Crypto Market Forecast: 30th September 2019

A brutal week in the crypto markets ended with traders licking their wounds following double-digit losses early in the week. An unfavorable global macro narrative, cascading liquidations on futures platforms, and an underwhelming BAKKT launch were all contributing causes of the price drop.

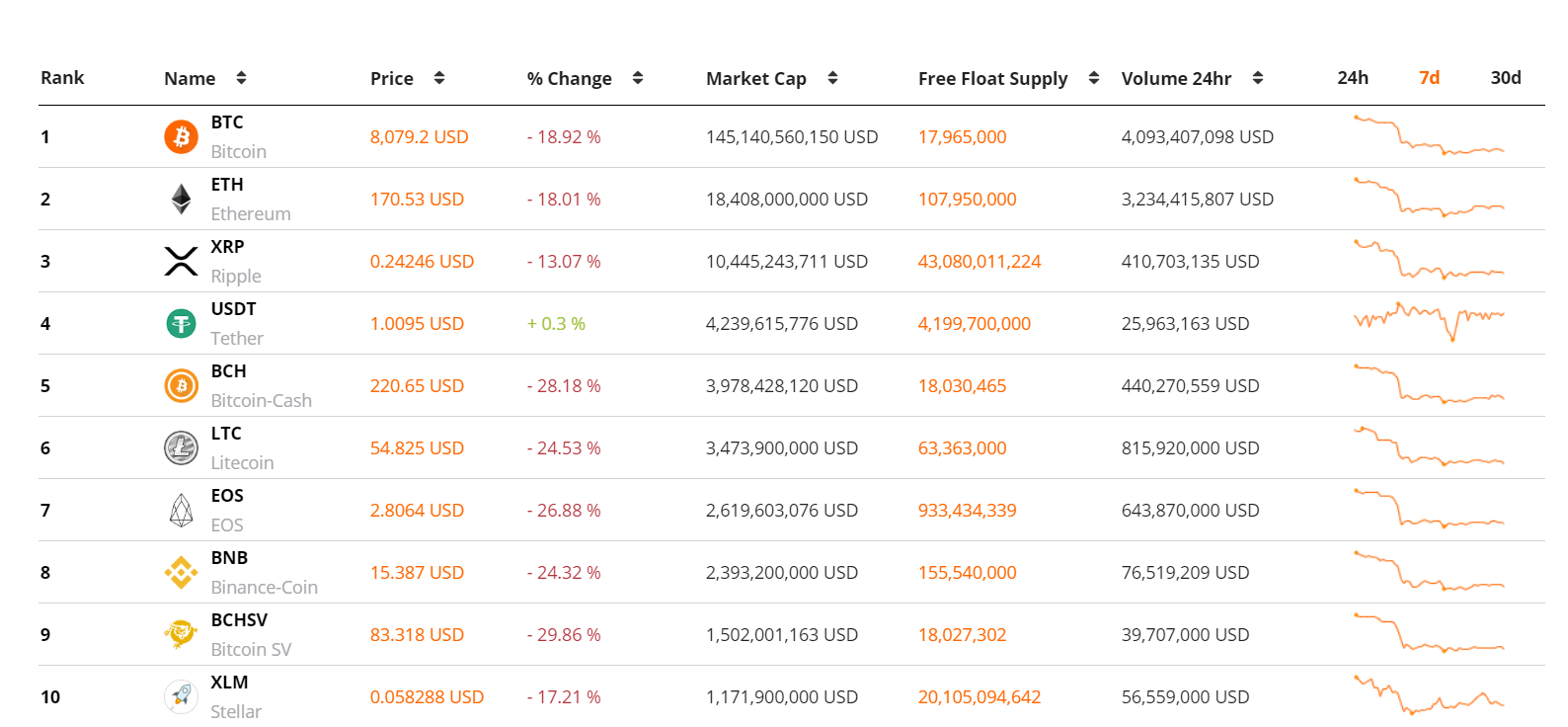

There was carnage in the crypto markets with most assets ending the week with heavy double-digit losses. Market benchmark BTC fell by ~18%. Large cap altcoins like ETH, XRP, and LTC also faced ongoing sell pressure falling ~19%, ~18% and ~28% respectively. The overall crypto market cap fell ~19% in a week that investors will likely want to forget.

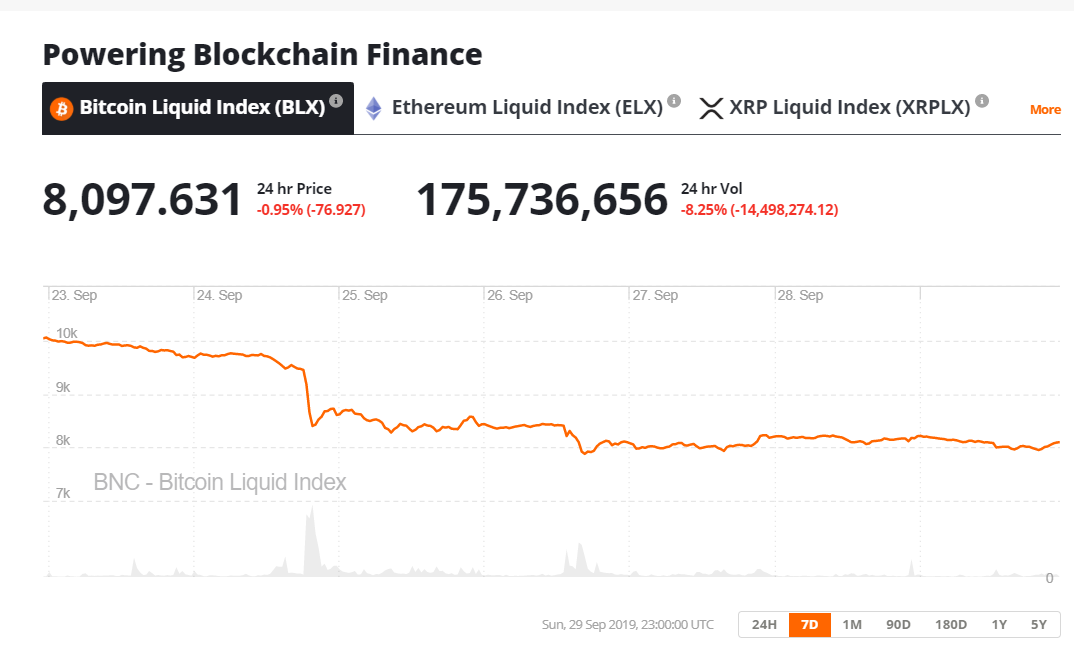

The losses were triggered by a price crash on Tuesday that saw the price of BTC fall from ~$9,750 to ~$8,400 in less than 24 hours. There was no clear reason for the price dump, however, some analysts view the underwhelming launch of the BAKKT Bitcoin futures contracts as the sell signal that triggered Tuesday’s losses and a wider sell-off across the week.

Another factor is the increasingly bearish global macro outlook. Legacy financial markets were down over the last week which can lead to pain in the crypto markets as traders look to exit risk-on positions. The Nasdaq and Dow Jones markers struggled last week against a turbulent geopolitical backdrop. President Trump’s potential impeachment and reports that the Trump administration is considering limiting US investment into China (for example by delisting Chinese companies such as Alibaba and Baidu from US stock exchanges) have created uncertainty and bearish sentiment.

The bearish week was compounded by a near-collapse of the federal reserve repurchasing rate. The repo rate is an interbank lending interest rate that banks use to borrow and lend from other banks to fund daily operations. On Friday, the Federal Reserve injected billions of dollars into the repurchasing markets to help curb ballooning rates, raising questions around the stability of the repo market. A big bank was willing to accept a 10% interest rate from the repo market, around 5 times higher than the normal rate. This suggests banks are desperate for overnight US dollar funding and implies that big banks are in an increasingly fragile financial position.

A possible global dollar shortage and uncertainty in global trade markets affects the crypto and Bitcoin markets negatively. Many investors view Bitcoin as an alternative investment or as a high risk, high return portfolio position to compliment or hedge more conventional positions. When the global investment space faces a period of uncertainty, some money is likely to flow out of crypto as investors adopt a risk-off approach until market conditions improve.

Bitcoin retains value as a digital store of value asset with non-sovereign, immutable, inflation-free characteristics. But poor supporting infrastructure (exchange platforms and custody solutions), and the possibility of price volatility created by market manipulation means it retains a ‘high risk’ characteristic. This means it may continue to struggle when global investment markets are capital tight.

This week in crypto

1st October- Final deadline for critical Ravencoin update

The Ravencoin blockchain is updating its hashing algorithm, switching to the X16RV2 algorithm to maintain Ravencoin’s resistance to ASIC mining. The update will help the network remain decentralized and minable by everyday users. However, there is some concern it will leave the network vulnerable to a 51% attack in the short term. The price of Ravencoin fell ~6% in the last week.

4th October- Kyber Network Protocol Parameter update

This Friday the MaxgasPrice for Kyber Network contracts will fall from 100 Gwei to 50. The update will make it more difficult for traders attempting to profit by frontrunning other traders. Kyber network reserves, who set prices for token transactions onchain, now have greater control to prioritize transactions. The change should make the Kyber network trading system more secure and reliable. The price of native token KNC fell ~13% in the last week.

Top 10 crypto assets

A brutal week in the crypto markets ended with severe bleeding across the market’s top 10 assets. Even a long-awaited Binance listing for Tezos (XTZ) failed to create buying interest as it fell to a heavy ~16% loss over the week. Tether (USDT), the market’s leading stablecoin pushed up to 4th on the table as traders sought safe haven from the sharp drops.

The price of BTC ranged near the ~$8,000 level following mid-week selling pressure that pushed prices to levels near ~$7,750. A factor behind the aggressiveness of the price fall was likely a wave of margin calls across Bitcoin futures markets. Between USD 600-800 million worth of Bitmex contracts were liquidated during the price drop, while the Okex exchange is said to have used 84% of its insurance fund to manage liquidity demand.

Don’t miss out – Find out more today