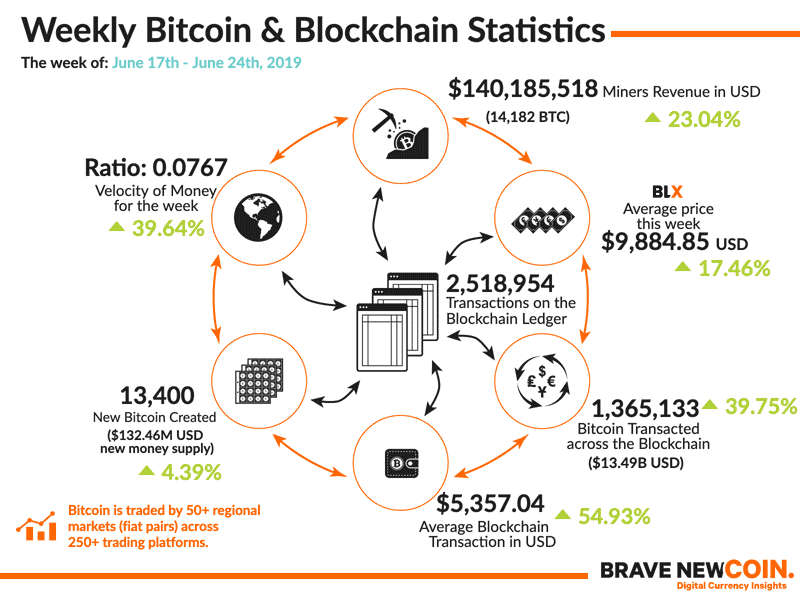

Speculators appear to be back in force in the Bitcoin trading markets. During the weekend, Bitmex, the popular Bitcoin derivatives platform, set a new record in the amount of daily volume traded. In the last 24 hours, there has been a significant spike in the number of both short and long positions opened on the platform.

The recent price volatility and the sudden increases in price are likely to have been accentuated by short squeeze events in the Bitcoin Futures markets. This occurs when shorts are forced to close their positions (at a loss) due to price increases. These traders are forced to cover these positions quickly before the price goes even higher. If enough shorters are caught in this position, then the subsequent squeeze can have a tangible effect on price. Currently Bitmex derivative traders are ~48% long and ~52% short trading Bitcoin.

Another factor in the ongoing bullish price run may be increasing demand for Bitcoin as a hedge against macroeconomic uncertainty. Weekly demand for LocalBitcoins has spiked in India over the last few weeks, while on BitBNS, an Indian rupee crypto exchange that operates using a unique voucher based withdrawal model, the BTC/INR markets are currently trading with a significant premium (USD equivalent price ~$11,642) vs the rest of the market.

The Indian rupee has fallen significantly against the US dollar in recent months, while the country’s current account deficit is 2.5% (India is importing more than it is exporting) and government debt is quickly growing. BTC’s programmable and deflationary monetary policy and its rapidly rising USD value may be making it an appealing proposition for some Indian rupee holders.

Bitcoin has had a difficult relationship with India’s government and financial regulators in recent years. On April 6, 2018, the RBI released an extremely unfavorable ruling for the crypto asset sector in India. The RBI issued regulatory guidance to all financial institutions under its jurisdiction, barring them from providing their services to any entities associated with crypto assets.

Another potential catalyst for the recent buy pressure was last week’s official release of a website and whitepaper for the Facebook backed Libra digital currency project.

This week in crypto events

June 25th- TRON AMA and Livestream

Justin Sun, CEO of popular blockchain project TRON hosts a community AMA (‘ask me anything’) this week. Questions may cover dates surrounding upcoming network updates and Sun’s upcoming charity lunch with mega-investor Warren Buffett. Positive sentiment from the AMA has the potential to affect short-term buy/sell action of the underlying token TRON.

June 29th- CME futures trading round expiry

This Saturday marks the last trading day before the CME XBT(BTCM19- December to June) futures contract ends. The nature of futures contracts means they need to be settled on a predefined date, based on a contract. All contracts will have to be traded, or settled, before this date. There is generally a fall in the trading volume of futures around expiration, which coincides with a rise in volatility and a potential short/long squeeze. CME Bitcoin futures hit new highs over the past week potentially signaling an increase in institutional interest in Bitcoin.

It was a strong green trading week for most large cap assets with a number of assets enjoying double-digit gains. ETH prices hit a 10 month high in the last week as the USD price crossed the $300 threshold. The launch of Ethereum 2.0 in less than 6 months may be a driver for the re-emergence of ETH bulls. Dapp activity and Gas usage have both hit all-time highs in recent months suggesting strong fundamentals for the token.

Following a quiet start to the week, the Bitcoin markets exploded into life on Thursday easily crossing the USD10,000 price level before surging past the USD11,000 level. Some analysts have viewed Bitcoin’s sustained momentum as a sign that gains look set to continue in the short term.

Don’t miss out – Find out more today